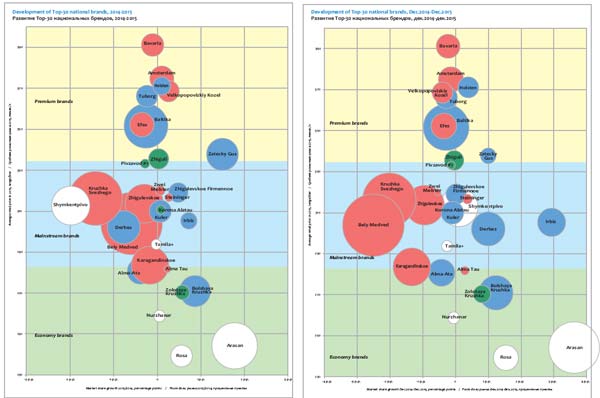

In 2015, Belarus beer market fell by 9%. However, not all market players incurred losses. In the first place the decline resulted from interest drop to premium Russian brands. They suffered from consumers’ economizing, state regulation and launch of local production. Besides, local brands by Heineken have yielded their positions considerably, as competitors, in the first instance, Krinitsa with private labels and Lidskoe with its version of Zhigulevskoe, started pressing them. Export in 2015 failed to support the beer production dynamics.

Briefly on the market

Companies and brands in 2015

Krinitsa

Olivaria (Carlsberg Group)

Lidskoe pivo (Olvi)

Heineken

Import beer in Belarus

Beer export from Belarus

Malt production

Briefly on the market

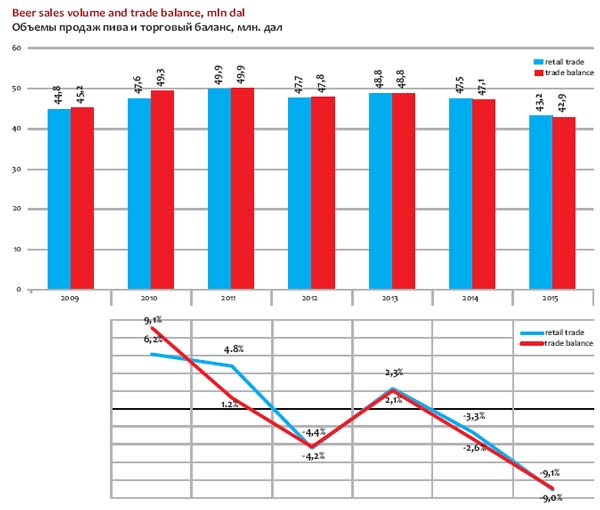

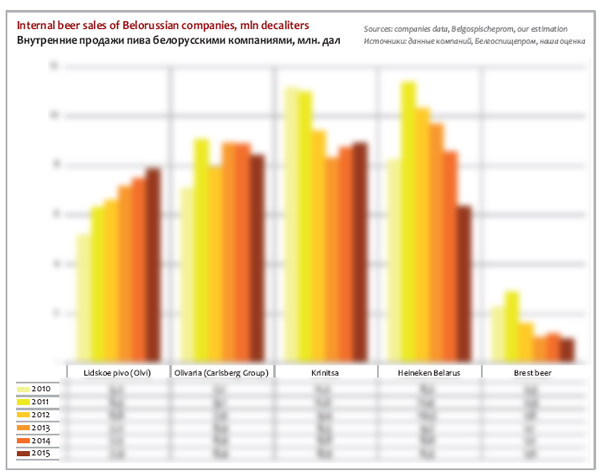

According to “Belgospischeprom”, in 2015, the retail beer sales dropped by 9.1% to 43.16 mln dal. When we calculate the trade balance, we get approximately the same percentage and volume, that is, in 2015, the decline accelerated to 9% to 42.89 mln dal of beer.

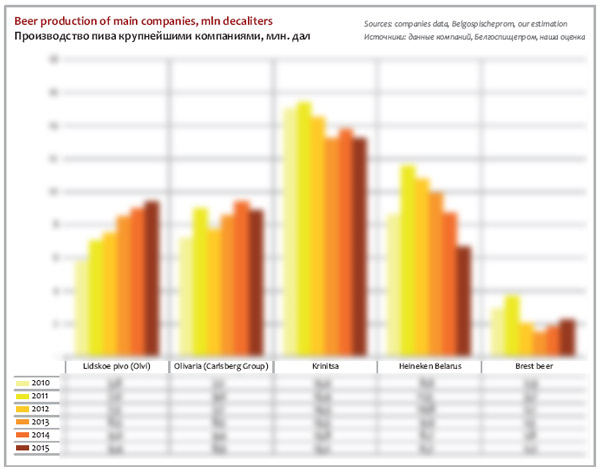

In general, the rates of production and sales of national brewing companies were better than the market. Their output volumes in 2015 fell by 6.2% to 40.6 mln dal. We should at once say that the performance of the major beer producers differed. The major negative impact was made by Heineken and Carlsberg, that were yielding their positions in the economy segment to fast growing brands by their competitors. Instead, the year turned out to be clearly positive for Lidskoe pivo, if we judge by the increase of production and sales.

We should note that after 2010, one could hardly expect any increase on the beer market. But the meek signs of stabilization turned to negative in 2014, which fully developed by the end of 2015, when the regional problems touched upon Belarus. Besides, in 2015, there was a sharp devaluation of Belarus ruble, which halved against dollar from January till December.

Fall of consumer sentiment in Belarus obviously impacted the beer market. The second half of 2015 was the harshest time. The producers’ dynamics followed the market, the retail beer sales were decreasing at ever faster rates during the year.

The beer market in its turn slowly followed the gross domestic product. While in the first quarter, one could speak of stagnation in the economy, April saw a pronounced decline. By the end of 2015, the gross domestic product of Belarus went 3.9% down. Though compared to Russia and Ukraine, such dynamics even seems a good performance, we should keep in mind that it has been the most long-lasting and dramatic decline for the last 20 years. Also note that the deepest nosedive was observed in the building and processing branches where workers traditionally make a big contribution into beer consumption.

Retail prices for beer in Belarus were growing comparatively slowly, that is at the level with inflation which, according to official data reached 12%. Thus, comparing to December 2014, the average prices for Belarus beer grew by …%, approx. to … ruble/liter. And the import beer prices increased by …%, approx. to … ruble/liter.

Basing on the average prices and natural volumes, we can estimate the beer market size by value. In 2015, it grew by …% to … bln of Belarus ruble. Such dynamics seems very low against the …% market growth in 2014 and …% in 2013.

If calculated in US dollars this trend becomes even more obvious. By the end of 2015, the beer market fell by …% to $… mln. And in 2014, the market went …% down, while 2013 saw a …% growth.

Administrative barriers, Belarus ruble devaluation and consumers’ economizing allowed decreasing the market dependence on the import beer. That is what determined the dynamics of Belarus companies’ production, which was better than the market. But how did the brewers’ revenues change given the weak growth of retail sales by value?

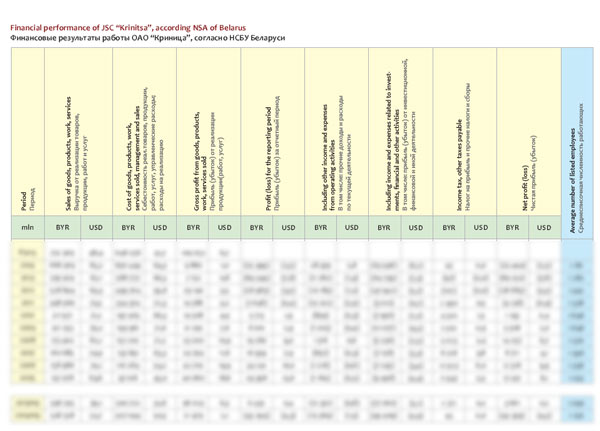

At the time of the article preparation, the performance of public limited companies over the first three quarters of 2015 is known. This group includes all major companies except for Heineken brewery in Bobruisk. Their net profit minus VAT and excises increased to … bln ruble. By the year end, it can reach nearly … bln ruble.

Basing on our estimation of Heineken sales decline and one hectoliter earning rate for international companies we can assume that the net profit of brewers over 2015 could amount to … bln ruble, the net profit growth being close to zero. In dollars the companies’ profit fell roughly by …%, to $… mln.

The import reduction and the national producers’ share growth were certainly connected to changes in the market price segmentation. Thus, the economy segment, big as it was, grew, while the premium decreased, mainly due to the sales decline of marginal Russian brands.

Companies and brands in 2015

Development of Belarus brewers is taking place under unusually strong influence of import and export. The competition with foreign brands including them into portfolio or launching licensed production led to fluctuations of market shares and companies’ output volumes.

Belarus producer’s performance (volumes and market share) can be measured differently 1) as a subdivision of international group, considering the joined portfolio of brands produced in Belarus and imported brands (in case of Carlsberg and Heineken); 2) as Belarus producer, that sells beer in the domestic market; or 3) as a business that produced a certain volume of beer, regardless of where it is sold – locally or abroad. These three frames of references make the analysis of companies’ reports more complex and require regular specifying.

One way or another, as of 2015, the leading positions are clearly divided. Krinitsa is still the major beer producer and the sales leader among Belarus brewers. Carlsberg remains a big company taking into account the market share of the joined brands’ portfolio (produced in Belarus and abroad). Lidskoe pivo did better than other companies in sales dynamics in the domestic market.

In 2016, state brewery Brestskoe pivo, will probably stop operating. At least in the original form of property. It has been long operating in the red, and did not evade bankrupt procedure and its equipment is about to be sold out.

Krinitsa

According to the report of state enterprise Belgospischeprom, production of beer Ktinitsa in 2015 amounted to … mln dal, which is …% lower than in 2014. Thus, the dynamics of company’s output was better than the branch average, but the production growth that emerged in 2014 was swept by the general consumption decline. At the same time, Krinitsa brewed a third part of all beer produced in Belarus, having somewhat increased its share in the national production.

However, by the end of 2015, the shipments of Krinitsa beer into the domestic market grew by …% to … mln dal. As we will describe below, the good growth in 2015 resulted from an attractive offer to Belarus consumers they could not resist. That way the company put an end to Olivaria’s leadership and took the first position, yet there is still a long way to former volumes.

According to Belgospischeprom data Krinitsa had …% of sales volume among Belarus producers in 2015, having increased by … p.p. If we estimate the company’s share taking into account foreign competitors, the growth will be more substantial, by … p.p to …%. The company has been regaining the former positions for the second year in succession.

A considerable difference in volumes of sales and production as well as a variety of trends was caused by a big export share of Krinitsa. However, in 2015, the company cut shipments abroad by …% to … mln dal (see chapter Beer export).

By the end of 2015, Krinitsa raised revenues considerably.Under our estimation they grew approx. by …% to … bln ruble. Yet due to the national currency devaluation the revenues in dollars fell by a quarter – to $… mln. Krinitsa managed to achieve the profitable level. Starting from 2011, the company was working in the red, but in 2015, the net profit can amount to nearly … bln ruble to $… mln.

Entering positive territory became possible due to the growth of sales profitability which in 2015 reached about …%, that is, virtually the market leaders’ level. Just in 2013-2014, it was only …% and Krinitsa was incurring big losses.

Natural volumes growth in 2105 is attributable to economy brand Khmelnov. It appeared in retail early in 2012, and network Euroopt fully consolidated the brands’ sales. This network is a major retailor in Belarus working in discount format with 498 outlets. At its core, Khmelnov is a private label, as it was developed by Eurotorg, Ltd. managing company of the retailer.

According to Krinitsa management, Khmelnov, being a private label of Euroopt, has become a full-fledged brand, demonstrating such sales levels and consumers’ loyalty that are enjoyed not by all promoted trademarks. Plus, it has an attractive price.

Quite understandably, consumers’ economizing stimulated Belarus buyers to opt for discounts. And there, the most attractive beer is still Khmelnov. An additional impetus to sales was given by new sorts Barnoe and Krepkoe, though its main sorts, namely, Svetloe and Bochkovoe were gaining weight rather well. By the end of 2015, Khmelnov’s share on the beer market has almost …, reaching …%.

One should note that Euroopt’s effort to surprise beer lovers with a premium private label, was not so successful. In summer 2015, Krinitsa brewed 100 000 liters of “crafty” beer Authentic Pub, presented in three special sorts, yet it did not raise a high interest.

Krinitsa’s capacities also dispense beer for other four major retailers of Belarus. Yet under our estimation, their net share does not exceed …% as of the end of 2015. Besides, Krinitsa earns profit by packing competitors’ beer in can.

Against the riot growth of Khmelnov, sales of company’s own brands did not look very good. Two mass brands Krinitsa and Alexandria lost approx. … and … p.p. of their market share. We can say that their decline was caused by the pressure on the lower border of mainstream segment from economy brands.

In summer, the company relaunched youth brand Urban Beer. Its market share has got a new growth impulse, however so far it is only …%. The sales were promoted by reasonable price, expressly English addressing, and fully renewed design, which took the place of the traditional beer “heraldry”.

Olivaria (Carlsberg Group)

In 2015, both Belarus division of Carlsberg Group and the group itself faced a lot of challenges. According to the data from JSC Pivzavod Olivaria beer output in 2015 decreased by …% and amounted to … mln dal. As the dynamics of the production decrease was approximately at the level with the branch reduction rates, the company’s share in the total volume of Belarus beer output remained practically the same, i.e. …%.

Olivaria exports relatively small volumes of beer – nearly … mln dal in 2014. As export does not much influence the total volumes, one can speak of a sales reduction of beer brewed in Belarus by nearly …% to … mln dal. The market experienced a much deeper fall and Olivaria went on increasing its share, under our estimation, by … p.p. to …%, which is just a little worse than the performance of their closest competitors.

On the other hand Carlsberg is presently the major beer importer in Belarus (see chapter Beer import), and the international group’s sales are currently consolidated by Belarus subdivision. Given the administrative pressure and policy of import substitution, Olivaria’s sales in general, if we include import brands, suffered considerably. Under our estimation the decline reached about …% to … mln dal. And the net share of Carlsberg Group went … p.p. down to …%.

Under our estimation, in 2015, the revenue of Pivzavod Olivaria in Belarus rubles declined by several per cent to … bln. In dollars that was nearly …%, to $… mln. Yet, the company managed to increase sales revenue in the national currency by …%, which can be roughly estimated at … bln ruble. In dollars the revenue fell by …% to $… mln. The net profit decreased by a …, to $… mln.

Note, that the company’s sales grew in 2014, due to transfer of Carlsberg Group’s international brands to Olivaria. Until then, agent division of Baltika in Belarus dealt with their distribution. Olivaria revenues grew by … times then. However the sales profitability in 2013 and 2014 was approximately the same – about …%. By the end of 2015, it grew to approx. …%. This can be explained by positive influence of the price mix – minor reduction of natural volumes primary took place due to economy brands.

The weight of Olivaria equals more than …% of the total sales volume of beer produced by Belarus subdivision. The share of Olivaria in the market amounts to nearly …%, having somewhat increased over the year, that is the leading positions of the brand are free from any danger. However, inside the portfolio itself the dynamics was uneven. Good growth was demonstrated by … and specialties … and …. At the same time, subbrands … and … have considerably yielded their positions.

Other local brands also showed neutral dynamics, if we take their general share. The launch of marginal strong beer, an analogue of Ukrainian … in spring 2015 balanced the decline of economy brand …, which is probably being excluded from the product range. … share has not changed, which would have looked negative against the competitors if not for the comparatively high retail price.

However, the international brands by Carlsberg Group suffered much in 2015. Here one can speak of a general trend as the shares of both economy beer Bolshaya Kruzhka and marginal sorts of Baltika experienced the same decrease. Though a lot of challenges were set also in front of other trademarks that the company traditionally supported by launching new sorts (for instance, Zatecky Gus Nefiltrovane z Taverny) or by festivals (Tuborg GreenFest). Besides, Holsten share shrank despite the price decrease and license production launch.

Lidskoe pivo (Olvi)

Lidskoe pivo is the only company on Belarus beer market that has been long expanding production steadily. Even in the difficult 2015, it grew by … to … mln dal, which looks very good against the general branch downslide.

Export shipments in 2015 decreased by approx. …% to … mln dal. Until then export was growing at rather high rates, refrained by capacity lack. That is, possibly, the decline in 2015 resulted from shipments growth into the domestic market. However, the production expansion and lower beer consumption in Belarus will stimulate export direction in 2016 (see chapter “Beer export”).

Note that late in 2015, the second stage of large-scale modernization the enterprise started in 2013 was finished. Finnish investor, company Olvi, allocated 41.1 mln euro for this purpose. As a result, the brewery capacity increased at the stage of water preparation, brewhouse, and filling line by 45%. JSC Lidskoe pivo is planning investments to the sum of 4 mln euro in 2016. They will improve the sales system and logistics.

Production growth and export reduction in 2015 arithmetically meant sales increase of Lidskoe pivo in the domestic market by …% to … mln dal. As at Krinitsa, one of the growth drivers was an active expansion to the economy beer market, though the company’s sales structure remains balanced. The market share of Lidskoe pivo under our estimation grew by … p.p. to …%. As we can see, the company is catching up with the two market leaders.

Lidskoe pivo in 2015 was the revenue growth leader among the major producers. Under our estimation, it grew by …% to appox. … bln ruble. In dollars it fell by …% to $…3 mln. And the company cut the sales profitability down from … to … %. Resultantly, the net profit collapsed and is now balancing at zero point. We can say that the rapid growth of the market share was the price of such results.

In particular, profitability decline can be explained by the impact of price mix. Generally speaking, the sales structure of the company consists of two brands, namely economy beer Zhigulevskoe and mid-priced Lidskoe. And while the share of Lidskoe by the end of the year grew a little meaning neutral dynamics of sales, the key contribution into the natural volumes growth was obviously made by Zhigulevskoe.

By the year end the company dispensed as much of Zhigulevskoe as all other competitors taken together (including import). The ownerless brand version by Lidskoe pivo became the … by sales volumes with a market share of …%.

If not for the rapid growth of private label by Krinitsa, Lidskoe would have kept its second position in the top list of brands. Lidskoe is represented by a lot of sorts, which, by the end of 2015 demonstrated various dynamics, but in general, the brand’s market share has grown a little. Thus in the Lidskoe family … acted as a sales engine in the economy segment, while mid-priced … and … lost some of their market weight.

Heineken

2015 has probably been the worst year for company Heineken over all operation time on Belarus market. Basing on the regional statistics data, after a minor stabilization trend, beer production at Bobruisk brewery nosedived by …% to … mln dal.

The domestic sales of beer produced in Belarus declined almost in keeping with the production rates decrease and amounted to … mln dal under our estimation. And beer shipments abroad doubled having exceeded … mln dal. However, one can speak of an aggravation of protracted sales decrease at Belarus subdivision of Heineken which started as early as in 2011 when all brewers faced difficulties.

In our view, import stability, has marginally helped to balance the negative dynamics. Though the share of foreign subdivisions of Heineken in Belarus market is not large, that is, nearly …%, the general volume of the company’s sales shrank by …% to … mln dal. The net market share of Heineken has therefore dropped by … p.p. to …%

As Belarus subdivision, being a closed joined stock company, does not publish any reports, we do not know the financial performance. However, judging by the news, company’s payments into the budget of Mogilyov region in 2015 dropped by nearly 30% (including excises, VAT and other payments). This means substantial revenue decline in the national currency.

The decline can be observed in all price segments, but brand Bobrov wich produces its sorts mostly in the economy segments, incurred the biggest losses. By the year end, Bobrov share decreased by nearly … p.p. to …%. At the same time the share of … has shrunk substantially and sort … has been practically washed out of the market. The share of economy brand … which started being packed at Bobruisk brewery, has also dropped.

In general, the negative dynamics of … and … can be explained by rapid competition growth from … and Private label. In particular, even Heineken ‘s … has demonstrated some growth, which has somewhat offset the fall of natural volumes and has already gained a substantive weight in the company’s portfolio.

In the mid-priced and premium segments Heineken is represented by license Russian and international brands, which demonstrated various dynamics by the end of 2015. In our view, the market shares of … and … have grown. Other marginal brands …, … and main sorts of …, on the contrary, yielded their positions.

Different brands’ stability could have been connected to how long has passed after the license production launch. Thus, in 2014, the portfolio of Heineken Belarus was increased by beer Okhota, a major Russian brand of the company. In spring 2015, a licensed production of Amstel brand started preceded by investments to 0.7 mln euro. Thus among the prominent import brands only Heineken and Krusovice will soon remain in the portfolio.

If the season of 2016 is hot, the dividends will be obtained by Heineken subdivision in Belarus for kvass production. In spring 2015, the capacities for this drink production were increased by … mln dal.

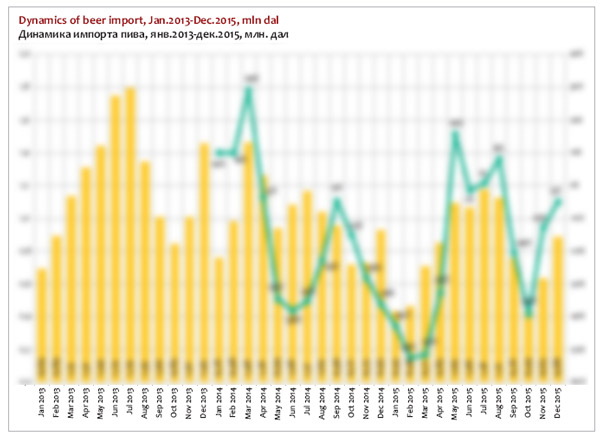

Import beer in Belarus

By the end of 2015, beer supplies from abroad went on falling at high rates, i.e. by …% to … mln dal. And if we compare these volumes to the peak 2013, we will see that the import has shrunk by … times. The import share on Belarus market has decreased from … to …% over this time.

The key reasons of import popularity loss lie in Belarus ruble devaluation and lower interest to the premium segment due to the economizing trend among Belarusians. An important role was also played by various barriers the state created to importers.

Import beer is present in all price segments of Belorussian market. Certainly the weakest positions of import beer are in the economy segment, yet in 2015, its share grew a little, exceeding …%.

Instead, the mid-priced import beer share is the highest, about …%. This is no surprise, as Belarus producers in general focus on the economy market segment. Lower sales of the mid-priced import was a little ahead of the market decline.

The marginal brands of the premium segment in 2015 either became mid-priced or lost their market share. As a result, the premium import segment has got sufficiently slimmer and weighs …%.

The … percent belonging to the superpremium segment are all represented by license international brands, which are produced in Russia. The superpremium segment saw some of its share reduction in 2015.

The list of key countries forming the import beer market almost fully has not changed, these are Russia and Ukraine. But while in 2014, the negative dynamics primary resulted from the Ukrainian beer import decline, in 2015 Russian beer import reduction was the reason.

Thus, the first wave of the steep decline of shipments was in summer 2014, after import licensing for beer produced outside the Customs Union was introduced. In order to get the permission, distributors had to bring an agreement with foreign producers, where the minimum beer price is stated.

While in 2013 the share of Ukrainian beer amounted to …% of the market, in 2014 it shrank to …%. The bulk of Ukrainian import consisted of Obolon production, or more specifically, the title brand priced to fit the mid-price segment. Note that this segment is not a mass one – in Belarus the term “mainstream” rather refers to the economy segment. However, Obolon, being one of the major brands determines a certain price level and economy brands have to distance from it.

In view of Ukrainian reaction, import beer licensing did not last for a long time, but caused much harm to beer supplies. The harm was both direct and indirect as breaches of contracts with network impacted future sales of Ukrainian beer.

In 2015, Ukrainian import increased its share a little by retaining the volumes against the falling market. Yet the sales structure was more varied. The main contribution into sales stabilization of company Obolon was made by economy brand Svetovar brewed specially for Belarus network Euroopt and export markets. Its share was growing very rapidly, reaching its peak (about …% of the market) by summer 2015. The title brand of the company is keeping its share of …%. Besides, brand Chernigovskoe by AB InBev has become weightier. Its share by the end of 2015, doubled and accounted for …% of the market. Authentic brands by company Persha Pryvatna Brovarnia started winning interest of Belarusians.

Russia is still the main trade partner, providing … of the import supplies. That is why the negative dynamics of import in 2015 primarily results from the sales decline of Russian beer by …% to … mln dal. The reduction pace accelerated twofold against 2013/2014. Accordingly, the share of Russian import on the marker reduced again by about … p.p. to …%.

The negative dynamics was in the first place the upshot of sales fall of several brands by Baltika. The company’s share on Belarus market fell by nearly … p.p. to …%.

Though Baltika in Belarus was mainly represented by premium sorts, the volumes fall of economy brand … was the most notable. Possibly, it was connected to the activity on the segment of Belarus producers or to the policy of import substitution. In 2014, … accounted for about …% of the market, but by the end of 2015, its share dropped by several times. Besides there was a considerable sales fall of the sorts that company Carlsberg started producing at Olivaria’s capacities.

The title brand by Baltika demonstrated relative stability. But due to consumers’ economizing, the share of premium … has decreased a little. However, here was a trend for recovery in the second half of 2015, that can lead to recovery or even growth of the subbrand’s market share to …% in the running year.

Other Russian importers sell less beer in Belarus. Approximately …% of the market accrue to … company and the next …% to …. … in 2015 won …% of the market primarily due to the growth of brand … market share. Russian subdivision of … is poorly represented in Belarus unlike Ukrainian subdivision.

The beer import from other countries (mostly far abroad countries) halved against 2013, to … mln dal. Currently, its market share amounts to about …% which is less than in Russia and Ukraine. The bulk of import from far abroad consists of AB InBev brands.

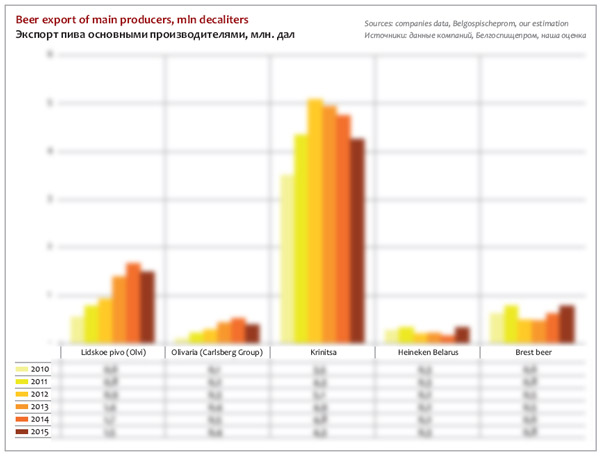

Beer export from Belarus

In 2015, the beer export as well as import experienced decline, as it fell by …% to … mln dal. The decline of beer consumption affected the neighboring markets which are still the major buyers of Belarus beer.

For the most part the import reduction was caused by shipments drop to Russia (-…%), and there was a substantial fall of supplies to Lithuania (-…%). The decline in these directions was offset by a sharp growth of export into Ukraine, which can be attributed to termination of the trade wars between the countries.

Trade balance as the difference between export and import has approached zero (because the import was decreasing twice faster) but it is still negative.

The export share in the total volume of the output was rapidly growing till 2013, when it reached …%. However, recently the export weight has been gradually decreasing in 2015 equaled …%. Note, that it is an unusual percentage for the Eastern Europe; Belarus is unique in this account. On the one hand, the republic government by the state program is stimulating beer export as an important foreign currency income item. On the other hand, in Russia and Ukraine consumers have developed a positive image of Belarus products, as inexpensive but produced under “fair”, Soviet quality standards.

Given the state-planned approach, and absence of foreign parent capital, it is no wonder that the largest state company Krinitsa has been and still is the sales engine. In summer 2015, Alexander Kizhuk, CEO of Krinitsa told that 35-40% of the total production volume is sent abroad: to Russia, USA, Canada, Germany, and Baltic countries being major beer exporters in the country (60% of export). “When Belarus market became more crowded and fiercer, it was export that saved Krinitsa. We do not plan to give up export. It is yielding high profitability”, – said the CEO.

Because of the problems on the Russian market that started from Russian ruble devaluation the enterprise strives to diversify supplies. Nevertheless under our estimate, Russia remains the major output for the company. Here Krinitsa according the company’s management succeeded in entering practically all trade networks (Ashan, Pyaterochka, Avoska and so on). The share of Krinitsa on Russian market under our assessment, amounted to only …% but given the market scope, and this share is rather sufficient.

Lidskoe pivo also exports substantial production volumes. Under our estimation, in 2015, against the sales volumes growth in the domestic market, the company cut supplies abroad, approx. by …% to … mln dal.

According to Adrius Mikshis, company’s CEO supplies abroad were retained by capacity deficit in summer period. In one of interviews, in autumn 2015, he said: “Russia’s share has not changed substantially and amounts to nearly …%. On the one hand there are reasons for Russia’s share decline in the general export volume, but, on the other hand, were are mentally close to Russia and there were are taken friendly, unlike, for example, Poland”.

He specified that in 2016, the company is planning to increase the production by …%. And all volume growth will go abroad.

Malt production

Belarus malt production grew in 2015, by 4.1% to 131.5 thousand tons. Virtually the entire volume accrues to jsc Belsolod. Basing on the data of the regional statistics, the company’s output volumes grew by 7% to 127 thousand tons. And in 2015, Belsolod increased its sales revenue from 30 to 64 bln ruble.

If we base on the general expenditure norms of malt at beer production, the demand of the national producers in 2015 reached not higher than 70 thousand tons. Belsolod has long ago satisfied raw materials needs of Belarus brewers. But apart from supplies to the domestic market, the enterprise annually increases export, which has long ago become its main income item. In 2015, the export grew by 4.1% to 82.4 thousand tons. Out of this volume, according to the data of the customs statistics 61.2 thousand tons (or 75%) was bought by Russia, which roughly corresponds to purchases in 2014. The growth was attained due to a row of Asian countries.

In 2016, Belsolod plans to expand production volumes to 130 thousand tons, despite the aggravation of the market situation. For this purpose in 2015 a project of special malts production was carried out. Presently the malt house produces caramel and black malt sorts at the new work shop with a capacity of 3.15 tons a year. Here we should note that in 2015, the malt import did not change and amounted 1.8 thousand tons, of which 1.3 thousand tons belonged to the category “roasted malt”. Probably these volumes will be in the first turn offset by Belarus products.

Besides, the big news of 2015 was the joined Belarus-China project to build a malthouse in Minsk region. Its specificity lies according to authorities, in the absolute orientation on foreign markets.

Juxin Malt Technology plans to build a supermalthouse with a capacity of 300 thousand tons a years. The total investments volume will equal $112 mln. The construction will consist of two stages each of which will be finished with a capacity launch of 150 thousand tons. The agreement provides for the raw materials to be fully imported and 100% of products will be exported to China.

To get the full version of this article propose you to buy it ($30) or visit the subscription page.

2Checkout.com Inc. (Ohio, USA) is a payment facilitator for goods and services provided by Pivnoe Delo.

The article materials were prepared using data by “National Statistical Committee of the Republic of Belarus” and “Belgospishcheprom”). A number of estimations are based on information provided by beer producers and by research companies.

In case the information source is not provided, the data on companies’ output and their interpretation are our assessment based on the current trends.

We do not guarantee that the given information is absolutely correct, though it is based on data obtained from reliable sources. The article content should not be fully relied on to the prejudice on your own analysis.