The beer market of Russia was warmed up by the hot summer, but the preparation for large volume PET prohibition has already impacted it negatively. The year was successful for Efes, MBC and regional producers; Carlsberg’s positions were virtually stable but AB InBev and Heineken lost a part of market share having focused on the sales profitability. The dynamics of big brands was determined by how much the companies were willing to keep the prices down or by their promotional activity. In this context the economy segment of the beer market and sales of inexpensive draft beer were increasing. The premium segment started shrinking due to license brands migrating to the mainstream segment.

The beer market of Russia was warmed up by the hot summer, but the preparation for large volume PET prohibition has already impacted it negatively. The year was successful for Efes, MBC and regional producers; Carlsberg’s positions were virtually stable but AB InBev and Heineken lost a part of market share having focused on the sales profitability. The dynamics of big brands was determined by how much the companies were willing to keep the prices down or by their promotional activity. In this context the economy segment of the beer market and sales of inexpensive draft beer were increasing. The premium segment started shrinking due to license brands migrating to the mainstream segment.

Beer production and beer market in 2016

Big beer alternative

Hot season effect: results of 2016, outlooks for 2017

Developing of sales channels

Private and small

Less alcohol

The market segmentation by price

The external trade rises

TOP-4 and their brands

Beer production and beer market in 2016

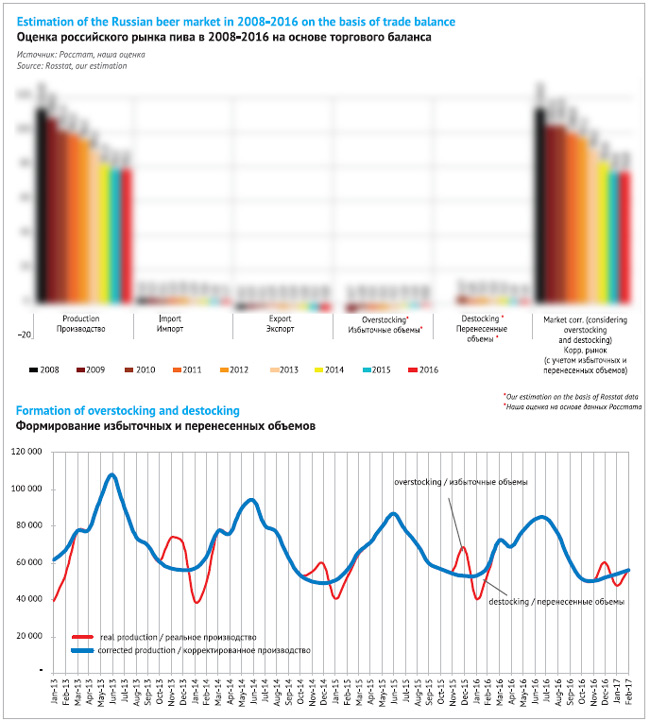

In 2016, the decline of the Russian beer market that started in 2008, stopped. Brewing companies that base their estimations on the retail audit data, speak of a 1-2% reduction of beer sales. However, if we rely on the trade balance data and the obvious decrease of carryover stocks, the market volume remains virtually at the level of the previous year, 768 mln dal.

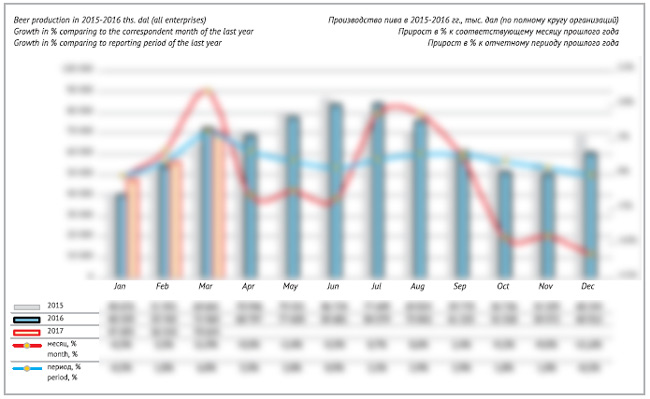

The dynamics of production and sales in 2016 was uneven, and changed its plus/minus sign by quarters. The rise in the first and third quarter of 2016 transformed into correction which became particularly apparent in the fourth quarter. But the start of 2017 was marked by yet another switch of dynamics to the positive trend.

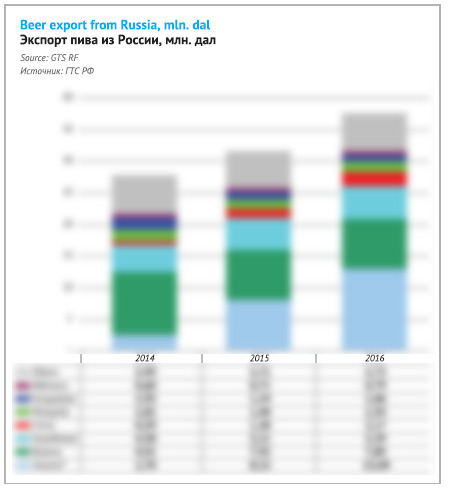

The production of beer and “beer drinks” in 2016 shrank by 0.12% to 781 mln dal, beer import to Russia grew by 8% to 17 mln dal and export increased by 19% to 38 mln dal. However, the final performance of 2016 was mostly influenced by carryover volumes.

At the end of 2015, brewers were much more actively loading warehouses of distributors than at the end of 2016. That is, in 2016 distributors sold a bigger volume of beer than brewers produced for the inner market. It is quite easy to explain such change – in 2017 the beer excise has grown by only one ruble and producers’ economizing by loading warehouses before the New Year was not substantial.

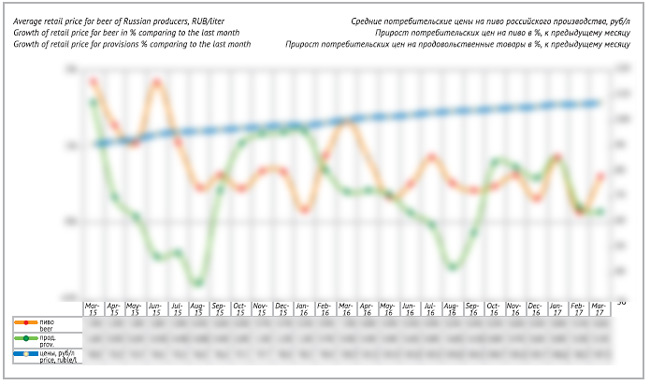

According to Rosstat publications, after a considerable decrease of manufacturer’s price early in 2016, the prices have been hardly increased by producers. Some rise was registered only at the end of the sales season, but it was not significant, and just brought the prices to the level of the previous year. Such restrain will be further explained by sales growth of inexpensive draft beer by regional producers, expansion of Zhigulevskoe market share, alternation in the license segment structure towards affordable beer and further sales decline of the “old” federal Russian brands.

According to Rosstat publications, after a considerable decrease of manufacturer’s price early in 2016, the prices have been hardly increased by producers. Some rise was registered only at the end of the sales season, but it was not significant, and just brought the prices to the level of the previous year. Such restrain will be further explained by sales growth of inexpensive draft beer by regional producers, expansion of Zhigulevskoe market share, alternation in the license segment structure towards affordable beer and further sales decline of the “old” federal Russian brands.

Basing on manufacture’s price data one can calculate the volume of brewers’ revenue. In 2016, it increased by just …% to … bn RUB. In dollar terms due to ruble devaluation brewers’ sales went …% down to $… bn, yet this decline looks much better than a year earlier.

Direct data by Rosstat concerning revenues based on reports by core beer producers reflect a …% decline to … bn RUB. The cost price of sold production went …% down to … bn RUB. But here we should keep in mind many income and expense items not linked to beer production and finance allocation by affiliated companies.

The dynamics of prices for raw materials was obviously favorable to brewers’ revenues. After a considerable decline of prices for malt barley at EU exchanges* early in 2016, by Autumn they rose again to the previous level. Contract prices for the harvest 2017 are gradually declining. Taking into account the long-term character of contracts, one could expect further positive influence on cost price of beer in 2017.

* Which correlates with the cost of Russian malt barley.

We should also note that the advertisement budgets for federal TV ad placement almost tripled from … bn RUB in 2015 to … bn RUB in 2016, according to the National advertisement alliance.

The rise of advertisement activity was conditioned by the compromise made between limitations and effectiveness of advertisement which meant active promotion of non-alcoholic versions of the key brands. Besides, the brewers had a good possibility to advertise alcoholic sorts which could support sports competitions. In 2016, such chance was provided by a lot of big sports events (hockey world championship in Moscow, football European championship in France, Summer Olympic games, and others). Basing on the data by advertisement analytics, one can assume that nearly half of the total GRP accrued to brands by Carlsberg Group which is back on TV.

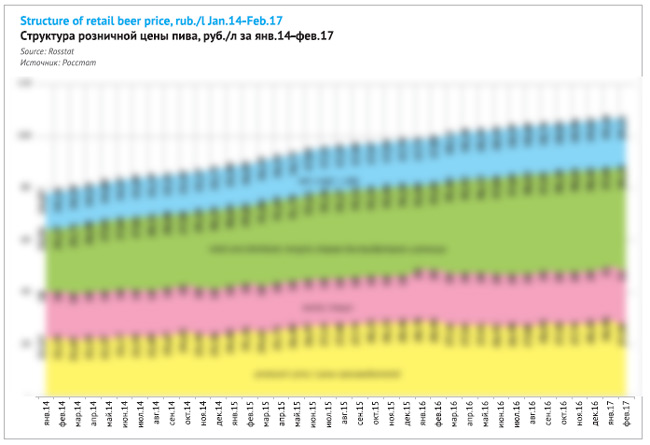

Retail beer prices for beer made in Russia according to Rosstat and the market players were growing virtually by linear trend. According to the official data, at the end of 2016, a beer liter cost … RUB, or … according to independent estimations. The average weighted price for all beer (both Russian and import) grew by …% to … RUB for a liter according to official data. But basing on the companies’ data, the price growth in retail reached nearly …%.

According to Rosstat, the prices were growing most rapidly and exceeded the inflation level in the category “foods” during the period from June to September 2016, that is, when the beer market was also growing. In Autumn, the beer price rise slackened and in general corresponded to the inflation level of foods pricing. According to the market players’ data, from October 2016, the price rise was temporary arrested due to a sharp decline in price of keg Zhigulevskoe by Carlsberg Group, which started more actively developing the draft segment in the threshold of the prohibition to output beer in large PET package.

Basing on the volumes and prices we can approximately estimate that in 2016 the Russian beer market grew by …% to … bn RUB by value*. In terms of dollars, it reduced by …% to $ … bn.

* The beer market by value is an imputation as a part of volume is sold in HoReCa establishments, where prices are not monitored and the trade mark-up can vary.

The general turnover of retail trade was growing much slower than beer sales. According to Rosstat data, it grew by …% and reached … tn RUB. Correspondently, the beer share in the general retail turnover increased from … to …% and in sales of foods category from … to …% according to our calculations based on the official data.

The retail trade experienced some activization due to absence of shocks and GDP stabilization.

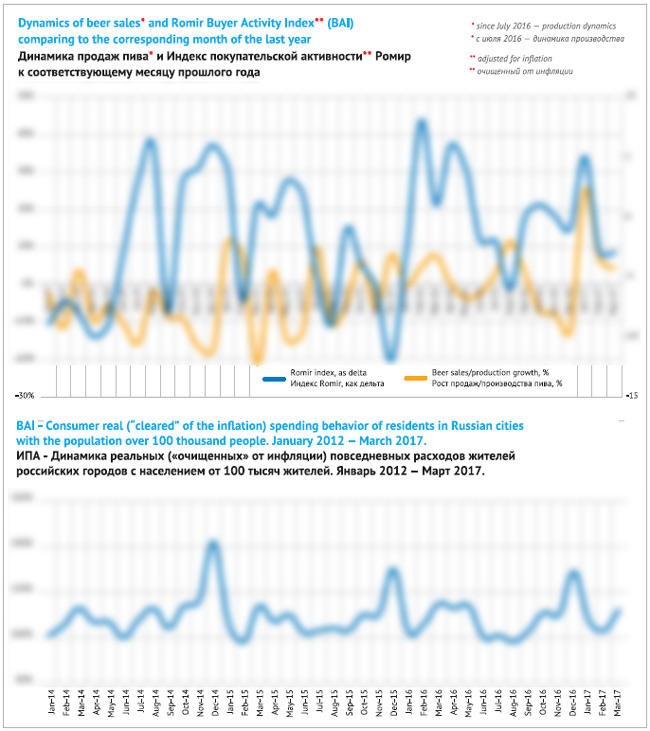

According to Romir Scan Panel the dynamics of actual (“clear” from inflation) daily expenses of the Russian in 2016 was moderately positive. One can say that the beer market has also got stabilized following them. But if we estimate the link between expenses and beer sales, in dynamics, in 2016 we will not see a clear dependence between them. Or rather, during the cold periods, the general trend is easily seen, but in summer the actual consumers’ expenses did not grow and the beer production on the contrary grew. Obviously at that time, the market was influenced not so much by the general economic factors as by weather. The weather influence will be discussed below.

Big beer alternative

The draft bill on prohibition of PET package was introduced into the State Duma by the ruling party as far back as in spring 2013. The authors proposed to pass a prohibition on beer sales in plastic bottles bigger than 0.5 l. The explanatory note said that beer consumption in the country had grown to “menacing proportions”, the cheapness of plastic package raised the affordability of this drink for the population, and its large volume promoted higher consumption. The Duma passed the bill in the first reading in June 2014.

For a long time the draft bill stayed without action as there was no shared vision in the government as for amendments to it. Carlsberg, AB InBev, Heineken, and Efes protested against the original version of the draft bill. President of Carlsberg Group submitted a letter to Prime Minister saying that the prohibition on PET package bigger than 0.5 l would be a “real disaster for the consumption and (would be) an extremely bad signal for international investors”. The ambassadors of Denmark, Belgium, the Netherlands, and Turkey stated that international groups could exit the Russian market. Newspaper “Kommersant” told of agreements reached in October 2014, to limit the volume of PET-packages for alcohol to 1.5 liters by 2017.

In March 2016, at the government meeting dedicated to problems of non-ferrous metallurgy, UC Rusal president Oleg Deripaska claimed that the absence of PET issue resolution hindered the development of the aluminum branch. In followup of the meeting, a group of ministries and departments were obliged to consider the bill draft “taking into account the government’s position”.

The amendments issued by the governments stipulated a complete ban on alcohol output in plastic package larger than 1.5 liters starting from 1 January 2017 and on retail sale starting from 1 July. In this statutory wording the law “On amendments to the law “Concerning the State Regulation of the Production and Circulation of Ethyl Alcohol and Alcoholic and Alcohol-Containing Products and on Limitation of Alcoholic Consumption” was passed in June 2016.

As we can see, the brewers had nearly two years to grasp the inevitableness of the ban introduction and to get ready for the changes. So, what does the ban introduction mean to them?

Due to large volume packages brewers were able to make a rational offer to consumers who wanted to economize or buy much beer at a time.

For example, the retail price for one beer liter in PET-bottle of 2.5 l. in 2016 was averagely …% lower against the same beer packed in a glass bottle of 0.5 l. And there was approximately a …% difference compared to PET package to the volume of 1-1.5 liters (allowed for sale). These ratios are in general actual both for mainstream and economy brands.

Certainly, the large packages had the highest significance in the “rational” segment of economy beer.

In order to answer this question, we should analyze the structure of beer in PET by two aspects – price segmentation and key brands. To do this we use data by the market players over the period when the impending limitation could not influence the brewers’ sales structure directly.

If we allocate all beer packed in PET by segments, we will have to shift the price boarders down against the general segmentation of the beer market.

The smallest among them is the discount segment (with a share of less than …% of beer in PET) where the average beer price equals 60 RUB/l. Here belongs Carlsberg’s version of … which is rapidly gaining popularity and brands … by AB InBev and … by Ochakovo. Most of … in PET and a small number of regional brands can be referred to this segment too.

The other end of the price range is occupied by mainstream segment – that is, beer sorts costing more than 80 RUB/l with a share not more than …% of the total beer volume in PET. Brands …, … various sorts of … in PET and some other brands belong here.

As we can see more than …% of the beer volume in PET should be placed within the economy segment with their prices ranging from 60 to 80 RUB for a liter. However, not only economy brands belong here but also brands with broad positioning, with sorts placed in different categories (for instance …). Besides, this segment houses the most of regional brands that, if we average out volumes and prices, gravitate towards the low boarder of the economy segments not crossing the line to the discount segment.

Further, it is noteworthy that the package size of nearly 1.5 l is out of danger area. As far back as at the end of 2014, brewers (as well as other FMCG participants) started downsizing – decreasing the quantity or volume of the packed products without changing prices. At that time, it was a feedback to the sales decline and lower purchasing power. But, currently, due to the prohibition, all beer packed in 1.5-liter bottles flowed into 1.4-liter bottles.

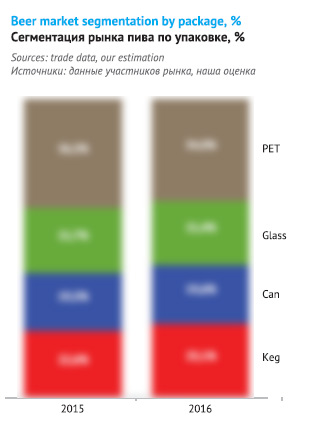

So, only beer in PET of more than 1.5 liters is at risk. Yet, the share of such containers is not so big – about …% of beer sales in PET.

Here, in 2016, Efes was expectedly the leader with its low mainstream brands and a share of about …%. Company AB InBev in 2015 also was selling considerable volumes in large package, both at medium and low prices. But as soon as the begging of 2016, AB InBev started distancing from large sizes by offering consumers a substitution, namely “…” in 1.4 l. bottle. And the vacant space in the subsegment of cheap beer in large package was taken by company … as well as by several regional brands.

If we generalize all this info we can make a rough forecast for 2017.

In the first place, there will be a logical decline of beer sales in PET caused by downsizing. The redistribution of …% of “big” beer volume to smaller PET package means a possible risk of price rise by …%. The prohibition of PET package in the first place presumes that economy beer and discount sorts of regional companies has got into the hazard area. The price rise is likely to result in a considerable reduction of their sales. Affordable mainstream beer is at a lower risk as its sales volumes easily “flow” to smaller package.

Thus, the sales shrinking due to the ban will be “dampened” by their structure only partially. Basing on the market players’ prognoses which now look quite realistic, the negative effect in general can reach …% for PET segment. And the beer market in general can lose up to …%. But this will take place under the condition that brewers do not react to the prohibition by increasing the price distance but decrease prices for 1.4 l volumes in order to make it more affordable.

Even if there is some sales decline, it will not much affect the revenue of major companies. Among the market leaders … will suffer the most, but the biggest part of their big volumes will be reallocated to smaller packages. Other companies will have local failure of sales – one can expect further volume reduction of … by Carlsberg Group as well as beer … by Heineken. The prohibition of large volume PET will most painfully impact … (for example, … which used to be one of the leaders in the segment) and many regional breweries where PET is the main package for beer while the price is the major instrument in competitive struggle.

… will also experience negative influence as in developing their networks they made the main emphasis on PET, which serves as package for more than …% of the beer including large volume package. The sales growth of … was caused by forced necessity of the Russian to adapt to the recession and was absolutely rational.

As a result of all these processes, in 2017, the economy segment share can stop growing.

Hot season effect: results of 2016, outlooks for 2017

The probable transition of the market to equilibrium state means that seasonal fluctuations will be more directly reflected on the sales dynamics than previously, when they belonged to secondary factors.

A spike of beer production and sales in July-August 2016, made it possible for brewers to if not exceed then at least repeat the last year performance. Yet, this growth seems to be based not on fundamental factors, but on one-time bonus and results from hot weather in certain regions of Russia.

In other words, the high base of the third quarter of 2016, means that the dynamics of the third quarter of 2017 will not likely to be positive. Only in case the weather is again extremely hot or there arise some other positive factors.

Market leaders as well as regional producers are unevenly represented on different territories. That is why the weather condition effected them differently, determining to a large extent the performance in 2016 and outlooks for 2017. In this aspect, it is interesting to compare the temperatures in different territories and their performance in 2016.

For this purpose we gathered data on average monthly dynamics of temperatures in April-September 2016 in 16 regions, which make the biggest contribution into the beer consumption.

Summer 2016 was in general rather warm and the zones of high temperatures were shifting. But in June 2016, it was particularly hot in the territories with low level of beer consumption. Thus, in June 2016, it was mainly hot in the northern part of Siberia. And in July, the weather was hot in the north of European part of Russia in western Siberia.

Instead, August 2016 was rather warm nearly all over Russia – from Central region to Ural inclusive. But the weather in the populated area of Volga region and South Ural was particularly hot. Here the temperature difference 2016/2015 was great as the seasonal fluctuations of the two compared periods came into antiphase. This brought about a spike of beer production and consumption.

Under our calculations, “delta” of average temperatures reached …°C in Ufa, …°C in Kazan, …°C in Samara, …°C in Yekaterinburg, and …°C in Chelyabinsk.

But who then benefited from the hot August of 2016?

In the Central region it was not the hottest, but due to its market weight, it made the main contribution into the sales volume increase of Russian beer. The sales structure in the Central region was more even than in other regions in terms of share division between the market leaders. Thus, one can hardly say that any of the leading four much benefited from the summer heat. We can only call your attention to Moscow Brewing Company whose share in Moscow and Central region under our estimation is almost twice bigger than in the rest of Russia.

Volga region stands out for its high market share of medium-sized regional and small industrial enterprises. Together they control about …% of the market. However, their output volumes in 2016 were multivalued basing on the data of the regional statistics, the most of medium-sized breweries kept output volumes at the past level.

But in Volga region there are also two big breweries of Efes, in Kazan, and Ulyanovsk region. And that is where in 2016, a particularly high production rise was obsereved. One can assume that the output volumes of Kazan brewery in 2016 increased by …% and amounted to … mln dal.

In Ulyanovsk region, according to Rosstat data in 2016 a twofold beer production uprise, to … mln dal took place. However, along with Efes there is also regional producer … that reported of an output volume rise. Apparently this enterprise made the biggest contribution into the dynamics of regional volumes.

Besides, in Volga region Baltika has been gaining the market weight during the recent years, pressing Heineken and AB InBev.

Ural region differs from Volga region by domination of major beer producers and small share of regional brewers. And the bulk of beer is not manufactured at the local market but delivered from neighboring regions. Nearly …% of the beer sales in Ural accrues to … and it can be considered the main beneficiary of the sales increase.

The high base of 2016 in Volga region and the South Ural bespeaks possible cutbacks in beer production and consumption. It will in the first turn put pressure on …s performance, that is more dependent on sales in these territories than … and ….

Besides, the year of 2016 made it very clear that hot weather stimulates sales of affordable draft beer more actively than sales of beer in PET.

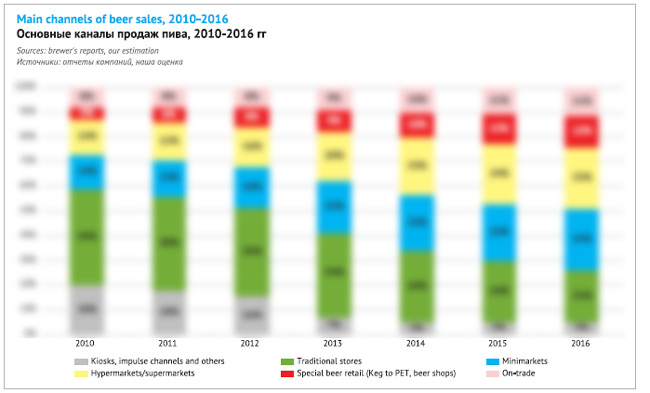

Developing of sales channels

Generally speaking beer distribution can be divided by three groups which differ considerably. 1) General foods retail that includes big networks, minimarkets and traditional shops; 2) HoReCa including traditional beer restaurants, bars and craft gastropubs; 3) specialized retail which includes Keg-to-PET shops with limited beer range and beershops with lots of packed beer sorts.

Craft breweries mostly work in megacities and with specialized distributors or directly supply products to beershops, restaurants, and gastropubs. The majority of such “craft territories” are focused on well-to-to and curious guests and propose them several dozens of special beer sorts.

Craft breweries mostly work in megacities and with specialized distributors or directly supply products to beershops, restaurants, and gastropubs. The majority of such “craft territories” are focused on well-to-to and curious guests and propose them several dozens of special beer sorts.

In the recent years, there has been a steep increase in the number of craft beer outlets. In Moscow about … bars and shops according to 2GIS included craft into their product range. Saint Petersburg, according to 2GIS also numbers more than … of such places and there are at least several dozens of them in each million-city.

At the same time, beer lovers found half as many places where one can buy craft beer in Moscow. Such discrepancy in calculations results from the common trend when HoReCa establishments and beer retail following the fashion only declare “craft” in their sites, catalogue or when speaking to their guests. But they do it only grounding on their variety of non-mass beer. Even if a restaurant, for instance points out its traditional German spirit, brews beer by “German technologies” and has a German name.

For regional breweries and their key output channel, shops of draft beer, 2017 is going to be complicated due to the state regulation.

It will not be an exaggeration to say that exactly draft beer helped keep the beer market stable in 2016. Keg beer has the advantage of low price and wide range which makes the medium and small producers increasingly popular in the local and neighboring regions.

In each region new popular draft beer brands are emerging in the draft beer segment which has no much space either for big companies with their versions of draft … or federal brands. But even “old” brands of regional breweries yield their market share to them, though it is taking place due to the stagnation against the rapid segment increase.

For instance in Siberia there has been a prolonged market share growth of … and …, in the South … and … are rapidly gaining market weight, and in the Central region company … is moving to the fore. But if we look at the sales of keg beer in general, it would be pointless to distinguish any company in certain markets. There are no leaders. But the share of at least one hundred regional brands by several dozens of regional producers is growing.

The sales rise of draft beer is also connected to sales decline of beer in PET because of the large package ban. This can be explained by departments of draft beer in networks and specialized outlets currently propose beer in the same format as common retail, in PET bottle of medium size. The advantage of buying packed beer “for the future” at a supermarket has become not so evident. Instead, the major advantages of buying draft beer have become more evident as such outlets are often located within walking distance and beer is usually fresher, tasty and various than beer packed in a PET bottle.

At the same time, there two negative aspects of the state regulation the aftermath of which is yet to assess.

The first one is the demand concerning all entrepreneurs selling beer to install modern point-of-sale terminals by April 2017. Almost half of all entrepreneurs, according to data by “OPORa of Russia” have been working without cash drawers and did not install them in time due to objective or subjective reasons in connection to lack of cash drawers. And starting from 1 February 2017, there is an official fine for those who have not renovated the equipment.

Considering unfeasibility of the terms the Ministry of Finance made a step toward business. Entrepreneurs can avoid sanctions in case they “take all measures they can to comply with the legislative requirements”. A contract for delivery of fiscal storage device can play a decisive role. That is, if an entrepreneur dealing in beer can prove he/she has taken all necessary steps, but still has not acquired a new cashpoint, there will not be a fine.

The second negative aspect is traditionally connected to the limitation on draft beer trade on the ground floors of apartment blocks. Though at the federal legislative level such initiative were dismissed, the regional authorities have rights to set additional limitations concerning time, conditions, and places of retail sales of alcoholic products.

For example, since 1 January 2017, in Krasnodar Krai it has been forbidden to sell daft beer in apartment blocks (except for café, where operation is stipulated by project documents). According to the official data, in the region there are … restricted entities located in apartment blocks. Among them … are in Krasnodar and … are located in Sochi. Soon a lot of news appeared informing of inspection in apartment blocks, fines, and beer confiscation.

It is known that, at the moment, there are a lot of similar draft bills passed or under review in many regions of Russia (Kursk, Orsk, Volgodonsk, and others). Beer shop owners often accuse big trade networks of lobbying the trade prohibition.

If the two negative aspects of the state regulation outweigh the single positive one, reduction of beer outlet number will mostly reflect adversely on medium-size and partially on small producers. Then the losses of regional brewers caused by ban on large PET packages will not be offset by “flowing” of their sales into other distribution channels. At least this can be expected in Krasnodar Krai.

Major international companies dominate on the packed beer market in retail chains. There they compete with medium regional breweries.

Modern trade today is not only the biggest beer distribution channel, it is also the most promising one as it is the only one to demonstrate a growth, though not rapid but rather stable. The beer sales decline in traditional groceries has been progressing by two-digit rates because of their number decrease and stronger consumers’ rationalism which means sticking to planned purchases at supermarkets in order to economize.

According to brewing companies’ reports, in 2013, traditional outlets sold twice bigger beer volumes than the modern trade. Yet, the ban on beer sale in kiosks and riot growth of chains over 2014 changed the situation for their favor. According to the results of 2016, the modern trade formats in the total volumes of retail beer sales grew by nearly … p.p. and reached about …%. Non-chain shops and other traditional retail currently account for a little more than a third of the total beer sales.

The redistribution was particularly rapid in the first half of 2016. While in Siberia, Far East, and the South there is still some parity between beer sales at the retail trade formats, in Ural and Volga regions, to say nothing of the Central and North-Western the traditional shops now account for nearly …% of beer sales.

Major companies Carlsberg, Efes, and Heineken have been most actively cutting down their market presence at traditional shops. Judging by reports by two market leaders they purposefully focused on sales increase at supermarkets. Good performance of MBC in 2016 was achieved among others by intensive growth in the regional chain retail.

Unlike the market leaders, regional brewers were developing quite steadily in all channels of retail. They increase there weight at traditional shops greatly pressing federal brands. The same process but to a lesser extent was taking place in the modern trade. For example, a range of medium sized enterprises including …, … and many other Siberian breweries have considerably strengthen their presence in Ural region. By the way brewery … also had an excellent performance in other regions of Russia.

On the one hand, medium breweries pressed the market leaders in small towns, where there are still many non-chain groceries. On the other hand, as we have already said, the growth of regional breweries was much based on large PET package which will be forbidden to sell in retail starting from this summer. So it is uncertain whether it will be possible for them to further increase their share in modern trade in 2017.

At the end of 2016, all brewers got a chance to strengthen their presence in chains, yet there appeared a risk of losing their shelf spaces. According to new amendments, to “Trade Act” networks are not allowed to take any fees beside a 5% bonus for services or of volume sold production from suppliers. As a result contracts are being revised and the purchasing prices are growing in order to compensate for the traders’ loss of profit. And even the beer market leaders sometimes failed to reach a compromise and conclude contracts with all previous partners.

Private and small

According to Rosstat data, small beer producers* in 2016 retained the output volumes approximately at the same level, that is … mln dal. Accordingly, last year, their market share did not change having amounted to …%. Such performance can not be considered positive as in the previous period 2015-2014 the growth reached …%.

* According to Rosstat classification, small breweries are those which have staff of up to 100 persons and sales revenues not exceeding 400 mln RUB.

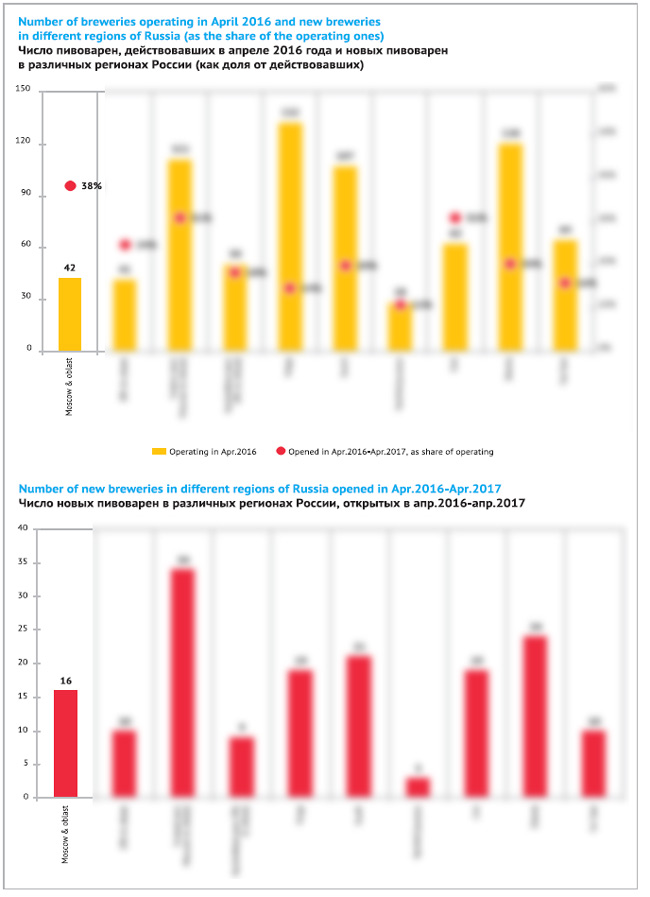

Besides, under our estimation based on declarations, starting from April 2016 till April 2017, about … new beer producers announced the start of their operation. Technically, there are nearly … new brewers, but some of them have just changed owners or started operation at previously working breweries. We don’t have info on how many breweries were closed during this period, but we can positively say that the general number of breweries in 2016 increased considerably and now it is approaching ….

The biggest increase in the number of small enterprises in absolute terms was seen in the Central region (about … new objects), if we do not take the capital city into account. And in relative terms, the most intensive growth was observed in Moscow and Moscow region where … breweries, mostly craft ones, have been opened and their total number has grown by more than a …. Besides, there was a considerable growth in Ural region. By the way all the mentioned territories are dominated by big transnational companies and developed premium segment of the beer market, which is certainly a good basis for small brewing development.

The number of small beer brewers in Volga region and North Caucasus was rising comparatively slowly.

But how is it possible that the brewery number is increasing while the official output volumes by small brewers stay the same?

The small enterprises group includes all core minibreweries and a small part of medium breweries. Under our approximate estimation, more than a … of output volume of small enterprises accrues to … of rather big minibreweries with different positioning – from … to … beer. But their absolute majority consists of minibreweries with a capacity of 300-500 l. per one brew. So, the change in their number does not much influence the total output volume.

The increase of the small producers’ market share is limited by trade channels they use, price and the formats they operate in – either in highly competitive traditional or in narrow craft one.

In Moscow and Saint Petersburg the craft beer segment with specialized distributors and sales channels is developing the most rapidly. But in regions most of breweries continue operating in traditional beer formats and compete with medium-sized breweries supplying their products to draft beer shops. Currently exactly such breweries go to make up the majority in the list of Russian small producers and their net output volume is bigger than that of craft breweries.

In the USA, usually all beer made at private breweries with capacity of less than 71 mln dal is considered to be craft. According to craft brewery motherland’s standards we can say that every fifth bottle of beer made in Russia belongs to craft, but than the notion of craft itself will be smoothed over. That is why, outside the USA it is reasonable to detach from the formal definitions and consider craft brewing as a special group of producers who purposefully distance from the mass output by big companies. Craft brewers underline their exclusiveness by special beer tastes, enthusiasm, positioning, original design, and informal activity.

Along with the world fashion two factors promote the craft segment development, namely, the image inflation of the license beer and sharp price rises of import beer since 2014. As a result in the marginal segment of the beer market, there appeared a large price niche. However, the price of Russian craft beer is now comparable to major import brands.

Regardless of a craft brewery’s size, the bulk of beer is packed in kegs and sold in HoReCa or in shops of draft beer. Only a few brewers can afford having an automated bottle filling line. According to official data, this package type is registered only in …% of small breweries, not taking restaurant breweries into account. Yet, the glass bottle share is increasing due to demand from specialized beershops that aim at proposing a wide range of craft beer. But here small brewers compete with each other for comparatively small group of consumers.

The most effective distribution channel, grocery chain retail is still not developed by small brewers. Noteworthy, in the USA supermarket shelves and even grocery store shelves have become the main sales channel for alternative beer, which allowed winning 12% of the market.

On the shelves of the regional modern trade stores you can hardly find beer by small brewers. Though at supermarket there are often departments of draft beer, where you can buy it. This is easy to explain: chains need packed beer in large volumes with stable taste, long shelf life and unchangeable supply terms. This immediately limits the number of potential suppliers for the retail to a couple of dozens of big breweries. We know several examples of chain cooperation: … and … with craft beer and … with traditional sorts as well as a row of projects integrated into the retail. Small breweries try cooperating with supermarkets from time to time, but as far as we know without a steady success.

That is why alternative products in the modern grocery retail are offered by international companies themselves among other ways by contracts for import brands distribution. Carlsberg and AB InBev were attempting to secure a foothold in this segment. Yet Moscow Brewing Company has become the craft market leader, despite the scale of its operation.

In 2014, MBC started outputting Mokhanty Shmel Ale and, from mid2015, it has been supplied to all regions of Russia. The brand is packed in usual and one liter glass bottle (costing 135 RUB) and positioned in the premium segment of the beer market, where it is rather successfully competing with mass license brands.

Next launch was carried out by Volkovskaya Brewery outputting beer which corresponds to the craft formant by many characteristics. However Volkovskaya Brewery is mainly focused on the mass consumer and its beer is available in modern trade costing about 85 RUB for a 0.5 l bottle. Under the umbrella brand a range of usual five craft sorts and several specialties was output. But the biggest distribution and correspondently popularity are enjoyed by IPA and porter Port Artur. And IPA by Volkovskaya Brewery has rapidly become the biggest brand by sales volume in that category.

At the same time, MBC has begun importing well known in Russia world craft brands that have also got to chains: Anderson Valley, Stone, and Rogue from the USA, Jopen from the Netherlands and Mikkeller Denmark. They were priced higher than average import brands, but low enough to attract even not the richest lovers of craft beer.

As we can see small craft breweries at their market faced a fiercer competition both from legendary Western brands in expensive segment and from big companies in affordable one. Pressing the markets leaders into the premium segment which is also having difficult times, makes them ever more actively search for an alternative for mass license international brands and import beer into the international premium segment. That is why, in the nearest future, Russian small craft brewers will have to get down to promotion and popularize their mastery although not hoping for immediate profits.

Less alcohol

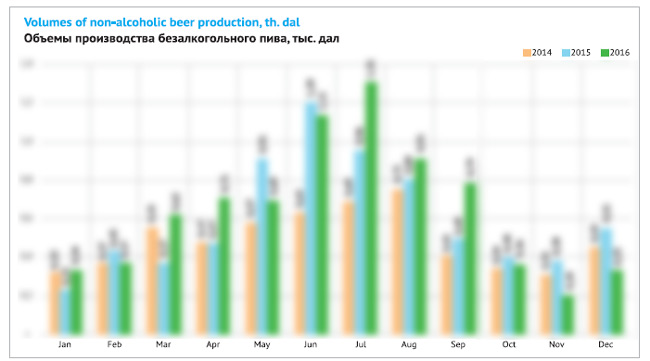

The sales increase of non-alcoholic and light beer has become an evident trend, which has made a contribution into the market stabilization of 2016. However, the growth of non-alcoholic beer output reduced twofold, having amounted to …% to … mln dal by the year end. According to Nielsen, Baltika refers to the non-alcoholic beer segment in 2016 grew by nearly …%.

The popularity of alcohol-free beer is based on the fact that the biggest consumer group now consists of the generation born in the 80-ies. This generation’s share in the total volume of drunk beer, according to RLMS HSE*, has already reached …%, plus …% accrue to the generation that hardly ever drinks, those born in the 90-ies. Unlike the previous generations, who placed beer high, the young people of today have quite different priorities. They value healthy life style and do not consider large amounts of alcohol effective for social adaptation.

* Russian monitoring of population’s economic condition and health state RLMS HSE.

Baltika #0 remains an unrivalled leader of the non-alcohol segment with a …% share. According to Carlsberg data, the sales of this sort grew by …% over 2016. In March 2017, the company even launched a new production line for non-alcoholic beer at their brewery in Samara.

Also its growth has been driven by new launches as popular brands started gaining non-alcoholic versions. For instance, in summer 2015, there appeared Bud Alcohol Free on the market. AB InBev has been actively promoting it as a world football championship supporter. And in spring 2016, sort Zhiguli Barnoe Alcohol Free was launched. It gained a marketable weight immediately and became particularly popular on Moscow market.

New launches and the category growth were supported by a very active promotion which complied with the law. The majority of brands advertized on TV in 2016 were alcohol free which allowed them to avoid advertisement limitations.

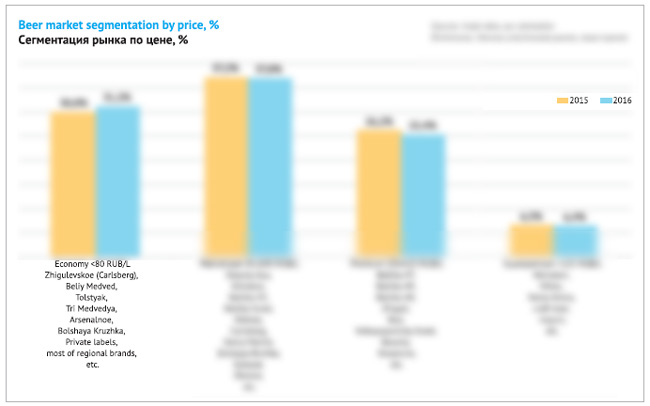

The market segmentation by price

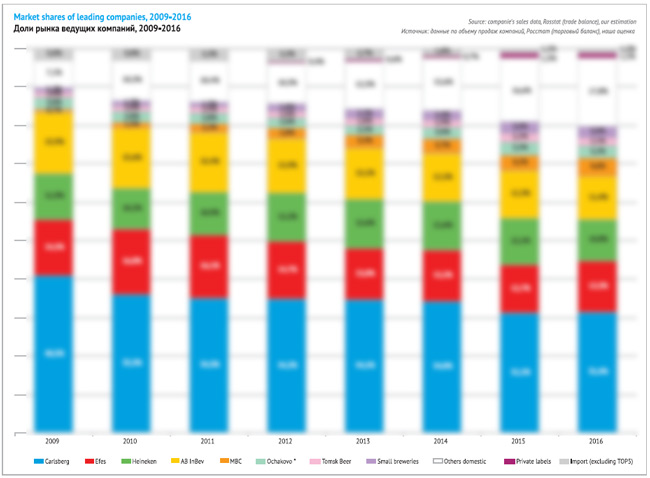

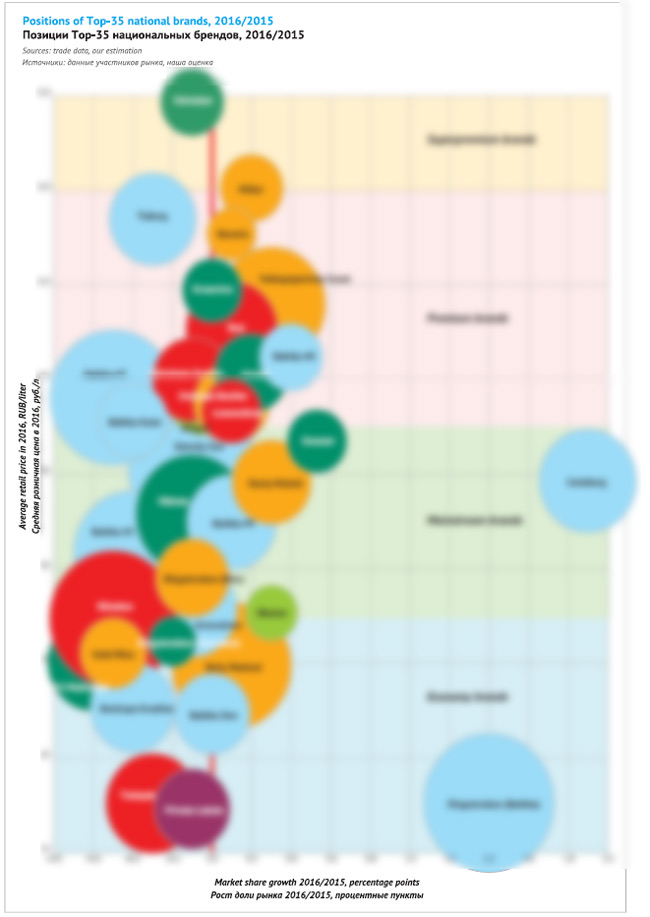

The segment shares did not much change in 2016. In retail, economy segment of the beer market has increased while the premium one has decreased. The mainstream share remained practically the same, as well as the sales of superpremium beer. But there were ups and downs of many brands behind the seeming stability.

The main growth driver for the economy segment was a host of economy brands, along with new leader of the Russian beer market … by Carlsberg and …. They managed to compensate by far the decline of many federal brands where the share loss of … by Heineken, … by Carlsberg, and … by AB InBev were particularly evident.

Most probably the share of economy segment would have gone up even more if companies and retail had not started excluding PET of large sizes from the turnover. For the same reason, … failed to support the segment rise in 2016, though they had been developing intensively prior to 2016. The ban on large size PET will hinder the segment growth further in 2017.

The mainstream segment had an even more difficult and contradictory situation. The share of … and … went on falling having already yielded the first place to economy brands. But the segment got a powerful support from sharply cheapened brands … and …, which were popular among Russian consumers for their affordability. … and … have also proved to be comparatively stable.

The premium segment reduction was fully caused by share decrease of …, …, and …. The rest of major brands have kept their relative stability, while … and … did not stop developing and went on growing. Certainly, the negative impact into the premium development was made by migration of brands by … and … to mainstream which took some of marginal beer sales. The license segment is now less overlapped with the premium one.

The superpremium segment remained stable as a minor share reduction of some expensive license brands was offset by import and craft beer growth.

The external trade rises

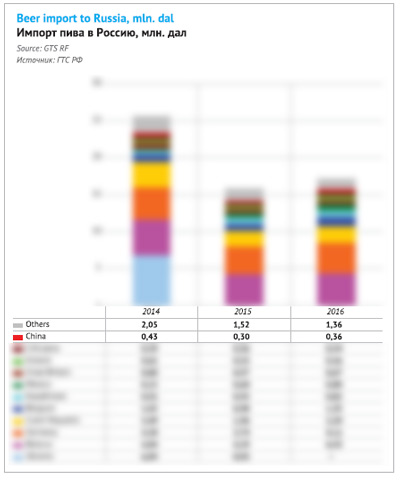

In the previous year, the external trade in Russia developed momentum – both import and export of beer were on the rise.

Beer import to Russia in 2016 increased by …% to … mln dal. The volumes grew due to expensive beer from far abroad countries. The major supplier, Belarus, remained virtually at the same level of deliveries, while Kazakhstan and Armenia have reduced theirs. Yet the big three of EU suppliers – Germany, Czech Republic, and Belgium have been increasing their volumes at … rates. Such dynamics was connected to consolidation of expensive beer sales in the hands of major companies, that provide for numerical distribution increase.

The biggest contribution into sales of beer from far-abroad countries has been made by company AB InBev. German Spaten and Mexican Corona continue growing after they occupied first positions in the import beer market. Besides, German Franziskaner, as well as Leffe and Hoegaarden from Belgium belong to Top-10 import beer sorts from far-abroad countries.

Company MBC has also been enjoying a considerable sales increase of import beer, on the one hand promoting Budweiser Budvar and on the other focusing on variety of brands known to lovers of expensive beer. Irish Harp, German Krombacher, and Erdinger, a big family of brands by British company Wells & Young are only some of a host of brands represented by MBC.

Besides, there is an increase in deliveries by major expensive beer distributors, cooperating with companies Heineken and Diageo.

Beer export from Russia has technically grown due to Ukraine, but clearly it concerns exclusively the deliveries to breakaway regions. In 2016, beer export in that direction grew by …% and reached … mln dal. And the share of Donetsk and Lugansk regions in the total volume of the Russian export amounted to …%.

It is interesting that more than …% of beer that is delivered to those regions consists of products by numerous independent producers, the largest among which is … and …, rather than by transnational companies. As a rule it is quite an affordable beer in PET package.

By the end of 2017, one should not expect a substantial rise of deliveries to the breakaway regions, as on the one hand their market has been already well saturated and on the other hand in Donetsk the former brewery of Efes has resumed operation. The designed capacity of this brewery is comparable to the local market size.

The export volumes of Russian beer to Belarus and Kazakhstan in 2016 hardly changed and amounted to … and … mln dal correspondently. The beer export to China is still rapidly growing, but its share in the total volume is not too big – about …% of supplies.

TOP-4 and their brands

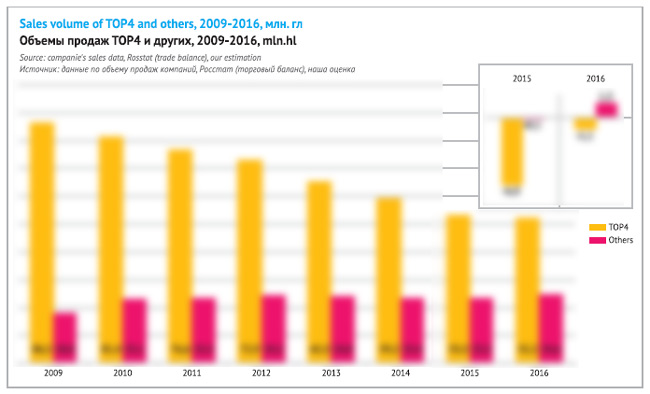

If we assess the beer market as a ratio of the four leaders’ sales to the sales of the rest of producers, one can speak of a balance that emerged in 2016. The net sales of TOP-4 decreased but not so considerably as previous years and the sales of “the rest” grew and compensated for the volume reduction of the leaders. By the end of 2016, following a prolonged decline of the leading companies’ market shares and expansion of the rest of producers, their volume relation is roughly 2 to 1, but not 5 to 1 as in 2009.

The balance became possible as two leaders stepped forward – Carlsberg and Efes that value the Russian market high enough to secure and if possible increase their share despite the fiercer price competition, economic challenges, and lower beer popularity as a drink. Why exactly these companies got the leading role is easy to understand if we look at sales geography and weight of Russia in financial reports.

Besides, if Moscow Brewing Company continues growing and expending the distribution in the regions by the current rates, in the immediate future, we will speak of five regional leaders rather than of four. Yet, so far MBC’s volumes are … as those of AB InBev according to our estimation.

In 2016, Carlsberg Group managed to turn the prolonged tide of the market share reduction. The company’s sales grew by …% having in our view amounted to … mln dal of beer. According to our calculations the market share increased by … p.p. having reached …%. The company revenue, by the end of 2016, grew by a singlevalued sum, having slightly exceeded … bn RUB by RAS (net of VAT and excises).

According to the company’s report the net revenue on the Russian market reduced from … to … mln Danish crones due to the ruble devaluation.

The shipments growth resulted from hot weather in the third quarter and the market share expansion in the second half of 2016. A key priority for 2016 was to strengthen the position in the modern trade channel, which was achieved, while the market share was down in the traditional trade channel. Besides, the company reported of an excellent performance in selling Carlsberg brand due to its positioning as well as of growth of brands Zhigulevskoe, Baltika #0 (…%), and Zhatecky Gus (…%) while the there was a decline (of sales and market share) of brands Baltika #7 and Baltika Cooler.

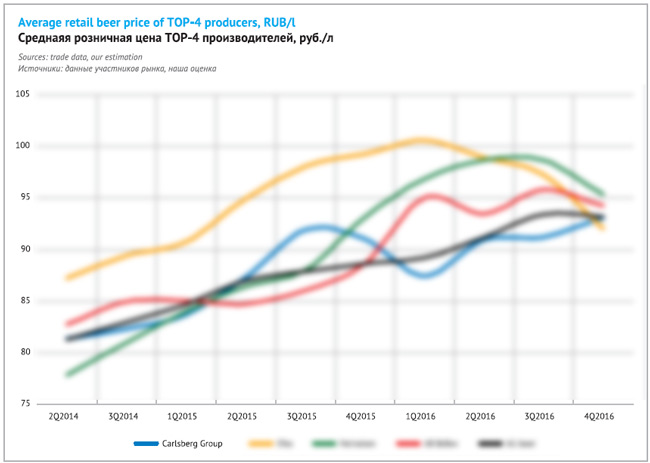

As for achievement on the Russian market, Carlsberg Group’s management reported of an organic growth of operational revenue. Besides, it was said that the company’s share in allocation of beer sales revenue on the Russian market is considerably higher than its market share (…% under the data by retail audit).

Under our estimation, the change in the market share of Carlsberg Group to a large extent was determined by the average price dynamics. It was rapidly growing during 2015 which resulted in a considerable decline of sales volumes. But at the end of 2015, among the price “rally”, the company’s retail beer price on the contrary went down substantially which drove the market share restoration. This took place among other reasons, due to broad downsizing. By the end of 2016, the average price for Carlsberg Group got comparable to prices of brands by other major companies again.

To some extent the retail price dynamics reflected a transformation of sales structure of Carlsberg Group. The leading positions did not weaken but the portfolio came closer to economy segment.

There was a fast growth of license but mainstream brand …, and a slow growth of … sales, supported by the most powerful advertisement among the company’s other brands. Their growth made up for the volume decline of more expensive … and …. Mainstream … also saw its market share shrink. As we can see, despite the volume increase of non-alcoholic sort, brand Baltika turned out to be an anti-leader of 2016 by the scales of the market share reduction.

The growth of … brand also had some negative impact on the sales of … and …, that saw their share decline which led to company’s positions deterioration in the premium segment. But here we can rather speak of pressure from competitors, in first place from marginal brands by ….

… was the company’s remedy for the sales decline of more expensive … and some regional brands that yield their positions pressed by regional breweries and cheap draft beer. And the brand sales increase was observed in two most rapidly growing channels, namely, in modern trade and at the keg beer market. In order to strengthen the positions in the draft segment, the company slumped prices for keg … at the end of 2016, so they have become more competitive and are now able to attract the most rational and economizing consumers.

The territories that provided Carlsberg Group this good performance at the Russian market in 2016 were obviously …, …, and … regions. Here the company won a share from … and …. Besides, the company’s sales in the … region remained stable.

Company Efes in 2016 was much more successful than other market leaders. Under our estimation the company’s sales grew by …% to … mln dal. The market share according to our estimation went … p.p. up, having reached …%.

According to the company’s report, the sales growth was attained thanks to the economy recovery, favorable weather conditions and period of grace as for limitations of PET package sizes. The improving performance over the year translated into a double-digit growth by the yearend. At the same time, Efes managed to get this growth not through a compromise with profitability. The company informs, of success in the modern trade and the market share increase in segments Upper Mainstream and Premium.

Company Efes as well as its major competitor, was rather rapidly increasing retail prices in 2015 and went on increasing them at the beginning of 2016, when it temporary found itself among the leaders by the average prices for beer. Yet in spring 2016, some months after the decline of Carlsberg Group’s average beer price, there emerged a disproportional price gap and company Efes started a forced and rapid correction of the sales and price structure, though still remaining one of the companies mostly focused on the premium segment.

Last year, Efes did not have any breakthroughs or very unexpected steps. Nevertheless, the bulk of the company’s key brands expanded their market share or at least kept stable due to the representation growth in the modern trade. Retaining prices for all the brands had equally positive sales results. And the sales needed less stimulation, thus Efes’s level of promotional activity was lower than that of other companies.

The premiumization of Efes brands portfolio was connected to the company’s market share growth in the premium market segment and share reduction in the economy segment.

The sales of inexpensive beer went down first of all due to withdrawal from circulation of large-size PET package. This process was more important for Efes than for other big producers as the company once focused on the package volume exceeding 2 liters, which resulted in a problem that could not be solved by downsizing as in case with 1.5 l bottles. In general, at the market, about … of retail beer sales in such package accrued to Efes brands, under our estimation.

The problem was more actual for brand … which was mostly packed in large PET bottles and less actual for beer … which was also gravitated towards large packages but was better represented in glass and PET package of 1.5 liters or less. As far as we know, at first, there was a sales reallocation of beer in large volumes from more expensive … in favor of … that expanded its shelf space in the modern trade. Then, the sales of … were reallocated to smaller packages and glass bottle. As a result, by the end of 2016, the market share of … decreased dramatically and … share experienced some growth. And the net share of beer in PET in Efes’s sales structure became the smallest among the market leaders.

The biggest contribution into the company’s market share growth was made by marginal brands …, …, and …. Here too positive dynamics was achieved by synergy of many factors, namely, reduction of average retail prices, growth of representation in the modern trade, rather active TV advertisement, and sorts corresponding to the market trends of increased popularity of light and special beer.

The biggest sales growth was achieved by Velkopopovicky Kozel that is currently number one license brand and has a market share of nearly 2.5%. In the premium segment depending on classification Velkopopovicky Kozel either ranks first or second to subbrand ….

In terms of regions, the company’s sales were growing as the company’s positions in the modern retail were strengthening. Under our estimation, the growth in … and … region was of crucial importance. In … Efes demonstrated a far better performance than other market leaders. The … of Russia was a negative exception in the sales geography; in this region the company closed a brewery several years ago, and currently the leadership there belongs to Baltika.

Heineken company in 2016 scaled back on sales volumes in Russia by more than …% according to the annual report. According to the company itself, the decline was caused by the difficult situation on the Russian beer market against the ongoing inflation and low level of consumer confidence. The company reported it was increasing the share of premium brands in the portfolio and focused on the price, which allowed raising the gross income for a hectoliter, yet the performance was affected by the fierce price competition on the market.

Under our rough estimation, the sales volume of the Russian branch of Heineken shrank by nearly …%, to … mln dal. The company’s share went 1.3 p.p. down, to …%. At the same time, due to changing the sale structure and prices the company’s revenue by RAS obviously remained at the level of 2015, nearly … bn RUB.

Starting from the third quarter of 2015, the average retail price for beer by the company began growing. And soon as early in 2016, it was much ahead of the average prices of AB InBev and Carlsberg Group and by the third quarter 2016 it left company Efes behind too. Such a dynamic growth was caused both by raising prices for economy brands and by their share falling in the total sales volume because of the higher prices.

Having given the top priority to profitability, Heineken easily yielded the market share to regional producers, while its competitors, on the contrary retained or decreased prices for affordable beer striving to preserve the sales volumes. However, Heineken was the most active among the market leaders in launching promo packages.

One can say that the economy beer price was growing in inverse relation to its level. The major negative contribution was made by brand …, having lost about a fourth of its market weight in 2016. Sort … turned out to be the most unfortunate, and even the launch of sort … did not succeed in making up for its decline at the beginning of 2016.

The sales of regional brands … and … went substantially down, and output of beer … was altogether discontinued in 2017. Finally, resulting from a considerable price increase there was a fall in sales of …, which had been an answer to medium-sized breweries at the markets of draft beer and beer in PET.

In the context of optimization and profitability increase, one can also consider beer production stop at Kompania PIT in Kaliningrad starting from January 2017. Its output volumes were … in 2015, though by the end of 2016, judging by the regional statistics, the enterprise increased its output from … to … mln dal. Early in 2016 the company relaunched brand Königsberg, so the decision on the brewery close was obviously taken swiftly.

The decline of cheap beer sales was followed by shifting Heineken’s marketing focus to the medium price segment, where the company’s performance looked much better. The key brand … had only a slight decline of the market share against the dramatic sales reduction of the “old” mass brands belonging to competitors. Here the original focus on PET package of medium rather than large volume as well as a downsizing taken beforehand (which was started as early as at the end of 2014) yielded positive results. Besides, the brand stability can be explained by the specialization trend of beer consumption, to which major sort … conforms. In 2017, the company undertook the brand restyling, pointing out at its strength.

But the major impact to the sales growth of the mainstream beer was made by … that actually used to be one of the most successful brands of 2016. As in the case of … brand, a sharp decline of the retail price of a license brand and its transfer to the mainstream has dramatically raised its popularity. While at the beginning of 2015, …’s market share numbered tenths of a percentage point, by the end of 2016, it already amounted to about …% of the beer market under our estimation.

… and title brand Heineken in 2016 did not enlarge their market share. But thanks to advertising campaign, there was a growth of sales and market share of … beer, that won the competition at the lower level of the premium segment, and secured good positions at the market of marginal beer for the company.

To get the full article “Beer market of Russia 2016: PET goes to draft” in pdf (52 pages, 23 diagrams) propose you to buy it ($40) or visit the subscription page.

2Checkout.com Inc. (Ohio, USA) is a payment facilitator for goods and services provided by Pivnoe Delo.

The article materials were prepared using statistics of Rosstat, presentations and reports of brewing and research companies. Publications in “Kommersant” and “Vedomosti” were used in the article.

The data on beer volumes and their interpretation are our assessment based on the current trends in case the source has not been named.

We do not claim the given information to be absolutely correct, though it is based on data obtained from reliable sources. The article content should not be fully relied on to the prejudice of your own analysis.