Beer market of Kazakhstan acquired both traits of East European countries and South Eastern Asia taking a transitional position between them by many criteria and consumption style. Yet there is a positive trend in beer production which differs Kazakhstan from most of the neighboring countries. The market has remained consolidated in the hands of two international players because of its small size. However, it faces dynamic processes such as fast growth of draft beer sales, up and downs of regional companies and Carlsberg Group’s ultimate expansion. Excessive mainstream segment has declined over the recent years, yet, Zhigulevskoe and national brands with regional links have yielded their positions to a range of new products. In our review special attention was paid to regional analysis of the markets. In 14 regions of Kazakhstan we compared the companies’ positions, the market price segmentation and DIOT channel development. Besides we have compared the beer market of Kazakhstan to neighboring countries.

General picture of the market

Beer market of 2018 in figures

Beer against other categories

Price segmentation of the market

Draft beer in Kazakhstan

Draft beer market development

DIOT on rise

Brewers’ positions

Carlsberg Kazakhstan

Efes Kazakhstan

Medium and regional breweries

Small brewers

List of Kazakhstan beer producers 2018

General picture of the market

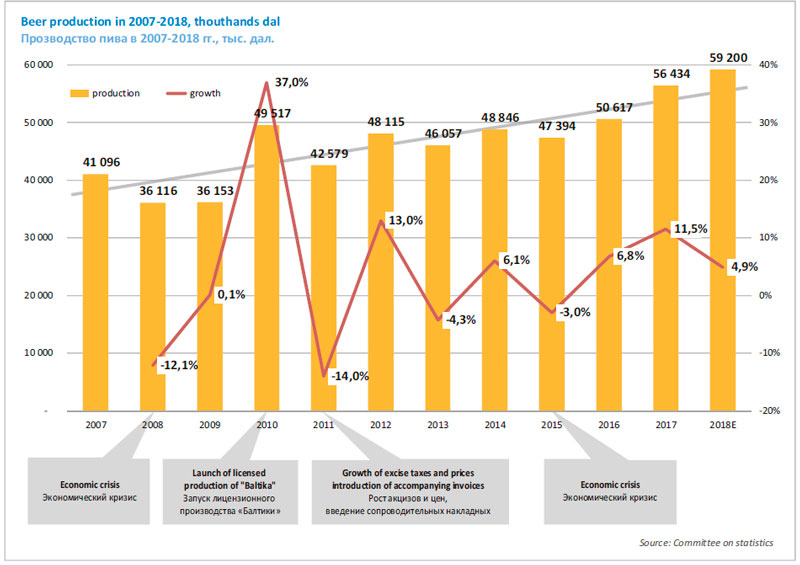

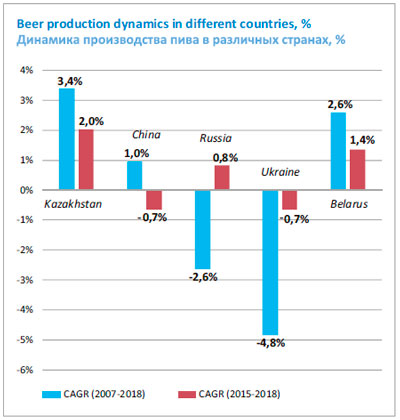

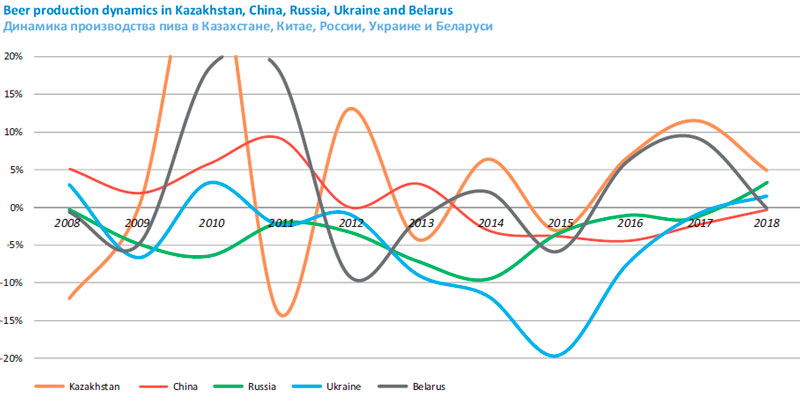

In 2018, the beer production in Kazakhstan went on growing having increased by 5% and came close to 6 mln dal. If we smooth up the unevenness of beer output caused by transient factors, one can speak of a positive trend. The combined annual growth rate (CAGR) from 2007 to 2018 is 2% and 3.4% from 2015 to 2018.

This is a good performance if we compare the beer industries of Kazakhstan to other post-soviet countries or China. And the pronounced positive dynamics for three years looks an outstanding achievement by itself.

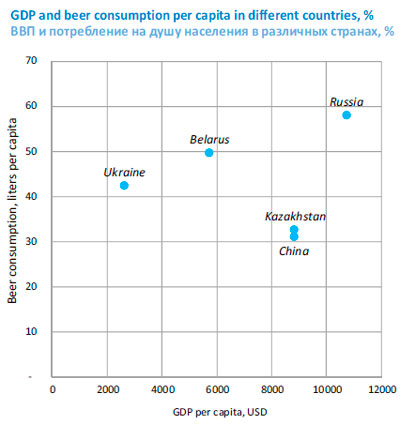

The beer production increase can be partially explained by the fact that the market is still not saturated if we take into consideration the consumption level and GDP per capita. By these criteria Kazakhstan is currently close to China where the beer market has stopped growing a long ago.

Yet as for culture and consumption style, Kazakhstan is closer to the countries of Eastern Europe than to China with its street food and predominance of industrial production workers. And if we compare Kazakhstan to Russia, Ukraine and Belarus, we on the contrary can speak of a bigger growth potential, as having a relatively high GDP per capita Kazakhstan is much behind them by consumption volumes.

Marketing stage of market development is one more aspect of growth. Russia and Ukraine experienced a break in this as there was drifting of beer consumers core to older age*. There are fewer young people and they drink less beer, instead, the generation born before the 80-ies remains loyal to beer. These processes resulted in popularity of the people’s brand Zhigulevskoe amid the decline of sales of mass youth brands by big companies.

* According to longitude researches RLMS HSE in Russia.

Kazakhstanian brewers also said that, the share of population under 21 who does not consume alcohol at all increased by 8% in 2017 against 2016. At the same time, among people who continue consuming alcoholic drinks, there was a beer loyalty increase. The market growth over the recent years results in brewers’ view from healthy lifestyle trend as consumers choose to decrease the consumption of expensive strong alcohol that is rising in price considerably from one year to the next in favor of low-alcohol drinks*.

* Agency Kapital 18.09.2018 remains attractive to investors.

Besides, unlike countries of Eastern Europe, during the recent years, we have observed a comparatively low popularity of Zhigulevskoe and brands with geographic links; its share on the market of packed beer has decreased. At the same time, the share of local brands with Russian and Czech names has continued quickly growing rapidly. In our opinion the sales structure of beer speaks to fact that the market in Kazakhstan has not yet become overripe.

Besides when we analyze the beer market of Kazakhstan, we should keep in mind the vast difference of sales allocation by regions. According to our estimates Almaty and the region account for a quarter of the national beer sales, which is comparable to 8 out of 14 regions (by the aggregate market weight) making up the most of the country territory. This intensive unevenness in volumes allocation is specific for Russia and countries of South-Eastern Asia.

Such fragmentation usually means strong positions of regional breweries. Yet there is a rather strict dependence between the market size and the number of national scale leaders. That is why the relatively small market size promoted for its consolidation in the hands of two international players (among other factors, due to a range of global M&A). The consolidation also resulted from leaders’ wish to fill all niches and outlet channels relying on the experience in other similar markets.

Beer market of 2018 in figures

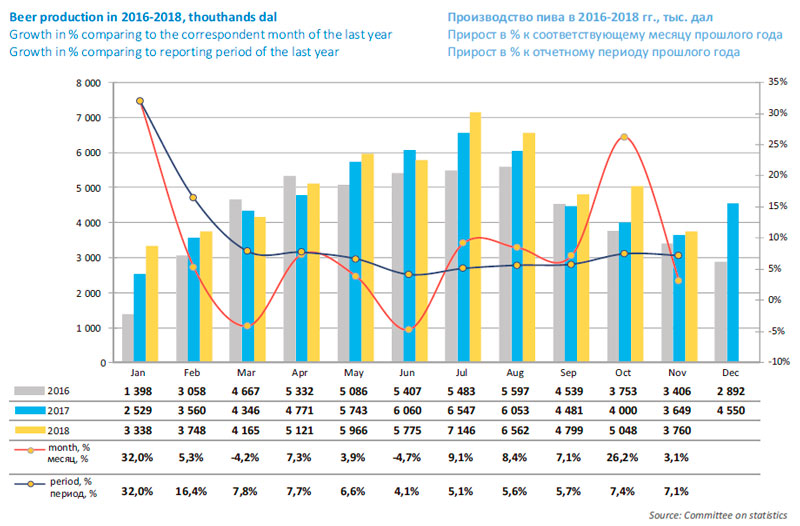

2018 was more positive in general, yet the biggest production growth took place from July to October when several brewing companies increased the beer output.

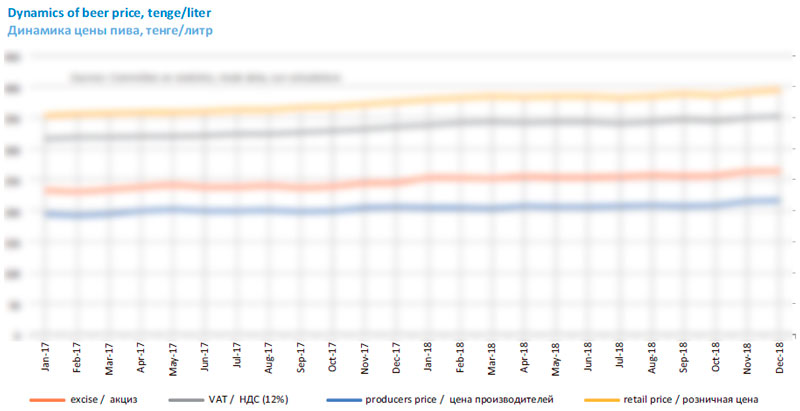

Producers prices without VAT and excise basing on the official data have come up by 4.2% or 8 tenge to 208 tenge for a liter. That said, the excise growth at the turn of 2018 amounted to 23% or 9 tenge, to 48 tenge for a liter. Weighted average retail prices for beer in 2018 increased by 6% or 23 tenge, to 385 tenge for a liter.

Official consumer inflation in 2018 amounted to 6%, while the price rise for food goods reached 5.1%. Thus, the price increase for beer in 2018 was moderate.

In dollar, due to tenge devaluation the prices have virtually remained the same – as producers prices fell by 1.5% to 60 tenge for a liter, while retail prices increased by 0.5% to $1.12 for a liter. To compare – in Russia weighted average price for beer in 2018 was $1.61 for a liter.

In 2019 the excise rate for beer has risen by 9 tenge or 18%, so its effect on the price will not be too big. Yet a considerable negative impact will be probably made by tenge devaluation and growth of prices for raw materials which are bought abroad.

As the official export and import does not exert a considerable effect on natural volumes, we can approximately calculate brewers’ revenues and the market size.

Thus, in 2018 brewers’ sales by value increased by 10% to 123 bn tenge. In dollar terms the growth was smaller, that is, by 3.6% to $358 mln.

Beer market in Kazakhstan went 12% up by value, having amounted to 228 bn tenge. We can also say it went by 6% to $660 mnl.

However, our estimates of the market scale are rather conventional, as they have no account of the price difference in retail and HoReCa and of non-official volumes of foreign shipments. Packed and draft beer belonging to premium price segment is imported from Russia. At the same time, Russia gets inexpensive draft beer from Kazakhstan.

Beer against other categories

If we compare beer production growth to adjusting categories, we can note that it was taking place at nearly the same rate as vodka production (+6.6% over January-November) or liqueur production (+7.3%) lagging behind cognac production (+52.7%) and wine (+32%). Characteristically, beer was noticeably ahead of other categories of non-alcoholic beverages – mineral waters and carbonated drinks have increased by only 2%, while other drinks even lost 10.1% of their volumes.

Thus, the reasons for beer output volume growth are not to be found in favorable weather, because in that case (as usual) the sales of other thirst quenchers would have risen too. At the same time, the registered output growth of alcoholic drinks could result from factors not connected to the consumption directly.

In particular, among other reasons for alcohol sales growth can be market unshadowing connected to many inspections, electronic auditing system, and consumers’ negative attitude to non-official alcohol, as well as the growth of unreportable export to Russia due to comparatively low excises in Kazakhstan.

At the same time, speaking of beer we can speak of real consumption growth as the biggest volume expansions were observed at international companies, that target the inner market. The volume increase of some regional businesses complies with many-year trend or connected to recovering after troubles in operation.

Price segmentation of the market

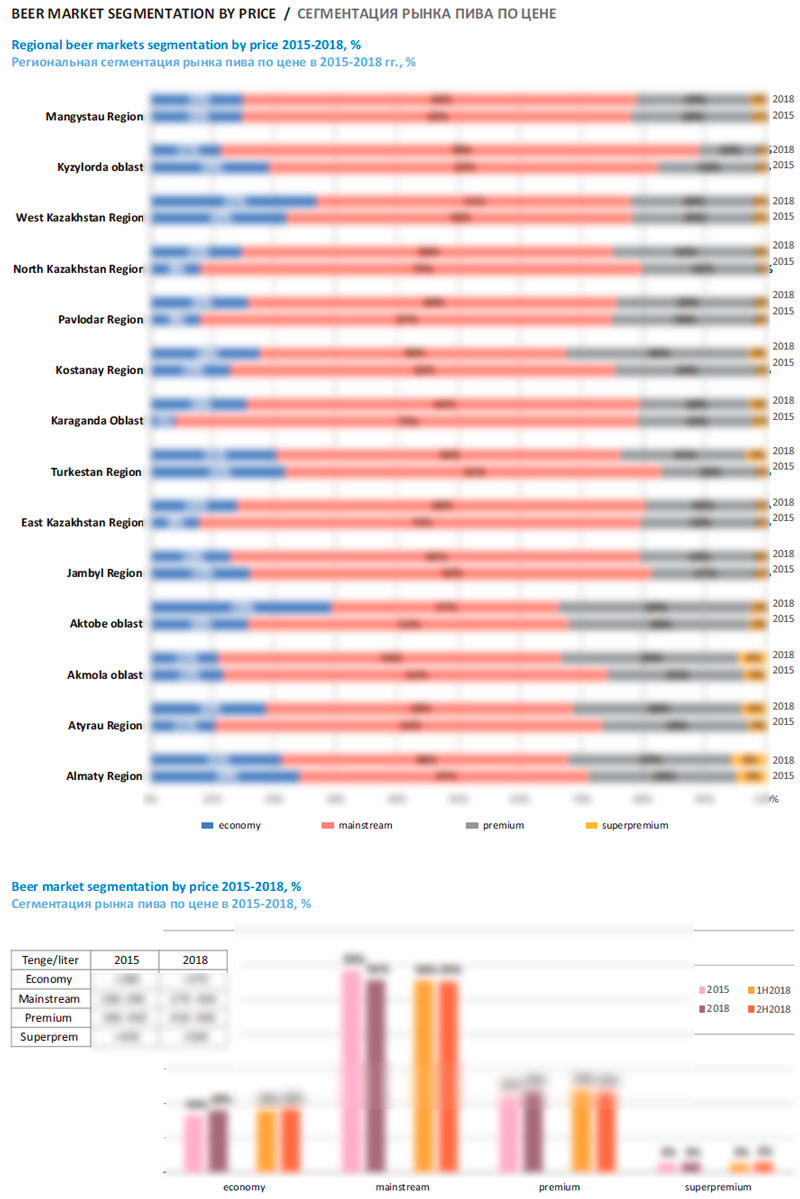

The Kazakhstan market is characterized by a high share of mainstream segment. This situation is opposite to that in Russia and Ukraine where mainstream is devaluated and term “middle price” is no longer equal to “mainstream” and “mass” due to the market polarization. Nearly ten years ago, middle price superbrands were leaders too, but in course of time, the mainstream boarders blurred and sales were actively reallocated in favor of more expensive and cheap brands.

In many developing Asian markets including China, the economy segment has grown out of proportion, as cheap mass brands take up the bulk of it. Demands to taste as well as to gravity or alcohol content are very low. In this respect the Kazakhstan market is not very similar to the markets of South Eastern neighbors.

In Kazakhstan we can speak of a rather definite price positioning of brands in the beer market, which has been stable for a long time. Some brands may lose popularity but are substituted by others in the same segment. There is migration to adjacent segment, but not very active.

The stable price structure of the market and brand positioning is certainly not only the merit of marketing experts of brewing companies but also the result of strong consolidation of Kazakhstan retail beer market which is virtually divided by two players.

The price structures of Ukrainian and Russian markets have been changed by many independent regional businesses as well activity of Oasis group. However, in Kazakhstan their output volumes are so far not big enough to exert a serious competitive pressure on the leaders’ brands.

However, the share of the mainstream segment is gradually decreasing even in the Kazakhstan beer market. Over 2015-2018 it went 3p.p. down to 56% including 1 p.p. in 2018.

Assessing the mainstream segment boarders, we took into consideration rapid price rises for beer. In 2015 they amounted to 280-340 tenge for liter, and 370-430 tenge in 2018. The lower boarder in 2018 is determined by average retail price for brands Beliy Medved and Karagandinskoe by Efes Kazakhstan. The upper boarder was formed by brands Teterev by Perviy Pivzavod and Derbes by Carlsberg Kazakhstan.

The key impact to the mainstream reduction in 2015-2018 was made by lowering shares of Beliy Medved and Zhigulevskoe buy Efes Kazakhstan. Besides losing several market percent due to changes in positioning of brand Zhigulevskoe Firmennoe by Carlsberg Kazakhstan also affected the situation. Probably, considering the popularity Zhiguli brand by the competitor, this version of Zhigulevskoe occupied the niche of nostalgic premium beer and moved up.

Over the three-year period and in 2018, the mainstream segment was supported with Zatecky Gus by Carlsberg Kazakhstan and Kruzhka Svezhego by Efes Kazakhstan. That said, Kruzhka Svezhego left Beliy Medved behind and led the market. The position changes of “old” Kazakh middle price brands was multiple-valued but negative in general.

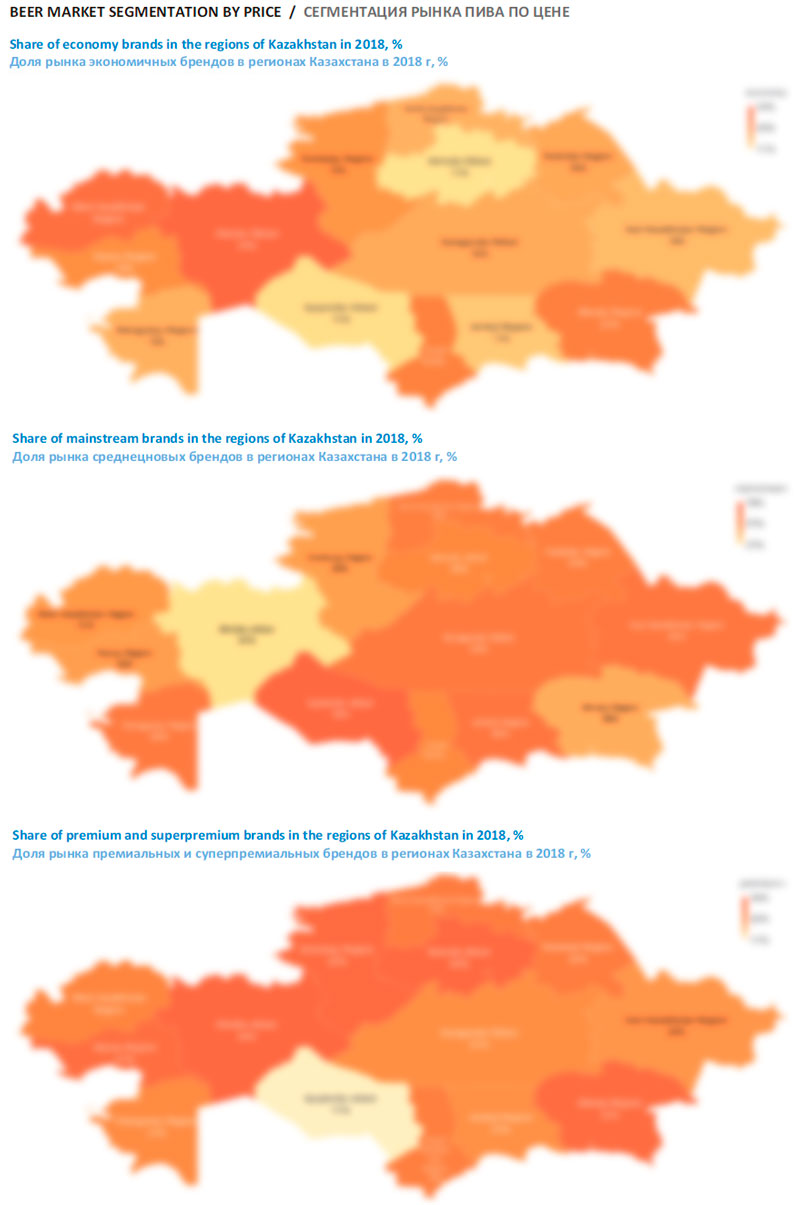

As we assess the mainstream share by geographical criterion, it is easier to start from the end and name the regions where this segment is relatively small. These are Almaty region (including the city itself) and Aktobe region that have seen a market polarization over the recent years – that is taking middle price share by cheap and expensive brands. Mainstream has the biggest share in Kyzylorda region, enjoying almost 80% of the retail market. Nearly half of beer sales here is accounted for mass brand Kruzhka Svezhego.

In the economy segment of the beer market of Kazakhstan there have been considerable changes since 2015 both in positions and the list of the key brands. The market share of affordable beer over three years went by several p.p. up and continued growing in 2018.

Brands with average market price lower than 370 tenge for a liter in 2018 (and lower than 280 tenge in 2015) are considered to belong to economy segment. According to this criterion, in economy segment brands Alma-Ata by Carlsberg Kazakhstan and Vesĕlecký Hmel by Perviy Pivzavod had the highest price. The cheapest big brands are two trade marks by Efes Kazakhstan namely, Schedriy Pivovar and Slavná Pivnice.

As we can see now, the economy segment shot the moon with bright launches in the field of “Czech” beer where Zatecky Gus by Carlsberg Kazakhstan seemed to dominate. Both Efes Kazakhstan and Perviy Pivzavod have been obviously successful with their cheaper alternative also brewed with Czech hop but more affordable. These launches could be called attack at the competitor, yet Zatecky Gus has not been much affected.

By the way, in tune with the fashion for animalistic names for beer branding, in 2017 Carlsberg Kazakhstan output one more affordable novelty – beer Dodriy Bobr (Kind Beaver).

The economy segment was affected by the market share decline of Almatynskoe Zhigulevskoe by CBH targeted mostly at the local market of the country South.

The positions of the biggest economy brand Bolshaya Kruzhka by Carlsberg Kazakhstan also look multi-valued. While during 2015-2018, its share has increased considerably, in 2018 the brand share lost approximately 1 p.p. under the pressure of a lot of new affordable products.

As for geography the share of the economy segment is the biggest in Aktobe region, where the retail market has grown much polarized since 2015. The key impact was made by brand Bolshaya Kruzhka that still enjoys high popularity here. Besides, the share of cheap beer has expanded in West Kazakh region.

The premium segment of the beer market grew a little starting from 2013 (+2 p.p.) while in 2018 there was some decline.

The premium segment of the beer market grew a little starting from 2013 (+2 p.p.) while in 2018 there was some decline.

Basically, the premium segment can be divided into two roughly equal parts that is, brand Baltika and other brands. Over the three years, the market weight of Baltika has increased, and the share of many marginal trademarks has shrunk.

Naturally, the vast market share of the premium brand is connected to its price lying on the lower boarder of the segment (430 tenge for a liter in 2018). We conventionally limited the upper boarder of the premium segment at 500 tenge for a liter which is close to Velkopopovicky Kozel by Efes Kazakhstan.

Over 2015-2018, Carlsberg Kazakhstan made the key impact into the segment development, yet the percentage points won by Baltika were partially offset by share decline of local Irbis and global Tuborg, that have been in the Kazakh market for a long time. In the same time the price rise for Zhigulevskoe Firmennoe that migrated from the mainstream to premium, was followed by only a minor decrease of the market share over 2015-2018, which thus can be considered a successful step.

Hard-drink Seth & Riley’s Garage is positioned between superpremium and premium segments and has so far a small share but a growing popularity.

Superpremium segment of the beer market has been steadily growing since 2015. Due to the segment small size this growth does not catch eye, yet for expensive beer 0.4 p.p. during 2018 is a good performance indicative of a trend to choose image products. To some extent the growth of the superpremium segment in Kazakhstan results from low popularity of craft beer. Ales and original beer sorts are mainly imported from Russia and in large part represented by MBC product range (likewise Perviy Pivzavod belongs to Oasis group).

Three major superpremium brands are Carlsberg, Miller and Heineken all of them represented by international companies.

Brand Carlsberg has won the leading position due to price control which was first started several years ago. Yet in the second half of 2018, it still costs more than premium brands. Such changes in positioning look a little less radical than in the markets of Russia or Ukraine where Carlsberg brand moved to middle price segment and increased its market weight dramatically. Though in those countries its market share is several times more.

Until recently brand Miller was the leader in superpremium segment, but yielded to competitors because of too significant price difference as beer Carlsberg costs nearly 1.5 times cheaper.

For a long time, brand Heineken was in downturn trend because of several changes of licensee (from Heineken it went to Efes Kazakhstan and than to Perviy Pivzavod). But in 2018 the brand market share has growing.

Among marginal brands of the second line the market share of beer Karmi is worth mentioning. This brand has been recently launched by Carlsberg Kazakhstan, to form a niche of women’s beer in the local market.

In order to make the analysis of regional retail market peculiarities easier, we sum up the shares of premium and superpremium segments. So we can see the “belt” from Atyrau to Akmola regions with a high share of sales of marginal beer. Besides, Almaty region stands out too.

Despite the domination of Baltika brand the sales structure of premium brands is quite diverse and varies even in different regions.

Baltika enjoys the biggest popularity in Astana and Aktobe regions while in Karaganda, East-Kazakhstan and West-Kazakhstan regions it has the smallest popularity. Thus, we cannot say that the Russian brand is especially popular in the regions bordering Russia (neither can we state the opposite).

Draft beer in Kazakhstan

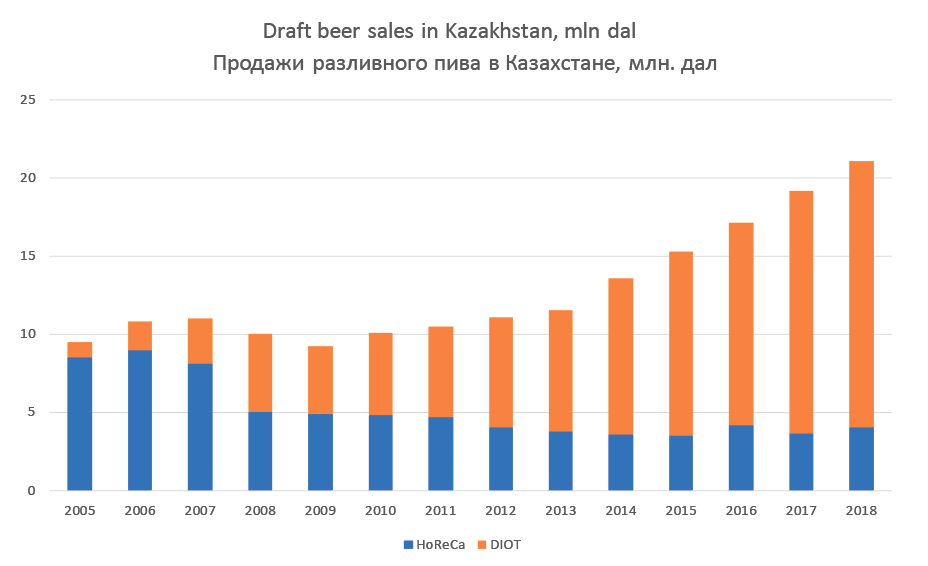

The share of draft beer at Kazakhstan market is unusually big against other post-soviet countries. Over the last ten years the sales growth of draft beer changed into decline and back to growth and the major output channel DIOT has been formed and the list of main players has been expanded.

At least a half the positive dynamics of beer production in 2018 came from the draft beer figures. This conclusion can be made both basing on the dynamics of specialized stores number growth and on brewing companies’ reports.

- The number of independent draft beer outlets in 7 biggest Kazakh cities in 2018 increased by 39%.

- By the end of 2017, the share on draft beer amounted to about 35% of the market*.

- By the end of 2017, the share on draft beer sold in DIOT (Draft In On Trade) amounted to about 28.5% of the market (+2 p.p.).

The next two chapters are dedicated to the draft beer market development and specialized retail in the cities of Kazakhstan.

* Отчет Carlsberg Kazakhstan

Draft beer market development

Currently the sales of draft beer are up due to riot development of DIOT. As everybody knows, the form of trading beer from kegs or PET emerged near Kazakhstan at Novosibirsk market approximately in 2004. At that time the draft beer in Russia was virtually pressed out of the market (with a market share of 5%) and regional breweries were having not the best times. By making a stake on DIOT channel, regional producers seized the initiative from transnational companies with their idea of “live” beer. The regional players relied on the generation of mature and active beer consumers, born before the 80-ies.

But draft beer in Kazakhstan was rather popular in early 2000s due to popularity in HoReCa channel. In 2004 its market share equaled about 25% while sales were growing 15-20% annually. The growth took place both due to bars and restaurants development and significant investments of brewing companies. They were actively purchasing keg beer filling system and trade equipment for cooling and filling beer. As a result of these processes synergy, draft beer was growing more affordable and could compete with packed beer.

A special role at the market of draft beer in HoReCa was played by Shymkentpivo with sales growing rapidly till 2008. Draft Karagandinskoe by Efes Kazakhstan also had a considerable weight with a share of 15%.

However, during the rapid market development the share of packed beer increased substantially due to marketing activity of international groups. Canned beer experienced the biggest sales increase because due to the ban on PET it remained the only light package (by the way, in 2017, the shares of cans and bottles equaled and in 2018 can took the lead).

The share of draft beer was decreasing until draft beer stores gained weight. The success of DIOT in Kazakhstan was destined to success. Since draft from kegs to PET was the only saving and convenient way to buy large volumes of beer. Certainly, draft beer sales were also promoted by other factors (alternative taste, freshness, and nostalgic associations) common for post-soviet countries.

We can name several market players that took the key role in growing of the draft segment and got the most of revenues in 2008-2018.

For instance, company Arasan with brands Zhigulevskoe, Cheshskiy Sladek, Rudnenskoe, Praga, and others increased its weight considerably. The company originally focused on draft beer production and provided it to the market of the Northern Kazakhstan. Though production of packed beer became an important development stage for Arasan, yet putting a stake on the DIOT channel expending to other regions provided for a fast volume growth which virtually doubled over the period from 2008 to 2010. By 2015, the company became the draft sales leader due to protracted sales decline at Shymkentpivo. Basing on our assessments of the sales volumes, the popularity of brands by Arasan company are growing up to date.

In the course of the Kazakh draft beer market development, Russian producers started entering it actively. For the main part Russian beer is represented by independent companies from the Siberia, namely Tomskoe pivo, Barnaulskiy pivzavod, Volchikhinskiy pivzavod and others. Stable quality and volumes, enough kegs and contracts with the major trade partner have granted wide distribution and popularity to Siberian brewers. However, the average retail price for Russian beer is nearly 1.5 times higher than for Kazakh, which does not allow it to dominate the market.

Carlsberg Kazakhstan has become the most outstanding player at the draft beer market. As far back as at the stage of active DIOT channel growth, the Kazakh subdivision of Debres entered this market not yielding it completely to regional brewers. In 2010 (before joining with the Kazakh division of Baltika) the share of draft beer in Debres sales amounted to 20% by the company estimation.

But several years after the assets joining, the growth potential from Russian brands localization was exhausted. In 2015 Kazakhstan faced a new recession connected to decline of raw materials income which resulted in collapse of beer market and Carlsberg Kazakhstan sales volumes. At the same time at the draft beer market there was sales growth of beer by independent brewers in the North of Kazakhstan and Siberian brewers.

Striving to be in trend, Carlsberg Kazakhstan reinforced their activity at the draft beer market attacking competitors. For example, Shymkentpivo in 2016 was in litigation with Carlsberg Kazakhstan asserting ban on using name Debres Shymken Myagkoe that was to the company’s opinion easily taken for draft Shymkent. Yet the company was successful in supplying a lot of brands to all price segments for instance rather affordable Alma-Ata, middle price Zatecky Gus, premium Kronenbourg Blanc and others.

By the end of 2017, Carlsberg Kazakhstan reported a 57% growth in DIOT channel and taking a leading position in this segment by the end of the year. To some extent this achievement was connected to a sharp decline of Shymkentpivo sales, that had problems with finances and owners.

In order to enforce the leading positions in summer 2018, Carlsberg Kazakhstan launched a new kegs filling line at the brewery in Almaty. According the company, that resulted in a 20% rise of the company’s productive capacity. They say at Carlsberg Kazakhstan: “the segment of draft beer is currently promising in terms of volumes increasing as it has shown a steady growth for the recent several years.”

DIOT on rise

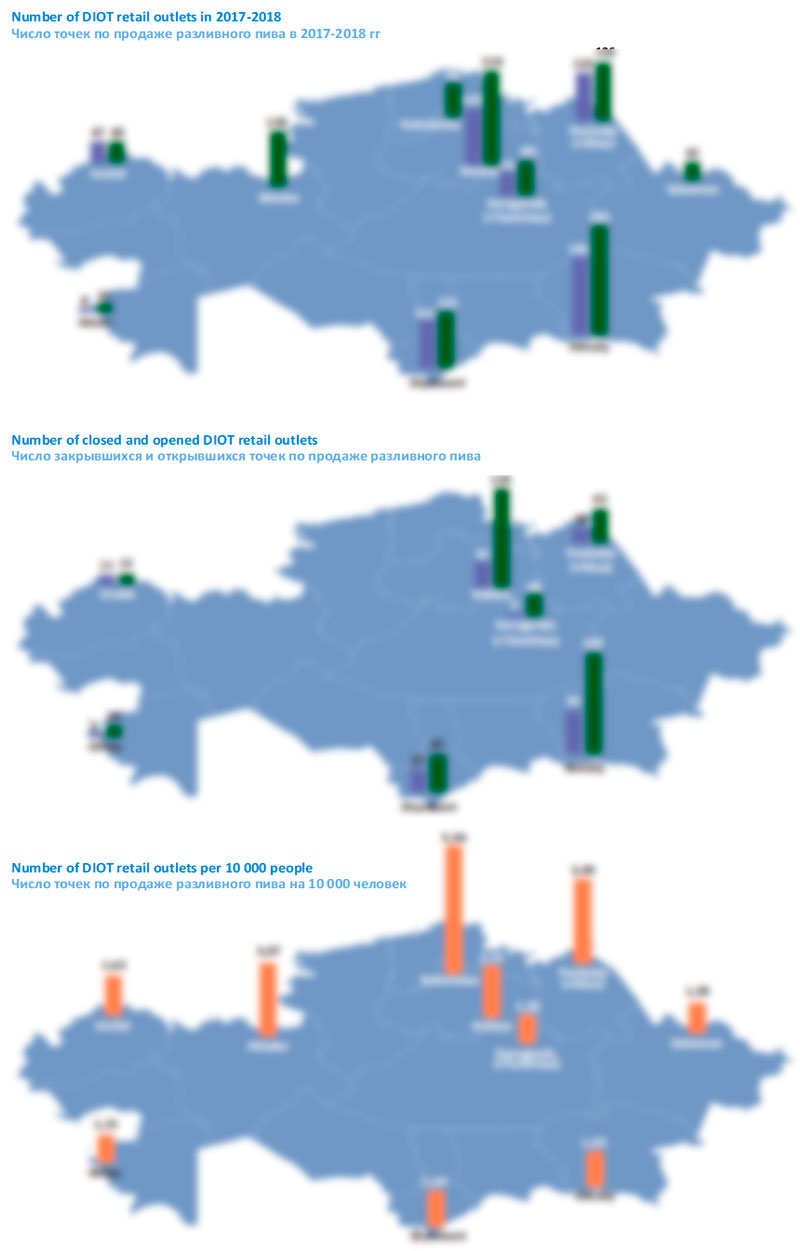

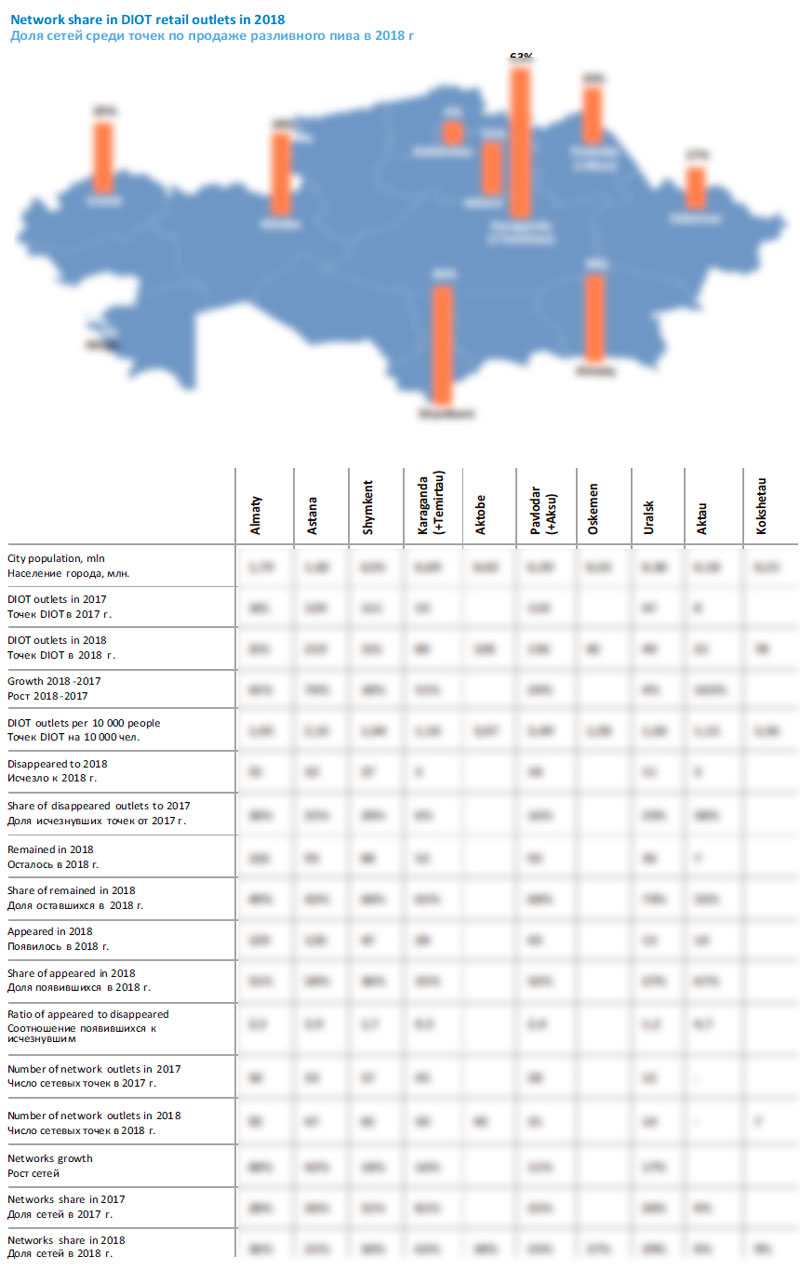

Basing on organization databases of 2GIS in different years one can estimate the dynamics of DIOT channel development in many big cities of Kazakhstan. At least in the context of separate draft beer stores, their number, appearing at a new place and disappearing at the old addresses as well as net development. With some approximation we can extrapolate this assessment to the whole country.

We used some data for 2008-2009 and compared two cross-sections of data in category “draft beer stores” by the end of 2017 and 2018. At the same time, we took efforts to account for frequent streets renaming and other changes that could influence our assessment.

Let us notice that as far back as ten years ago DIOT in Kazakhstan had considerable market weight comparable to HoReCa in our opinion. While the sales of draft in bars and restaurants were decreasing under the pressure from packed branded beer, channel DIOT on the contrary was developing rapidly. Off trade draft beer sales was quite a profitable business, that drew more and more entrepreneurs. However, by 2009, due to absence of experience and sharp competition the economic recession led to number reduction of outlets and the market volume.

Starting from 2011, DIOT segment switched to moderate growth, judging by the output volumes of regional businesses. At the same time, there was an intensive rotation – some stores were opened and some closed in larger number.

Since 2014, modernization by independent breweries, expansion of Russian draft beer producers, sharp activization of Carlsberg Kazakhstan has given a new impulse to draft beer sales. The business development was promoted by legislation that in 2016 definitely divided production and sales of beer in PET and also by relatively liberal attitude to small business and trade.

Let us look at the main figures that characterize DIOT channel today.

By the end of 2018, in 10 biggest cities of Kazakhstan* there are 1135 stores dealing in draft beer separately from other outlets. And for 1085 specialized stores this is the main type of activity.

* Cities-satellites are included into big cities (Temirtau into Karaganda and Aksu into Pavlodar).

Taking into consideration the relation of country and city population, as well as our estimations of outlet number in remaining cities of Kazakhstan the total draft beer outlets number mounts to at least 2500. Estimated volume of beer sales through them is 12-18 mln. dal per year.

Taking into consideration the relation of country and city population, as well as our estimations of outlet number in remaining cities of Kazakhstan the total draft beer outlets number mounts to at least 2500. Estimated volume of beer sales through them is 12-18 mln. dal per year.

More than 200 draft beer outlets are located in Almaty and Astana each which is not a surprise as these cities are #1 and #2 by the population number. However, there is no further interdependence between the number of people and outlets. For instance, Shymkent, the third by the population city of Kazakhstan has fewer draft beer outlets than the seventh city, Pavlodar.

Apparently, such difference is connected to traditions of beer consumption in the south and north of the country, as in Shymkent the share of HoReCa in draft beer sales is bigger, while the market of the country north is more like for example the Siberian one with a considerable weight of DIOT. By the way, this change is in tune with on-trade channel growth in beer sales as we move from Europe to Asia. Thus, if we consider the draft beer outlets number to population number ratio, we can notice that in northern cities of Kazakhstan there are nearly twice as many draft beer outlets as in cities located in the south.

However, there is also a fact that in big cities an average outlet has more customers. Cities in the north of the country (Aktobe, Pavlodar, Oskemen, and Kokshetau) are smaller by population than those located to the south (Almaty, Astana, Karaganda, and Shymkent).

By the way if we compare the density of outlets in cities of Russia and Kazakhstan, Kazakhstan will be much behind. For example, at the end of 2018, in Moscow and Saint-Petersburg 2.33 outlets come on 10 000 population and nearly 6 in big Siberian cities. Yet, the difference between the countries are connected to the fact that per capita beer consumption in Kazakhstan is twice lower than in Russia.

By seven* cities basing 2GIS data we can trace appearance and disappearance of outlets

* Almaty, Astana, Shymkent, Karaganda (+Temirtau), Pavlodar (+Akslu), Uralsk, and Aktau.

In general, in the seven cities in 2018, the outlets number growth reached 39% (though possibly some of them have not been accounted in the database of 2017). Such dynamics is a result of significant preponderance of outlets registered at new addresses over those that disappeared from the old address.

The biggest increase of the total outlets number was registered in Astana. Besides, it is logical that Astana and Almaty are far ahead by the number or stores with new address.

By the end of 2018, the share of new stores amounted to 45% and those remaining at the old address to 55%.

Out of the total number of outlets in 2017, 23% were no longer found at their old addresses in 2018.

In Almaty we could not find 30% of outlets at their old addresses while only 6% disappeared in Karaganda (and Temirtau). By the way the rates of outlets number increase in these cities in 2018 are comparable, which means that in Karaganda the business of selling draft beer was developing more successfully than in other big cities.

In 2018 the nets were growing approximately the same way as DIOT in general. The share of nets in the channel amounted to about 35% so we cannot say it is consolidated so far. Yet we referred only to outlets joined by common name and trade mark to networks. There were 365 such outlets in 10 cities in 2018.

The biggest by the number of outlets nets, namely Volna, Pinta, “Пинта”, and Barik accounted to only a third of net outlets, so neither can we speak of consolidated market inside the nets so far. However, the nets trade is very fragmented by regional characteristic. Only nets Volna and Pinta can be considered national, though they also have “home” regions and expansion regions.

DIOT has the biggest net share in Karaganda (major nets Volna, Pinta and Pivnoy ryad) and Shymkent (Pinta, Pet and Beer, Beer Litr).

Brewers’ positions

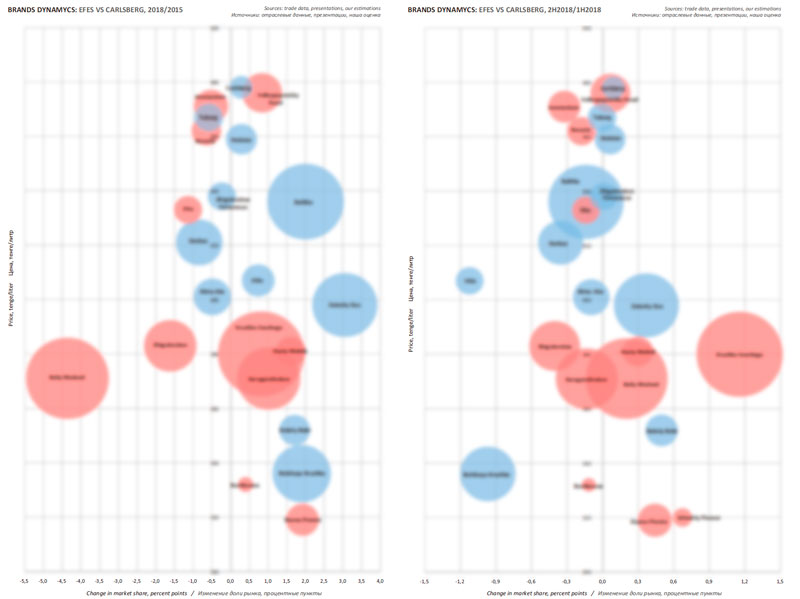

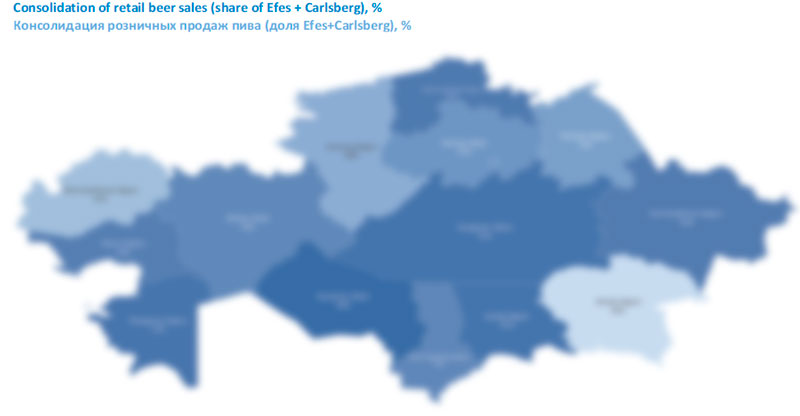

The beer market of Kazakhstan is rather consolidated. In regions the share of two leading producers hovers around 85-98% in retail. And in the total output volume 70% is accounted for by Efes Kazakhstan and Carlsberg Kazakhstan. Their share has been very stable over the recent ten years. Though there is sales allocation between the leaders that looks like adjustment in favor of Carlsberg Kazakhstan.

If we look at the consolidation level of the retail market in different regions, we will see that it is considerably lower in those regions that have independent brewers. In the regions where there are none, or the market leader’s breweries are located, the share of Efes Kazakhstan and Carlsberg Kazakhstan can approach 100%. However, this estimation does not account stores of draft beer that could change the figures in favor of the regionals.

The Kazakh beer market yet has not seen a revenge of regional companies with national capital that used to play an important role in developing of Russian and Ukrainian markets over the previous 10 years. Development of many local breweries was hindered by financial problems, changing of owners and their conflicts. Some businesses found it hard to adapt to expansion of transnational companies and failed to develop beyond home or neighboring regions. In 2017-2018 a decline and subsequent recovery of Shymkentpivo production due the known problems significantly impacted the competitive situation.

Efes Kazakhstan

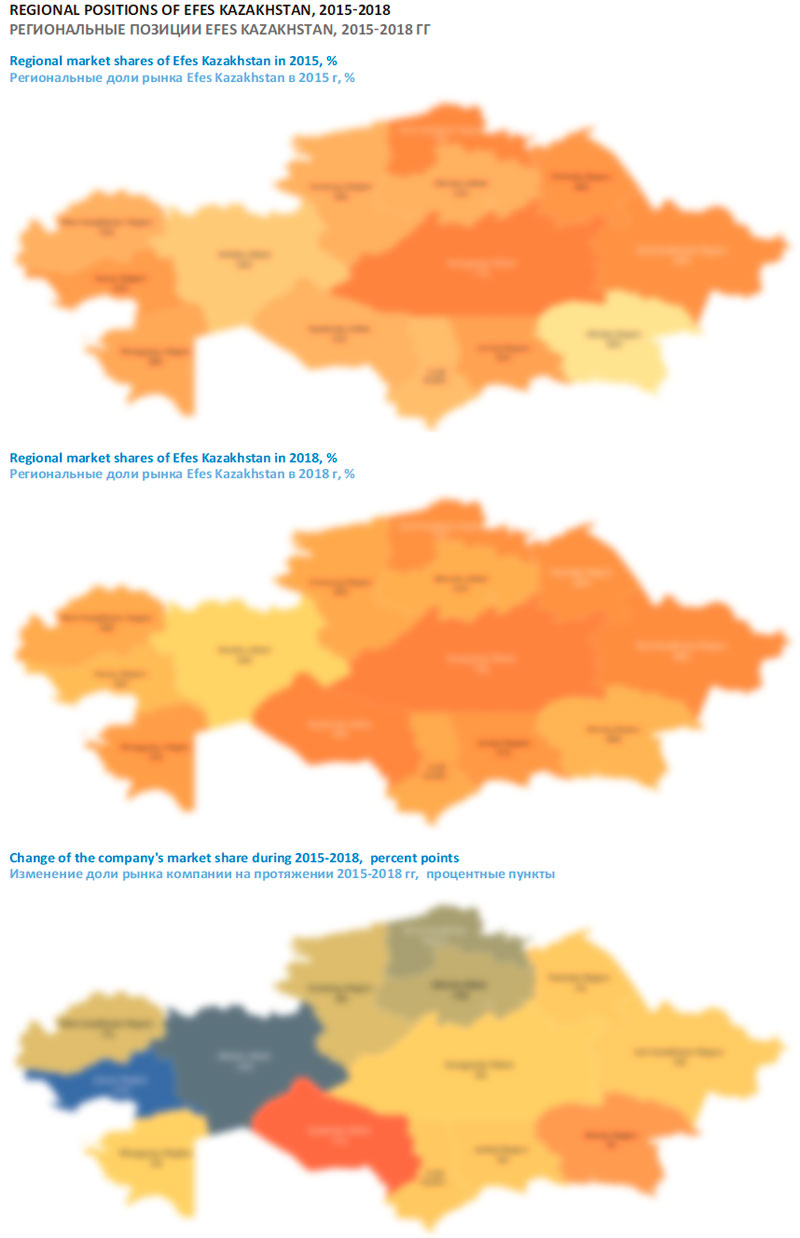

Efes Kazakhstan is still the leader at the Kazakh beer market. In 2018 the company continued increasing output volumes that went 4% up and amounted to 23.6 mln dal according to our estimation. As these rates were relatively equal the regional average, the company share in the total output volume has remained the same and amounted to 40% in 2018.

The output growth for two years can be considered a good performance as during 2014-2016 Efes Kazakhstan was substantially yielding their positions to the competitor. Over just three years, the company share in the total beer output volume decreased by 12 p.p. having reallocated in favor of Carlsberg Kazakhstan. At that time, it seemed that the leader’s positions are at a risk. But as during 2018 Efes Kazakhstan have returned some of their share, it seems that at the regional markets there was sales levelling and new balance settled, that makes the company’s position look just not so monopolistic.

In different regions the company share is fluctuating considerably. We can speak of a “belt” that includes Kyzylorda, Karaganda, West-Kazakhstan, Pavlodar and North-Kazakhstan regions where Efes Kazakhstan’s position are especially strong and the company share in retail exceeds 60%.

The three-year period of market positions deterioration was followed with a considerable share reduction at North and East retail markets that are however not characterized by big volumes of beer consumption.

There was a sharp decline of position in Atyrau and Aktobe regions and a considerable decline in North-Kazakhstan and Kostanay regions. At the same time, Efes Kazakhstan positions grew dramatically in Kyzylorda region.

However, the main balancing fact that helped to substantially mitigate the negative dynamics was sales growth in Almaty region where the company’s positions had been the lowest among other regions of Kazakhstan. It is exactly why we can speak of a general negative change for Efes Kazakhstan as of organic process of sales levelling at competitive market.

Besides, as we compare the regional market shares in the second part of 2018, we can make a general conclusion that the company started restoring their positions at the retail market in many regions and in the north of the country in the first place where the decline was deeper. Besides the company went on improving their positions in key Almaty region and lost some points in “home” Karaganda region.

The brand portfolio of Efes Kazakhstan is represented by 14 trademarks only two of which are developed for local market.

The structure of retail sales is almost by 80% formed by mainstream brands, that is, the middle price segment of the portfolio is excessively big compared to the market structure. For this reason, the polarization trend of the recent years has affected Efes Kazakhstan’s positions. However, the company itself influenced the market structure having increased the activity in economy segment, where the company’s share used to be disproportionally small. Taking into account weight decrease of premium brands in the portfolio, one can say that its gravity center has shifted to the economy segment.

In particular, the company’s market share decrease during the recent years generally resulted from competitive pressure on two middle price brands namely Beliy Medved and Zhigulevskoe. The biggest decline of the market share in retail took place in the north of the country where the positions of Carlsberg Kazakhstan and regional breweries trading in draft beer grew much stronger. At the same time, the figures of the other two middle price brands Kruzhka Svezhego and Karagandinskoe have remained virtually the same.

Stronger positions in the economy segment resulted from renewal of the range of affordable brands. Brands that have a geographic links Tien-Shan and Alma-Tau were replaced with such novelties as Slavná Pivnice, Schedriy Pivovar and Bochkovoe that were rapidly taking over the market and by the end of 2018, had a share of nearly 3%.

In the premium market segment the company changed their focus, which is obviously connected to merges at the global market. In particular, in 2015, title brand Efes was the key one, yet its share has gone substantially down despite comparatively low retail price. Its position (and 3% of the market) was taken by Velkopopovicky Kozel that became a premium representative of rapidly growing “Czech” segment. The share of superpremium Miller and premium Bavaria experienced some reduction, probably because of competitors’ activity.

Carlsberg Kazakhstan

Carlsberg Kazakhstan for the last 10 years were changing their market positions considerably. In 2008 the company was the market leader, yet then till 2013, there was a recession and stagnation which was transiently interrupted by moving the production of Russian brands to Kazakhstan instead of importing them.

In 2015-2017, Carlsberg Kazakhstan attracted attention by very dynamic increasing of output volumes due to a very high branding activity and expansion to DIOT segment. The company’s volumes substantially approached the volumes of the market leader, but could not reach them as in 2018 the production dynamics lost steam and approximately equaled the general market rates.

Thus in 2018, under our estimate beer output volumes Carlsberg Kazakhstan have increased by 4% and reached 9.4 mln dal. The company share in the total output volume accounted for 31% which is comparatively equal to the level of 2107.

Over the recent years, the company achieved a substantial progress in all four price segments due to staking on four major brands in each of them. At the same time, the company’s sales structure is considered to be heavily oriented at premium segment, the product mix of Carlsberg Kazakhstan looks much better than the mix of the main competitor. Slowing of growth dynamics in 2018 was followed by enhancement of the premium part of the brand portfolio, so the results also look not bad.

To significant extent, the slowdown of natural volumes growth and improvement of product mix resulted from downsizing. Currently Carlsberg Kazakhstan is actively replacing 0.5 l pack with 0.45 and 0.47l packs.

Due to focusing on the premium brands, Carlsberg Kazakhstan is to bigger extend targeted at working with modern trade retail than Efes Kazakhstan. Despite the general difference in volumes, at supermarkets the shares of the both companies are virtually the same.

In the economy segment, over the recent years, brand Bolshaya Kruzhka has been the sales growth driver that made up by far the decrease of Alma-Ata market share. In its turn, in 2018, Dobryi Bobr brand which was rapidly gaining popularity, covered for some share decline of Bolshaya Kruzhka.

Interestingly, in 2017 the company’s novelties with actual for beer naming animal images performed well. The second of them was dark sort of mainstream Zatecky Gus brand. This brand from 2015 to 2018 increased its market share by 3 p.p. and provided for Carlsberg Kazakhstan’s substantial reinforcement in the middle price segment.

However, the market share of beer Derbes, once a very popular brand, went on declining during this time. The market share of Irbis the second “old” national brand of the mainstream segment was growing due to price control, but in 2018 it also yielded to the competitors, both on the market and its own shelf. It is obvious that these changes are connected to deterioration of many Kazakh brand’s positions with a geographic link. Pressure on Derbes and Irbis led to some downslide of Carlsberg Kazakhstan’s positions in the second half of 2018 in the mainstream segment.

The company is still the absolute leader in marginal segments of the Kazakh market. Here Carlsberg Kazakhstan is not enhancing but rather working on keeping their dominating positions. Besides, the premium segment share still accounts for the sales bulk of the company.

Such structure is mainly connected to Baltika brand which has gained even more market weight since 2015. This took place thanks to Akmola and Turkestan regions, in particular, in Shymkent, the brand share was disproportionally small, but presently it is closer to the country’s average. The dominating sort in the numbered range of the brand was cosmopolitan Baltika #7 Export (as it happened in other countries, where Baltika is produced). The second place in the range was taken by Baltika #9 Krepkoe.

Besides, Carlsberg Kazakhstan has considerably enlarged their share in the premium segment due to migration of Zhigulevskoe Firmennoe brand. As we have already noticed, at the market of packed and cheap beer the nostalgic image turned out to be not very successful for the competitors (among other reasons due to competition to draft Zhigulevskoe). While the price for Zhigulevskoe Firmennoe increased, its share faced only a minor decline, yet the margin increased considerably.

License brands of premium and superpremium segments in general improved their market positions both during 2015-2018 and in 2018. There was a decline of “old” youth brand Tuborg but this happened at all markets of post-soviet countries in general due to mediainflation and decrease of loyalty to beer brand among youth. But this reduction was to a considerable extent made up Holsten brand.

After “the hat trick” at Russian and Ukrainian beer markets where Carlsberg brand migrated from the superpremium to the mainstream and rapidly increased sales, one could expect the same to happen in Kazakhstan. However, here it is still a high margin brand with price that used to be controlled but still corresponds to the boarder between premium and superpremium segments. Obviously, in Russia and Ukraine the migration was reasonable because of lower consumers’ loyalty to local brands. For sales structure of Carlsberg Kazakhstan that is shifted to premium segment, it would just disrupt the effective positioning. That is why the beer market share of Carlsberg at the local market equals to nearly 1% and in Russia and Ukraine it is several times higher.

As we know from Carlsberg Kazakhstan’s reports the record-breaking beer output growth in 2015-2017 was to a big extent a result of expansion to the market of draft beer (see previous chapters). Not taking anything away from the company’s activity, let us note that it was also promoted by temporal change in competitive situation when Shymkentpivo stopped shipments of draft beer. That is why as the competitor resumed operation in 2018, the dynamics of output volumes growth of Carlsberg Kazakhstan slowed down.

Medium and regional breweries

The share of two leaders in the general volume of beer production remained virtually the same during 6 years. Accordingly, the “rest” of the brewers accounted for 30% of the output. We can name 7-9 rather well-known companies two of which (Arasan and Shymkentpivo) stand out for bigger output volumes and one (Perviy Pivzavod) for their active marketing policy and belonging to international group.

Originally the strategy of Arasan company based on keg beer sales. The company’s key brands (Zhugulevskoe, Rudnenskoe, and Czeshskiy Sladek) belong to the leaders of draft segment and rather popular in DIOT segment all over Kazakhstan.

About 10 years ago, Arasan started filling beer in glass bottles (key brands Erzman, Zhugulevskoe, Rudnenskoe etc.). However, their sales volumes are still incomparable to draft beer. In our view, the original focus on affordable beer gave an advantage in the domestic region but remoteness from the key south regions offset this advantage on the national scale. So, in the segment of packed beer Arasan could not compete with international groups as beyond Kostanay region the company share in all-food retail does not exceed several percent.

In 2013 according to Arasan data, they came first by draft beer output volumes. At the same time, the company started export beer to Russia. Due to the rapid growth of draft beer market in Kazakhstan (and, obviously in Russia) in 2015 Arasan substantially increased the output volumes and took the third place among all companies and first place among regional companies. In the following years, the growth slowed down, but 2018 the rates exceeded the market average again (basing on the data of regional statistics). Thus, according to our assessment, the company’s output increased by 8% to approximately 6.8 mln dal.

Shymkentpivo is one of the biggest (by capacity) brewery in Kazakhstan focused on mainly the draft beer market and the south regions of the country. Shymkentskoe is one of the best recognized brands of draft beer in Kazakhstan. At the same time at the market of packed beer the company’s brand was not big taking into account the whole output volumes.

In watershed 2007, Shymkentpivo was virtually brewer #2 in Kazakhstan along with Carlsberg Group. The share of Shymkentskoe beer in the draft segment at that time amounted to more than 60%. During the period 2007-2010, the output volumes stagnated and then a downturn trend began. The black streak continued till 2017 when the company even ceased output.

The main volume of the company’s beer is sold in HoReCa of home Turkestan region (until 2018 it had name South Kazakh) at the Almaty market and also exported to Uzbekistan and Kyrgyzstan. The distribution of Shymkentpivo in the north direction was very weak especially that applies to packed beer.

The output volumes of Shymkentpivo fell basically because of market leaders’ expansion to Turkestan region. Naturally this process was linked to pressure on draft beer from packed beer at the market of draft beer too.

Since 2012, the company’s market problems aggravated due to financial troubles connected to legal claim concerning returning of a great loan taken as far back in 2007. Arrest of Shymkentpivo owner in 2016, extensively covered by the press, was the next shock. In 2017 Shymkentskiy Pivovarenniy Zavod, belonging to creditor bank became the legal successor of Shymkentpivo. At first, they tried to sell the brewery, but there were no buyers. The bank took it under its management, resumed paying salaries, beer production and export.

In 2018 Shymkentpivo restored the output volumes to nearly 3 mln dal (the level of 2016).

Pervyi Pivzavod is presently the fifth by output volumes brewery in Kazakhstan. The company belongs to international group Oasis, known due to successful competition with transnational companies at the markets of the post-soviet countries. Under our rough estimates, in 2018 the output volumes of Pervyi Pivzavod amounted to nearly 2.3 mln dal and the share in the total output volume equals about 4%.

While organizing the distribution system Pervyi Pivzavod is chiefly focused on the net retail in the supermarkets their share twice bigger than in the traditional channels.

The company’s portfolio can be conventionally divided into groups of brands: trademarks developed for Kazakhstan and local markets, imported Russian brands and superpremium license brands Heineken and Krusovice.

Recently, the company enhanced their activity at the market of affordable beer having launched two “geographic” brands: Yichang “Chinese rice beer with pleasant light flavor of hop” and Vesĕlecký Hmel “easy drinking beer of Czech segment with addition of Vienna malt and Saaz hop”. The both brands are rapidly gaining market weight and by far offset a minor reduction of economy brands Zolotaya Kruzhka and Korona Altau.

The output volumes of small regional breweries declined from 5 to 4.5 mln dal in 2018. Under our estimation only Pavlodar brewery Zhana Rosa (previously Rosa) had positive production dynamics as the output grew by 10% to 1.5 mln dal. The brewery used to output much more beer (packed for the most part) and presently they are restoring their positions in the home region.

Small brewers

There are not many small brewers in Kazakhstan and their market share amounts to 1.5% if we rely on regional production statistics.

This journal issue contains a catalogue of brewers, where one can learn that there are 49 operating small breweries in Kazakhstan (including 27 restaurant breweries). Several businesses out of them can be in our opinion attributed to industrial mini-breweries (Line Brew, Асеr, Altyn Amir, and Kaz Beer Group). Half of small brewers are located in Almaty and Astana (including regions, where there are particularly many restaurant breweries.

Such country as Kazakhstan with the 18 million population could have 2-3 times more of small brewers like for instance countries of Eastern Europe. However, if we compare Kazakhstan to the countries of South Eastern Asia, it will on the contrary stand out for a high relative number of breweries. This situation in Kazakhstan can be explained by the fact that mini-breweries with more or less significant output volumes mainly play on the same competitive field with regional breweries producing lagers and selling them to DIOT and HoReCa.

To get the full article “Kazakhstan beer market analysis” in pdf (49 pages, 21 diagrams, 19 maps, 3 tables) propose you to buy it ($45) or visit the subscription page.

2Checkout.com Inc. (Ohio, USA) is a payment facilitator for goods and services provided by Pivnoe Delo.

List of Kazakhstan beer producers 2018 (demo version)

List of Kazakhstan beer producers 2018 includes 60 businesses ranging from large subsidiaries of international companies to rather small breweries.

The list includes 7 large breweries, 4 regional breweries and 49 small producers (including 27 restaurant breweries).

The list consists of businesses engaged in marketing, producing or financial activity in 2018. Messages and news at official sites and publics in social networks were taken into consideration. In 17 cases we did not find facts to confirm beer production in 2018, but those businesses may still be operating. These producers are marked with grey circles.

Data on the businesses were obtained in 2GIS system, Yandex.Maps and Google maps, in open official sources kgd.gov.kz, elicense.kz and stat.gov.kz as well as trade resources.

LLP “Carlsberg Kazakhstan”

AO “Caspian Beverage Holding”

LLP “BAZA Brewery”

LLP “Pivnoj dvor na Gagarina” (restaurant “Kabachok Gorynych”)

LLP “Altyn Orda” (restaurant HellBierHaus)

LLP “Olimp-64” (Olimp-64, restaurant “Pivovaroff Staronemetskoe”)

Munich, restaurant

LLP “Becker&Co” (restaurant “Prussia”)

Ultras, restaurant

LLP “Altyn Syra” (restaurant “Altyn Aula”)

Almaty subs. of JSC Foreign Enterprise “Efes Kazakhstan”

LLP “First Brewery”

LLP “Line Brew Bottlers”

Cheshskiy pivovar, minibrewery

Hessen pub, restaurant

LLP “Capital-Grand” (restaurant “Pivovaroff”)

0’16 Syrahana, restaurant

Birhoff, restaurant

Brewery, restaurant

Epoha, restaurant

Nottingem, restaurant

O’Hara Irish Pub, restaurant

The Barley, restaurant

LLP “Asyl-Syra”

LLP “SM Brewery”

LLP “Staier Brewery”

LLP “Viktoria-NS” (“Nemetskoe pivo”)

LLP «Pivovarnya v Kokshetau»

LLP “Shymkentpivo”

LLP “Sigma Brau”

LLP “Alliance City” (restaurant “Pivovarov”)

LLP “Kaz Beer Group”

Revolver Grub & Pub, restaurant

LLP “Susyndar”

Armata, restaurant

LLP “Tamila Plus”

LLP “Aser”

LLP, “Ul’binskiy pivovarenniy zavod”

LLP “Zyryan-Kajnar”

LLP “Vostok-Pivo”

LLP “Leninogorskiy pivovarennyy zavod “Ridder”

LLP “Fresh Market”

LLP “Irtysh” (Bierhoff)

LLP “Ak Zhar” (restaurant Beer King)

LLP “Blonderbeer-Taraz” (restaurant “Forfas”)

AO “Nurzhanar”

LLP “Firm Bonus” (restaurant AB pub)

Prazhskie nochi, restaurant

JSC Foreign Enterprise “Efes Kazakhstan”

LLP “Forpost-Karaganda” (restaurant Forpost)

LLP “Osakarovskoe Pivo”

LLP “Firm “Arasan”

Rudniy subs. of “Firm “Arasan”

LLP “Altyn Omir” (Araj)

LLP “Pivovarenniy zavod “Arman” (restaurant Bierhaus)

LLP “Zhana Rosa”

Alpenhof, restaurant

LLP “Casco Agroservice”

LLP “Akbar Plyus” (restaurant Erstes)

To get the full article “Kazakhstan beer market analysis” in pdf (49 pages, 21 diagrams, 19 maps, 3 tables) propose you to buy it ($45) or visit the subscription page.

2Checkout.com Inc. (Ohio, USA) is a payment facilitator for goods and services provided by Pivnoe Delo.

The article materials were prepared using data by Committee on statistics Ministry of national economy. A number of estimations are based on presentations and reports provided by beer producers. The publications in issues Kursiv and Capital were used in the article preparation.

The totals of 2018 on the beer output volumes are extrapolation of data for 10-11 months of 2018.

In case the information source is not provided, the data and their interpretation are our assessment based on the current trends.

Images with maps of Kazakhstan were created automatically using Bing Geonames that is why the names of regions on the maps partially do not coincide with the official ones.

We do not guarantee that the given information is absolutely correct, though it is based on data obtained from reliable sources. The article content should not be fully relied on to the prejudice of your own analysis.