- Current data

- The influence of export and import

- Non-alcoholic boom

- Output and market by value

- Beer prices

- Who can afford beer?

- Segmentation by price

- Segmentation by channels of sales

- Beer sales in HoReCa

- Segmentation by tastes

- Positions of major companies

- Polish craft brewers

In order to better understand the current changes at the beer market, let us look at the historical trend.

After Poland left the Soviet bloc, foreign investors got immediately interested in Polish beer market. Rising on the development wave there passed 25 years of rapid growth. But roughly in 2017 the current stage of saturation. The beer output has been fluctuating at 40.5 mln dal. Brewers began writing about weather and state regulations as about main sales factors in their reports. Rapid qualitative changes started being observed at the same time. The market structure, (that is, product range, tastes and geography) was becoming ever more complex. In 2021 the pandemics dropped the natural volumes to 38 mln hl.

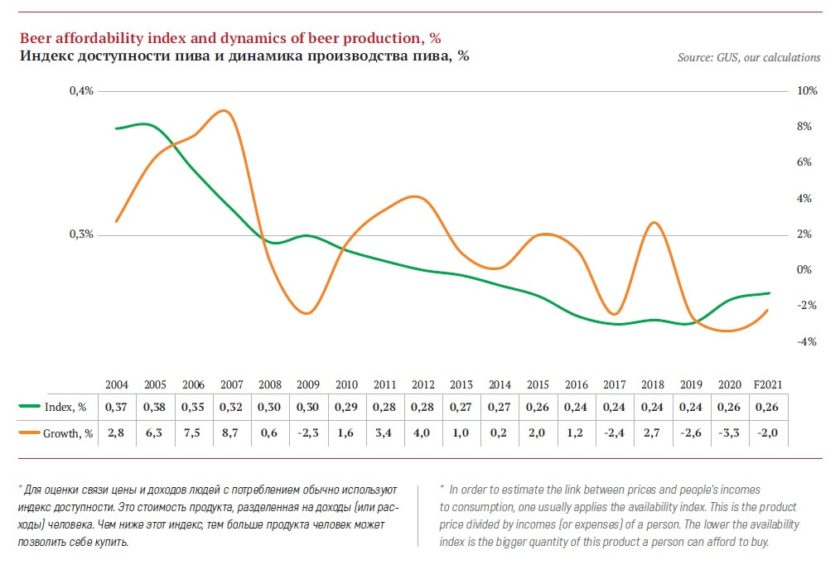

The growth and subsequent market saturation of the Polish market were closely connected to beer availability. It stabilized in 2017 and then reverted its development.

As we can see on the graph, the periods of rapid decline of beer availability index meant high production rates. And on the contrary, slowing down or decrease of beer availability index (for example 2009, 2017 and 2020) were followed by output decrease.

The current reasons for the natural volumes decrease lie not so much in the ability to buy beer for one’s income, but in changes in people’s attitude to beer. And this is a global trend. The new generation of the Polish brought about conscious consumption instead of consumerism.

According to meta reviews*, 20 years ago the youth all around the world in general (and in Poland in particular) has started treating beer not as an every-day beverage, but as an alcoholic drink containing calories that one should limit. Among the motives of beer consumption, taste enjoyment or self-identification by the beer brand is growing more important. The significance of alcohol as a psycho-stimulator or communicator is decreasing.

* Decreases in adolescent weekly alcohol use in Europe and North America: evidence from 28 countries from 2002 to 2010. European Journal of Public Health, Vol. 25, Supplement 2, 2015, 69–72. doi:10.1093/eurpub/ckv031

Dainty tastes of Polish consumers is reflected in the share growth of alcohol free, special, import and craft beers which we will talk below, though the pandemics can slow this trend down. As special beer is more expensive, market premiumization is taking place.

Brewing companies are in tune with the trend as they are expanding their shelf spaces for premium beer. They mostly focus on their profitability (revenue from a hectoliter), but not keeping the volumes or fierce fight for the market share. Thus, over the recent years, the availability index reverted into the opposite direction and now it reflects qualitative changes in consumption.

Let us analyze the above-mentioned trends in more detail.

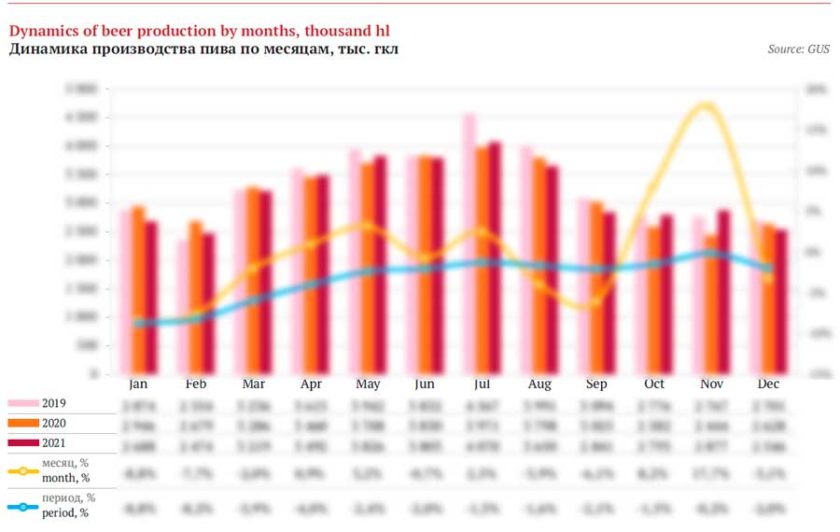

Current data

The forecasts by Polish brewers on 2021 were pessimistic and most of the year proved them to be true. Grupa Żywiec in their report noted that 2021 would be difficult for brewing industry that would still feel the consequences of pandemics restrains and suffers from huge inflation pressure.

The company cited Nielsen’s data that is, beer market without including HoReCa, over the first year half decreased by 3.8% (by the end of 2020 the decline amounted to 1.6%). The official dynamics of the beer output fluctuated but was also negative. According to data by Główny Urząd Statystyczny (GUS) the decline amounted to 2% by the end of the half year. And the whole summer season was in general worse than the previous one.

Yet in October and November, months that are usually not important for the year performance, GUS suddenly registered a good production increase. So, by the time of the article preparation, we can unexpectedly speak of a neutral dynamics by the end of 2021 with the beer output volume a bit higher than 39 mln hl. However, the volume stabilized at a rather low “abnormal” level of 2020 unseen for last 1o years.

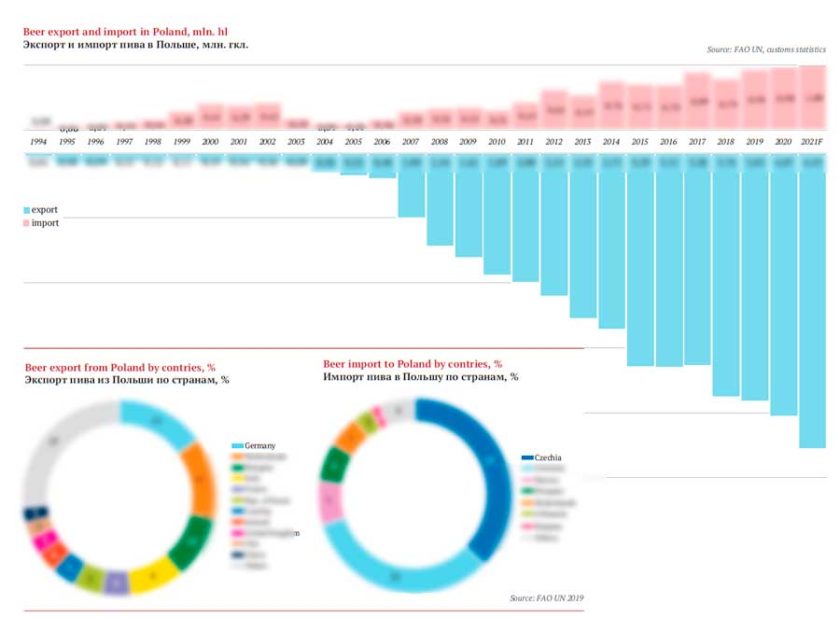

The influence of export and import

One should also take into consideration the impact of vivid external trade of Poland. Nearly …% of manufactured beer is exported. Mostly these are countries of the EU but the geography of major supplies is very broad from the USA to South East Asia. The export growth is promoted by open EU borders where for instance Czech Lidl sells big volumes of Polish beer under private labels.

Besides, driven by the beer market premialization trend the import also grows, with a rather simple looking geography: a … part of beer is brought from Germany and a … part is imported from the Czech republic. Under our rough estimation based on the trade balance the share of import beer at the Polish market reached …% having added … over last three years. By value it is almost twice smaller.

As we can see, the trade balance is offset towards export in proportion …/…. This means that the volume of the Polish beer market is smaller than the output volume. Thus, the result of the trade balance (output + import – export) which nearly equals the inner market*, has decreased by …% under our estimation.

* The impact of carry-over stocks is in our view negligible, as of October 2021, they hardly increased …% compared to the previous year).

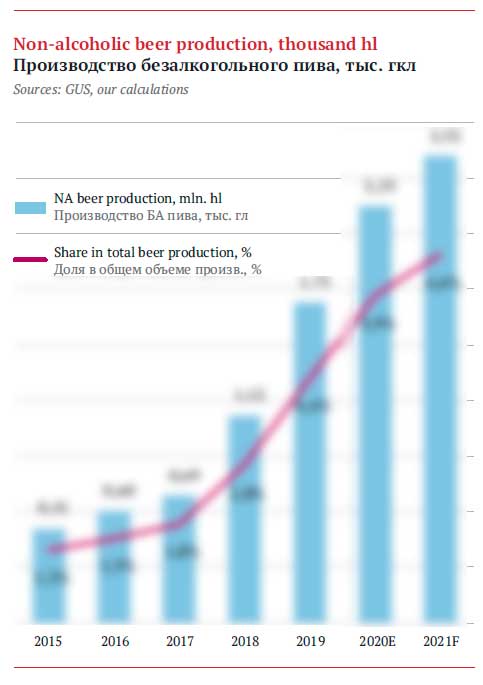

Non-alcoholic boom

Our estimation of the industry dynamics would be incorrect if we did not take the volumes of alcohol-free beer into consideration. Poland follows the world trends of decreased beer consumption and lower alcoholic content in beverages. From 2017 to 2020, the market share of alcohol-free beer at the Polish retail market tripled having reached …% of the market (or …% of the output by our estimation). Basing on the companies’ reports in 2021 the sales of alcohol-free beer went on growing though not at such high rates as before. One can presume that its share in the output is approaching …% against the stagnation of the alcoholic beer market.

But if we take the alcohol-free beer into consideration, the dynamics of the Polish beer market in 2021 will look better. The difference from the previous year amounted to -…% according to our estimation.

According to data by NielsenIQ the rising popularity of beer without alcohol is gradually leading to lower average alcohol content in beer. In 2018 it amounted to …%, …% in a year and …% in 2020.

Output and market by value

Despite the output reduction, in 2020 the revenues of Polish brewers from selling its major product increased by …% to … bn zloty. Because of devaluation the growth in dollars amounted …%, to … bn. For comparison, according to official data, the sales of strong alcohol producers increased, while producers of non-alcoholic drinks saw a decline in their volumes.

Below we will consider companies’ performance so we need to say that the net revenue of brewing companies basing on the data of Polish finance ministry is much higher and exceeds … bn zloty, as beside indirect taxes it includes sales of all beverages and not only sales proceedings.

Basing on the average retail beer price and trade balance including alcohol-free beer, beer market by value can be estimated at … bn zloty (…% against 2019), that nearly equals $… bn. These are estimated data that do not consider the difference between retail prices and HoReCa segment, where before the pandemics, almost every 10th liter of beer used to be sold.

For comparison let us cite NielsenIQ data that basing on market audit in 2020 estimated retail sales at … bn zloty with a …% growth while the natural volumes fell by …% to … mln hl. This estimation does not include beer sales in HoReCa.

Beer prices

GUS data reflect average price growth for a half-a-liter beer bottle by …% to … zloty for a liter in 2020. Preliminary data on alcohol drinks reflect further growth by several more percent in 2021.

NielsenIQ data for 2020 show dynamics which is close to the official one. According to retail audit, the price for a beer liter grew by …% to … zloty in 2020. The average price for beer had been growing for a long time as it increased by nearly … zloty per year which means that by the end of 2020 it was …% higher than early in 2019.

According to brewers in 2020 the retail price grew due to a …% excise rise at the beginning of the year and the raw materials cost growth.

It is unlikely that the situation will improve in the nearest or distant future.

«“2021 is going to be a tough one for the brewing industry that would still feel the consequences of pandemics restrains and suffers from huge inflation pressure… observing the future one sees that we face unprecedented hardship in the industry. On the one hand we are affected by the rise of all operational expenses from raw materials, energy, gas and package to salaries. On the other hand, the 10% excise rise in 2022 and 5% rise in the next years as announced by the state will cause bigger tax burden by more than 50% by 2027, though the industry has not yet recovered from the pandemics and the previous rise in 2020”.» – Simon Amor, head of Grupa Żywiec comments

Who can afford beer?

The market reduction in 2020-2021 can be partially explained by the beer availability dynamics we told about above. The availability depends on beer price and (incomes)expenses of people.

In 2020 not only the price changed. The second ingredient of the availability is people’s ability and wish to spend money on beer. And at this point an unusual situation was observed during the first year of the pandemic.

«In 2020 the financial standing of households improved a little despite the pandemic of COVID-19, that had a big impact in the expense level and structure in particular. The households had higher incomes and much lower expenses compared to the previous year», — one can read in the latest GUS report.

In the report there are data on expenses on beer in different groups of people. On the one hand it is obvious how much the general expenses on beer grew in 2020 – from … zloty per month to ….

Certainly, employed people spend more on beer and manual workers stand out among them. The unemployable Polish were particularly reasonable in beer consumption and cut down expenses on it.

Yet even the expense growth of employed people did not lead to growth of beer sales volumes, as it was evened by both retail price growth and consumption premialization (see below).

Temporal outflow of migrant labor could have also negatively affected the volumes in 2020-2021.

Here let us note that the Polish beer market transited to stagnation in 2017 only while the markets of former Soviet bloc had stopped growing much earlier. One of the reasons for it could have been a riot growth of labor immigration mostly from Ukraine that started in 2015.

According to estimation by Ukrainian ambassador in Poland Andrey Deschitsa almost 1.5 mln Ukrainians work and 50 thousand Ukrainians study in Poland.

Due to introduction of restraints, in the first wave of coronavirus epidemic, at least 250 thousand of Ukrainians left the country and obviously many postponed their planned trip.

As for the Polish population the number of those who left seems to be small (0.6%). But we speak of not very significant market volume changes and of active beer consumers taking into consideration their age and physical labor.

Here let us cite the spectacular example of China, where the direction of inner migrant flow is a very important factor for the market development. The mobile labor can dynamically influence the volume of economy and mid-priced beer sales. And here an important part is played not only by the physical presence of inner migrants in the cities but also by consumer sentiment which is linked to their confidence in the prospects of a stable job.

Some reduction of the Polish market as well as the character of changes in the sales structure (there was a decline of affordable beer but not premium, see below) is fully consistent with this logics.

Segmentation by price

The beer market growth by value is connected not only to price rises but also to premialization. By the time of the article preparation, we had data for 2020. Yet in 2021 update reports by brewers register both sales growth of premium beer and bigger revenue from each sold hectoliter, so premium is still growing.

According to Asahi’s own estimation that manages company Kompania Piwowarska in the long run (CAGR 2014-2019) there were a significant sales growth of superpremium beer and a minor growth of premium beer. At that, the mainstream and cheap beer, on the contrary, lost a little of their sales volumes.

In 2020 a … p.p. growth of the superpremium beer market share took place at the expense of mainstream segment that went down by the same amount. Cheap beer kept its positions.

NielsenIQ’s data for 2020, are a little different form Asahi data, though their price scales are probably different too. Beer sales in category top & ultra premium, that is, costing more than … zloty for … l grew most of all, by …%. the demand for beer of premium class that is costing from … zloty to … zloty for 0.5 l grew by …%. Economy segmet beer (up to … zloty for 0.5 l) and mass beer (up to … zloty for 0.5 l) registered a …% and …% drop in sales accordingly.

Segmentation by channels of sales

In Poland the retail sales is not very consolidated, here the share of small stores and local networks is traditionally high. So brewers do not experience such a strong influence of the modern retail as in many other countries. Yet the pandemic has made the positions of several kinds of networks stronger.

In November 2021 GUS published analytical report “Rynek wewnętrzny w 2020 r.” with data on retail channels of sales.

By the end of 2020, the number of stores in Poland was …% less than the previous year. Food retail where the bulk volume of beer is sold fell by …% to … thousand stores though there remained the same amount of alcohol stores, … thousand.

The net selling space of the stores has hardly changed, but there has been a redistribution of spaces.

Small outlets up to 99 m2 did not suffer (obviously these are stores of category “near home”). But the net spaces of small stores shrank considerably (100-299 m2 by …% and 300-399 m2 by …%). At the same time, the stores ranging 400-999 m2 have increased their spaces by …% and stores with spaces 2000-2499 have grown by …%.

Probably like in other countries as the pandemic started, consumers started going to modern retail buying more products (and beer) for future use more often having cut down the frequency of impulse purchases. Though one cannot say that the redistribution was a special characteristics of 2020, this is a long term trend, it just got accelerated by the new situation.

Interestingly, in Poland as well as in other countries small outlets demonstrated stability in 2020, as they balance the necessity of immediate small purchases.

But which exactly network channel of beer sales was the successful one? NielsenIQ data and brewers themselves say “We can clearly see the extension of pandemic trends – further decline in traditional retail and the discounters growth”.

Discounters, that as it has turned out recently started giving up ground, took sales volume from other grocery stores both of bigger and smaller scale. The share increased by … p.p. in the first place at the account of hypermarkets. Besides, the stability of beer sales through gas-filling stations, but a short time ago that channel was the fastest growing one.

Let us note that the share of discounters in Poland (Żabka, Lidl etc.) is not big enough to influence companies’ market shares or the product range. For example, in Ukraine the share of discounters in beer sales in retail exceeds half. But since 2013, in their reports the market leaders have been anxiously speaking of discounters and their axiety grows with each crises and reduces in the normal conditions.

Obviously, stronger discounters with their private labels, constant promoactions and strong negotiating position involves brewers into price competition and negatively affects the profitability. Yet everybody has to accept the new reality, in 2021 even Polish craft brewers started making beer for Lidl.

Beer sales in HoReCa

Beer sales in the segment of bars and restaurants are still not included into statistics and ignored by research companies and we only have estimations to judge on them.

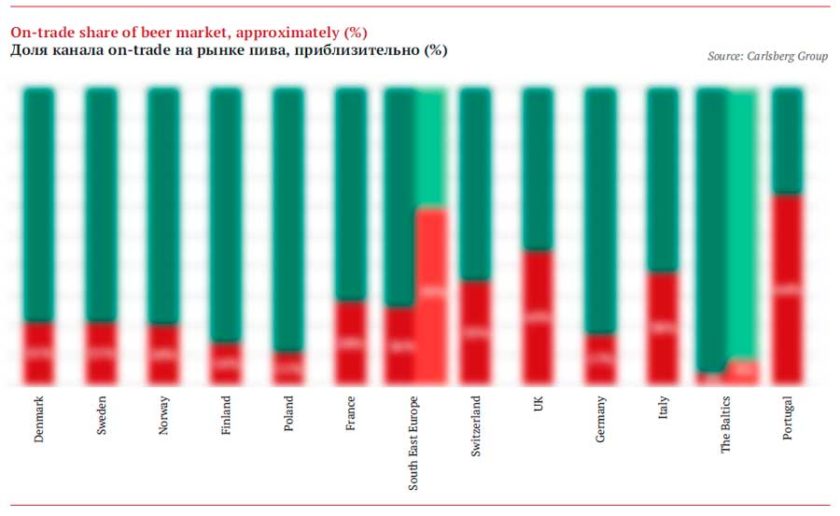

Before the pandemic, Carlsberg Group estimated the share of beer sales on-trade in Poland at …%. This level is … higher than in post-Soviet countries but … lower the average EU level (however, the share of on-trade sales on the Baltic countries is even smaller). But this was what helped to keep stable. According to companies’ reports: “Although the beer market declined slightly, it was less impacted by COVID-19 than most other Western European markets due to a relatively small on-trade channel.”

How significant was the decline of HoReCa sales?

According to GUS, due to long-term operation restrictions in 2020, the number of restaurants businesses fell by …% to … thousand. The net incomes declined by …% having amounted to … bn zloty.

As for the beer market it important to know that the biggest losses were incurred by alcohol and tabacco sales (…% to … bn zloty). In the third quarter of 2021, according to GUS, restaurants and hotels were among leaders by restoration of businesses number. But this process is slowed down by staff shortages as those who resigned as well as new potential employees do not believe that job in HoReCa will be stable.

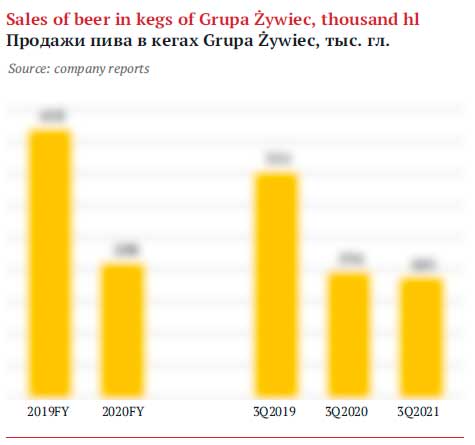

We have not found industry data concerning the beer sales decline, but to some extent one can estimate the decline basing on Grupa Żywiec report. Company’s sales of beer in kegs during the first year of pandemic were …. Preliminary data on draft beer sales for the three quarters of 2021 show that during the second year of pandemic, there was a stabilization as the reduction amounted to only …%. Yet we can see that despite the recovery of restaurant operation and consumers’ adaptation, there has not been a recovery of beer sales.

It is easy to calculate that for Grupa Żywiec the share of kegged beer sales fell from …% in “normal” 2019 to …% in the following “abnormal” year. That is, a considerable decline in absolute numbers seem insignificant for big companies. And it is clear why Carlsberg Group also spoke of a minor impact of the restrictions on the market dynamics.

Yet the biggest loss was incurred not by leaders who account for the bulk of beer sales. The negative effect was in inverse ratio to the size of the business. The president of Polish association of craft breweries Marek Kaminsky told as he was describing the situation for Franczyza & Biznes:

“The craft beer segment suffered the most from the pandemic as its manufacturers are closely connected to gastronomy. In the average in Poland breweries sell nearly 15% of beer in HoReCa, while in craft breweries this share amounts to nearly 30%. There are such craft breweries that do not sell on tap at all and completely rely on gastronomy. During the full lockdown that we had to face from mid March till late May 2020 many brewers were left without a possibility to sell anything and get income”.

Segmentation by tastes

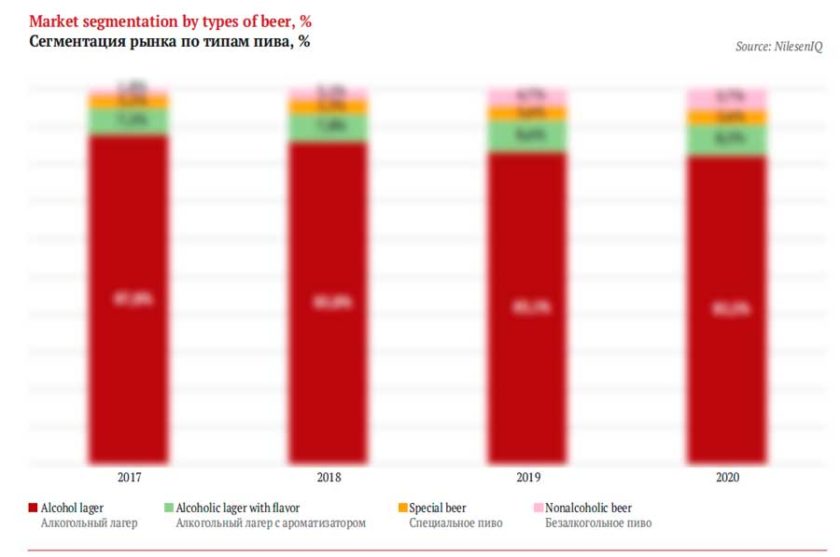

Though traditional lagers absolutely dominate the Polish market, the share of special tastes is rapidly growing. The interest to non-standard beer tastes is a world trend, but the activity of Polish brewers is the key factor. The market leaders started developing the category of special beer nearly in 2015 by making unusual sorts of major brands. The new brands got much shelf space as well as marketing budgets, which defined the fast growth of the category.

Special beer sales are connected to development of premium segment as such beer is more expensive (and the difference in price will become even bigger) and the alcohol-free segment as it is currently also developing driven by sorts with supplements.

The pandemic has slowed down the share growth of special and flavored sorts. But now there are new restrictions that influenced the affordability of special beer and can make major producers carry out auditing their range and beer formulae. Namely, brewers faced additional excise for sweet drinks which touched upon the segment of flavored beer with sugar.

The excise is levied on the total sugar content including the ingredients supplemented to the ready beer such as for example juice or sweetener. This innovation is demanded by directive ЕС 92/83/ЕЕС. All member-states have to comply with it up to 2030. Yet, the Polish parliament got down to business immediately and the changes will come to force starting from 2022.

Depending on a certain product and its content, the excise rise is likely to be 20-60% which will effect the final price for the consumer. As for the brewing industry in general it can mean a 3% rise in taxes according by estimations by Bartlomey Morzhitskiy, the head of Employers’ union of the brewing industry.

Positions of major companies

Kompania Piwowarska (Asahi)

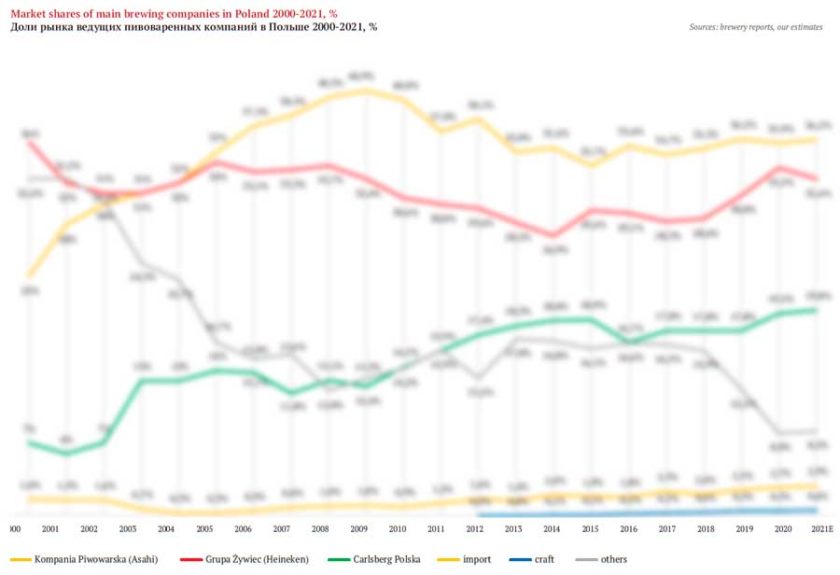

Kompania Piwowarska (KP) is the biggest brewing company in Poland that appeared in 1999 as a union of two major breweries namely Tyskie and Lech. They currently form the core of the group too.

In 2020 the sales volumes of KP amounted … mln hl (a …% reduction) and the market share remained nearly 36%. At the same time, by the volume of net revenue according to the ministry of Finance the company occupies not the first but the second place after Grupa Żywiec as by the end of 2020 it amounted … bn zloty (a …% decline) or $… bn.

Originally KP could claim a confident second position, but the European asset caught the eye of SABMiller one of the most ambitious transnational brewing companies at the time. In 2003 SABMiller entered the capital of KP and it got resources for a third acquisition in Belostok. In 2009 SABMiller got the full control over KP.

That whole decade – from formation to full acquisition was a period of a superdynamic growth for KP that doubled the market share from 20 to 40%. The company became the leader as far back as in 2005 and by 2009 the break away from Grupa Żywiec seemed to be irreducible, almost 10 p.p.

But later on started a long term dark period. First KP as well as its nearest competitor were affected by economic recession that according to the report resulted in an intensified competition and fragile consumer environments.

The crisis for big brewers lasted from 2009 till 2011 but it was a real spring board for regional producers. Interestingly, similar processes were taking place at the same time in post-soviet countries to the east of the EU where the fashion for “live” beer came from the depth of the Siberia. Thus, in Poland too the popularity of non-pasteurized unfiltered beer by independent brewers grew unexpectedly fast. The new fascination of Polish consumers was connected to being tired of eurolagers by transnational companies.

Big major brands by KP (Tyskie and Zubr) were mostly under the pressure. Though after the crisis the affordable brands such as Wojak on the contrary caught fancy of economic consumers and gained some of market weight.

On the opposite side, the situation is complicated by riot growth of discounters where buyers came willing to economize. The price competition at the supermarkets led to high promotional activity of brewers. Discounts for beer, worsening of the product mix as well as a glut of inventories affected the potential performance of KP.

A new lucky period seemed to have started in 2012 as the market revival also meant recovery of price market structure. The consumption market growth was promoted by football championship Euro-2012 in Poland and Ukraine. Though KP was not a sponsor there, but supported the key brands by new launches and invested into marketing. For instance, there were advertising campaigns for Tyskie and Zubr that had sales volume increase. As the Shandy sorts line was launched for the key marginal brand Lech, the company extended the promising category of flavored beer.

However, advantages that major brewers got from advertisement and the championship were temporal. Regional breweries (as well as private labels producers during the supermarket growth surge) won back their lost market share having taken it from KP and Grupa Żywiec.

On the opposite side KP was attacked by other international companies that were actively developing both the segment of flavored beer and the premium segment. The sales of women’s beer Redd’s went down. Though the sorts of special line Lech Shandy were growing they were taking a share from Lech major brand. Affordable brand Zubr had been increasing its share for several years and keeping KP volumes from rapid reduction but this led to product mix worsening.

As a result, through 2015 the KP profitability went down and the profitability and sales volumes reduced (though the market in 2015 expanded). Yet, by 2016, a turning point in the company’s fate, it was experiencing positive dynamics of revenues and volumes, though the brand positioning needed revision. That was done by a new owner.

SABMiller acquisition which was the largest at the global beer market in its entire history resulted in European regulators demanding AB InBev to sell the assets. Asahi, Chinese and private investors started fighting for them.

Asahi due to the Japanese market stagnation and global ambitions was extremely interested in such a big piece European pie and offered more than others. 7.3 bn euro was paid for assets in Czech republic, Slovakia, Poland, Hungary and Romania. The company management were fully aware that the beer consumption in the EU had reached its peak but they believed in the business profitability and brands’ power. In the very first reports after Asahi acquisition repeated the situation estimation, that is, the price competition at the Polish market has intensified and the market is unlikely to grow.

Asahi’s strategy in Poland has been consistent over the recent years and based on strengthening the national brands. At that, relying of the company’s reports, the focus is not made on the volumes increase.

Two core brands Zubr and Tyskie operate in the mainstream segment and sell a total volume of about … million hectolitres, while in the premium segment, KP sells more than … million hectolitres through a diverse range of brands and sorts. The challenge of the recent years has been to continue the premialization journey through the Zubr and Tyskie margin growth as well as through the focus on premium brands in high growth profitable segments.

Tyskie was relaunched in 2018, with a new recipe and a completely renewed visual identity which according to the company’s data led to its stronger positions in the premium segment. At the alcohol-free market the stake was made on Lech Free 0.0 and on its flavored sorts on the first place. In 2019 the subbrand doubled the volumes and took the first position in the segment and further on the product line went on expending.

Besides, KP also strengthened its position in the flavored alcohol beer segment. In 2018, the company launched rum-flavored beer, Captain Jack, and further on added new flavors to it. The portfolio of Czech brands was substantially strengthened by beer Kozel and the fashion for craft beer reflected itself in multiple sorts of Książęce brand (such as IPA, Porter or Weizen) that originated from different parts of the world.

Under our estimation based on KP reports, in 2020 the company kept the market share at nearly the same level. At the same time, according to Asahi’s data, the sales structure has shifted considerably towards the premium at the account of the mainstream reduction. It can still look excessive if we compare it to other international companies. But according KP’s own estimation of the sales structure, KP has practically left the market of cheap beer having left it behind to competitors. So the price mix looks as least not worse than that of other market players.

What did 2021 mean to KP?

Preliminary data based on Asahi’s reports over the first three quarters of 2021 reflect a …% volume reduction in Poland. The major decline too place early in 2021 due to the high base of the previous year (2020). Taking into consideration the general dynamics, KP kept their market share at approximately the same level by the end of 2021. Besides, according to the report KP goes on strengthening its positions in the … segment of the beer market, for instance, due to … as well as the recent launch of special tastes beer … with three fruit tastes.

Starting from recently, the strategic focus on profitability instead of volume keeping does not threaten the leading positions of KP. However, the last rather big acquisition at the beer market (that we will tell about later) resulted in the gap between KP and Grupa Żywiec amounting to as little as …-… p.p. That is why in case KP continues following the premialization course, and Grupa Żywiec suddenly decides that it is time to sacrifice margin and concentrate on volume increasing, there can be a new leader at the Polish market in the medium term period.

Grupa Żywiec (Heineken)

Grupa Żywiec currently takes the second place by beer sales at the Polish market.

According to the report in 2020 sales of the company grew by … % to … mln hl. And the company took the lead by the gross revenue that by data from the ministry of finance increased by …% to … bn zloty (nearly $… bn).

The brewery in Żywiec can be called a pioneer both in big Polish privatization and inviting foreign investors. Zakłady Piwowarskie w Żywcu was one of the first to be reformed in JSC and in 1991 its shared started to be traded at the Warsaw stock exchange.

Heineken group also entered the Polish market early in the 90-ies. First off, it organized the distribution of the title brand delivering it from abroad. And in 1994, the group decided to localize the production and purchased 25% of shares of Żywiec brewery. So the Dutch were gradually increasing the share in the Polish company bringing it to 75% by 1998. The general investments of Heineken into the business are estimated at nearly 1 bn euro, which allowed the brewery to become one of the biggest in the world.

However, Heineken never became the sole owner. In 1998 it acquired the first stake of Elbrewery brewery with the biggest at the moment Polish brand EB. However, this purchase was indeed an exchange of stakes with its owner Brewpole (Harbin B.V.). At the same time, Heineken entered the capital of Warka and Leżajsk Breweries and thus, within 1998 alone carries out the biggest consolidation at the market. Currently Heineken controls 65.15% of Grupa Żywiec and the share in Harbin is 33.19%.

Grupa Żywiec includes five production sites, they are: Arcyksiążęcy Browar w Żywcu , Browar Leżajsk, Browar Elbląg, Browar Warka and Browar Namysłów.

On its way to that structure Heineken purchased, closed and sold a host of breweries. And the latest two deals took place just recently (see below).

Though Grupa Żywiec is controlled by Heineken according to expert political union Klub Jagielloński it has a rather big autonomy including in managing the brand portfolio. Tellingly, the group was not renamed Heineken Polska as it is usually done in other countries.

A powerful start that made it possible to get a big piece of market pie made Grupa Żywiec not increase but keep the share. The development of other international companies that entered the market later was happening not gradually but in spikes due to rapid acquisitions of regional brewers. As the result Grupa Żywiec lost its leadership in 2005.

In 2008, when owing to the economic recession, the Polish started choosing cheaper sorts of beer, the price competition became much fiercer on the one hand and on the other hand, brewers had to raise prices. Grupa Żywiec attempting to keep the profitability dropped sales to a bigger extent than Carlsberg and KP that staked on affordable brands. Increasing of TV ad expenses did not much help the situation as well as a very non-standard (for Poland) measure, that is, launching affordable beer Warka in 1.5-liter PET bottle in 2009.

As the recession finished, during the rapid market recovery, regional breweries got the initiative and pressed brands by Grupa Żywiec.

That negative period went on till 2014-2015. But in 2015, Grupa Żywiec unexpectedly increased both the volumes and revenue against the neutral market.

One should take into consideration a range of steps the company took at the same time:

1) It restored the relation with one of networks that developed during the crisis and became a difficult but important partner.

2) Consumers recovered after the crisis and started showing interest to premium novelties including different variants of flagman brand Żywiec.

3) Grupa Żywiec entered the same competitive area with regional brewers by launching a non-pasteurized unfiltered beer sort. At the same time, EB that started the story of the company returned to the market.

4) The company rearranged the distribution system having switched from its own distribution system to modern agent operation schemes.

5) Finally, viewing the activity and performance of competitors, the company believed in special beer potential and launched a range of new sorts Warka Radler, Desperados Nocturno with rum and others) and also entered the cider market.

Soon Grupa Żywiec became the leader in the category of alcohol-free beer just a few months after launching Bezalkoholowy (Żywiec 0.0% since 2018) having left behind its major competitor Lech Free.

Another strengthening of positions was connected to a big acquisition which had not been seen in Poland for a long time. In 2018, there appeared first messages and in 2020 Grupa Żywiec signed a contract on purchasing Browar Namysłów for 500 mln zloty (nearly $132).

Browar Namysłów annually outputs about 1.7 mln hl of beer. But for new owners the marketing asset was much more important as it is a mighty historical background of a regional brewery and premium promising brands.

The enterprise itself is located in a castle and the brewing tradition dates back to 1321. Due to the merge, Namysłów got the chance to use the distribution network of Grupa Żywiec and it in its turn got a promising brand and the possibility to benefit from the growing interest of consumers to special beer. According to the comment by the company the segment of craft and regional beer is rapidly developing and Namysłów at the time of purchase was the fastest growing regional brewery. Browar Namysłów even before the acquisition was the most prominent at the Polish TV. But Grupa Żywiec did not lose the communication with consumers either and in 2021 started a campaign Namysłów należy do otwartych» (literal translation: Nemyslow belongs to the open). Its message is that Namysłów has now become more open for special beer lovers from all regions of Poland.

Taking into consideration the stagnation of the Polish market Heineken is not likely to look for additional capacities. Having purchased Namysłów assets the group also bought a small regional brewery in Branevo. There was a period, when it did not operate, but Namysłów managers invested 100 mln zloty into its reconstruction and brought the production back to life. But currently the threat is hanging over the future of this brewery. Unnecessary businesses are often closed in Poland by international companies despite protests of the locals and bombastic speeches of the city authorities.

But the brewery is lucky as in 2021 the “non-strategy” asset was sold to Van Pur company for a very reasonable price probably. The mayor of Branevo Tomash Selitsky wrote on Facebook that he was highly satisfied with such a turn of events: “Could the brewery workers, their families as well as all Branevo residents dream of a better Christmas present?”.

Along with the company’s market share growth (Grupa Żywiec focused on keeping the high growth dynamics of Namysłów brand) in the recent years, the company development relied on rapid adaptation to the pandemic conditions.

In the interview for Parkiet Simon Amor, the company’s chief executive told about a range of steps that were taken. In order to react in time the management went from quarter and annual planning to regularly updated weekly and monthly plans as well as flexible management basing on different scenarios. The sales team was retrained to work with client in the conditions of restrictions. And most of employees started working from home.

In 2021 the company kept the marketing focus on … beer having launched new varieties of … and …. The hot summer start brought about a sales growth of … brands (…,… and … beer) which improved the revenue for a sold hectoliter. Besides the company reported of a sales increase of light beer with reduced bitterness …. But the change in consumer sentiment and buying patterns touched upon the … market segment, that … and the … segments which led to the “general decrease of volumes and incomes of brewers”.

Here we should cite an external assessment of the company’s sales structure. According to Asahi’s own estimation, by the end of 2020, Grupa Żywiec shifted its focus considerably from the … to … segment. Besides, most probably those data did not include Namysłów brewery along with its … brands acquisition.

In 2021, a new wave of the share growth of discounters worsened the profitability of Grupa Żywiec sales. Bad weather in the second half of the year negatively affected the general beer consumption. Against the …, due to all those moves by the end of three quarters of 2021, there has been a …% revenue reduction and at the same time the income has gone up by …%.

Obviously the reduction of Grupa Żywiec sales by the end of 2021 will be considerable too and is likely to be lower than the average for the industry.

Carlsberg Polska

Carlsberg group has been at the Polish market for a long time but still does not claim to be the leader. Its positions are particularly strong in the premium and economy segments as if embracing the market from two sides (if we compare the sales structure of three leading companies). Thus in tune with the market premiumization trend the group has been recently developing faster than the competitors.

The first acquisition by Carlsberg took place as far back as in 1996, when it became a strategic shareholder of Okocim brewery. In 2001 there was a group formed out of breweries in Okocim, Shecin (Bosman), Serpts (Kasztelan) and Wrotslaw (Piast that was soon closed).

Due to those acquisitions and organic growth the company market share doubled over just one year of 2003 and reached 13%. Then other international brands entered the competitive struggle actively and even aggressively, so the positions of Carlsberg Polska did not change till 2008. Instead, during the recession the company managed not only to keep the sales like other companies but also to expand their volumes by growth of inexpensive brands Harnaś and Kasztelan.

From 2010 to 2012 Carlsberg had a period of recovery and rapid growth when the natural volumes expanded by 15% annually. Sponsor support of championship Euro-2012 that took place in Poland and Ukraine also played an important role. Thanks to active marketing following of the event, promotion of key brands and fast extension of representation at supermarkets the company won almost a fifth of the market. After that, Carlsberg Polska managed to not only secure the gain but was gradually increasing the share, however, with some fluctuations.

In our view on the Polish market Carlsberg Group traditionally applies its branded “balance of golden triangle” that is, volumes, operational income and profitability where each part is equally important. So, while over 2012-2020 two major competitors have been showing either profit or loss, the activity of Carlsberg Polska was constantly profitable judging by publications by the Ministry of Finance.

Perhaps, these balance and non-standard reaction to external events explain why the dynamics of natural volumes of Carlsberg Polska sales is in opposition to the dynamics of beer market development.

For example in 2016, when the sales of Polish brewers were growing the company decided to get rid of some economy brands and dropped the volumes by …% while the share went down too. But then, it turned out that that trick was reasonable as the beer market was developing exactly towards premialization and while competitors were balancing at the edge of profitability with big but low-marginal brands, the profitability of Carlsberg Polska was growing.

Another company stake was made on specialization – further strengthening in the category of alcohol-free and flavored beer (including radlers). For this purpose in 2018 there was a modernization at Bosman in Shecin costing 92 mln zloty (about $24mln). And again, judging by Nielsen data and internal reports by the company, the performance of Carlsberg Polska was much better than that of competitors. The planned marketing potential allowed increasing the sales volumes and the company’s share in 2020 when the beer market was decreasing.

According to data by Polish ministry of finance in 2020 Carlsberg Polska raised its revenues by …% to … bn zloty. Yet before-tax profit fell twofold, to … mnl zloty. In dollar the revenue can be estimated at about $… and the profit at $… mln. with roughly the sale dynamics. The profitability decline took place against its rise at other major brewing companies.

Besides, by our estimation based on reports by Carlsberg Polska, in 2020 its sales volume increased by …% by volume having reached … mln hl. Against the market reduction it meant the company’s share growth by … p.p. to …% according to our calculations.

According to the company report over 2020 in Poland it achieved solid revenue growth due to volume growth and positive price mix. The craft and specialty, with brands such as Somersby and Zatecky, and alcohol-free beers, were the most successful especially within the flavored subcategory. Thus alcohol free sorts of Somersby and Zatecky provided a …% growth to the alcohol-free beer category in 2020.

Here we will cite an alternative estimation as Asahi has a slightly different view on the competitor’s performance in 2020. For instance, KP owner also registered the market share of Carlsberg Polska but basing on the published figures the …of Carlsberg Polska was negative in 2020. Taking into account the relatively stable … brands the company dropped the share of … brands and increased the sales of …. Let us take into consideration that this is a subjective assessment based on the competing company’s data.

Somersby brand appeared at the Polish market in 2012 after launching in other European countries. The transition to other category supported by Party Like a Lord advertising campaign was piloting as the radler segment and flavored beer was only starting at that time. One can say that Somersby was one of the drivers for the segment development gradually increasing the market weight and adding a lot of different flavors. Not surprising, after the success of alcohol-free radlers at many other markets and against the rapid growth of alcohol-free segment in 2019 there appeared alcohol–free Somersby, first with classic apple flavor and later on with other flavors too.

We should also pay attention to Zatecky brand growth. The company must have been inspired by Zatecky Gus success at the markets of the post-soviet countries and so decided to use the Czech image in Poland too having output Žatecký Světlý Ležák in 2017. In the commercial for this beer the images of a Czech town and humor were used and the product line developed in the same direction – over the time there appeared alcohol free and dark sorts. But this is it with similarities. In Poland there was no adapted word Gus or the character. Neither the beer design nor the advertising communications can by no means be called an adaptation of the old practices.

Judging by the transitional data Carlsberg Polska in 2021 the positive dynamics slowed down but was observed and the same products drove it against the pandemics. The company reported that the sales of alcohol-free sort of …, and …as well as sales of local brands … and …. At the same time, the sale of Somersby beer in general went down despite the launch of ….

If we specifically speak about the sales positive dynamics was slower in the third quarter of 2021 after the high season. According to Cees ‘t Hart, the chief of Carlsberg group “Poland had a difficult quarter due to severe market decline following heavy rainfall and low temperatures. In addition and specifically towards the end of the quarter, the beer market was impacted by growing inflationary pressure, reducing consumers’ spending power. Our business gained market share, but not sufficiently to offset the market decline”.

Van Pur

Van Pur is the biggest national brewing company with a turnover exceeding … ($…mln). It has changed the owners multiple times, was a part of international groups but in the end it returned under the founder’s control.

Van Pur is also interesting for its distribution directions that are quite untraditional for leaders. Producing private labels for major international networks as well as export are as important as direct presence at the Polish market. So there is no contradiction in the fact that having a …% share in the net production of Polish beer Van Pur brands account for only …-…% of the national market under our estimation. Van Pur currently consists of 6 breweries as well as Bagpack (can producer) and Qbev (beverage manufacturer).

The first part of the company name comes from Zbigniew Wantusiak the owner of several companies and not a very public person. The final part is after Siegfried Pura a German entrepreneur. In 1989 the partners founded a common business and in 1992 they restored a brewery in Rakszawa and for the first time in Poland beer tin filling started. The new package had a great success but during the first year the company focused on contracted filling for other brewers only. In 1993 a brewing house started operating there and the company began packing Van Pur Premium beer. A considerable part of the output went to export.

The start of the 2000s could have been the first turning point for Van Pur when the company concluded a license agreement with Brau Union for beer Goesser manufacturing and was soon sold to that group. Later, the Austrians were purchased by Heineken too. Van Pur had to be put for sale as after the major deals (concerning the reacquisition of BBH) Heineken needed funds. Wantusiak took that chance and rebought the company back. Thus Van Pur has become an independent company again.

Under the management of “old new” owner the company was rapidly growing. The volumes increased due to inexpensive beer, that Van Pur started outputting under networks private labels. The company started expanding through rapid acquisitions. In 2005 a brewery in Zabrze became parts of the company, and breweries in Koszalin and Jędrzejów did the same in 2009.

Another turning point could have been the deal with Dutch Royal Unibrew when a brewery of that group in Łomża was given in exchange for 20% of Van Pur shares, but with the priority right for rebuying. However, giving a share of stock did not become a step towards final acquisition that happened so often in Poland. In 2012 Wantusiak employed the stock option plan and rebought the stock back. Thus, he has gained 5 breweries under his control.

The final deal took place late in 2020. After Heineken’s Polish assets got major regional group Namysłów, it (like 200 years ago) exchanged it for its other asset that was gained together with the main one. 100% stock of Braniewo brewery with several strong regional brands were sold to Van Pur. Together with the new brewery the net production capacity of the Polish group increased to almost 6 mln hl per year.

But why Van Pur want another brewery at the Polish market that has been decreasing for several years running? On the one hand, the price of the brewery was hardly high. The city authorities of Braniewo told that the brewery was under the threat of closure and the deal virtually saved it. On the other hand, the capacity could be useful taking into consideration the high interest to regional beer. Besides because the Polish export (and obviously foreign deliveries by Van Pur) are still growing.

For international companies foreign markets cannot be important by definition. They can provide affordable and mass export only to small, distant or complicated markets. Besides only famous brands with strong geographic links and high retail price are exported which restrains the sales volumes. All those deterrents are absent at big national companies so practically in all countries export is very important to them. This is clear both from the export share in their sales and by their share dominating in the national export.

For example, Kompania Piwowarska in 2020 shipped abroad about …% of all brewed beer and Grupa Zywiec shipped about …%. It is logical that Asahi with its strategies for expansion and lesser presence in the UE is actively using Poland for providing beer to other counties while Heineken does not need it. Van Pur according to some estimation in the press does about a … of its sales abroad.

To a big extent it is explained by the fact that Van Pur produces private labels for international networks, Tesco for instance. The transparent trade borders of the EU allow to conclude scale contracts for manufacturing big volumes of inexpensive beer (on the website of Van Pur one can read about a nearly 30-year experience of supplying private labels to international networks). The company adjusts beer characteristics to fit traders’ needs relying on its marketing activity as well as its own lines of package production.

Certainly much attention was paid to international promotion of the company’s own beer. In the first place the best sartorial statement are brands Karpackie, Łomża and title Van Pur that can be found in all key export markets.

The export of some other “national” brands that are appealing for local lovers of import beer is of equal importance. For example, sorts Edelmeister and Hermann Muller are popular in post soviet counties. For instance … mln liters of that beer is brought to Russia annually. At distant markets an import product with a German name on the label is actually taken for a German product (and the “non-Polish” name of the manufacturer also supports this self-deception).

Polish craft brewers

How are Polish brewers of small scale doing? Which trends are influencing them?

According to estimation by Polish association of craft brewers (Polskie Stowarzyszenie Browarów Rzemieślniczych), craft breweries in 2020 managed to adjust to the new unusual situation by engaging new consumers and enlarging its market share. The output volume of the breweries that belong to the association grew by …% and amounted to … hl (PSBR, according to their own estimation represent about …% of the craft segment).

Basing on these data, one can calculate that the market share of craft breweries at the market exceeded approximately …%. But many participants in the craft movement believe that the share of small brewers is significantly higher. For example, according to Polskie Stowarzyszenie Piwowarów Domowych (home brewers’ association with 1350 participants) the share of craft amounts to nearly …% of the beer market.

By the way, according to PSPD virtually all national craft projects are started by home brewers who eventually decided to have a bigger production. In Poland home brewing is well developed and appeared much earlier than the industrial craft. Home experience has got its traits such as enthusiasm, love for constant refreshment of the product range as well as developed communication in the community.

It is considered that the history of craft brewing in Poland started at the time when Pinta brewery’s founders in 2011 made beer Hop Attack. They were impressed by beer round trip in the USA. By the way, fascination by American experience and raw materials is also typical for Polish brewers in general.

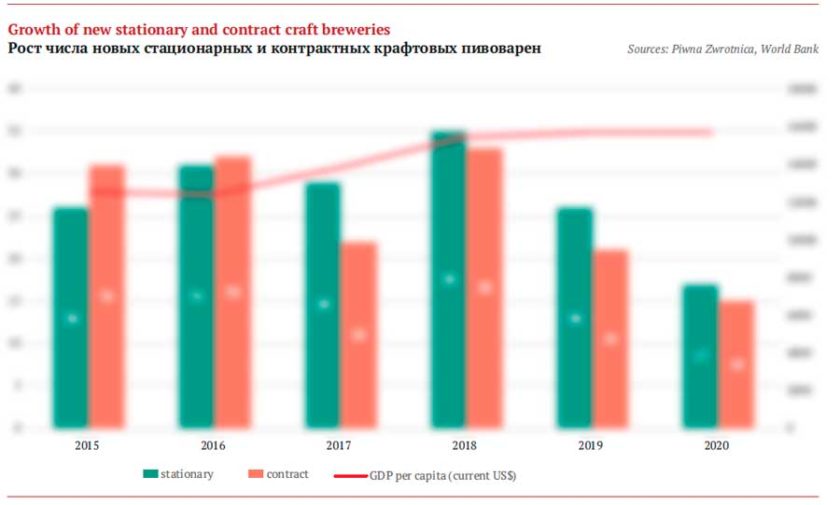

Until 2015 the growth of breweries’ number was exponential which is natural taking into consideration the low base. After that, before the pandemic, there annually appeared about 50 new names of craft breweries on the Polish map. The maximum was reached in 2018, as according to assessments by influential bloggers from Piwna Zwrotnica the inflow amounted to almost … breweries (yet almost half of them are contract projects).

In comparatively favorable 2019, the number of new launches went down and in the crisis 2020 their number was halved against the record breaking year. Thus, according to Piwna Zwrotnica estimation, in 2020 there were … breweries operating in the country, … stationary ones and the remaining … were contracted productions. Let us note that in 2021 the authorities gave unpleasant surprises to contracted brewers (see below) which can negatively affect their development, yet they hope these are just temporal difficulties.

Along with a host of contracted businesses, the craft brewing of Poland stands out for its big number of collaborations and these are often trans-border projects. Despite the difficulties according to Piwna Zwrotnica the number of contacts with foreign brewers are growing, and there have appeared constant “bridges”. Among the directions that are chosen most often are Czech republic and Ukraine.

Is there any space for development?

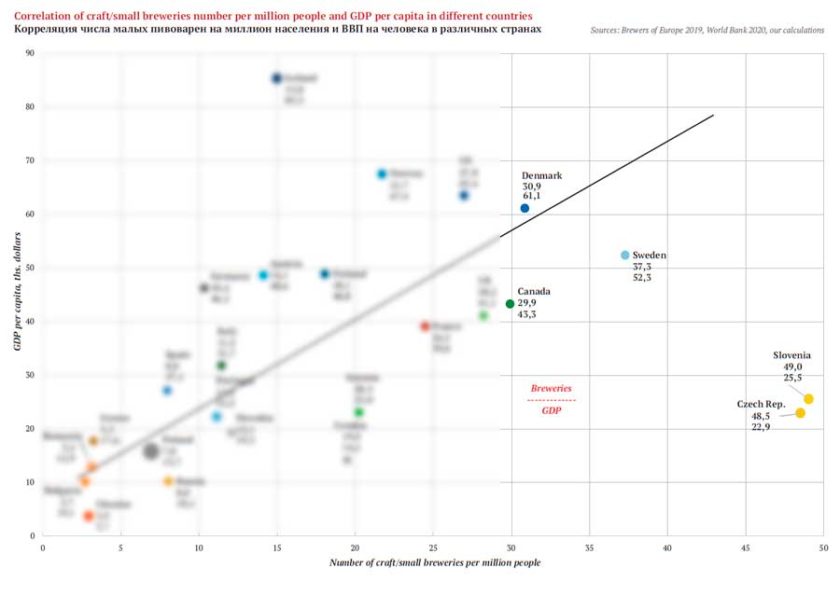

Is … stationary craft breweries a big amount for Poland? No, it is not. The graph shows how their number (in terms of one million people) is connected to the average GDP per capita in different countries. There is a distinct dependence on the economic level. Obviously for a country to have a big number of craft breweries, it has to be wealthy.

For example, Switzerland and Liechtenstein did not even have enough space on the vertical and horizontal axes as these countries are record breakers both by income and by the craft breweries’ number (124 and 50 breweries per one million people accordingly).

Our graph could have been more like a straight line if not for the traditions of the beer consumption. For example in Czech republic and Slovenia there are disproportionally many craft breweries though the well-being of these countries is comparable to Poland. Just special love for beer is expressed in initiatives of local entrepreneurs.

In this connection it is interesting that Germany is not a country of small brewing. Here a vast number of old regional breweries narrow the competitive field for craft brewers.

Yet the motherland of the craft that is so unlike Germany is completely in tune with the average trend having 8884 breweries in 2019. The USA do not differ much from say Scandinavian countries if we divide that number by the population number.

In general our graph illustrates that in Poland as well as in other countries without constant and mighty beer traditions the development of small brewing is closely connected to the economy. If it grows fast and HoReCa recovers completely the potential of craft breweries will be big. So when making up forecast one should take into account the growth prospects of GNP in Poland.

Thus, as long as GNP was growing, the number of craft breweries was also increasing. Then GNP went down considerably in 2020 due to the restrictions. Though the Polish economy managed to adjust to the conditions of the pandemic, yet the recovery in 2021 was slower than in many other countries of the EU.

Consumer growth drivers

The economic prospects are not completely clear, yet consumer trends that promoted craft beer sales have become stronger during the recent years. We have already mentioned the first two but let us get back to them again as this context is especially important for the craft.

Market premiumization. At the retail market the Polish have been rapidly losing interest to inexpensive mass brands, their sales have been falling and affecting the market. On the other hand the sales of premium and import beer that is close by price to craft beer have increased. Various researches of Polish consumers’ preferences also show that they are willing to pay more for a good and qualitative product.

Tastes variety. The growing variety of tastes among Polish beer lovers (as well as at the FMCG market in general) has been registered in many researches. The pandemic seems to have stopped the share growth of non-standard tastes basing on Nielsen data. But in 2017 they accounted for …% and for … in 2020.

Support of the local business and fashion for local products. During the pandemic as never before, it became important for the Polish to support local small entrepreneurs who aren’t as stable as the market giants. As Strefa Biznesu writes people are aware that the pandemic led to considerable losses of many grocery producers especially those whose sales depend on HoReCa. It turned out people are willing to help small businesses choosing to buy products there. Being confident in the community support allows local brewers to launch new projects even in difficult times.

The most outstanding example is Mazurska Manufaktura SA company that in 2021 purchased 11 historic brands from all over Poland and has restored the production at some abandoned breweries. Their big experience in local business management, active support by locals and opportunity to buy inexpensive and high-quality equipment (for example, used equipment from Germany) promoted a superfast expansion.

“Regional breweries have much to propose. But we can also observe the development of patriotism of local consumers and return of good attitude to old brands. So there appeared the idea of restoring and returning the past grace to the cult regional breweries and brands through launching production with attractive price/quality combination ”, – says Yakub Gromek, Mazurska Manufaktura SA Bizness president.

Direct pandemic impact

Paweł Leszczyński the head of Wolny Kraft breweries’ association and a fest organizer told about the pandemic impact on small brewing. Under his estimation neither the sales decline nor massive breweries shot-down, despite the original catastrophic forecasts, happened.

“Most of them are still operating. I rely not on market researches but on my own observations. So far the coronavirus has not had a strong impact on the market, but I think that it will change in the next couple of years” – says Paweł Leszczyński

He thinks that craft brewers just could not abandon the business and people who became a part of their life even if that meant losing money. The union of craft beer lovers tightly knit round the breweries played the crucial part. Those people helped them to get through the toughest times.

However, right now the optimism of Pawel is not so strong: “Raw materials, aluminum tins, packing material and human labor have become more expensive, sometimes twice. The same can be said about the electricity, water and waste utilization”. The price rise can still have serious influence on the craft breweries’ statistics.

The trends at the Polish market of craft

Less than ale, more than lager

According to PSBR, 2020 turned out to be one more year of dynamic growth of the market beer of low fermentation. In 2020 craft breweries produced …% more lagers than the previous year. Over the same period, the beer production of high fermentation went down by …%. Now every third beer brewed by a Polish craft brewery is lager though in 2018 its share amounted to as little as …%.

Beer without borders

In 2020 the significance of foreign markets went much up. The share of breweries exporting beer grew to …% (among PSBR). At these breweries every tenth bottle or can is sent to foreign consumers (in 2019 it was every twentieth bottle).

More cans, fewer kegs

The most prominent trends in the package in 2020.

1. Abrupt fall of keg share in general sales volume. The decline was caused by the pandemic and two lockdowns that lowered the demand for beer in kegs almost to zero for several months. The breweries were forced to actively searching for buyers of beer in bottles and cans and the share of kegs in the net production volumes of breweries decreased from …% in 2019 to …% in 2020.

2. Growth of craft beer volume packed in aluminum cans by more than … times. In 2020 the number of breweries PSBR proposing beer in cans grew from … to … compared to the previous year. The growing popularity of craft in can and accompanying installing of can packing lines at breweries means that in the nearest years this trend is likely to continue.

The product range is setting down

The relation of new products and regular beer sorts at craft breweries member of PSBR has remained at the same level for two years. The produced beer structure shows that despite the common opinion the breweries in the first place are focused at maintaining stability of supply (almost …% of the output) and they also do not forget about new products (almost …% of the output). Nearly …% more taken by rare sorts that are not brewed every year. Multiple and bright new products in breweries’ supply do not have a big influence on the general output of breweries.

IPA is still on the horseback

Piwna Zwrotnica also notes a comparatively low activity of craft brewers. According to enthusiasts’ estimations in 2020 there were fewer novelties for understandable reasons (… against …). The analysis of produced sorts means that the share of IPA launches grew from … to …% and this style clearly dominates. Stouts did not yield their positions (every … was a new product) and the interest to “sour” increased (…% against …% a year earlier). Wheat beer found itself among outsiders as the share of such new products declined from … to …%.

The geography of launches shows that the regions are getting more enthusiastic though the center of craft movement is still Warsaw, Katowice and Gdansk.

We recommend to check up the original report for trends concerning usage of hops, additives barrel ageing. We hope that Piwna Zwrotnica will issue a new review in winter 2021 and we will see the craft community of Poland is moving in the second year of the pandemic.

Caso giuridico with contracted breweries

Despite the favorable business climate in Poland there are legislative risks for craft breweries. And this concerns not the new excise for sweet ingredients that experimenting brewers use quite often.

The national laws are harmonized with the EU provisions that provide tax benefits to small brewers on excise payment. However, the authorities started looking for new opportunities for filling the budget and tried to question those benefits.

Starting from 2006 (in a slightly different form) such benefit has been in force:

“Tax payers, beer producers who output up to 200 000 hl of beer per a calendar year are exempt from paying excise to 50% of the excise sum calculated using the excise rate… The provision is applicable to r such tax payers: 1) who are juridically independent and self-sufficient of other brewing enterprises; 2) are located apart from other brewing enterprises; 3) do not brew beer on license got from other entrepreneurs.”

As we already know two hundred of Polish contracted craft breweries cooperate with stationary manufacturers. But these relations are under a threat due to the taxmen’s activity and divergence in interpretation the tax benefits.

As the pandemic started, the Polish tax service made the revisions more frequent and put a stronger control over breweries working for “contracted breweries”. They even levied fees on some business thinking that a contract between a stationary and a contracted brewery means working under a license, which excludes the tax benefit. Theoretically, they can even demand to compensate the sum of excise for the recent five years.

It is no doubt, a contract between an actual and a virtual brewery cannot be considered a license agreement by its essence, as the contracted brewery produces its own beer and the actual remains within its annual limit. It seems brewers managed to unite and bring their point to the authorities, but only review of the laws can put this matter to rest.

To get the full article in pdf (54 pages, 30 diagrams) propose you to buy it ($40) or visit the subscription page.

2Checkout.com Inc. (Ohio, USA) is a payment facilitator for goods and services provided by Pivnoe Delo.