Where is the non-alcoholic beer market heading to?

Companies and brands.

Baltika as a democratic leader.

Heineken – how do you shake up the market and shove up the competitors.

AB InBev Efes – premium corner.

Non-alcoholic import beer.

Non-alcoholic beer – Who drinks it?

General conclusions.

Summer beer.

Where is the non-alcoholic beer market heading to?

Low popularity of non-alcoholic beer in post-Soviet countries resulted from the first failures of brewers to come up with a good product. Because of the production technology limitations as far back as in the 90-ies, the flavor of non-alcoholic beer was heavily distorted. That was not a “beer minus alcohol”, but a weird drink that arose no desire to be tasted again.

But people drink beer not only for its taste. Social motives and conformism when members of a group drank alcohol in order to be appreciated by others and not to be seen as a black sheep used to have a particular significance (which is much less now). Understandably, non-alcoholic beer looked a rather asocial product. Its image was even more damaged by the meme about the “rubber woman”.

At the beginning of 2000’s technologies of alcohol elimination gave the possibility to preserve the beer taste. There were only import brands represented at the federal level. But following the success of Sokol Bezalkogolnoe that emerged in 1999 and instantly took a half of the segment, other brewers started non-alcoholic sorts of their own that also gained market weight rapidly.

The first wave of non-alcoholic category was even higher than the current one, judging by the natural volumes. In 2000-2003 the rates of n/a beer growth amounted nearly 50% per year, which was several times faster than alcohol beer. The low-base effect played its role there. The non-alcoholic beer category was demonstrating moderate but leading growth rates during 2003-2007.

That made the collapse in 2008-2013 even more dramatic, as the sale dynamics of non-alcoholic beer turned out to be considerably lower than that of alcoholic beer (that was also going through its difficult times). The peoples’ love for beer started withering rapidly and its popularity among the youth declined. Beer was excluded from the cultural field and its image was proven negative by the state.

However, the ban on TV ads for alcoholic beer in 2012 generated a new form of brewers’ marketing activity. Starting from 2013, in the ranges of the key brands as well on TV there were emerging new non-alcoholic sorts. Though the market share of many of them was tending toward zero, the companies got a chance to support their brands communication.

The stage of the general market stabilization 2015-2019 caused a second wave of the non-alcoholic beer popularity. Brewers presently believe in its potential. This is reflected in expansion of regional production network of market leaders and major regional breweries.

Recent launches of new lines look quite unusual, as brewers have closed a dozen of businesses and only seldom updated their capacities since 2008. But in 2019 alone, Baltika opened two new lines for non-alcoholic beer in regions (in addition to the existing four), while Heineken made their first move to the east, by opening a line at Volga brewery.

The present expansions wave resulted from the fact that the complicated technology of non-alcoholic beer production had strongly restricted the number of businesses where it could be used. Even zero excise on non-alcoholic beer output was not enough to make up for the expensiveness of installing such equipment, as there had not been a big demand for those products. Yet the demand had been to some extend limited by the high retail price for non-alcoholic beer. For high logistic costs were the flip side of the production centralization and it gave additional load on the cost price.

Not surprisingly, for instance AB InBev and Heineken position their alcohol-free beer as a premium product. Their truly popular non-alcoholic sorts belong to license brands and occupy a disproportionally big share in non-alcoholic segment in comparison to the market in general.

We can see that the popularity cycles of non-alcoholic and alcoholic beer are closely connected. Such connection can be explained by considerable overlapping of consumers’ groups (which will be in details discussed in the chapter about consumers). Yet, the volatility of non-alcoholic beer sales is much bigger than the general market fluctuations. That is, the sales of non-alcoholic beer in an exaggerated form reflected the market trends, while the stabilization of the recent years has led to a considerable sales increase.

This is explained by the fact that fluctuations of non-alcoholic segment share are linked to the dynamics in premium and license segments. The sales of license beer were shrinking as consumers switched to economizing mode yet they grew during the stabilization periods. Adjusted to launches non-alcoholic sorts having been dependent on the advertisement regulation.

However, the current capacity expansions of non-alcoholic beer production will probably blur the price borders and separate the non-alcoholic category from the premium one. Besides, the current growth trend coincides with a much more fundamental trend, namely reduction of alcohol consumption.

How will the pandemy of 2020 and the general decline of brewers’ sales change the non-alcoholic beer?

- Non-alcoholic beer is an almost totally packed (not draught) product by federal and major regional breweries. The bulk of it is sold neither at HoReCa that have suffered or at shrunk outlet network of draft beer, but at general grocery retail, that has now drawn most of customers. That is, the outlet channels of non-alcoholic beer proved less affected by the crisis.

So, the sales of non-alcoholic beer are in the first place dependent on customers’ behavior.

- Popularity of news on medicine as well as active discussion of coronavirus in the social networks result in anxiety as to one’s fitness facing the possible disease. People react to it by self-limiting and challenges, a form of communication where they show their approach to lifestyle, diet, keeping away from harmful habits and so on. All this can stimulate the sales of non-alcoholic beer. Raised attention to one’s health closely correlates with its consumption as we see from survey data the next chapter dedicated to.

- Social distancing bereaves alcohol consumption of a very important factor, namely, establishing and strengthening connections between people. That is, I drink in order to better socialize, to enjoy the party and the holiday, create a friendly and joyful atmosphere for communication or celebrate a special event with the others. All this has been temporary taken under formal and informal ban. Yet non-alcoholic beer is a more individual drink that is consumed not for communication but rather for the taste. So social distancing was not so crucial for it. Taking into account the previous statement, beer lovers can adjust their habits and opt for alcohol-free drinks.

- This point is not connected to the pandemy, but is likely to negatively influence the first half of 2020. Cool weather that settled in spring can slow down the growth of non-alcoholic market share, as it is a much more seasonal drink than the usual beer (see chapter on the seasonality).

Companies and brands

In the 90-ies, all the range of non-alcoholic beer belonged to superpremium, as it was represented by import brands. Holsten and Bavaria stood out among them. We should say that Bavaria Malt still enjoys high popularity among lovers of beer without alcohol.

The crisis of 1998 dropped the sales of import beer that got more expensive and gave a chance to Russian brewers. In 1999, there appeared a non-alcoholic version of national brand Sokol that rapidly won a half of non-alcoholic beer market.

That step was certainly noticed by the competitors and as soon as in 2000 there were launched Baltika 0 (“nulevka”) and Bochkarev Bezalkogolnoe. During 2001, the both brands were rapidly gaining their market weight and the segment got the sales leader, namely Baltika 0 beer. We can say that the biggest non-alcoholic subbrand is at the same time the oldest one, as “nulevka” has been output for 20 years in a raw.

During the following years, Sokol and Bochkarev found themselves elbowed on the shelves by other brands. So, by 2008, the segment of non-alcoholic beer looked rather simple. Baltika 0 reached market share of …%. The second position was shared between Bavaria Malt and Sibirskaya Korona Bezalkogolnoe. Other brands had negligible weight and were mostly represented by import.

The consumption collapse in 2008 heavily affected non-alcoholic beer sales, brewers lost interest to this category. Though the crisis promoted experimenting and searching for market niches by the market leader. Thus, in 2010, Baltika for the first time represented Baltika 0 with various special tastes (Grain, Apple, Lemon and Ginger). But at that time those sorts failed to take their place in the Russian market.

Then by 2013, the market of non-alcoholic beer hit the bottom. But as soon as in 2014, it got new points of growth.

Firstly, brewing companies and retail networks started realizing that decline in alcoholic beer popularity was a global trend that came to stay. Healthy lifestyle became popular as well as non-alcoholic beer popularity.

Secondly, because of the ban on alcoholic beer advertisement, launching a non-alcoholic sort became the only chance to support communication of the key brands. The first such steps were individual and exotic (such as for example Sibirskaya Korona advertisement with David Duchovny).

2016 was marked by much stronger brewers’ advertising activity. Then the market leader agreed on using a special pictogram pointing to non-alcoholic character of their products and got guarantees that such commercials are legal from the Federal antimonopoly service controlling observation of law “On advertisement”. However, in 2016, the time of beer commercials translation equaled only …% of the level of 2012 (the data of TNS) compared to low level of the previous years it was a considerable progress. And naturally all the air time was dedicated to non-alcoholic beer.

Economy and mid-priced sorts non-alcoholic versions looked a little cardboard and such novelties could not gain a considerable market weight. Instead, several license sorts non-alcoholic beer Bud Alcohol Free, Amstel 0.0 and Zlaty Bazant Nealko showed great results. The first two won a considerable market share by 2016 and the latest gradually lost it along with the major brand.

It seemed that by 2016 there formed a more or less stable market structure of non-alcoholic beer.

1) Nearly a half was occupied by deathless and democratic by price leader Baltika 0 with premium expansion of several special tastes.

2) Nearly …% of the market consists of more expensive federal sorts that were growing in number and by weight. In particular, 2017 was marked by Heineken 0.0 launch which started out rather lowly. And, by the end of 2018, company AB InBev Efes demonstrated high branding activity.

3) The remaining …% was and still is represented by regional breweries’ production, many of which mastered non-alcoholic beer output. Besides, import started playing an important role, especially at the Moscow market.

Looking at the general development of the companies, one could expect AB InBev Efes to gradually win the market leader’s share as the effective alliance created preconditions for that. Yet, Heineken company upset the game and dramatically changed the competitive field (we will speak about it below). As a result, Carlsberg’s positions were shaken.

Baltika as a democratic leader

In response to the healthy lifestyle trend, Carlsberg Group management ever more often speaks of shifting the focus from traditional to “craft&specialties and alcohol-free beer” as of the key component of the company growth strategy. As yet, the net contribution of this product group is not so big, that is 7% of the natural sales value and 14% of Carlsberg Group revenue. However, it is growing, as by the end of 2019, and during the first quarter of 2020 the sales of alcohol-free beer grew by 7 and 5% respectively against the reduction of the main category.

Carlsberg Group declares wider availability of non-alcoholic beer at all markets to be one of their major goals. All kinds of tools from expansion of the shelf space to original proposed are applied – for example, draft non-alcoholic beer at bars and restaurants of north European countries.

Interestingly, commenting the coronavirus impact on the market (Russian in particular) the company’s CEO Cees ‘t Hart confirmed the positive mix in sales of non-alcoholic beer in the off-trade channel, which is however, taking place against the growth of this segment independently of the current moment.

In our view, taking into account the prolonged sales decline of beer in Russia, in the direction of non-alcoholic beer Baltika is doing quite well. Due to heterodromous dynamics with traditional packed beer, the share of non-alcoholic sorts in the total sales volume of the company grew … p.p. nearly to …% in 2019, according to our estimation.

However, the company is left behind by fast growing competitors. In the report for the first quarter of 2019 the company estimated its share in the non-alcoholic beer segment at 50%. Yet at the end of the year, Baltika confirmed its leadership with a 46% share.

The difference is more than obvious, but it is not a problem of “nulevka” as in general brands Baltika and Zatecky Gus are experiencing a dramatic reduction of the market share. The company started overcoming, but still has not managed to reverse the negative trend at their basic sorts, as their sales reduction went on in the first quarter of 2020.

Obviously, Baltika’s problem results from the fact that the average market price for beer by AB InBev Efes, the main competitor and the current market leader, is still considerably lower. And though in comparison the current price policy might seem reasonable, looking at a long period, one can understand that Carlsberg Group in Russia is taking efforts to keep the high margin but not the market share. Though the company management themselves declare such strategy it contradicts the general decline in loyalty to national Russian brands. Non-alcohol brands suffer for the same reasons but their sales are much more stable.

The competitors’ activity at the license non-alcoholic beer field has not changed Baltika’s branding strategy, that is, to develop their title Russian brand.

In summer 2017, the company made a rather successful step by launching sort Baltika 0 Unfiltered Wheat. That launch was in tune with the trend of outrunning sales growth of unfiltered beer that during 2017-2018 increased its share from 6.8 to 7.7%.

Baltika 0 Unfiltered Wheat gained its weight within a year from the launch and by mid 2018 its sales stabilized at approximately …% of the packed beer market, or …% of all non-alcoholic category. This can be considered a fine performance since we speak of an original variation of a subbrand. Certainly, the new product took some of “nulevka’s” sales, yet it won new consumers at the same time.

In summer 2018, the company drew attention to special non-alcoholic beer by launching Baltika 0 Refreshing Grapefruit. “This non-alcoholic beer combines the mildness of unfiltered sorts and refreshing taste of citrus. In the new sort the traditional hop flavor is favorably completed with grapefruit juice…” says the company press release.

Under our estimation, this sort has not achieved even a half of its wheat predecessor. However, in general, special tastes account for a third part of “nulevka”.

The beginning of 2019 was marked with restyling of three sorts of the subbrand. The company’s strategy is so, that the price for special sorts of “nulevka” does not differ much from international license competitors. As a rule, in such situations, Russian consumers made their choice in favor of the foreign brand. So, in our view, the restyling was aimed at outlining a special status and balancing the retail price for the brand and its perception.

According to the press release, “The new design has become more modern and premium and corresponds to communicational platform of the brand “refreshment”. The main package color has become more eye-catching on the shelf and the branding is enforced as the front side has got an updated logo Baltika and bright refreshing product zone depicting the main ingredients of the drink. The restyling of Baltika 0 package reflects the key values of the brand: freshness, modernity and naturalness”.

In 2018-2019, the company sales in non-alcoholic segment were supported not only by “nulevka” but also by another Baltika subbrand.

As in 2017 the company output a limited batch of non-alcoholic version of Baltika 7 Export, such step could be taken as a cover for an advertising campaign, as for many other brands. Yet, there it was about a rapidly growing brand, as in 2018 “semerka” in a single leap left behind declining “troika”, and became the leader in that numerical series. The growing subbrand could become a driver for Baltika 7 Non-alcoholic too.

Pavel Erankevich, Senior director of national and regional brands, speaking about the scale production launch said: “According to TNS, some consumers of Baltika 7 opt for non-alcoholic beer sorts by our competitors. By putting a new non-alcoholic sort to the mass market, we strive to satisfy the demand of “semerka” consumers who can now enjoy a glass of their favorite sort in new consumption situations”.

The sales share growth of non-alcoholic beer reflects the company’s strategy. By 2022 Baltika attempts to provide a 100% non-alcoholic beer availability, that is, everywhere, where the usual beer can be bought, there will be a non-alcoholic variant. In order to optimize the transport expenses and better satisfy the demand, installment of new lines for non-alcoholic beer production was planned.

In 2019, production of Baltika 0 was launched at company’s branches in Novosibirsk and Yaroslavl. At those and other breweries dealcoholization is done via membrane filtration. The equipment capacity of such beer production in Novosibirsk and Yaroslavl amounts to 1.6 mln decaliters yearly. One should keep in mind that Baltika is already producing non-alcoholic beer in Saint Petersburg, Samara, Tula, and Rostov-on-Don. Following the modernization, that capacity of the company will amount to 18 mln decaliters per year. The net investments at two plants reached 80 mln rubles.

Logically, in the first quarter of 2020 Baltika went on investing money into the development having spent 642 mln rubles (56% increase). According to reports, the key directions of investments became fridges for outlets and equipment for non-alcoholic beer production.

Heineken – how do you shake up the market and shove up the competitors

As far back as three years ago, it seemed that Heineken did not pay any interest to non-alcoholic direction. The share in non-alcoholic beer segment as well as its significance for the company were very small if we compare to market leader. Heineken in Russia seemed not to have brands that could provide it with a weight in the segment. But since then there have been several launches and currently the share of non-alcoholic beer in the company sales has grown from … to …%. Heineken share in the segment has also increased more than ….

The main event took place in spring 2017 when Heineken 0.0 with a blue label simultaneously appeared in 13 European countries and Russia. Blue is considered to be associated with non-alcoholic category of drinks. The brand launch was supported by an integrated advertising campaign including commercials, activity in social media as well as promotion in the output channels.

“Being pioneers in brewing we are obliged to satisfy our consumers’ expectations by giving them the unique innovative product. From 2010 to 2015, the non-alcoholic beer in Europe and Russia according to Canadean 2016 was growing by 5% yearly. Inspired by the taste of our innovative product, which before Russia appeared in Spain, Germany and Austria, we can expect this positive dynamics to grown. Our goal is to lead the non-alcoholic market with our premium product. That market is still small but demonstrates a good potential”, told Etienne Stripe, the former CEO of Heineken Russia.

A rather high retail price of non-alcoholic version of the flagman brand checked its growth at the beginning. The market share of Heineken 0.0 was growing quite moderately during the year after the launch. It seemed to stabilize at 10% in the non-alcoholic segment.

But the price index of Heineken 0.0 was growing slower than that of the competitors; as a result, the flagman non-alcoholic sort got a little expensive than special sorts of Baltika 0. By summer 2018, due to price keeping and unprecedented advertisement, promotion at HoReCa and expansion of numerical distribution the growth got market significance. The company openly aims at pressing competitors out of the non-alcoholic segment.

In 20 Europe markets and Russia program Zero Zone (Zero point) giving a special shelf space for non-alcoholic producst has been provided. According to the company plan, at 80 000 Russian outlets specially designed equipment is being installed (including refrigerators) in order to attract attention to their non-alcoholic production.

Besides, in Russia the company relaunched Amstel 0.0. In May 2019, launching of Amstel 0.0.Natur (non-alcoholic beer drink with juice) and non-alcoholic dark Krusovice was announced.

Along with commercials, the company actively employed non-standard channels of communication in order to reach the youth. For example, in many summer festivals and events one can see branded van Point Zero, and youth art-public was enticed.

Speaking of the performance, at the end of 2019, Boudewijn Haarsma, CEO of Heineken Russia told journalists “We are number two now (at the non-alcoholic market in Russia), our ambition is to rank first, to become the market leaders in the future. We think that there are two factors that will help to get us there. The first is the brewing technologies that are highly important in this segment, the second one is marketing technologies in creating premium brands”.

In our estimation, based on distributors’ data, in 2019, Heineken 0.0 share amounted to nearly …% at the non-alcoholic market. Generally, all growth in the non-alcoholic category has been provided by this brand. Accordingly, the sales of many other competitors’ brands started stagnating or lost the growth dynamics, which was unusual taking into account the extensive development of the recent years. Let us also note that Heineken brand traditionally focused on can package that is rapidly gaining popularity now. It is no surprise that almost … of Heineken 0.0 beer is sold in can.

The future growth of Heineken 0.0 and other non-alcoholic sorts will be supported by a large-scale modernization of production at Voga brewery in Nizhniy Novgorod. It was announced completed at the end of 2019. The company invested 140 mln rubles into equipment for dealcoholization of beer brewed by traditional technology, Kommersant wrote. Prior to that, non-alcoholic beer at Volga brewery was made by fermentation stop.

According to Oleg Bokov, the brewery director, the new dealcoholization process allows preserving all the taste qualities of beer. This technology leads to higher cost price of the production by 30%, yet the company will not raise the retail price. “We do not want to be more expensive compared to other brands on the shelf and we do not transfer our cost to consumers”, – explained Oleg Bokov. After launching the new non-alcoholic beer output line, the share of this production in the general production volume at Volga will amount to 1%.

In the years to come the company plans to increase the production volume at Volga brewery by more than 27% to 35 mln dal. In order to do that, Heineken is investing 1.5 bn rubles into the brewery modernization.

The means will be directed to construction of a new warehouse for finished goods, installing a new can line to the capacity of 60 thousand packages per hour. The acting can line produces 24 cans per hour, it will be dismounted and sent to one of the company’s breweries in Russia (bottle line of Volga brewery outputs 55 thousand bottles per hour). As Oleg Bokov explained the company decided to increase the can capacity due to the growth of market demand for beer in such package. The company is planning to install new CCT for expansion of output.

The company’s branding activity in the non-alcoholic segment is still high. In April 2020, there appeared Krusovice Psenicne 0.0 with orange peel and coriander. Certainly, this launch is filling an obvious market niche, yet, at the same time, it is an attack on the main competitor, launching Baltika 0 Unfiltered Wheat was a distinctly successful step, that Heineken is trying to copy.

By the way, the very success story of Heineken 0.0 that we are observing now is not unique for the Russian market. Equally riot and much more massive was the growth of the title brand by Carlsberg five years ago. Then superpremium Carlsberg within several months became a quite affordable beer both by price and presence in retail. Likewise, the huge power of Heineken brand in 2018-2019 provided for a mighty synergy to such important changes as entering promising non-alcoholic and canned beer segments, affordability increase against the competitors’ price growth, dramatic expansion of distribution and advertising support.

In 2020, the potential has not been exhausted yet and the market share of Heineken 0.0 sort is likely to go on. However, this expectation is not connected to Heineken prospects in general, that in the first quarter of 2020 could not be proud of positive dynamics of the market share.

AB InBev Efes – premium corner

Several years ago, the global leader AB InBev set out for a new goal, that is, to bring the figures of non-alcoholic and light-alcoholic beer in their portfolio to 20% of the net volume of global sales by 2025. In the Russian market the company also states this strategy, but due to the current competitive situation, they have not managed to achieve much.

While in 2017 the net share of AB InBev and Efes at the market of non-alcoholic beer amounted to nearly …%, the next year it declined dramatically and has been at …% for the second year running. Besides, over this time, the share in the company sales of non-alcoholic beer remained the same, as low as …%, which is too modest in our view compared to that of competitors. However, the same share here is connected to outstanding results in sales increase of traditional beer.

Though the alliance of AB InBev and Efes resulted in emergence of a new leader at the Russian market, in the non-alcoholic segment the company have been pressed down to the third place. Several years ago, it seemed that branding policy of AB InBev Efes would guarantee its stable growth and price domination at the non-alcoholic beer market. Yet as AB InBev Efes faced Heineken in the same segment, it incurred the maximum losses in the market positions.

Currently AB InBev Efes still keep two “old” sorts Sibirskaya Korona Bezalkogolnoye and Bavaria Malt that have long before represented the company in the non-alcoholic category. But they failed to become a growth base in the rapidly developing segment.

Sibirskaya Korona Bezalkogolnoye as far back as in 2014 was number 2 among non-alcoholic brands. Certainly brand Sibirskaya Korona is very well known to Russian beer consumers and the company hoped they would be able to bring back life in it by diversity of tastes. Yet, like all Russian legacy of AB InBev, Sibirskaya Korona line started shrinking having given way to cheapened license brand. Together with the main brand, the market share of the non-alcoholic sort was declining for several years. Than the alliance with Efes caused revision of the marketing policy and emerging new favorites among the local brands.

Thus, AB InBev Efes started distancing from the mid-price non-alcoholic segment, leaving it to the leader. At first separately, then in AB InBev Efes alliance, the focus shifted to non-alcoholic sorts of global and European brands. So one can say that lower share in mid-price segment was partially compensated by launches of more marginal sorts. The branding activity was at the peak in 2017-2018 as AB InBev Efes presented more than a dozen of non-alcoholic SKU which nearly equaled new launches by all federal companies combined.

Today the non-alcoholic part of AB InBev Efes portfolio is mainly formed by several license sorts.

Brand Bavaria Malt, an “old” subbrand that belonged to Efes is still one of the company’s key brands. By 2016, its share reached the local maximum, and it seemed that it secured a second place in the segment. If not for a competitor’s emergence, most likely Bavaria Malt would have been growing further and the subbrand could keep the leadership among license non-alcoholic brands.

Bud Alcohol Free that entered the Russian market in 2014, also had leader’s ambitions. The subbrand immediately became the brightest rising star among non-alcoholic sorts. Bud being the title brand of the global beer leader was sure to get unprecedented marketing budgets for promotion. The company rapidly developed the sort distribution and took steps to make it affordable within the premium positioning. AB InBev invested vast sums into promotion of Bud Alcohol Free – from commercials that broke GRP records to the activity peak, that is, sponsorship in football World Championship in 2018 when it was consumed at stadiums.

Naturally, non-alcoholic sorts entered the ranges of the key European brands by the company. Stella Artois NA has been safe and sound in the superpremium non-alcoholic segment along with other means by margin price positioning (between import and license). Yet now its share is rather modest. Instead, the superpremium portfolio part was enforced by import Hoegaarden 0.0, that formed the niche of wheat non-alcoholic beer.

As we can see, if not for a new mighty competitor, namely Heineken 0.0, AB InBev Efes strategy would have allowed the company to earn profit at the non-alcoholic market though not dominating it. Saturating the whole premium non-alcoholic spectrum with powerful brands allowed the company to grow rapidly before it became too competitive.

The capital market specificity

The Moscow market accounts for nearly …% of the total non-alcoholic beer sales. And the market has two peculiarities, that however are relevant to traditional beer too. Firstly, here the share of premium sorts such as license and import beer is much higher. Secondly, the proportion of shares of Baltika and MBC is shifted in favor of the latter one.

Emergence of Heineken 0.0 was taken with special enthusiasm by Moscow lovers of non-alcoholic beer. According to our estimation the novelty increased sales from zero to a … within three years. Naturally, it found reflection in the positions of other brands, affordable ones in the first place. The market share of Baltika 0 plummeted, non-alcoholic versions of Zhiguly and Bud declined too.

Import, though did not increase its market share, went on keeping its positions at the growing market. Clausthaler share in 2019 equaled about …% and Hoegaarden 0.0 had …% of the segment. The net share of import non-alcoholic beer in Moscow amounts to …%, which is much higher than the average Russian level.

Non-alcoholic import beer

The import volumes of non-alcoholic beer to Russia are rather small, they have been fluctuating over the recent years but without reaching … mln decaliters per year. Much bigger volumes of non-alcoholic beer used to be imported previously but figures have become low as license production is actively taking place instead of import. For this reason, the main suppliers are not international companies but standalone, often independent European breweries.

In 2019, the import of non-alcoholic beer grew by …% and amounted about … mln dal. The share of import in the non-alcoholic segment is …%. The total of … brands having non-alcoholic sorts are brought to Russia. On the one hand, the import structure of non-alcoholic beer is constantly expanding and changing. On the other hand, it remains consolidated, as we will show below, seven leading sorts account for …% of supplies.

The import non-alcoholic beer in Russia has two traits. The first one is domination of German producers, which results from relative independence from international groups. The second one is the obvious domination of wheat sorts. This is obvious basing on the leaders’ list. Taking into account that wheat non-alcoholic segment has been developed by Russian producers only recently, it is no surprise that special premium beer lovers opt for such tastes.

Let us look closer at several leading brands (or better their sorts) with a market share of more than …% in the subsegment of import non-alcoholic beer.

Clausthaler is still the main foreign non-alcoholic beer and unconditionally leads the subsegment. This can be attributed to the brand specialization, as unlike most other German brands Clausthaler is represented by “beer with a negligible amount of alcohol”. Besides, the domination can be explained by two market factors, that is, the brand belongs to the biggest in Germany independent Radeberger Group, and its distribution in Russia is carried out by Moscow Brewing Company. The both partners have long and successfully dealt with international beer trade. However, against the rapid product range expansion, the share of Clausthaler is decreasing, as it used to be too big.

Under our estimation, in 2019, Clausthaler accounted for …% of supplies. And in the whole Russian market of non-alcoholic beer the brand share amounts to …% and it occupies the … position in the leading brands list.

The second position in the leading brands list is taken by “systemic” Hoegaarden 0.0, that is supplied by Belgian AB InBev subdivision to Russian one. Its share in the non-alcoholic import in 2019 equaled nearly …%. One sort by AB InBev is close in performance to another, non-alcoholic Beck’s Blue. Within several years, the supplies of this sort with a blue label increased from almost zero to …% in the import non-alcoholic beer segment. The company has probably refocused from local production to Beck’s import as despite the virtual absence at the market, Russian consumers remember this brand well.

The fourth position in the import alcohol-free beer list is occupied by Paulaner Hefe-Weissbier Non-Alcoholic, that has gained weight in the total supply volume. In 2019, the share of this sort in the subsegment reached …%. We have to note that Paulaner is one of the oldest and most famous German brand at the Russian beer market, that has kept its volume despite the flow of cheap import. 13 Paulaner restaurants opened by franchise in different cities of Russia are promoting it. It is obvious that non-alcoholic version diversifies the brand range that is striving to be present at the market in all formats.

Beer Maisel’s Weisse Alkoholfrei gained market weight rapidly in 2018 having entered the leading ten after being not a significant brand. We should keep in mind that Maisel’s is still the biggest brand in the portfolio of Svam Group, famous independent import beer distributor. But despite it, due to the constant expansion of company portfolio and a vast number of SKU the future of Maisel’s Weisse Alkoholfrei is difficult to foresee. In 2019, the sort share in the total supplies volume of import non-alcoholic beer amounted to nearly …%.

The 6th and 7th positions in the leading import alcohol free sorts are occupied by brands that are to a big extent targeted at not the inner but the export markets.

Thus, Deko went on increasing import of “amazing” German beer Maisel’s Weisse Alkoholfrei against the launch of license production of Heineken capacities. No wonder that a large part of supplies will be accounted by non-alcoholic sort.

The 7th position belongs to cheap Czech beer Keltske Dedictvi that in big volumes was purchased for Krasnoe and Beloe. Yet these supplies hit the ceiling in 2018 and went down in 2019.

Other brands share amounts to as little as …% of supplies. The bulk of it is non-alcoholic production of German breweries as well as small amount of beer sorts from Czech republic and Baltic countries.

Non-alcoholic beer – Who drinks it?

In our review we compare men and women, people of different age and professions by their attitude to non-alcoholic beer. We will also look at how the attitude to alcohol (and usual beer), diet and healthy lifestyle influence choosing non-alcoholic beer.

On data

For the article preparation, we used the data on Russian monitoring of economic situation and health of population RLMS HSE that is being carried out by National research University “Higher School of Economics” and Demoskop with participation of North Carolina university population center at Chapel Hill and Sociology institute of Federal sociological research center of RAS (RLMS HSE: http://www.cpc.unc.edu/projects/rlms and http://www.hse.ru/rlms).

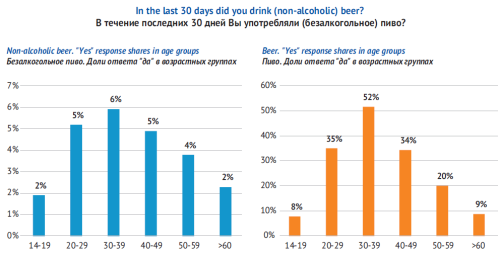

We have eliminated the data on children from RLMS HSE having left a representative fetch data of 10 312 Russians over 14 years old. The number of people who drank non-alcoholic beer within a month before the survey was not big, 381* (4% of the respondents). Such a low number was caused by the survey being held during the cold season. .

* Such parameters give confidence figure 95% and confidence interval ± 5%. However, analyzing separate groups of non-alcoholic beer we were much beyond the limits of confidence figure adopted in sociology and our analysis results can be substantially different from results based on large data fetches.

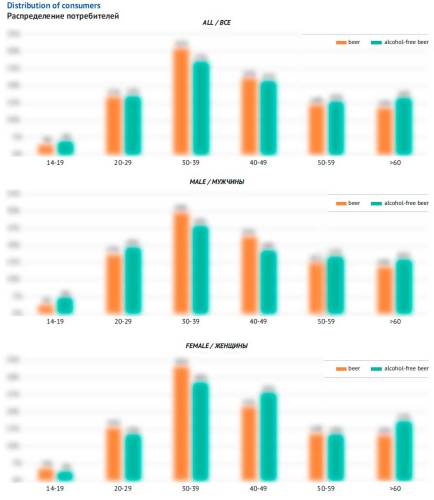

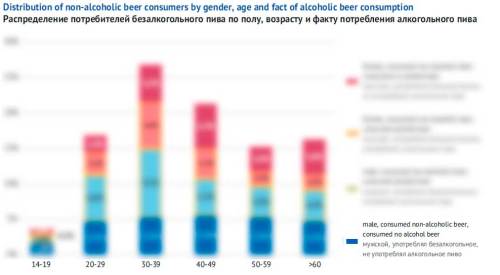

A respondent’s gender is very important. Over the month before the survey, …% interrogated men and …% women consumed non-alcoholic beer. As there are more women than men in Russia, their share among beer consumers amounted to …%. For comparison, women make up only a third of alcoholic beer consumers. In other words, non-alcoholic beer is a more female drink, than the alcoholic one.

Besides, there are differences in the age structure of non-alcoholic and alcoholic beer consumers. In the both cases the peak is at the age 30-39 as in this group more than … of respondents drank beer with alcohol and …% consumed non-alcoholic beer.

But as we look at distribution of the total number of consumers, we can see a less steep graph for non-alcoholic beer (that is, bigger share of young and old consumers). While men loving non-alcoholic beer give a comparative addition in the group of people aged 14-19, women increase its popularity in the group of older age.

When we see the concordance of output trends of non-alcoholic and alcoholic beer production, we cannot help thinking that their consumers are the same people. Or they are people who used to drink alcoholic beer but then switched to non-alcoholic one. The analysis of the consumer groups gives more confidence to that point of view.

Among those who did not drink alcoholic beer, only …% drank non-alcoholic beer over the month. At the same time, this percentage was much higher among consumers of the traditional beer. Besides, there was a certain dependence – as non-alcoholic beer was more often preferred by the consumers who drank a little of alcoholic beer over the month.

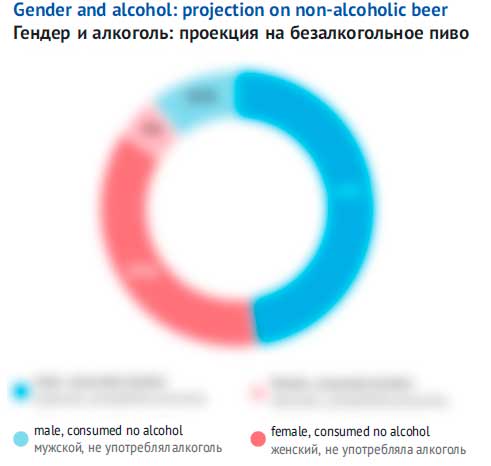

However, one has to take into account that …% of surveyed Russians did not drink alcoholic beer. That is why, it turns out that among non-alcoholic beer consumers the size of this non-loyal group equals the aggregate weight of those who consumed alcoholic beer.

Here a question arises: maybe many non-alcoholic beer consumers took no alcohol at all over the month? But their share is yet rather small – only …%, and mostly male.

Interestingly, in the young age, the subgroup of those who drank non-alcoholic beer but ignored alcoholic one is mostly made up by men. And vice versa, in the older age there are more women who prefer non-alcoholic beer to alcoholic one.

Theoretically, these data can be linked to researches* that show differences in bitterness perception in people of different age, males and females. Young men and women are much more perceptive to bitterness, yet the taste receptors seem to change over the age, and the hop bitterness and beer taste get more usual. Let us note that some researchers then associated the gender differences in tastes not with the number or peculiarities of taste receptors but with selectiveness of taste habits formation inside the population.

* Hyde RJ, Feller RP. Age and sex effects on taste of sucrose, NaCl, citric acid and caffeine. Neurobiol Aging. 1981; 2:315-318

So, out of season, a half of non-alcoholic beer consumers drink alcoholic beer (usually a very limited quantity) from time to time. They are often young people under 40 years old, that are likely to be willing to control their health and do not want to be drunk at certain situations.

The second half of non-alcoholic beer consumers who did not drink alcoholic beer, consists of people of older age, often women.

What can be a situation or factors influencing the change of non-alcoholic beer? This choice is often attributed to people’s care for their health, wish to avoid harmful consequences of alcohol consumption.

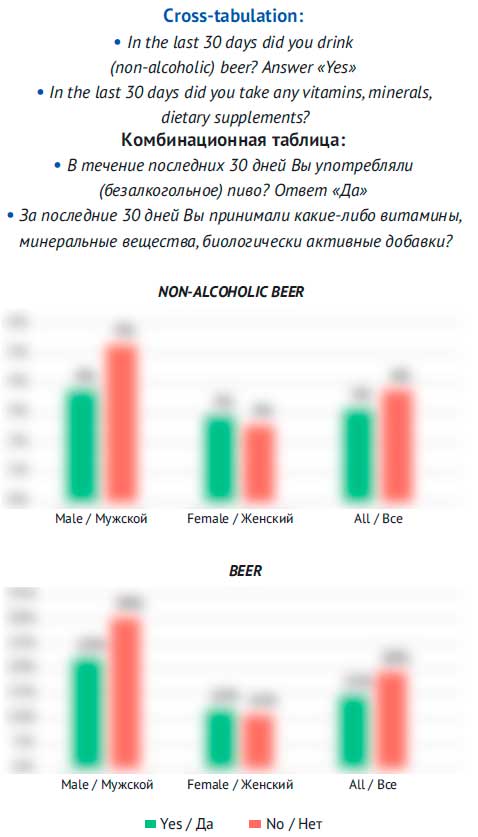

For example, one can assume that non-alcoholic beer will be preferred by those who keep a diet (that is, changing their every-day ration in order to lose weight, or to keep or improve their fitness). However, this assumption is confirmed by only a …. This means that certainly, when on a diet, one is likely to drink less alcoholic beer, but it applies to men, not women, who do not much change their preferences. Loyalty to non-alcoholic beer when on a diet grows insignificantly both in male and female groups. One can say that only 9% of surveyed Russians are keeping a diet (…% women and …% men), that is, the importance of this factor is not high.

Taking vitamins, minerals and supplements is not very popular among Russians and for some reason influenced only surveyed beer loving men. Besides, nutritionists affect both non-alcoholic and alcoholic beer consumption among men.

Is beer consumption connected to possessing a smart watch (fitness-trackers)? Yes, the share of non-alcoholic beer consumers is several-fold bigger among their owners.

The wish to observe the data on their exercise correlates with negative attitude to alcohol. However, so far only …% of Russians wear smart watches.

Does physical activity influence consumer habits? The survey data show that it hardly change alcoholic or non-alcoholic beer preference. All the difference are within the statistical spread both for men and women.

How does the state of health influence the respondents’ choice? The dominating share of the surveyed people said they had either medium or good health. And though the distributions differed not very considerably, among alcoholic beer consumers there were more healthy people.

Smoking is an important factor that is connected to the lifestyle and health and closely correlated to the product choice. Compared to those who did not drink beer, there were more smokers in the non-alcoholic beer group and much more in non-alcoholic beer group.

Social and economic factors do not play an important role in choosing beer with or without alcohol.

Confidence in the future drives consumption of any beer but the difference inside the alcoholic and non-alcoholic beer consumers groups was within the statistic spread. For instance, self-estimation of the wealth level, the fact of salary shortcut, fear of losing a job or getting poorer do not change the beer the respondents drink, so we will not give these graphs.

Study, job or retirement correlate with people’s preferences.

In the group of non-alcoholic beer consumers, there are fewer employed than in the group of alcoholic beer consumers. The choice of beer without alcohol is more often made among students, retired people and housewives. This is well aligned with a more sloping distribution character of non-alcoholic beer consumers by age.

The marital status that is, whether the respondent married or not, is not very significant for consumption. But it is significant if a person is divorced as in this group the share of consumers of both alcoholic and non-alcoholic beer is much bigger. This might be the reason for divorces, namely immoderate drinking (particularly beer).

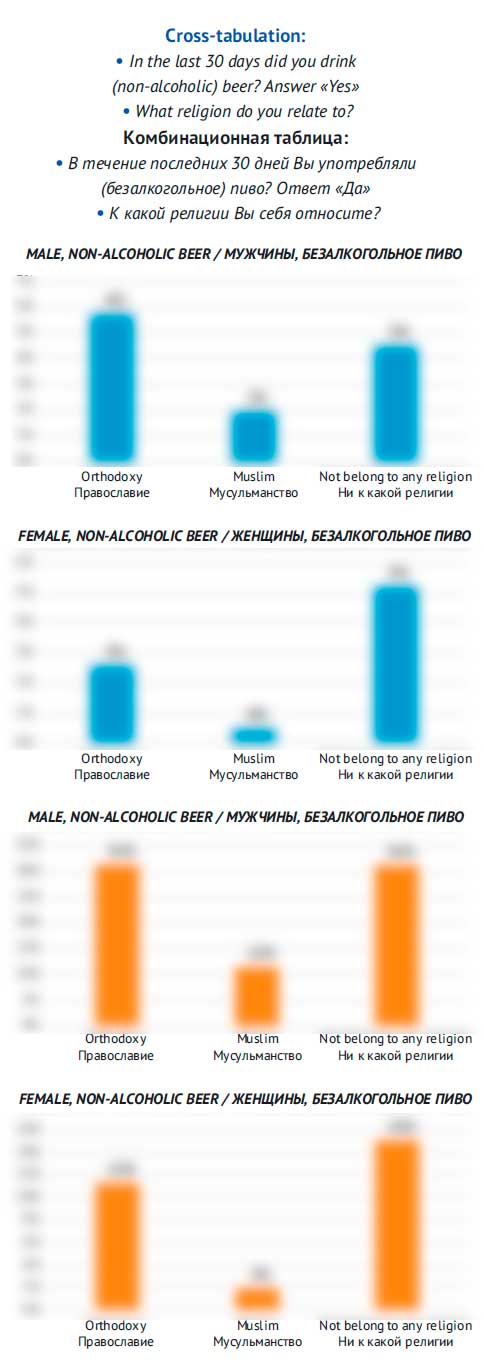

Among religions practised by people, Islam has a big influence on attitude to alcohol and beer. We can see a particularly small share of consumers among Muslim women. Islam does not much change the choice of beer type, obviously because consumption of both non-alcoholic and alcoholic beer is not welcomed. We can note a minor increase of consumer share in female group practising no religion.

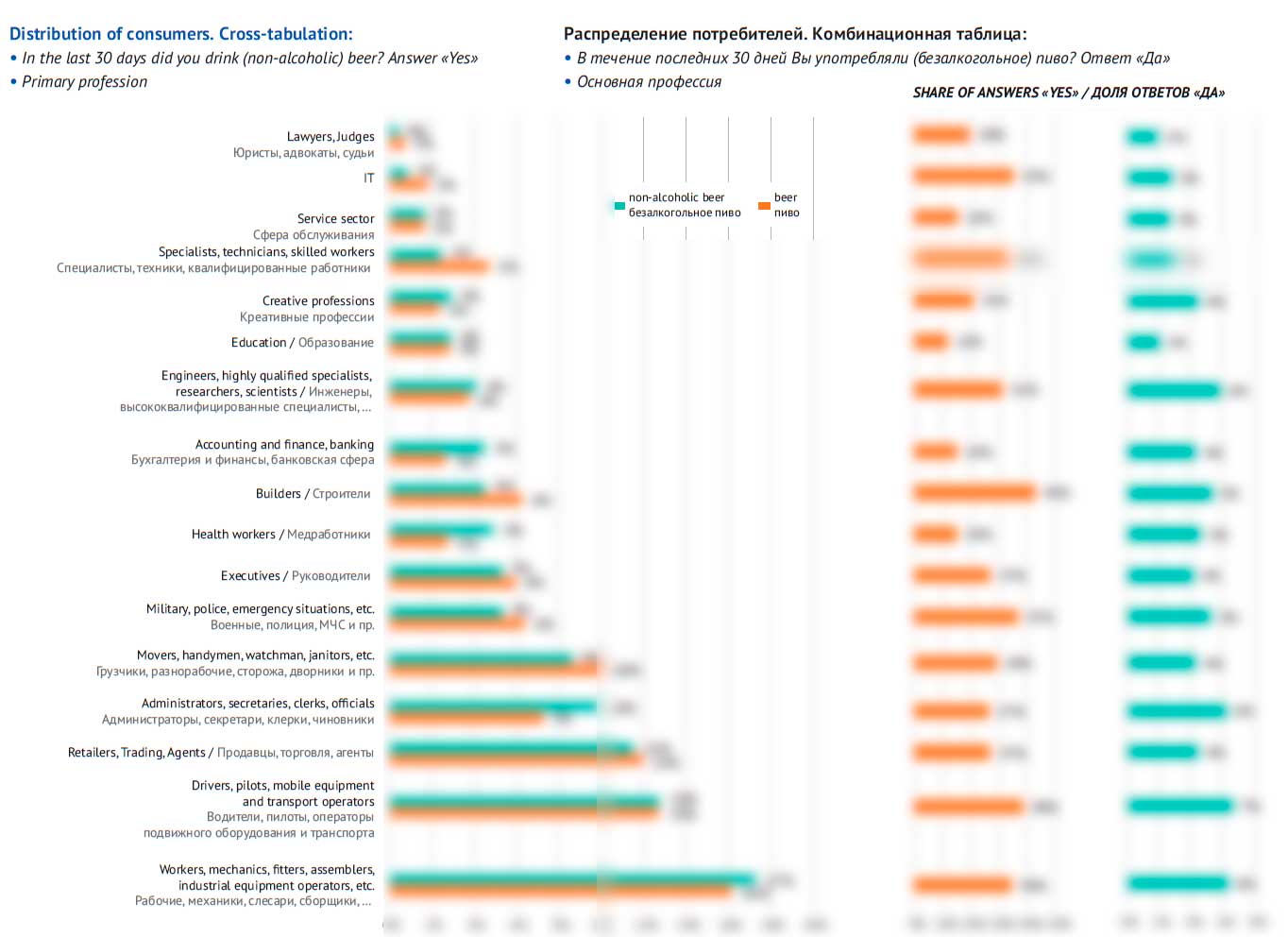

The profession is directly connected to the share of both non-alcoholic and alcoholic beer. In the first place, this is linked to numerical superiority of men over women in that sphere of activity. However, there are some interesting peculiarities.

Due to rather high percentage of consumers multiplied by number of people the biggest group includes workers and people of the specialties involved in manual or mechanized physical labor.

A considerable consumer weight is contributed by drivers and transport operators. But in spite of the common opinion on love to non-alcoholic beer, the shares of consumer groups distribution among representatives of those professions for non-alcoholic and alcoholic beer do not differ at all.

The third by weight group, namely, salespeople and agents, though having a high percentage of consumers, due to its big number is making a rather large and equal contribution into the sales distribution of non-alcoholic and alcoholic beer.

In many other groups we can see a distinct difference in attitude to beer.

For instance group “administrators, secretaries, clerks and bureaucrats ” have a much bigger share of non-alcoholic beer consumers. The same applies to medical staff and joint group accounting/banking/finances.

The opposite situation can be observed in the group of unqualified workers “loaders, unskilled workers and watchmen” because of non-alcoholic beer ignoring and rather loyal attitude to alcoholic beer. The same can be said about other groups such as builders, highly-qualified technicians and IT-specialists that also disproportionally gravitate to alcoholic beer.

By the way, building profession can still be called the “beerest” meaning the alcoholic beer. Only due to small number of builders their share among consumers is not very big.

Group «Military, police, emergency» though being loyal to non-alcoholic beer still love strong beer more.

The current level of education has a little influence on the consumer groups. We can see a difference in favor of non-alcoholic beer among group “7-10 classes without a certificate or diploma” among young men only. Probably the difference is caused by the fact that most of the respondents were still studying at the moment of the survey, that is, the mentioned age dependence was in force.

We can also note a considerable shift of preferences toward non-alcoholic beer among women. But here the general proportion consumption/age/gender can play its part here.

General conclusions

Basing on the demonstrated logics of “gradually getting used to beer over age” and especially provided the share dependence of non-alcoholic beer on the consumption level of alcoholic beer, it is obvious that most of them have formed a certain loyalty to beer as a drink.

Perhaps, in certain situations or life goals, beer lovers choose non-alcoholic options among familiar beer brands (or according to their status).

The key factor in changing alcoholic beer for non-alcoholic one is striving for health control. This factor is likely to be even more important than the wish to avoid being drunk. This results from 1) the above given data on transient “healthier” position of non-alcoholic beer among smokers, 2) higher loyalty to it among owners of fitness trackers and men on diet 3) equal contribution of drivers into the share of non-alcoholic and alcoholic beer consumers, which means we should not overestimate the urge not be drunk.

But it is hardly probable that striving for healthier lifestyle will by itself become a stimulus for buying non-alcoholic beer as for example an isotonic or a natural drink rich in organic acids.

Controlling by family members or religion are likely to limit the general alcohol intake, but can hardly cause switching from alcoholic to non-alcoholic beer.

Summer beer

Sociology data show that consumers of non-alcoholic and alcoholic beer coincide considerably. They are very often the same people that love beer very much but want control. And in case the survey was made not in winter but in summer, this overlapping would be more evident.

Obviously, the hot weather drives consumption of any thirst quencher, but makes people avoid alcohol because of health risks, driving, concentrating on studies and so on. Naturally, non-alcoholic beer looks a good compromise here.

While the traditional beer is a drink with a strong seasonal sales, non-alcoholic beer can generally be called a summer drink, as its sales dynamics is closer to kvass or sweet soft drinks than to alcoholic beer.

In particular, in Russia the summer sales of alcoholic beer in retail networks are exceeding the winter sales by …%* while …% more of non-alcoholic beer is sold at the same time. The market share of non-alcoholic beer reaches …% in summer (…% in winter).

* Taking into the account the average figures of 2017-2018.

If we compare the warm time of the year (April-September) to the cold one (other months), we will see a …% seasonal growth of sales for alcoholic beer and …% for non-alcoholic beer. The market share of non-alcoholic beer in April-September equals …% (against …% during the cold time of the year).

In other words, the temperature in the sales season is a highly important factor for non-alcoholic beer consumption. A warm summer can significantly increase the market share of this category.

To get the full article “The market of non-alcoholic beer in Russia ” in pdf (48 pages, 44 diagrams) propose you to buy it ($35) or visit the subscription page.

2Checkout.com Inc. (Ohio, USA) is a payment facilitator for goods and services provided by Pivnoe Delo.

The article is prepared using the data by Rosstat, presentations and reports by brewing and research companies. A number of estimations are based on info provided by distributors and importers. At the article preparation publications in editions Kommersant, Sostav.ru and Vedomosti were used.

We used the data on Russian monitoring of economic situation and health of population RLMS HSE that is being carried out by National research University “Higher School of Economics” and Demoskop with participation of North Carolina university population center at Chapel Hill and Sociology institute of Federal sociological research center of RAS (RLMS HSE: http://www.cpc.unc.edu/projects/rlms and http://www.hse.ru/rlms)

The data on market and their interpretation are our assessments based on the regional statistics and current trends in case the source has not been named. We do not claim the given information to be absolutely correct, though it is based on data obtained from reliable sources. The article content should not be fully relied on to the prejudice of your own analysis.