In the seven regions of Russia we have analyzed:

- the share of companies of various scales – from federal breweries to minibreweries

- popularity of brands (license, national and regional);

- market segmentations by price;

- the dynamics of output, sales and prices

While in general in Russia there was a growth of AB InBev Efes and Heineken share reduction, in the regions especially in the east of the country the situation was not so black-and-white. Independent regional breweries yielded their positions in retail everywhere, while small brewers as well as expats were rapidly developing their operation in modern trade.

By the time of the journal preparation, we had official data for the first three quarters 2020 concerning shipments and beer sales as well as inofficial data by distributors on retail sales of the leading brands for the first half of 2020 and earlier.

Central Region

In 2020 the Center demonstrated a rather weak performance of the industry and market compared to other regions.

The official beer shipments for the three quarters 2020 increased by only 2% and sales went down. Inofficial distributors’ estimation of retail sales is also twice lower than the average for Russia (data for the first half of 2020).

A more detailed review shows that regional sales declined because of Moscow, as it accounts for a quarter of beer consumption. Good performance in majority of administrative units failed to overcome the negative dynamics.

Thus according to Federal Service for Alcohol Market Regulation beer sales decreased by 15%, which seems “outstanding” even against other unsuccessful regions. Interestingly in Moscow oblast the sales on the contrary went 5% up. Probably, the reason for the sharp decline in Moscow was traditionally high beer consumption in HoReCa and the fact restaurants were not having their best time because of the coronavirus.

The share of microbreweries in the net output volume of the Central region was close to the country average. However, the share of big minibreweries and small regional breweries here is … lower. Big regional breweries are also comparatively weakly represented as they output …% of beer in the Central region against …% in the average in Russia.

The retail sales structure by the company types reflected the common trends for Russia. Federal and especially regional manufactures were pressed out by small breweries and expats.

In the brand sales structure the relation shifted towards foreign brands.

Thus, over the estimated period the share of license beer has increased by … p.p. and AB InBev Efes has made a special contribution into it. For instance, … and … impacted much as they entered the competitive field of local brands of low mainstream. One floor higher in the upper mainstream, … and … increased their weight as well as recently launched Bud Light. As for the premium segment … and … performed well. However, there were also three outsiders belonging to …, premium title brand as well as … and affordable ….

The weight of national Russian brands was decreasing in accordance to the long term trend. Besides, the share of regional brands and collective Zhigulevskoe declined. But we can speak of consolidation as the majority of leading brands became stronger than before.

Due to lower price the share of retail share of … by Baltika went up, while most of the competitors had their … sales decreased (especially AB InBev Efes and … suffered). Besides, … being on the lowest price floor also incurred losses. The share of affordable regional brands also decreased both at local and federal companies. Along with discount beer significance growth, the title brand by … as well as beer … went on losing their market share. Their positions were taken by mass brands by AB InBev Efes, namely …, … and … that have demonstrated an excellent growth each at its one part of the price spectrum. Beer … that has lost market share was an exception as it moved from low mainstream to almost premium among other reasons due to sort optimization.

Rapid growth of import beer share has become characteristic for the region. The Center of Russia has made the main contribution in the positive dynamics of such beer sales. At the same time, there was a change in structure as the share of foreign beer in federal producers’ portfolios growing moderately but the share of other importers was growing rapidly. Among “system brands” …, … and … distributed by AB InBev Efes showed good growth. And independent Lithuanian … and … have achieved success. By value import accounts for as much as …% of the market.

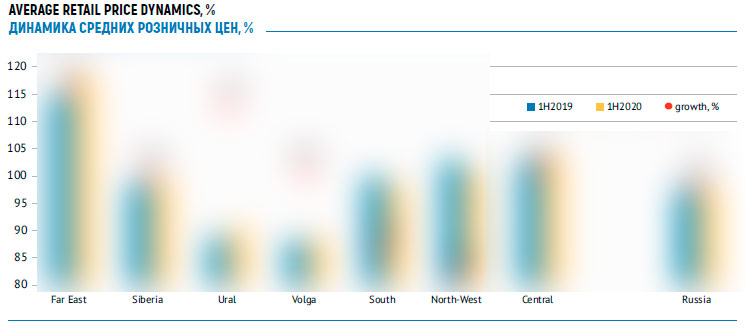

The growing weight of small producers, expats, license and import beer is naturally reflected in the market premialization trend. However, there was a decline of not so much economy segment as of low mainstream that lost … percentage points. These percents were divided by upper mainstream, premium and superpremium segments. Finally, the average price for sold beer increased by …% over the estimated period.

North-Western region

In 2020 in North-West region the volumes of beer shipments remained almost the same which does not seem a good result against the general growth. At that the beer sales volume according to official and inofficial estimations was average for Russia.

The shipment dynamics was poor due to reduction in Saint Petersburg that provides for nearly a third of the regional output. As for sales, Federal Service for Alcohol Market Regulation noted an unusually high growth in the Republic of Karelia. Without it the common sales dynamics in the region would have been poor as in Saint Petersburg the beer sales decreased.

The regional structure of brewers in North West is rather specific. Small breweries (from small craft to minibreweires) here have comparatively high weight in the net beer output (see diagrams). At the same time, big regional breweries are poorly represented. Even more, if we consider that Vasileostrovskaya Pivovarnia which is operating in the craft field formally belongs to them. The regionals’ positions were particularly negatively influenced by problems at Novgorod Deka.

Naturally the fact that the number of regional breweries is not big means that the share of federal brewers in the retail sales structure is very big. Both license and Russian federal brands in the North-Western account for unproportionally big market share. Yet, license beer in 2020 pressed import beer and small breweries’ production. And the national megabrands sagged a little under the pressure of …. There was also a growth in … sales.

Historically and geographically, the positions of … and … are especially strong in the North-Western region. … is still dominating despite the market share decline due to higher pressure from ….

Cheap beer … made the biggest contribution into … stability. However that beer won a part of sales not only from competitors but also from its own discount brand, beer …. … launch was a mighty strike in the economy segment as the new brand gained …% of the regional market. At higher price levels … remained stable (due to lower price), yet the sales of key sorts by … and other national brands (… and …) fell considerably. Against such background the performance of license …, that made up for weak dynamics other marginal brands, looks particularly good.

The main competitor’s key brands …, … and … are still not comparable in North-Western to other regions by their size, though they have made some progress. Instead, … were rather successful with their affordable license … beer that has doubled the market share and pressed … brand. At the higher price floor other license brands (mostly …, … and …) pressed …’s products (mainly beer … and Amstel).

… as we understand decreased the regional market share according to the all-Russian trend and only brands … and … comparatively kept their positions. Besides one should also note that … in the North-West kept its market share despite the decline in other regions. The combination of such factors as: 1) …’s activity in the inexpensive beer market, 2) expansion of affordable brands by … as well as 3) … stability logically led to a considerable increase of economy segment. In this way, the North-Western region differs from the general Russian context. Besides, due to the inflow of licensed beer, low mainstream reinforced its positions. These two segments won a part of upper mainstream sales. Taking into the account comparable stability of marginal segments, over the considered period all that led to …% decline in the average price of sold beer against the neutral Russian dynamics.

South region

In 2020 in the South region breweries’ shipments increased nearly at the average Russian level. Instead, the beer sales dynamics was higher than the average, both according to the official and inofficial estimation.

According to Federal Service for Alcohol Market Regulation over the accounting period in the South of Russia there was no region where the producers declined their beer shipments including Krasnodar krai and Rostov oblast that together provide for more than a half of regional output. At that the official beer output growth in 2020 was to 2/3 accounted for by Krasnodar krai.

The South region was noted for a strong pressure on federal producers from both regional breweries and small breweries. Thus, over the accounting period, the share of leaders declined by …%. Though independent producers cannot compare to the Siberia by productivity, but the regional market is gaining the status of one of the least consolidated ones in Russia.

The South region is notable for a vast number of small producers. According to official data, in 2019 the share of smallest breweries outputting less than 10 thousand dal amounted …% of the regional production which is twice higher than the Russian average. Besides, larger brewers, that is minibreweries of local and regional scale, stand out for bigger market growth. However, they usually operate not on the craft field, but rather their beer compete with a very wide range of regional brands.

As for the sales structure by brand types, in the South region considerable changes took place in the market on inexpensive beer. One can say that regional brands by federal producers yielded their positions to many types of … as well as brands by local independent breweries. To a smaller extent regional brewers pressed federal brands on the retail shelves. License beer managed to increase the market share, but due to its comparatively low weight, this improvement did not help federal producers much. The share of import beer in the south of the country is quite small.

In the South the major competition is taking place between … that traditionally has strong positions and … that is considerably behind but has been recently cutting the distance rapidly. The third place with a big gap is shared by … and ….

In the leader’s sales structure there have been considerable changes. Like in many other regions, among federal sorts there has been the biggest sale decline of title brand … and beer …. Besides, the sales of major regional brands by the company namely …, … and … decreased. A fast growth of … and … has to a large extent, though not completely compensated for that decline. At that … and … have won a market share of other federal but not regional brewers. Besides, we should pay attention to new regional launch – beer … that is only gaining its market weight.

In the South region sales of brands by … have been rising most intensively, which is connected to the low base effect and their wider distribution. For instance … brands that was hardly represented in retail in the region has become the sixth by the sales volume at one blow. Though what actually happened was substitution of beer … that on the contrary lost a big market share. … sales increase benefited from a range marginal brands such as …, … and … while … has become the more niche and premium product, having lost some market share.

Federal companies of the second row have yielded their positions. Sales of Ochakovo that used to be a major regional player as well as those of … went down considerably. At the same time, … managed to increase its market share. Besides, there has been a growth of private labels that are so for no competitors to local beer.

Among regional brewing companies excellent growth was shown by /// and a big contribution was made by brands …, … by the same-name companies. The share of more expensive … decreased which however can be linked to organizing brands in the price range. In general, regionals in the South of the country in the first half of 2020 increased their sales in retail by …% which is no doubt connected to negative factor, that is, channel narrowing of specialized beer retail.

Redistribution of economy brands’ sales from the companies of the second row to leaders and regional companies has not affected the market share of economy beer. At the same time, … sales growth led to low mainstream expansion and on the other hand to the premium segment growth which took place due to upper mainstream blurring. However, it would be incorrect to speak of market polarization. One can rather speak of its cheapening as it led to a …% reduction of the average retail price of sold beer.

Volga region

Beer shipments in Volga region were considerably higher than the Russian average. At the same time, the sales dynamics was multivalued as by the official data over the three quarters of 2020 it went only 2% up and according to inofficial data, retail sales over the first half year grew by 7%.

A big contribution into the shipments growth was made according to Federal Service for Alcohol Market Regulation regions where breweries of federal companies are located except for Ulyanovsk oblast (here, obviously, the decline of … output influenced).

And the official growth rates were not high due to decline in Udmurtia Republic, Saratov and Ulyanovsk oblasts.

Volga region is notable for major federal producers domination. The output share of independent medium breweries here is much lower than in general in Russia. Yet in the region the small brewing is poorly developed the share of each subgroup from microbreweries to minibreweries being … lower that the Russian average. Nearly a … of small brewers is located in Samara oblast, the most favorable from the point of view of population income.

Naturally, such manufacturers’ structure means a high share of retail market of federal companies that exceeds …%. Regional brewers mostly compete with them in the cheap beer market. On the one hand it provides for their stability, on the other hand they hardly grew (which is why they lost some of their market share) because of the competition from economy federal brands. Major pressure hit not regional own brands by medium breweries but many versions of … (among other factors, due to … by federal brewers). Interestingly, even … that unlike other Russian regions decreased their share in Volga region experienced the price pressure too.

In the sales structure by brands the share of federal national brands went down, yet the share of license beer increased. On the other hand, the regional sorts by independent brewers also won a market share from regional sorts by federal companies. Despite significant reformation of investor list, the share of … increased. Besides, small brewers, expats with minor brands as well as system player … enhanced their position in the retail.

Without going into too much detail, the competitive situation can be described this way: … company that had dominated Volga region before, increased its market share mostly by winning it from … and from many independent producers. … in general has kept its market positions.

Among … major brands, … have risen their market shares in retail, but one should speak of reallocation of brand roles rather than of market consolidation.

A range of federal brands that significantly yielded their positions to competitors belongs to …. Its title brand … (or rather many sorts of …) is no longer a market leader. … also occupies one of the last positions and … beer decreased their sales by several times. … has helped to fully balance their decline. We should also mention a minor growth of marginal sorts namely …, …, … and …. As we can see the company’s sales have become more polarized.

… that can be called the cheapest beer in Volga region has become a new regional leader. However, other national brands by … have substantially grown as well as … beer that has doubled its market share. Marginal license brands by the company have improved their performance but not significantly.

… has managed to increase sales and the market share of two major brands in the region, such as … and regional …. However, the title brand … yielded half of one market percent to license brands by competitors. There has been a notable sales decline of regional brand …, …, … and ….

A fierce competition in the economy segment has affected retail sales of major regional producer, namely holding …. Almost all brands of the wide product range by the company had a worse performance. Companies … pivo and … have kept their sales volume at the same level. All mentioned breweries cut their sales of …. Instead better performance has been achieved at …, …, … and a range of small regional breweries.

These changes in the beer market in Volga region have led to its polarization. The share of minor premium segment has increased along with the economy segment. This took place due to reduction of upper and lower floors of mainstream. As a result, the average retail price of sold price has remained almost at the same comparatively low level.

Ural region

Manufacturers in Ural region shipped 4% more beer in 2020, which is an average for Russia growth rate. At the same time the beer sales dynamics was two-digit, that is twofold faster than the average both official and unofficial assessments.

The dynamics was to some extent positive in all areas of the region. But the main contribution both into sales and output was made by Sverdlovskaya oblast where … production is located. Here about a half of the regional beer is packed and sold. High sales rates were also shown by two other key places, namely Chelyabinsk oblast and Khanty-Mansyisk autonomous district.

Ural is the only region in Russia where federal companies enhanced their positions in retail networks. They won a market share from regional brewers and even elbowed private labels a little. However, like everywhere in Russia here the popularity of import products and beer by small brewers has grown.

The market leaders managed to succeed in the region due to mighty growth of … beer sales. Yet if not for stability of their national brands the situation in the Ural region is not likely to differ from other parts of the country. Interestingly, economy groups of brands, such as regional sorts by local brewers and big companies as well as collective … have lost some of their market share.

In the Urals like in all Russia … stands out for rapid growth as here they exceed the main competitor by two times. The company has won a market share from …, Tagilskoe pivo and …. Interestingly, … has kept its position and even grown a little unlike the western regions.

One should notice that only several region breweries are well represented in the Ural retail market. The biggest among them, … is focused on the economy segment, other notable breweries, namely … and … are more focused on the low mainstream market segment. Independent producers from other regions are comparatively weakly represented. Thus, by nearly … the performance of regional companies is connected to … sales dynamics, and there is much to be desired there.

Like in many regions, economy brands … and … were making the major contributing into … growth. Besides … has become a growth engine that has approached beer … by popularity. Good performance was demonstrated by … and …. Unlike other regions in the Ural even … still keeps some popularity, though it is going down.

… has lost some of its positions in the Ural mostly due to a sharp sales nosedive of …. However, the title brand too lost one percent point of the retail market share. Besides, regional sorts of the company also had negative performance. Unlike in other regions sales of … did not exceed the market but were growing at the same level, so they were not able to compensate for the negative dynamics. Instead, the popularity of … beer was growing rapidly, as the market share is now close to …%.

The regional positions of … proved to be stable due to … brand. Its volumes have obviously compensated for the lost sales of competing strong beer …. … sales were also good. However, in the license segment the company has yielded to competitors. The positive effect has been levelled down by sales reduction of … title brand as well as other key brands, namely …, … and Gosser.

The described changes of brand shares led to beer market premialization in the Ural. Let us note that this movement seems to be natural, taking into consideration the obvious slant toward cheap beer share. A rapid growth of license brand sales at one dash balanced the market disproportion – as the share of the marginal beer increased straightaway by …%. This process had two stages: from economy segment the sales flowed to low mainstream but from low mainstream there was even stronger flow-out to upper mainstream.

The premialization resulted in retail price in the Ural rising by …%, which is not much but notable taking into consideration the neutral Russian dynamics. At the same time, the average price for local beer (… RUB/liter) is still one of the lowest among Russian regions.

Siberia region

Siberia region reminded Ural region by the key results dynamics. Besides the breweries’ shipments were a little higher than the Russian average. The official beer sales were four times higher than the average but inofficial distributors’ assessment on retail sales is twice higher.

However, some official data rise questions. The shipment growth due to main impact from Omsk oblast looks natural as it is connected to … stronger positions. However, beer sales growth registered by Federal Service for Alcohol Market Regulation resulted from volume doubling in Irkutsk oblast which is unlikely to be the truth.

It is known that medium breweries in the Siberian market play a more important role than in other regions. The share of independent breweries outputting more than 250 thousand tones here is … bigger than the Russian average.

In 2020 the weight of regional producers went down from one third to quarter of the retail market. Yet regional producers yielded most of their sales volumes not to federal but to small producers and expats that … their market share.

One can say that there has been a reduction of the affordable beer market. The net sales of … by all brewers went down. Besides, the share of regional brands both by local independent brewers and by subsidiaries of federal companies decreased. Federal national brands have lost comparatively little taking into consideration the fact they account for a … of sales. On the other hand, license brands of the market leaders as well as import (regardless of distributors) have risen in absolute and comparative figures.

… in the Siberia was not as successful as in other regions judging by the market growth. And the company’s leadership cannot so far be considered absolute and stable. This is connected to … stability and particularly high activity of small brewers.

Cheap … that had been poorly represented in the regional market until a short time ago, became the company’s sales engine. Yet nearly a … part of that growth results from substituting volumes lost by beer … that dropped its sales by two. … and … with lower price demonstrated a good performance. One cannot find any other break-through or failures – as license brands went up a little and … and … are still significant in the local market though they are reducing their share.

… has kept the market share thanks to three growth points in wide price range. In the economy segment … was such growth point that made the main contribution into market share expansion. In low mainstream segment sales of beer … were growing rapidly. And in the upper mainstream segment as in many other regions … beer was gaining weight. Regional brands by the company as well as discount … yielded their market share.

Company … is still a rather important player in the Siberian market though it lost some of its share. The failure with … brand was caused by fiercer competition with the market leader. On the other end of the range there was a considerable fall of …’s title brand positions which can be linked to company sagging in the national modern trade. Some improvement of market share of other license brands allowed to balance situation a little.

Among the five biggest by the retail market share Siberian regional breweries, only … managed to increase sales over the accounting period. Other big breweries, namely …, …, … and … lost more or less of their sales and market share.

At … the reduction of low mainstream brands, such as …, and … mostly affected the sales. There was a notable decline of absolute volumes of … beer that only several years ago had been rapidly gaining popularity, yet now negatively impacted the sales of … and … breweries.

The price segmentation of retail sales of beer in the Siberia did not change much over the accounting period. One can say that on the mass beer market there was a redistribution of market share of different companies at the same price level. And entering of growing brands by … was not so mighty as in other regions. Outrunning sales growth of license beer led to some increase of the premium segment. These changes resulted in minor growth of the average price by nearly …. It hardly differed from the Russian average by the growth rate and dynamics.

Far East region

In 2020 shipments by producers from Far East were growing not worse than the average. But official and inofficial data estimations do not coincide with the data on beer sales. According to Federal Service for Alcohol Market Regulation over the three quarters of 2020, they grew by 8% having twice exceeded the Russian average. But by distributors’ estimation over the first half year the beer retail sales fell by 2% which is a distinctly negative performance compared to other regions.

Thus, the growth of regional beer shipments was mostly connected to increase in Primorsky Krai where … brewery is located as well as Khabarovsk Krai where … and … beers are packed. Official data on beer sales reflect a decline in Primorsky Krai and Republic of Buryatia yet they also register a too unusual growth in the Zabaikalsky Krai (+142%) that compensated for those failures.

Due to small market size, distant location and presence of three federal leaders the producer structure in the Far East is very specific. Mid-sized regional breweries are poorly represented here. Instead small breweries play on their field.

Thus, the share of microbreweries is only a little bigger than the Russian average, but the share of minibreweries outputting 50-250 tones in the net volume is … bigger, while the share of minibreweries and mid-sized breweries outputting 250-1000 tones is … times bigger.

Certainly, small breweries are not able to completely compensate for mid-sized breweries by the shipment volumes in retail. So, federal producers control nearly …% of the local market. However, they yielded a little to regional and minibreweries in 2020.

As for the types of brands, the Far East market is specific for high share of regional brands by federal companies (… times higher than the Russian average). This is certainly because of the empty market niche due to absence of regional brewers. Besides in the Far East the share of … by different producers is very large (… bigger than the Russian average). This is connected to rather high prices for beer and the fact that marginal national brands are ignored by consumers. Besides in the Far East that share of license beer is comparatively low, and this is the only region where it went down in 2020.

The competitive situation was also unusual. Unlike other regions, here … did not have a breakthrough but modestly kept their market share. Volume redistribution was taking place between … and …. And … managed to succeed in the Far East despite the fallback in the Western part of Russia.

Thus, … lost in retail because of market share reduction of … and … brands. Yet, along with the key federal brands, the … sale reduction of … weighed in a lot. Affordable beer … is rapidly winning popularity in the Far East but its growth has not been enough to balance the general negative trend.

The positions of … major brands were fluctuating in 2020. … by this company is still the market leader. The share growth of … compensated for … reductions. Besides the share of brands … and … increased having compensated for regional brand … reduction.

… company managed to grow in retail mainly thanks to two affordable brands that are well known to consumers, namely … and …. Their success was more than enough to compensate for popularity drop of regional brand …. Likewise, in the marginal segment the reduction of … beer was balanced by the increase of ….

It is rather difficult to describe the market segmentation. High retail price for beer in the Far East raises many brands to higher price levels though there is the general for Russia price range. Borderline positioning of … brand in the region (here the average price for the brand family is considered) resulted in its shifting from upper mainstream to premium in 2020. And, despite the lower market share of the brand, formally the premium segment spiked while the upper premium decreased.

The high retail price for beer in the Far East has been increasing rather rapidly and currently it is …% beyond the Russian average.

To get the full article in pdf (53 pages, 11 diagrams) propose you to buy it ($40) or visit the subscription page.

2Checkout.com Inc. (Ohio, USA) is a payment facilitator for goods and services provided by Pivnoe Delo.