The year of 2021 has given the brewers a chance to relax a little bit. Formally the production has been decreasing but most importantly, the market has stopped experiencing pressure from excessive stocks and producer’s and retail prices have gone upwards. The price growth was initiated by AB InBev Efes which negatively affected its share. The main market trends of 2021 are unprecedented growth of non-alcoholic beer output, restoring of the market share of kegged beer as well as rapid expansion of the can. Low starting position, growing role of supermarkets and Obolon’s activity promote the growth of this package.

Where lost and where found

Prices set free

Can in chains

Market positions of Ukrainian brewers

Carlsberg Group

AB InBev Efes

Obolon

Persha pryvatna brovarnia

Regional producers

Where lost and where found

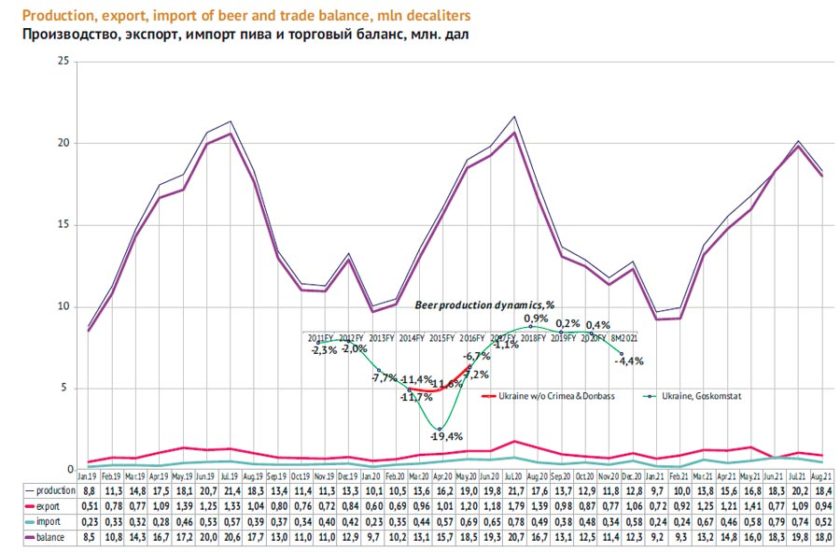

In 2021 a long period stability in brewing industry seemed was broken. A 4.4% reduction over 8 months according to Goskomstat was very unexpected as the dynamics remained neutral even in the stressful 2020. Neighbor product categories such as kvass, non-alcoholic beer, carbonated drinks on the contrary showed output volume growth at various degrees. Besides, it is unusual to see distributor’s data showing not of beer sales decline in general grocery category, but on the contrary of a 3.8% growth in the first half of 2021, when the main output decline was taking place.

So, what happened to the volumes? And can we call 2021 a really bad year for the beer market? To our mind, no. Let us analyze the reasons for the decline.

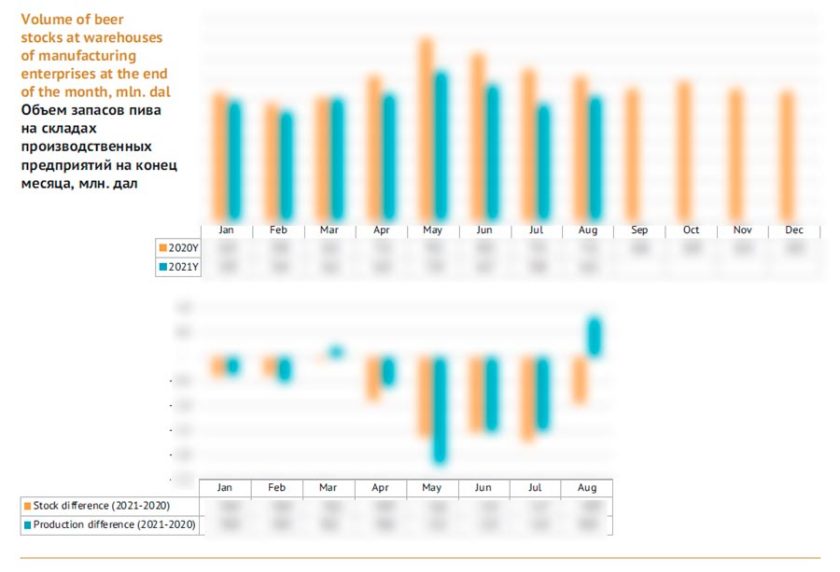

1. A couple of per cents of this decline can be explained by abrupt jumps of the previous year if we take into consideration not only uneven output but also beer at warehouses. By the end of …, before the summer season, the stocks volume amounted to record breaking for this month … mln dal. In a year, by the end of …, that judging by the production dynamics was the worst month there was … mln dal of beer in the warehouses. A similar considerable discrepancy was registered by Goskomstat in … and ….

In other words in the current warm season the breweries were less working for the warehouse than in the previous year. And in … 2021, as soon as the stocks volume started approaching the previous year, the beer output started growing immediately.

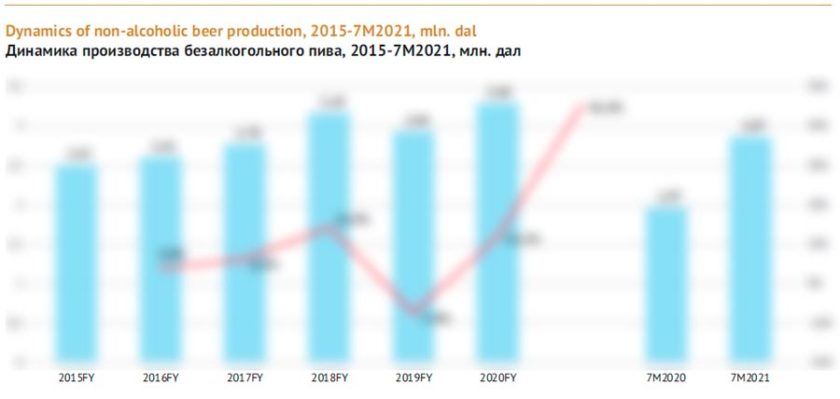

2. Alcoholic and non-alcoholic drinks are separately measured by the official statistics. Sales growth of non-alcoholic beer is a part of the long trend for healthy lifestyle which is actively supported by brewers at the transnational level. According to researches carried out in Eastern Europe (RLMS-HSE), coronavirus was a mighty trigger that made a part of alcohol consumers (especially light ones) avoid alcohol by among other things swapping to alcohol-free beer. Following an unexpected decline in …, when brewers seemed to have overestimated the outlooks for alcohol-free category, its output started growing at … rates again.

An unusually rapid acceleration was registered over the first 7 months of 2021 – as according to the official data the alcohol-free beer output growth amounted to …%. We will discuss the companies’ roles below but let us immediately note that all key Ukrainian producers made their contribution. The share of alcohol-free beer in the total output volume increased from … to …%. Accordingly about …% was added by alcohol free beer to the total output volumes.

In this context let us also note the growth of kvass output. Though its volumes should not be summed up with beer it is quite possible that in 2021 similar to non-alcoholic beer (and in tune with the CSD sales growth) kvass will have taken an audience part from beer.

It is obvious that the kvass market is already saturated as its output has been long fluctuation around … mln dal. In 2020 the production sagged again by …% following a two-year growth to come …% up again during the seven months of 2021.

Nevertheless due to a harsh competition at the beer market, brewing companies developed the kvass category really quickly. Relying on their powerful distribution networks, commercials and contracts with modern trade they have won sales from the second-tier producers.

3. The beer import-export balance in 2021 has been changing not in favor of Ukrainian producers. The negative balance has taken … of percent from the beer output dynamics (but not from the market).

Thus, over the period from January to August 2021, the beer import increased by …% judging by the Customs’ statistics (the calculation rules have been changed this year). By the end of 2021, the volumes may amount to … mln dal. Let us note that the dynamics has become much lower than last year when the import rates amounted to …%. At the same time, judging by distributors’ data, the sales of import beer to the domestic market went on growing at rates far from neutral. Possibly, a part of beer stocks came from 2020 to 2021.

Negative export dynamics had more influence on the trade balance both because of its volumes and abrupt change character. While in 2020 Ukrainian brewers increased supplies abroad by …% in January-August 2021 they dropped it by …%. Such deterioration can be explained by blockage of shipments to Belarus due to tension in relations between the two countries. By the end of 2021 one can expect the volume of exported beer to approach … mln dal.

***

In sum the mentioned factors practically completely nullify the registered production decline. They explain why the decline has had no influence on the Ukrainian market. But even a dynamics that is close to neutral cannot be considered a bad performance for brewers as they have considerably raised the retail price for beer in 2021.

Prices set free

The price increase was expectable in 2021 due to their negative growth in 2020. Then, due to strong competition growth in supermarkets and pressure of high beer stocks during the high seasons, producers intensified their promotional activity. They also focused on their own economy brands that had been losing their positions before. And the positions of both “collective” … and … went down dramatically. By the way, private labels yielded to brewers’ brands pressure in 2021, today their main competitor are brands by ….

The cycle of price decline at two transnational leaders cannot go on for a long time, as they are under a strong influence of share holders. In 2021, a fast growth of beer retail price was mainly provided by … and to a lesser degree by …. But some time later, other brewers too reacted to competitors’ actions cautiously.

As a result, the average beer price increased from 27.9 hrn/l in February 2021 to 30.1 hrn in July. The 8% raise of beer prices left the official inflation that amounted nearly 5% at that moment considerably behind. However one can also say so – beer prices have returned back to ….

As a result of rapid price growth the retail sales of beer sales by value over the first half of 2021 increased by …% having outrun them by volume according to distributors’ data.

Can in chains

The coronavirus has sped up the fundamental changes in the beer market. These changes have started not yesterday and influenced beer consumers and brewing companies seriously, especially in 2020-2021.

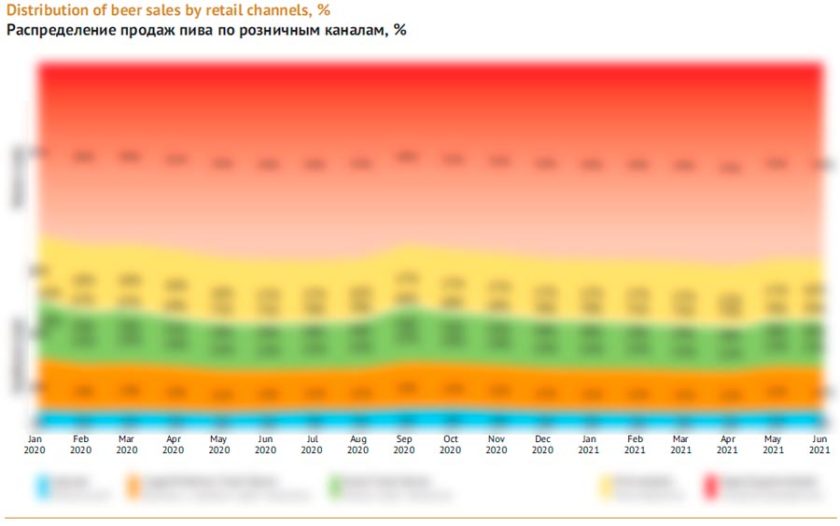

The key drivers for changes is growing significance of supermarkets not only among formats of general retail but also among all channels of beer sales. That is where all rational consumers turned, as they attempted to cut down the number of shopping sessions and increase social distance (due to large spaces) or economize on shopping.

The process of beer sale redistribution was most actively taking place in spring 2020. The proportion of conventional grocery stores plus kiosks to supermarkets quickly changed from …/… to …/…. Then warm autumn, general weariness and removal of restrictions seemed to have let play the situation back, as in September 2020 the share of the traditional retail returned back to the start of the year level. Those were however short term changes and in 2021 sales flow from traditional retail channels to modern trade has been registered.

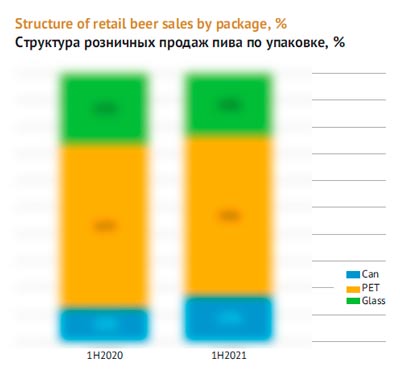

The pandemic played a big role in beer market segmentation by package. Consumer’s behavior in supermarkets is often connected to purchase of large volumes for the future. Thus more people in supermarkets mean shifting of focus towards light and large packages.

For the sake of adequate analysis we estimated both the production volumes and retail sales as this lets us take into consideration the kegged beer and the actual situation at the market.

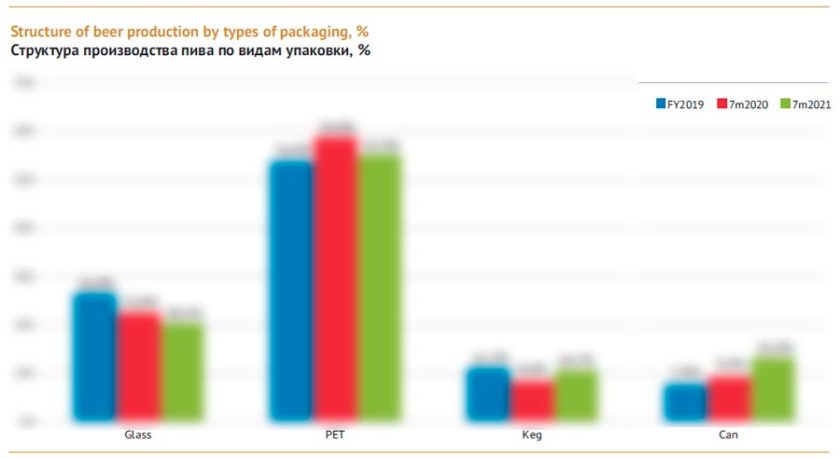

Sales growth of canned beer has become a major trend recently. We have to say that its share in the Ukrainian market was not and still isn’t large. In 2021 it amounted …% (+… p.p.) of retail sales of packed beer or …% (the same +… p.p.) of the total output volume. These figures even without the current changes were the preconditions for the share growth by several percentage points every year. And in other post-soviet states as in other western neighbors of Ukraine the can share is much higher and they often exceed …% of the market.

Low share of can in Ukraine is connected to exceptionally high popularity of PET-package as there is no restriction for it. The share of PET was growing steadily but in 2020 there was a leap (from … to …%), and this change touched on brands by all Ukrainian producers. In the new conditions consumers were looking for opportunity to economize and buy large volumes of beer at once.

In the first half of 2021, there has been a redistribution of sales in favor of the can. On the one hand, this was connected to brewing companies’ marketing focus on the premium brands, on the other hand there was a volume increase of cheap canned beer mostly by … company.

Beer in glass purchase is decreasing as it is more often one-time, that is not pre-planned and not connected to the intention to economize. It is more characteristic for traditional stores and kiosks. Obviously, the active inflow of consumers to supermarkets as well as suppressing their impulsive behavior led to decline of glass bottle.

In 2021, the output share of beer in kegs has returned to its normal level in the recent years (more than …%) though after the decline the absolute volumes remain lower than the average.

The current share growth of kegs means at least a partial restoring of beer sales in the HoReCa segment. The closure of restaurant mostly affected the sales of draft beer in 2020 and craft brewers had an especially critical situation that are not included into our data. Closure of beer stores could have become an even more serious stroke, but the lockdown went on only for two months of 2020 and happened in spring but not during the hot season.

Market positions of Ukrainian brewers

Carlsberg Group

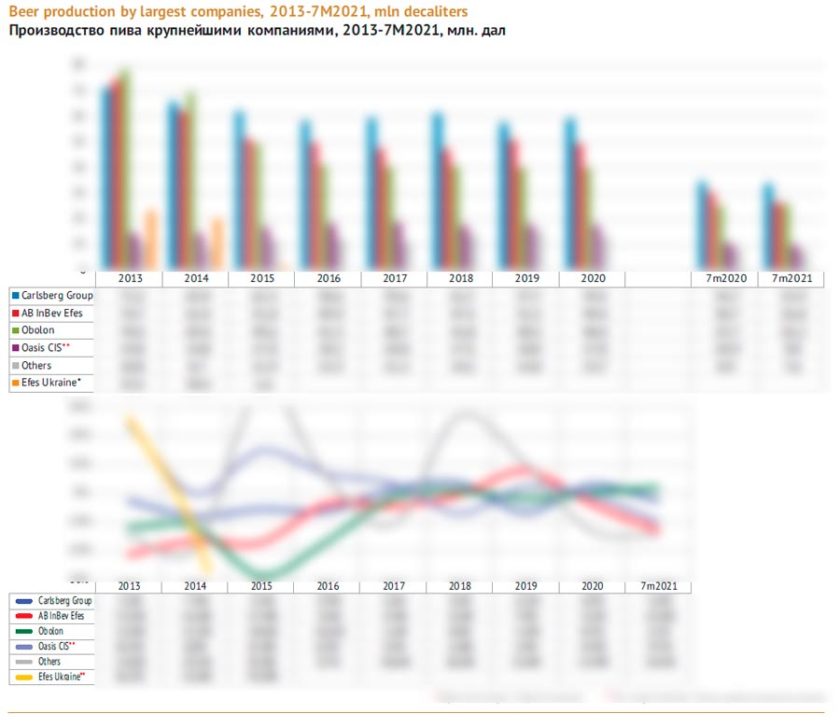

Ukrainian subdivision of Carlsberg Group has managed not only to keep the previously achieved results but also to reinforce the leading position in 2021.

The company like in past years managed to balance at … point. Over the first seven months, alcoholic beer output fell by …% but this performance is …better than the industry average. The net result is that the company’s share in the total output has increased by … p.p. and reached …%.

We should also note a powerful growth of alcohol-free beer production as its volume grew …% over the considered period. Accordingly the share of Carlsberg group in the total output volume has climbed … p.p. up having reached …%. However, under our estimation, the sales results of non-alcoholic beer as well as its share in the retail was not so large.

The kvass output has remained at the same level and has not affected the volumes. This result too can be called an achievement as over the recent years AB InBev Efes has been actively competing with kvass producers and taking their sales due to the kvass market saturation.

If we sum up the alcohol beer with volumes of non-alcoholic beer and kvass we can speak of neutral dynamics of company’s production.

We cannot but note a considerable output growth of beer in kegs that has been taking place in 2021 against restoring sales of retail prices of draft beer at restaurants. Technically Carlsberg Group was taking a part of … share, yet considering the complicated situation in HoReCa, the changes may have been connected directly to competition.

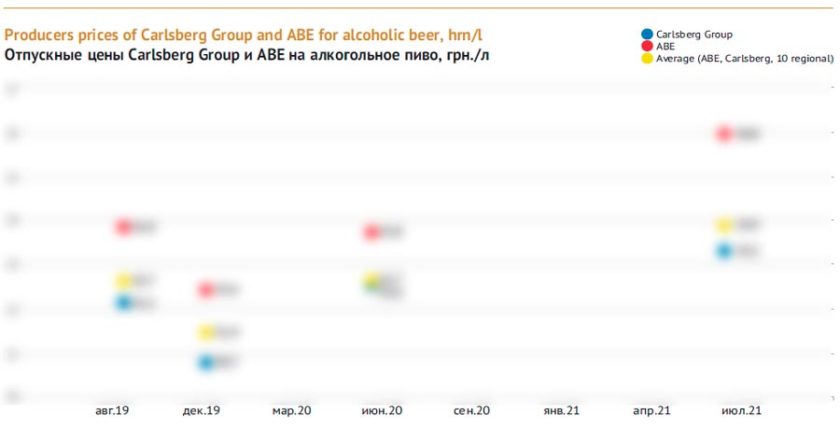

The good performance of Carlsberg Group has been to a large extent due to a reasonable raise of producer’s prices against a too obvious price rise of the production by …. Though the average price for Carlsberg Group restored after “the spring sale” in 2020 it was constantly fluctuating with a big amplitude and in general until 2021 it was growing much slower than competitors’ prices did. After that, though the price growth followed the market, but as the original level was much lower than …, the price difference remained sufficient for competitive advantage. In June 2021, Carlsberg Group beer cost …% less than beer by …, but if you compare half year periods 2020/2021 this difference amounts to …%.

Nevertheless, according to the company’s data the market share growth was not accompanied by deterioration in the sales structure. Cees’t Hart head of Carlsberg Group summarized the performance of the first half of 2021 in Ukraine: “Our volumes grew slightly in a flat market. Revenue per hectoliter improved, thanks to a positive product mix from Garage, Baltika, and Carlsberg, and price increases.”

If we estimate the company’s retail sales instead of output, the first half of 2021 can be called rather successful. Though … pressed Carlsberg Group in spring, the company has been quickly recovering and started taking a share from the main competitor namely, ….

Reinforcing of Carlsberg Group’s positions has been taking place in all regions of Ukraine except for the … of Ukraine where competitors had better performance. Instead the company has dramatically increased its market share in … regions unseating the dominant AB InBev Efes.

AB InBev Efes

The international beer market leader obviously had an intention to become the leader in Ukraine too. Only a short time ago, AB InBev Efes stuck to reasonable price policy increased its market share slowly, cutting the distance between itself and Carlsberg Group. The abrupt change in the market conditions led to significant fluctuations in the retail price for the company’s beer in 2020-2021 and as a result to a rapid decline in the production share and in sales.

Thus, in the … there was a stage of a rapid price decrease caused by stocks pressure as well as prior mighty promotion of Carlsberg Group. Then AB InBev Efes initiated another cycle of price competition. As the warehouses were being vacated in summer, the prices started growing and the market share started falling rapidly. In … there again was a short “seasonal sale” but afterwards prices began increasing in spikes. In …, compared to …, the producer’s prices grew by almost …% (the main competitor, let us remind, had a …% growth).

The explosive price growth let the company become the absolute price leader, yet dropped the sales by liters.

By the end of the year half, the company announced market share of brands …, …, … and … to grow by value. … and … brands reinforced their positions in the second quarter of 2021.

The brand portfolio has shifted in the premium direction. However, under our estimation, the share reduction of economy light sort … and affordable …that had balanced the portfolio now makes it impossible to speak of the market leadership. The market share of inexpensive brands has been taken for the most part by ….

Over the first months of 2021, the output of AB InBev Efes non-alcoholic beer in Ukraine shrank by …% which looks like a much worse performance than that of other considerable producers, but probably by a … due to excess stocks from 2020.

At the same time the retail beer sales by volume were down by …% in the first half of 2021, which led to a drop in the market share (…p.p.) And the average retail price for AB InBev Efes beer climbed …% up too and currently it is not at the same level but much ahead of the competitors. Accordingly, the market share by value was decreasing twice slower (by …p.p.).

By package the main decline of AB InBev Efes output fell on PET, as in the first place the market decline touched upon economy sorts by the company. The … share has also lessened considerably which is again not surprising in the light of the rapid growth of inexpensive beer by Obolon. The output of beer in … has remained stable. This is perhaps because HoReCa segment is regulated by its own rules and it is led by its own sales team.

Unlike the alcoholic beer category, the production of alcohol-free beer at AB InBev Efes has increased by … % after a decline in 2020. If we sum it with alcoholic beer, the output dynamics will be better by … p.p. (…%). However, here too the company did not manage to keep its share as Carlsberg Group has been expanding its output at vast rates, leaving behind all producers taken together by volume.

Kvass output by AB InBev Efes has grown not so fast, by …%. Yet, the company can be called rather successful in this category as kvass Selo i liudy appeared on shelves in spring 2019 and immediately took the … place at the market having left … behind. Kvass output volumes in 2020 equaled about …mln dal. If we sum up kvass to all beer sorts, output dynamics will be much better (…% decline, not …%).

By regions the reduction of AB InBev Efes market share at the retail market was observed virtually everywhere. In the … region the company’s positions deteriorated to the biggest extent (… p.p.). The market share in the … region where AB InBev Efes is represented much less than in the rest of the country, has practically stayed the same. In the majority of other regions the market share decreased by … percentage points.

Obolon

Company Obolon has become the most successful among the market leaders. Its share in the total output in 2016 was stable at the level of …-…% but over the first seven months of 2021, it exceeded …%. The production output of alcoholic beer has grown by only …%, however against competitors’ weaker performance it looks as a good achievement.

The output of non-alcoholic beer over the period under review has grown considerably, here the competitors have definitely outrun Obolon (especially rapidly growing Carlsberg Group). Instead the company has made the biggest contribution into the positive growth dynamics of kvass output by brewing companies.

Obolon has achieved great performance if we estimate packed beer production. The company has managed to increase its share in the net output volume of beer in … having won it from AB InBev Efes. Here it still shares the first position with Carlsberg Group. Besides, the share in the total …production has also grown a little bit. But most importantly, Obolon has more than … increased its output of …. Thus, though the biggest competitors expanded their production by …times Obolon company has managed to take their share.

If we take … beer output into consideration, Obolon’s performance will still be positive but will not look so definite. This may be connected to HoReCa hard conditions and revision of relations with suppliers including beer suppliers. One way or another, Obolon’s share of draft beer production has completely been taken by …. However, in 2021 there has been recovery of restaurant work and kegged beer output, so even the market share reduction does not mean that Obolon reduced its production (it has grown by …% which much less than at #1 and #2).

From the point of view of sales geography, Obolon succeeded in all regions and major cities of Ukraine. It is difficult to single out particular points of growth as it has been rather even.

On the one hand, Obolon due to cooperation with ATB is a major supplier of beer under private labels. On the other hand, in spring of 2020, Obolon took a share from private brands of chains having formed a firm base for growth in 2021. Besides, Obolon obviously, won sales from economy brands by market leaders …in the first place Zibert that found a new lease of life following a hard period of stagnation and decline has demonstrated a mighty growth. Besides, there has been a sales growth of several sorts of the title brand (… and …). … that due to their affordability and fresh design have become the key growth drivers to the whole … segment.

Let us note that by the end of 2021, Obolon will find it difficult to go on increasing the market share. The high base effect of … will influence its performance. Besides, the cost price growth in the second half of 2021 can touch upon all brewers. The company may find it difficult to keep the price distance with competitors at the same level.

Persha pryvatna brovarnia

We don’t have the data on the exact output volumes of PPB, yet, judging by retail sales, the company has been striving rather to keep the sales profitability than to take part in the price competition.

The retail prices for PPB products in the first half of 2021 have climbed by nearly …% unlike … and … that have been decreasing their prices. On the one hand, the price dynamics of PPB has been more likely to support …tactics. On the other hand brands by PPB in 2021 became considerably cheaper than those by … and the price rise over the …was much lower. Thus the company share in retail was … comparatively more slowly.

The bulk of PPB is provided by several inexpensive brands of economy or mainstream segment. A considerable retreat of “old” sort … was generously compensated by a fast growth the new product sales, namely …. That is why in the inexpensive part of portfolio one can rather speak of rotation. At the same time the market share of … beer declined as well the market shares of small by the sales volumes brands.

In the geographic aspect the market share of PPB has been …and the company also has …of the share at the “…” market. At the same time, PPB has … or kept its positions in the … of the country.

One can expect that in the end of the year Obolon and Carlsberg Group will start rising prices, at least due to cost price growth. In that case the final performance of PPB can be ….

Regional producers

In 2021 the output dynamics of regional producers has been multi directional having divided into +/- exactly by half. None of the 10 breweries (having output volumes that are known to us) has experienced either sharp ups or downs compared to the complicated year of 2020.

Major regional brewers Poltavpivo and Berdichev pivzavod have continued decreasing their volumes yet with a trend for stabilization. Interestingly, in 2020 Poltavpivo was developing and in 2021 went on developing a promising segment – a can is filled with “German” beer AltMuller or special beer Gaiser.

… experienced a considerable production cutback following a perceivable growth of producer’s price. The brewery’s brands are becoming ever more premium.

The breweries that have been reasonable in rising producer’s prices (if we compare 2020 and 2021) have enjoyed a good growth. For example, the prices have declined by … instead, the volumes have gone up considerably at Opyllia and Umanpivo, they are expanding production for the … year running. However, the effectiveness of these brewers was promoted by a good representation of brands in the modern trade. Umanpivo pays much attention to marketing and Opyllia brewery is rapidly increasing its … beer output in 2021.

There has been some growth of …, that has had the same producer’s prices, and the … seems to have increased both profitability and volumes.

To get the full article in pdf (36 pages, 23 diagrams) propose you to buy it ($40) or visit the subscription page.

2Checkout.com Inc. (Ohio, USA) is a payment facilitator for goods and services provided by Pivnoe Delo.