The trend of complication of Russian beer market is going on and in several directions at the same time. The range has got wider, the import and small segments are growing, namely craft beer, alcohol-free beer and special flavor beer. At the same time, all ex-mega brands and light lagers by Russian brewers are experiencing a decline of their shares. AB InBev Efes, Heineken, MBC and Pivzavod Trekhsosenskiy have exceeded the market, Carlsberg was developing slower than the market and Ochakovo as well as some other mid-sized breweries have been cutting down their volumes. To a big extent brewers’ performance was connected to their ability to reach agreement with networks, sacrifice their margin and enter new markets. Craft brewers are facing a serious danger of producers’ registration introduction – de facto licensing.

New old data by Rosstat

Market complication

Trends met in retail

Where the specialized retail sagged

Krasnoe & Beloe gains momentum

Brewing companies’ performance

«Балтика», Carlsberg Group

AB InBev Efes

Heineken

Moscow Brewing Company, Oasis CIS

Regionals’ positions

Small brewers: under a threat

New old data by Rosstat

The analysis of the Russian beer market was complicated by the fact that the data that had been inflowing since 2010, changed. They were recalculated post factum for 2017 by the category “beer, excluding brewing waste” (used to be 755.935, became 744.499 mln dal). Thus, due the base reduction, the corrected beer output growth in 2018 amounted not 2.5% but 4.1%, to 774.697 mln dal.

Let us give several parallel estimations.

- According to Rosstat data, retail beer sales in 2018 increased by 0.46% to 794.838 mln dal.

- According to data on shipments of beer and other beer drinks in USAIS, they increased by 0.8% to 767.3 mln dal.

- According to data by Union of Russian Brewers (URB) the production in general showed a 4.1% growth where 23% accrued to beer drinks. In general, the production reached 774.7 mln dal. As we can see, these figures correspond to the data by Rosstat.

- According to Nielsen presentation at press conference of URB beer sales on urban retail of Russia expanded by 6.4% in 2018 against the low base of the previous year.

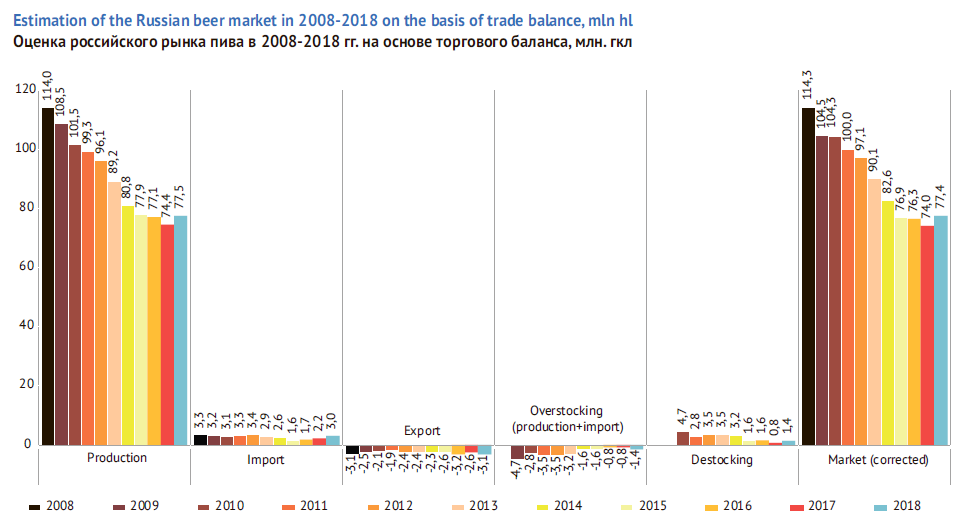

As the average production growth rates registered by Rosstat are confirmed by independent data, in our assessment of the market development we will base on them and the customs statistics. The import was growing rapidly in 2018 and virtually equaled the export. The impact of carry-over stocks must have been neutral due to retaining the excise rate. Thus the beer market grew by 4.6% to 77.4 mln dal, judging by the trade balance.

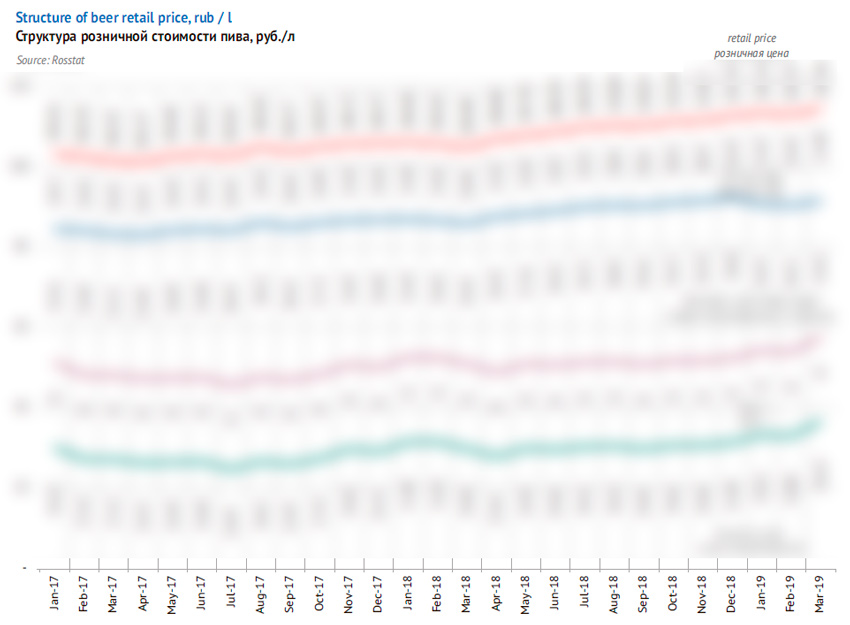

The beer market growth in 2018 was in no small part the result of brewers’ reasonable price policy. During the most part of 2018, brewers’ producer prices were rather stable and only in November they started to grow. At the same time, the Rosstat data reflect a slow growth of retail prices during the year.

According to retail audit data by Nielsen, the average retail price for beer in 2018 increased by only …% to … Rub/l (in 2017, the growth amounted to …%). The neutral dynamics, among other things, was caused by high promotional activity at the beer market. Last year, …% of beer was sold at a discount (+… p.p.).

The VAT growth from 18% to 20% as well as price rises by producers obviously have influenced the retail price of the first half of 2019, which can negatively affect the beer market. The warm weather in April 2019 has probably promoted the sales, yet the hot summer of 2018 is not surely to repeat. Besides, one has to take into account the one-time factor – the consumption leap during the FIFA last year. Along with a certain decline of consumers’ sentiment these factors make high rates of the market growth in 2019 not very probable.

On the other hand, in the first quarter of 2019, the growth went on. The beer output increased by …% in the first place due to Saint Petersburg where the beer production dropped last year, and the Ural region.

Market complication

The Russian beer market has been growing ever more interesting and diversified over the recent years. In different market segments (by price, taste, alcohol content and others) the shares of mass brands and sorts have been decreasing, instead, small and original ones have been growing. Let us name the most important and illustrative results of the market complication, taking into account the players and brands.

1) The general trend of further market fragmentation and share decline of national super brands (Baltika #3, Zatecky Gus, Klinskoe and so on) continues unabated.

In order to estimate the companies’ positions, it used to be enough to analyze the dynamics of megabrands’ market shares and link it to the competitive situation, price and advertising support. Currently the changes in key brands exert a limited influence on the final performance of companies.

Such blurring of the old and well-known brands’ shares is to a big extent connected to the market leaders’ positions who promote a lot of brands of the second raw including regional ones. The range expansion means stronger inner competition for shelf space. While in 2017 …% of the market was taken by nearly … major trade marks, in 2018 their number increased to nearly … according to our estimation.

Big brands had positive exceptions from the general negative trend, but there were specific reasons. For instance, a powerful advertising support and new sorts launches of the Heineken brand; price decreasing for some economy brands, namely … and …. Besides, some “aberrations” are introduced by some consumers’ striving for simplicity against growing variety which is supported by low price – for example Zhigulevskoe by many producers which is still increasing its market weight among weakening national brands.

2) The previous trend is directly connected to process of growing names variety. As a rule, without a powerful promotion there emerges a lot of new federal and regional trade marks as well as importers. The share of new TMs which were not present at the market by the beginning of 2017, amounted to nearly …% in 2018 by our estimation. For reference, in 2016 their share was …%.

Though there were no great launches and only some of the vast number of brands gained a significant market weight at the federal level, in general they have refreshed up the market. Among more or less considerable novelties one can name … by Heineken; import …; …, …, …, … by AB InBev Efes; … by Pivzavod Trekhsosenskiy; … by Carlsberg Group (this company attracted attention not so by their new brands as by big number of new sorts).

According to Nielsen’s presentation, in 2018 there appeared … new brands at the retail market, the total market equaling … brands. The influx accelerated by … times compared to period 2016-2017.

3) In market segmentation by alcohol content alcohol-free beer goes on increasing its market weight. The hot summer played a big part in the category growth, as the demand for non-alcoholic drinks is much dependent on the season.

According to Nielsen’s data, the share increased by … p.p. and reached …%. By absolute numbers the volume growth of retail sales amounted to …%.

Essentially, the growth of alcohol-free category has been a merit of two brands. Launched in 2017 non-alcoholic Heineken 0.0 within a year gained market weight and increased its share to nearly …% having won the second position among alcohol-free sorts. Besides, the market share of Baltika #0, which is obviously dominating the category with a share close to …%, has been growing steadily. Other brands did not show a considerable growth (except for Zhiguli Barnoe Bezalkogolnoe) as their volumes were growing a little slower or faster than the market while the total share equaled nearly …%.

Despite the hot summer, by the end of 2018, the segment of strong beer (containing 6 degrees of alcohol or more) grew a little. According to Nielsen’s estimation its share in retail increased by … p.p. to …%.

Here one should pay attention to the fact that the segment growth was taking place despite the volume decrease of the biggest brand at the market of strong beer, namely Okhota by Heineken. In our estimation by the end of 2018, its share amounted to less than …%. In the first place, the reduction is connected to sales decrease of Okhota in PET. The segment growth was provided by …, … and a lot of other brands by federal and regional brewers.

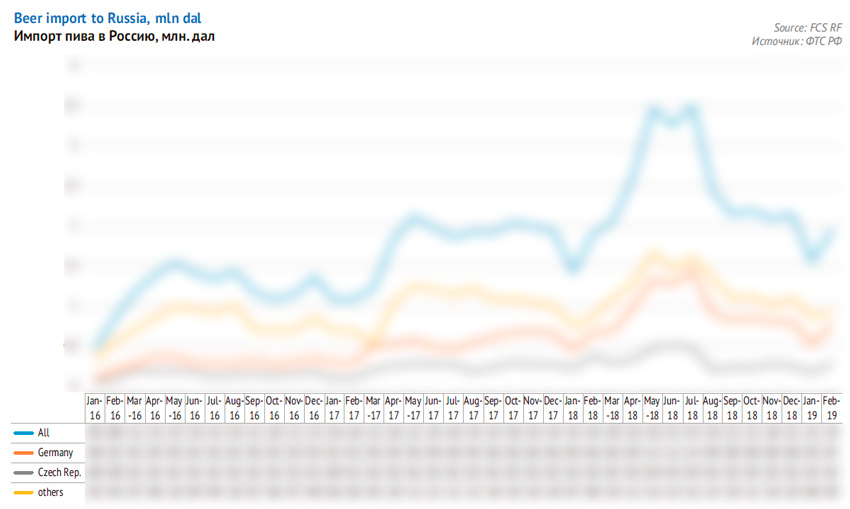

4) The variety of brands in the market is to a considerable extent widened due to foreign producers. A very fast sales growth of import beer was one of the main trends during 2017-2018.

According to State customs’ data by the end of 2017 the import of alcoholic beer to Russia grew by …% and reached … mln dal. In 2018 the import went …% up having reached … mln dal. If we rely on Nielsen’s presentation data, we can see even a bigger growth as it said the sales of import beer … in 2018.

However, there is a trend for the growth declining. If we look at the dynamics by quarters, the rates were very high (…-…% growth) till the fourth quarter of 2018. In the fourth quarter of 2018 the import increased by …% and by …% over the first two months of 2019.

If we base on the trade balance data, the import share in the Russian beer market has increased by … p.p. to …%. The retail audit data by Nielsen show higher rates of growth (+… p.p.), yet, the estimation of the import market share is lower (…%) by the end of 2018.

The main impact into the import market growth was made by EU countries and the biggest countries increased their volumes more than others. Over 2018, Germany raised shipments by …% to … mln dal, Czech Republic by …% to … mln dal, other EU countries also increased their import volumes.

The key reason for the sales growth of import beer is according to Nielsen a sharp decline of price index – by … point at once and the prices for license beer and national brands remained virtually at the same level.

Obviously, the key influence on prices was exerted by a massive expansion into the Russian market of affordable German beer ….

In the first half of 2018, the import beer market growth was promoted by stronger purchasing power of population, the ruble rate stabilization as well as a very high activity of trading companies-importers. During the second half of 2018, the ruble devaluated considerably and the purchasing power declined a little which could have become the key reason for the slower growth rates of sales and shipments of import beer.

The import beer share at the market was growing rapidly in all regions of Russia. The increase was the most significant in the Ural and … regions and slower than the country’s average in the South region as well as the …. As a result, the regions where the popularity of import brands is the highest are Moscow, …, the … and the … region.

According to the trade data, the positions of import beer particularly strengthened in Moscow where in 2018 its share amounted to nearly …% (twice bigger than the previous year). Unlike Russia in general, Moscow population showed interest not only to new cheap sorts but also started buying famous European brands that are much more expensive. The positions of brands … and … improved. The share of affordable German beer … declined considerably.

5) According to Nielsen data, the Russians ever more often opt for special beer sorts. In 2018 the sales in the niche segments grew by …% though their share is still not very big.

For instance, sales of flavored sorts increased by …% and their share grew by … p.p. and reached …%.

The sales of dark beer increased by …% and its market share grew by … p.p. to …%. Semi-dark beer sales were increasing at higher speed, however, its market share is still too small.

Non-filtered beer had the most considerable market share growth – by … p.p. to …%. The sales growth amounted to …%.

The common beer market share (non-flavored) decreased from … to …% within the year. Still the sales were growing and made the main impact into the market development.

This trend will certainly continue in 2019. The shift of companies’ focus to niche sorts is obvious taking into account their branding policy. It is reflected in most of news on launches in 2018 and 2019.

Carlsberg Group is especially active in this direction as they strive to keep up their market share and support their brands. Not until this spring the company’s portfolio received 4 unusual novelties: semi-dark beer Zatecky Gus Rubínový, brewed with caramel and rye malt, Cherry Night – light fresh beer with natural cherry juice (only in draft version) and Seth&Riley’s Garage Hard Black Cherry Drink with the taste of black cherry. Subbrand Baltika #0 received a new sort – non-filtered non-alcoholic beer with grapefruit juice.

Other companies were less active, but their launches at the beginning of 2019 also took place in the niche area – for example Hoegaarden with the taste of grapefruit by AB InBev Efes or Zhiguli IPA by Moscow Brewing Company.

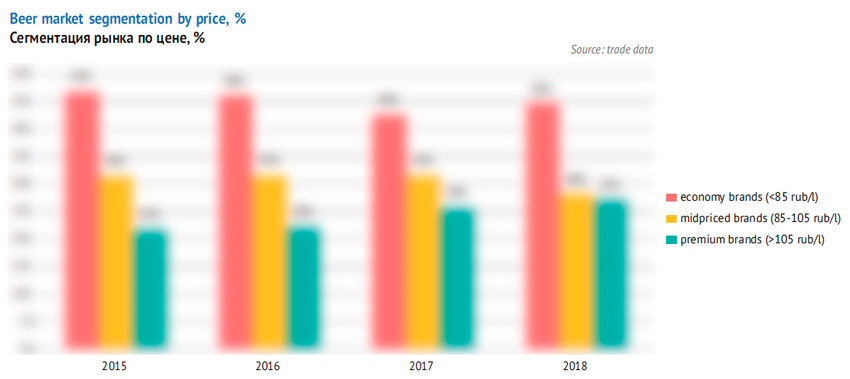

6) The beer market is still facing the polarization trend. As most of ex-megabrands form the mainstream (from upper to lower), the reduction of the market share means further decrease of the midpriced segment. The positions of some brands were rapidly declining for a long time (Klinskoe, Baltika #3) and some other brands were keeping a considerable share and stepped back only last year (Zatecky Gus, Okhota).

The market gravity center has shifted to economy segment, brewers are also shifting their marketing focus in that direction. And from above the midpriced segment is experiencing ever stronger pressure from license brands, cheapened import and сraft beer. As a result, the megabrands are shrinking despite the attempts to support their sales via promotions, shifting to lower price segment or entering other market niches.

Trends met in retail

Beer suppliers to the Russian market can be divided into four groups depending on the scale and geography:

1) Transnational companies Carlsberg Group, AB InBev Efes, Heineken and Oasis;

2) About 75 national producers represented mainly on regional markets plus Trekhsosenskiy Pivzavod and Ochakovo with Russian capital but federal scope.

3) Small brewers, from industrial mini-breweries significant only to the local market to craft and restaurant minibreweries.

4) Beer importers

During 2008-2015 transnational companies were rapidly losing their sales volumes and market shares, while enterprises with Russian capital on the contrary were rapidly increasing sales. In 2016, the share of independent enterprises stopped growing and stabilized at …% and in 2017-2018 it was declining and currently amounts to …%. Three remaining groups were growing faster than the market.

Probably one should speak of only a slight correction as the production volumes of the regionals in 2018 increased and the share decreased only against the growing market. Thanks to the World football championship, the federal companied had an advantage in promoting their brands (especially AB InBev Efes).

There are also two fundamental reasons of big independent companies’ shares reduction. The first one is fiercer competition in specialized retail both small brewers and international companies. The second one is rapid growth of network retail where international companies have traditionally had stronger positions.

According to Nielsen audit data, the share of keg at the market of urban Russia has grown …p.p. in 2018, having reached …%. The process of sales reallocation in favor of draft beer slowed down slightly, but its share has doubled since 2015. The company’s investments into equipment for beer filling in kegs and return package as well as ban on retail beer sales in large PET package have become powerful growth drivers for segment of Draft In Off-Trade.

Naturally, as the sales of draft beer grow, the number of specialized stores is also increasing rapidly. The positive dynamics has been registered for many years. According to 2GIS census of March 2019, in 85 cities of Russian cities there were …outlets of draft beer. This number is …% higher than at the end of 2017 (and almost … bigger than in 2015).

If we do not take into consideration wide-profile alcomarket network Krasnoe & Beloe we will be speaking about later, the number of draft beer outlets has increased by …% to … outlets.

Previously these two trends meant increasing of production volumes of regional breweries as for the majority of them specialized retail is the key sales channel and draft beer is the key category. However, in the recent years, transnational companies and small producers have arrived to the competitive field. Both the makeup of specialized retail (by outlets’ types and positioning) and the draft beer sales structure have changed.

Federal companies, Baltika and Pivzavod Trekhsosenskiy in the first place intensified their activity in the segment. In 2017, Baltika was especially successful and in 2018 Pivzavod Trekhsosenskiy showed wonderful performance. The both companies compete with regional producers in the economy segment, so after the ban on PET, their focus was naturally shifted to specialized retail – the only channel where it is convenient for consumers to buy beer in big package near their house.

Another specific market trend is connected to stronger positions of private labels of networks. As early as five years ago, Deka used to be the key contract beer supplier. Other big regional and federal companies tried to get their own marks to supermarket. They hoped for power of marketing and their brands, being sure the consumer would choose their beer, even though it may be more expensive.

However further market decline in 2014 and shifting of competition to the economy segment made brewers look for ways to secure volumes of output. In 2015 the share of private labels almost doubled having reached about …% of the market. There was one more leap in 2018, when it grew by … p.p. to …%. However, such dynamics is currently provided by several contracted partners of networks (federal companies and Siberian brewers) and Deka sales reduced by …% to … mln dal under our estimation.

Where the specialized retail sagged

In the majority of Russian cities the number of registered outlets went on growing by two digit rates. They grew by more than quarter in Saint-Petersburg, Samara, Rostov-on-Don, Krasnodar, Perm, Kaliningrad and many other smaller cities judging by 2GIS data.

At the regional level, the Volga region and the South of Russia got the majority of new outlets and in relative terms, the South, North-West and Far East regions saw the fastest growth.

The further growth of specialized retail can be hindered by changes in federal legislation. According to Baltika estimations, the initiative to limit alcohol sales in non-dwelling areas of blocks of flats is currently the most massive and dangerous for entrepreneurs. At different versions of such limitations, from 15 to 85% of outlets can be banned depending on the prohibition essence and infrastructure properties in each residential place of the region.

There periodically arise initiatives to make the trading rules stricter also at the level of regional administrations. If we exclude the bulk of cities where the prohibition on selling alcohol in flat blocks was not too strict (that is it concerned only stores located at the entrance side) there remains 15 more regions where draft beer sale is absolutely prohibited in dwelling houses. As far as we know these are:

Ivanovo region (the ban came to force in 2014), Orel region (2017), Ryazan region (2016), Tula region (2018), Krasnodar Krai (2017), Republic of Bashkortostan (2017), Orenburg region (2017), Penza region (2015), Samara region (2015), Kurgan region (2019), Republic of Altai (2016), Republic of Tyva (2016), Kemerovo region (2019), Republic of Saha (Yakutia) (2015), and Amur region (2016).

However, judging by 2GIS data, during the periods 2015-2017-2019 only a ten of residential places experienced a decline in draft beer outlets number, and they are hardly present in the list.

Moscow is the biggest city by outlets number and the only metropolis where the number of stores declined (by …%). Besides, there are now fewer draft beer stores in Tula (-…%), Naberezhnye Chelny (-…%), Ulan-Ude (-…%) and several other cities. Their depopulated was followed by reduction of output volumes at local breweries, judging by Rosstat data.

The reasons for the reduction in each residential area were specific and were not directly connected to the legislative limitations except for Tula.

In Moscow under our estimation, the depopulation is partially connected to strengthening and growing of specialized beer retail under the umbrella of network brands. Besides, the general trend of decreasing vacant areas and more intense renters’ rotation also made an impact into the reduction. Some of draft beer lovers could have shifted to HoReCa that continues restoring and increasing its share at pedestrian streets of Moscow. In other words, draft beer outlets reduction did not mean consumption decline.

In Tula the negative dynamics could have been connected to trade rules tightening starting from June 2018. The regional deputies prohibited retail sale of alcohol at stores located in the ground floors of dwelling houses. In the regional press the stores depopulation is linked to numerous inspections by Ministry of Internal Affairs and stricter rules. The same prohibitions in other cities usually made entrepreneurs reprofile their outlets in HoReCa establishments after which they could sell beer.

The reasons for reduction of beer outlets number in Naberezhnye Chelny are probably not connected to the state regulation as wrote Chelnynskie Izvestia citing Ruslana Yakusheva, general director of Bulgarpivo: “For one thing, the market situation has changed, and the purchasing power of the population declined. For another thing, there is a fiercest competition in the segment of draft alcoholic drinks. For the third thing, there is a price damping of prices by major network players. Small entrepreneurs with one-four outlets stop operation. For sure, only major network players that win by better service and product range will stay in the market. I’m afraid the small segment will not survive.”

Probably the reduction of outlet number also influenced the work of brewing enterprise that decreased the beer output by the end of 2018.

Besides, the outlets number reduction in Ulan-Ude was not a result of changes in trade rules and legislation. That is probably connected to the general trend of enterprises’ number reduction and increase of tax pressure on the small business. At the same time the general output volumes of ten local brewers that all can be called small entrepreneurs, have declined by 29%.

Krasnoe & Beloe gains momentum

Almost half of the outlet number growth selling draft beer was provided not by specialized stores but by alcomarket network Krasnoe & Beloe that along with wine and strong alcohol sells beer and other products. While in 2015, the share of Krasnoe & Beloe in the general number of draft beer outlets amounted to about …%, it was …% in 2017 and …% in 2019.

In other words, the biggest Russian alcohol seller is growing ever faster and its influence on the market is getting stronger. However, there was a simultaneous growth of other network of alcohol stores where draft beer is one of several alcohol categories, usually, not the main one.

Company Krasnoe & Beloe was founded in 2006 by businessman from Chelyabinsk Sergey Studennikov. The small format allows the network to pick up vacant outlets that do not match other companies’ requirements by spacing, format or class. Sergey Studennikov thinks that his network is “stores near home”.

Aggressive growth policy has already become a part of the retailer’s image. At the beer market Krasnoe & Beloe acts as a discounter that strives to give the lowest retail prices in the region. Krasnoe & Beloe is ruining the market by damping prices as compared to their competitors, according to research company Infoline. Thus, the network drives clients away from traditional retailers. “Whenever Krasnoe & Beloe opens an outlet, all non-organized retail within the residential quarter closes” – complain regional retailers.

Naturally, being an alcomarket of wide profile, so much a discounter, Krasnoe & Beloe when forming its product range is more focused on big producers and available brands. In the segment of draft beer the key suppliers and, accordingly, beneficiaries of riot development of Krasnoe & Beloe are Carlsberg, Pivzavod Trekhsosenskiy, AB InBev Efes and starting from recently, Tartspirtprom. All these companies increased their sales by the end of 2018.

The network Krasnoe & Beloe is very well represented by the “home” Ural region, where a third part of all retail outlets selling draft beer belong to them. In the key Central and Volga region (by the number of outlets) the network owns nearly a fifth part of outlets. At the same time, Krasnoe & Beloe is comparatively poorly represented in the Siberia and the South of the country.

Against the end of 2017, network Krasnoe & Beloe has increased its representation by … p.p. in the North-West region (it reached …% of outlets selling draft beer), by …p.p. in the Central region (to …%) and by 6p.p. in the South region (to …%).

Expansion of network Krasnoe & Beloe in any region as a rule means bigger pressure on economy segment of the market.

For example, in the Volga region where the network has been actively expanding its presence at the account of cooperation with local producers in 2018 the share of some other regional breweries was declining considerably. In particular, the output volumes of Ochakovo and Bulgarpivo saw a significant decline.

In the Siberia and the South regions of the country, where the network is weak, the local brewers increased their output volumes and the market share.

In the North-West, that was the target of rapid expansion in the previous year there was on the contrary negative dynamics of regional brewers production. For example, volumes decreased in Republic of Komi (Syktyvkar pivo -…%), in Arkhangelsk region (several small breweries -…%), Vologda region (small breweries -…%) and Novgorod region (Deka -…%). However, Deka had other reasons for decline.

Though the company mostly focuses aon alcoholic drinks, and the trade areas are small, Krasnoe & Beloe is gradually expanding the list of product categories. Further development of the network will be based on merging with other broad profile companies along with the aggressive growth.

At the beginning of 2019, big Russian retailer Dixy, networks of alcomarkets Bristol and Krasnoe & Beloe agreed to join into one retail business. As the result of the merge, there appeared a third by turnover retailer in Russia (currently X5 Retail Group and Magnit are ahead). In the joint business the owner of Krasnoe & Beloe, Sergey Studennikov will get a 49% stock.

The specialization of the three companies differs much. Dixy is a food market network including stores of different format. In Bristol alcohol occupies about 30% of sales, the network even started naming itself “store neat home”.

RBC analysts think that the merge was aimed at bigger purchasing power, that is the wish to get more profitable conditions for supplies to their shops. At that, every network will probably keep its specialization. Besides, the joint company will be more protected from actions of competitors and more stable in relations with federal and regional authorities. For example, at the end of 2018, Krasnoe & Beloe was suspected of selling contrafact, but inspections revealed nothing and the regular work continued.

At the moment of the article preparation, the number of Krasnoe & Beloe outlets has reached 7 700. The joint company will run 13 000 stores in Russia.

Brewing companies’ performance

Baltika, Carlsberg Group

According to our estimation, the beer output volumes of Carlsberg Group’s Russian subdivision by the end of 2018 increased by as little as 1% having reached nearly 23 mln dal. The company itself estimates the sales increase at 2%. One way or the other, the growth was much lower than at other companies with federal scope (except for Ochakovo). Against the Russian market recovery, the market share of Carlberg Group reduced by … p.p. to …% under our estimation.

The company’s market share started decreasing rapidly as far back as early in 2017, though in the first half of 2018, it seemed to stabilize. For one thing the sales of … and … were growing rapidly. And the longtime trend of market share decline of … (former market leader) started balancing by shifting of the portfolio gravity center towards economy segment.

Thus, due to a substantial cut of prices for economy brands …, … and …, their market share started growing rapidly. The price for these brands fell mostly for PET-package and in the segment of the modern trade. Besides, the share of draft beer … and … went down due to wider shipments to alco-discounters network Krasnoe & Beloe. In our opinion, over the recent years, it has been the company’s strategy to substitute a lot of old regional sorts in PET as a response to pressure from independent regional breweries. As a result, by the beginning of 2019, … beсame the biggest brand in the Russian portfolio of Carlsberg Group.

Thus, at the start of the high season 2018, one could expect the company to reduce the margin but retain the sales and the final performance of 2018 would be not bad. However, during the second half of the year, the share of the second major midpriced brand … started decreasing despite periodical sales leaps resulting from promotion and TV commercials of the brand on TV. The positions of … and … brands have deteriorated. One can say that the share of Carlsberg Group in the midpriced segment has gone on decreasing under the competitors’ pressure and stronger market polarization.

In the marginal segments the company managed to retain their positions despite the longtime downward trend of beer … market share linked to primarily the target audience reduction. Besides there was a decline of … market share. Yet, there dynamics was set off by a longtime upward trend as market share of … was growing. The sales of this subbrand was supported by reasonable price policy, promotion as well as unexpected launch of … in 2018 though in the numbered range of Baltika there is already one “zero” sort. License brands Carlsberg, Seth & Riley`s Garage and Kronenbourg 1664 both showed positive changes in the market share, yet much less than before – nearly … p.p. each.

Taking into account the popularity growth of craft and import beer the company started shipping Brooklyn Lager, Brooklyn East IPA and Brooklyn Naranjito from the USA.

As we have already noticed, the marketing strategy of the company in 2019 is obviously connected to the market niches development via launching original sorts of the existing brands. At the same time, in the 4 quarter of 2018 and in the 1 quarter of 2019 Baltika raised prices which affected the sales by the end of the 1 quarter 2019. The sales decreased by 4% which looks especially expressi against the volumes growth in the brewing industry.

Yet the company has managed to divert the negative trend of beer Tuburg sales (…%), increase the sales Baltika #0 (…%) and

AB InBev Efes

Despite the integration processes, there has not been a decline in the joined company’s volumes yet. Under our estimation in 2018 AB InBev Efes growth rates reached nearly …% to … mln hl. Accordingly, the total market share virtually remained at the same level having decreased by … p.p. to …%. The market leader’s margin has become not so big. However, if we unite brands by prior companies, one can say the trend is still actual: AB InBev is losing its market share is declining which is now being offset by the growth of Efes market share.

Currently in AB InBev Efes’s portfolio there are about 20 well-known brands and considerable changes of their dynamics lie behind the seeming stability of the company’s market share. First of all, let us note the rotation in the list of the company’s economy brands.

Brand Dushystyi khmel that had been sold in draft format and had been represented in network Krasnoe & Beloe by 2018 disappeared from outlets. Instead, at the beginning of the high season of 2018, there appeared brand Khmel & Solod filled in keg and sold in network Krasnoe & Beloe but it costs quite cheap (about 50 rubles for a liter), which in the aggregate determined the fast growth of sales. Khmel&Solod has rapidly accumulated the market growth – by the end of year its share grew by nearly …% of the market.

Among many other economy brands that belonged to Efes, … beer had a difficult year, as the sales decreased dramatically due to higher retail price and fiercer competition with the peoples’ brands by other brewers. At the same time, midpriced … that belonged to AB InBev and retained its price has considerably increased its market share but not enough to offset the deterioration of the positions of the first brand. Instead, there has been a significant market share increase of brands …, … and small economy brands. … was growing together with the market and by the year end the company started exceeding the market. … brand stabilized after a minor reduction.

In general, all described above processes led to strengthening positions of AB InBev Efes in the economy segment of the market.

The retail price of … brand has been retaining the level at the border between midpriced and economy segment. Like other brands with youth positioning, Klinskoe sales are declining considerably because of the target audience decrease, further beer market polarization and the general decline loyalty to old national brands against the growing variety. In 2018, the market share of … went on decreasing with a precipitation trend, due to a small growth of the average retail price among other things. Thus, if not for the growth in sales and the market share in the economy segment, the performance of 2018 could have been much worse.

Premium brands by AB InBev Efes were growing together with the market. A minor decline of the market share of major license brands … and … took place obviously due to pressure from rapidly growing import and craft beer segments. However, the retail price of Bud has increased a little and comparatively affordable premium brands … and … have increased their market share and offset the volumes decline.

In 2019, AB InBev Efes will lose …% of the market if we base on last year performance and mechanically deduct the market share of brands Staropramen and Miller from the future results. Yet, AB InBev Efes entered 2019 with a positive trend and if it is still actual during the year, the company will be able to retain the market positions.

Loss of Staropramen and Miller brands did not much influence AB InBev Efes performance of the last year, as according to agreement between Heineken and Molson Coors shipments to wholesale purchasers started from 15 December 2018, and the first shipments appeared in the modern trade on 1 January 2019.

Over the recent years, Miller’s market brand has been growing at rather fast rates from nearly …% in 2014 to …%. In 2017-2018 its positions were quite stable and by the end of 2018, they even improved despite the transfer. At the same time, Miller has been one of the most marginal brand in the premium segment with a retail price (about 130 rubles for a liter) much exceeding the most of the license brands by competitors.

Staropramen brand loss will be much less significant for the positions on the new alliance, as its market share under AB InBev control has been slowly decreasing in long time trend. While in 2014, it amounted to nearly …% of the market, by the end of 2018 it was …%. During the last year, Staropramen market share was falling. For AB InBev the brand had long ago stopped being significant even for local markets.

At the same time, Miller and Staropramen brands by Molson Coors company belong to four top-priority brands on the European markets. So, for the company it was quite natural to carry out an inspection among partners and consider possibilities to increase license fees.

Choosing Heineken for giving the license is probably connected to its pursuit of steady and effective expansion the company’s presence in marginal segments of the Russian market. In our opinion, the fact that Molson Coors is less competing with Heineken at the global level has also played its role there.

Heineken

Among the international groups, the best performance in Russia in 2018 was shown by Heineken. Under our estimation, the company’s volumes were growing twice faster nearly by …% and exceeded … mln hl. Accordingly, the market share of Heineken grew by … p.p. to …% under our estimation.

According to the messages from the company in Russia, growth in volumes was up 7-9% (high single digit) driven by rising of the total market and the momentum of their economy brands and Heineken, with a marked success of Heineken 0.0.

In the first quarter of 2019, the growth of Russian sale went on: according to press-release by Heineken N.V. they have grown by more than 10% (up double digit). The bulk of gains was accounted for by the premium segment due to Heineken brand and license brands Miller Genuine Draft and Staropramen that appeared in the company portfolio.

The start of 2018 was quite moderate and did not promise good performance, yet, the company managed to accumulated the market share during the high season and gradually increase it afterwards.

In the economy segment of the market the company got momentum from brands … and … that have considerably expanded their market share. … has been increasing on long-run trend. Well-known to the Russians … brand started recovering its positions after becoming the most affordable federal brand in the company’s portfolio and last year it was supported by launch of sort … packed in PET. The growth was partially levelled by the sales reduction of big brand … which probably was connected to the company’s efforts to keep the retail price at the same level despite high activity of competitors in the economy segment.

The company’s sales dynamics was affected by competitors’ pressure on Okhota brand in the segment of strong beer, where the variety has increased considerably. This reduction also lies on the trend of decreasing of shares belonging to old and big national brands of the mid-priced segment. Okhota is still the biggest brand in the Russian portfolio of Heineken, despite the sales increase of the title brand.

In the license segment the positions of affordable brands … and …have deteriorated. In particular, the share of … has fallen dramatically because of price rises and lower representation in the retail. It is possible that the company is clearing up the price niche for Staropramen in this way. At the same time the company managed to considerably improve the positions of other big license brands, namely, …, … and ….

Heineken’ sales increase results from unprecedented promotion, growing distribution (including HoReCa channel), cutting retail prices and certainly alcohol-free Heineken 0.0 launch.

Thus, the sales structure of the company was rapidly shifting to the premium direction in 2018 and its profit on a sold hectoliter was obviously the highest among the market leaders’. In 2019 under our estimation, Russian subdivision of Heineken is already sharing its leading position in the … segment with AB InBev Efes. Against the comparatively rapid growth such changes look a double strike of luck.

Moscow Brewing Company, Oasis CIS

Judging by the regional statistics and by assessments of the market players, MBC in 2018 exceeded the industry growth rates. Under our rather rough estimation, the beer output increased by …% to … mln hl. The company’s market share grew by … p.p., to …% under our estimation.

One can name three obvious factors for the company growth that are partially connected to each other. For one thing, MBC currently presents a half of packed beer range of the rapidly growing network …. For the second thing, last year and at the beginning of 2019, MBC was intensively developing their regional expansion. At the same time, on the local Moscow market, their share on the contrary declined, like the share of three other international companies due to the riot growth of import and counter expansion by brewers from other regions of Russia. For the third thing, the retail cost for the key brands by the company in general remained at the same level over the year.

The market share growth was mostly provided by the key brand Zhiguli Barnoe that experienced a particular demand during the high season. Besides, … also made a contribution into the positive dynamics. It became cheaper and probably took some of … share. Besides, the popularity and the level of national distribution of different sorts of Volkovskaya Pivovarnya brand is growing gradually, seriously supported by ….

Regionals’ positions

At the Russian market according to our estimation there are 75 independent medium-sized and big enterprises with national capital presented mainly at regional markets as well as Trekhsosenskiy pivzavod and Ochakovo with their federal scale.

In 2018 the total beer output of most of regional breweries increased. The net output grew by …% having reached according to our estimation … mln dal. Against the …% market growth this meant a minor reduction of the share of national brewers.

Behind the seeming stability of volumes there is a significant reduction of company Ochakovo production which is compensated by Pivzavod Trekhsosenskiy and a range of other enterprises. As a rule, better performance was shown by the breweries that are best represented in the net retail, and those who developed expansion to other regions (to the Central region and Moscow in the first place).

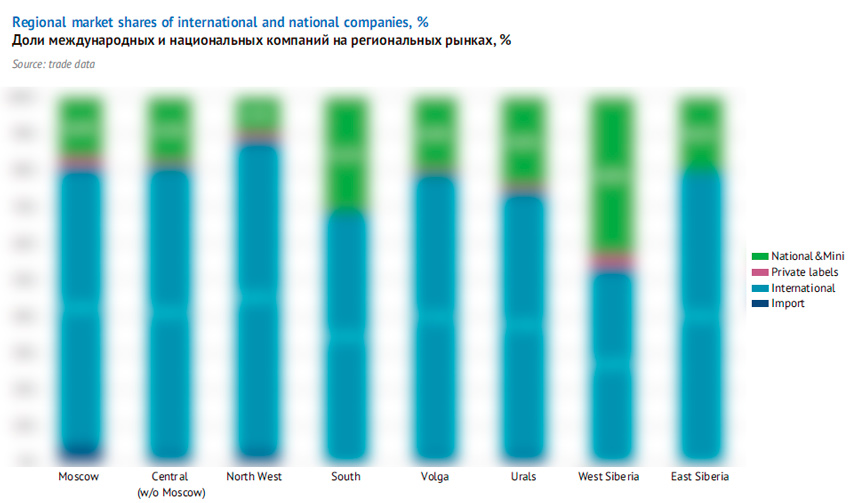

The proportion of the market shares of international companies and independent producers differs much by geography even in neighboring regions.

The strongest positions belong to regionals in the East of the country. For example, The market of the Western Siberia where a range of big and steadily operating independent breweries (Tomskoe pivo, Barnaulskiy pivzavod, Bochkarevskiy Pivzavod, Borikhinskiy pivzavod and others), their share exceeds …%. At the same time, in the Eastern Siberia the share of independent brewers is … lower. However, in 2018 it was … in the Eastern Siberia, while in the Western Siberia there was a … of their share.

One more region with unusually high share of regionals is the South of Russia. More than 150 brewing businesses work there. There are a dozen of medium-sized breweries and several dozens of industrial mini-breweries with rather high output volumes. As a result, in the south the share of independent businesses amounted to …% in 2018 and it is slowing growing. Here … was doing comparatively well, … and …was expanding here from North Caucasian region and some local producers was also increasing their sales.

Breweries in the North-West regions stand out for their low market share, as they account for only …% of the market. At the same time, not medium sized but small producers from mini to craft breweries have the biggest share.

Below we made an analysis of 8 major producers with Russian capital that output 2/3 of beer, while the remaining 1/3 is accrued to a lot of regional breweries with comparatively small output volume.

For Ochakovo company 2018 was rather difficult – its market share decreased considerably before the sales high season. Under our very rough estimation, the beer output went down by …% and is slightly above … mln dal. Against the market growth this meant a decline of the company market share by … p.p. to …%.

The company’s revenue in 2017 amounted to … bn rubles, and net profit reached … mln rubles. There has not been yet any data concerning 2018 at the time of publication.

Company Ochakovo is widely represented at the federal level, but its regional positions are quite uneven. The market share is considerable in the regions where production sites are located or near them. In Moscow the presence of Ochakovo is not especially obvious due to high competition, but in …, …, …, …, …, … and some other cities Ochakovo’s share amounts to 4-8%. As far as we know, last year, the market share of the company was relatively stable in …, but went considerably down in the … markets.

The company is traditionally targeted at the economy segment of the market. Till 2018, the bulk of its production was sold in big PET-package. Yet Ochakovo was far less focused on network retail than other federal players. As early as in 2017, the main brands of the company were Yachmenniy Kolos, Ochakovo and Zhigulevskoe in big pack.

Expecting the ban on big formats and reduction of main brands sales, the company launched brands Khalzan and “1 Litr”. The development of Khalzan brand, that appeared in April 2016 and was packed in can, has been successful. Eye-catching and rather affordable brand targeted at youth audience rapidly won nearly …% of the market. Beside the low price, the brand’s success was to a large extent connected to its witty package which combines the images of American freedom, superpower heroes, Euro-Asian name and animalism which is quite popular in beer branding. Following the market trends, at the beginning of 2019, Ochakovo launched an alcohol-free version of Khalzan.

However, in 2018, the market leaders considerably increased their activity in the segment of canned beer. The range has expanded dramatically as well as the canned beer affordability. While this package used to be associated with the premium segment, the decrease of PET category resulted in many competing economy brands entering it.

It is difficult to solve Ochakovo’s key problem by purely marketing methods. The constant redistribution of sales from the traditional to network retail where the company is comparatively poorly represented resulted in its market share reduction.

Pivzavod Trekhsosenskiy successfully completed the past season. On the one hand the rapid growth was driven by the low price for beer (competitors have many times accused the company of damping or the price lowering). On the other hand, the growth was based on wide distribution and affordability. Pivzavod Trekhsosenskiy is much ahead of regional businesses as well as the three market leaders by network share in the total sales volume.

Under our rough estimation, in 2018 the output volumes of brewery located in Dimitrovgrad (Ulyanovsk region) increased by …% and exceeded … mln dal, though the first half of the year did not promise such growth. Having … exceeded the market, Pivzavod Trekhsosenskiy went on increasing its share, though slower than before – by … p.p. to …%. As we can see, the company has become the fifth player by volume at the Russian market, having left Ochakovo behind.

The company’s revenue in 2017 amounted to … bn rubles and the net profit reached … mln rubles. There are no data on 2018 at the moment of the article publication.

One can say that the company development is in tune with two main trends – ever stronger domination of the network retail and rapid growth of specialized alcohol retail. These two trends join into expansion of alcomarket Krasnoe & Beloe where Pivzavod Trekhsosenskiy is currently the key beer supplier.

The brewery makes 3 out of 8 draft beer sorts available in Krasnoe & Beloe that are positioned as specialties (Barkhatnoe Temnoe, Venskoe traditsionnoe and Pshenichka non-filtered), as well as 6 out of 12 packed beer in PET, glass and can.

The company updates its product range: sorts …, … that were sold in PET and lead the pack several years ago, have now considerably lost their market weight and … and some other brands have entered the picture.

Pivzavod Trekhsosenskiy has made a considerable impact into the draft beer market development over the recent years. By the sales volume, the company is second on the Russian market with a share of more than …%. At the same time, in their own sales structure kegs account for a … according to our estimation.

Being focused on cooperation with Krasnoe & Beloe, Pivzavod Trekhsosenskiy have built their sales geography and the share at the regional markets in general similar to the network representativeness. Pivzavod Trekhsosenskiy’s share is the biggest in the Ural region (about …%), it is also considerable in the center of the country (about …%) and small in the Siberia and the Far east (about …%). At the same time, the brewery is well resented in the home Volga region (…%) especially in the market of Ulyanovsk and neighboring regions.

To a big extent the company’s sales growth in 2018 was connected to their powerful expansion to the capital city market. At the market of Moscow the brewery’s share went up by … p.p. and reached nearly …%. Besides, the brewery share has also increased at the market of Saint-Petersburg.

Certainly, staking on a dynamically developing network can also bear some risks. Today Krasnoe & Beloe is expanding the number of suppliers which can lead to inner competition. Merging of alcomarkets with Dixy and Bristol into one retail business can be followed by both wider geography of sales and further volume growth and negative scenarios for example resulting from decisions to reduce the beer category.

In 2018 the output volumes of Tomskoe pivo, the major Siberian producer, increased by nearly …% to … mln dal. according to the company data. Beside beer the business manufactures nearly 3 mln liters of kvass per year as well as alcohol-free drinks.

According to the company reports, financial performance improved: in 2018 the revenues increased by …% to … bn rubles and the net profit grew by …% to … bn rubles.

Unlike federal brewers Tomskoe pivo is comparatively poorly represented in the network retail, as the company focuses on draft segment and specialized retail much more.

Just several years ago, the leading brand of the company was Bolshoe pivo in big-volume PET and was quite a popular summer beer of low density and alcohol content. However, after the ban on such package, other well-known and affordable brands became more popular e.g. Kruger, Troe v lodke and Zhigulevskoe. According to our estimation they currently account for more than half of Tomskoe pivo’s sales and the remaining sales are accounted by nearly 15 sorts of the whole price range including special brands with craft style.

The geography of Tomskoe pivo’s sales is mostly presented by the Siberian region, the company has particularly strong positions in the West Siberia. Tomskoe pivo accounts for nearly …% of the beer market in Tomsk and about …% in Novosibirsk, Kemerovo, Novokuznetsk and has less than …% in other Siberian cities.

In 2018 the company was actively increasing sales in the Moscow market which to a significant extent resulted in sales volumes growth. The bulk of supplies consists of brands Kruger and Zhigulevskoe, yet on the capital city market one can find a lot of the company’s sorts including packed beer and special sorts. The market share of Tomskoe pivo in Moscow amounts to nearly …% which is quite good for a producer from a distant region.

The output volumes by Barnaulskiy pivzavod in 2018 under our estimation decreased by … and amounted to nearly … mln dal. This is the second biggest Siberain producer which is actively investing into expansion and diversification of production. In particular in the nearest future it is planned to launch a new line of beer packing in kegs.

In 2017 the company’s revenues amounted to … bn rubles and the net profit was … mln rubles.

Barnaulskiy pivzavod is competing with Tomskoe pivo and federal companies at the market of the West Siberia. Thus, in Barnaul the market share of BPZ is nearly …% and its positions are also quite strong in Kemerovo, Irkutsk, Novokuznetsk with a share of …-…%. In general, the geography of the Altai brewery sales is quite wide and its production is easy to find not only in the Siberia but also in the Ural and Volga regions and in a range of specialized retail outlets in Moscow.

The range of BPZ products is quite wide and includes more than 20 brands. Yet the key sorts that account for the bulk of the sales under our estimation are draft beer …, …, …, …. On the one hand, these brands are simple and understandable to mass consumers, providing for the company’s volumes. On the other hand, …, … and … is bottled by many Siberian producers. Some volume reduction is in our view could be connected to stronger competition particularly in the network retail of the …, where … by BPZ lost some of its market share.

Ryazan company Khmeleff under our estimation managed to stop the output volumes decline in 2018 and increased them by … to … mln dal. The company’s revenue in 2017 amounted to … bn rubles and the net profit was … mln rubles.

The company is staking not on glass bottle or supermarkets but on keg beer and specialized beer retail. The bulk of sales is accounted by sorts … and ….

The key directions of the company’s activity are home market and geographically close market of Moscow. In Ryazan the company’s share amounts to nearly …%. At the Moscow market it is about …%. Beer Khmeleff can be found in other cities of the Central region but there the market share of the company is quite small.

Emerging of a new regional brewery became an extraordinary event for the present Russian brewing industry. Tatspirtprom is one of the biggest Russian alcohol manufacturers and in June 2017 it started constructing a brewery in Chistopol (Tatarstan Republic). As soon as in a year, there was the first brew at new brewery Belyi Kreml (White Kremlin).

The construction received an investment to 2.8 bn rubles including the cost of brewing equipment, supplied by Krones AG under a contract, amounted to 30 mln euro. The production capacity of the brewery is 10 mln dal per year and it can be expanded to 15 mln dal. But as Belyi Kreml started working at the close of the sales high season, the output volumes by the end of 2018 were not high – about … mln dal. of beer.

Prior to the production launch, the company was very active in sales organizing. If we judge by analogy with Pivzavod Trekhsosenskiy the cooperation with network Krasnoe & Beloe can become the main precondition for fast growth. The scale of cooperation between the network and Tatspirtprom gives their relations a particular stability – as at the start of 2017, there was an agreement between the companies concerning creating a logistic center for expansion to the market of the Volga Region and further to the west. This motivation received the complete support form regional authorities taking into the account the agreement on realization of Tatarstan alcoholic products.

As a result, the packed beer range of Krasnoe & Beloe was completed by two new brands in PET to the volume of 1.4 l – “German” beer Bierstein and strong beer Kama, “brand built around the love for small motherland”. The range of draft beer also received a comparatively expensive sort Schlosskeller, “a live non-filtered light beer in traditional German style”.

Another Siberian producer, company “Ayan” from Khakassia had to reduce their output by …% to … mln dal, under our estimation. The company in general focuses on selling packed beer and beer in kegs accounts for nearly a … of the total output volume. At supermarkets and network retail beer by the company is poorly represented. More than a … of company’s sales accrues to beer Abakanskoe, and the second key brand is beer Joy.

The company’s revenues from selling beer, soft drinks and water in 2017 equaled … bn rubles. The net profit amounted to … mln rubles.

Almost all production by Ayan is sold at the Siberian market. Nearly … of the beer is shipped to Krasnoyarsk, where Ayan’s market share is approaching …%. Some minor reduction because of competitors’ pressure and the network trade development have influenced the general dynamics. Beside Krasnoyarsk, a considerable weight of the company’s sales belongs to the home region where Ayan is the market leader as well as cities Kemerovo and Novosibirsk where the company’s share equals ….

Buket Chuvashii-Bulgarpivo holding is well represented at the Volga market, it is considerable at the Ural regional market and one can observe as it is expanding to the Central region of Russia.

By the results of 2018, the output volumes of the major Cheboksary brewery increased by …% having reached … mln dal. At the same time, the volumes of subsidiary company Bulgarpivo from Nabereznyie Chelny fell by …% according to the assessment by the regional administration (by nearly … mln dal under our estimation).

The company’s revenue in 2017 equaled … bn rubles, while the net profit amounted to … mln rubles.

The company is better than others represented at supermarkets, it is much behind the market leaders.

Though the company’s product range includes a couple of dozens of sorts, the bulk of sales is accounted to by economy brands …, … and … (although the share of the first two brands is decreasing).

At Cheboksary home market, the company is still an unrivaled leader with a share of nearly …%. Besides, the company took strong positions in many medium cities of the region – in Naberezhnyie Chelny (roughly …%), Tolyatti (…%), Ulyanovsk (…%), Nizhniy Novgorod (…%). Sorts … and … are rather popular in the … region, particularly in …, though the company’s positions are multivalued there. Brands … and … are gradually gaining weight in specialized retail of the …, or more precisely at … market, though their share is not so big so far.

Small brewers: under a threat

If we speak in terms of an alternative to mass and common brands, we’ll say that mini-breweries have partially taken the lead from regional brewers increasing by number and expanding volumes. By our rough estimate, the beer output by nearly a thousand small brewers in 2018 grew by …%.

As a rule, at draft beer outlets, there are usually several fridges with dozens of special sorts of packed beer – regional, craft and import. A part of stores and restaurants is originally focused on selling a wide range of draft and packed beer. Against such background affordable regional brands look too simple, though they still provide the bulk of the turnover. Judging by 2GIS data many of new outlets in million-cities are positioned as isles of craft variety.

The current volume growth of small brewers and the growth in number of beer stores are interconnected. Yet, the outlooks of enthusiastic entrepreneurs are dependent on the state regulation as never before.

The threat of creating a register of brewers (licensing de-facto) can substantially complicate the operation of even big companies, to say nothing of craft breweries. The conditions of including and excluding from the register are almost identical to license conditions for vodka producers.

These issues are referred to as the most problematic by Union of the Russian Brewers, Union of non-alcohol beer market players, OPORA Russia and association of Craft Depot:

1) Lower capacity of brewing equipment limit, at which it is required to install controlling equipment, from 300 to 50 thousand decaliters per year.

2) Fee for applying for the register membership to the sum of 65 000 rubles for breweries with a capacity of less than 50 thousand per year and 800 000 if more.

3) Requirement to prepare a document package, when making an application, that can be considered for 20-40 days.

4) In case of technology or capacity expansion the application must be made again. Any violation of application terms for changes (regardless of what changes are introduced) in the register can be a reason for exclusion and operation suspension for up to 90 days.

5) There appears a lot of grounds for denial to include into the register – from tax arrears (the size of which is not specified in the discussed lawsuit) to lack of technical documents while the necessity to submit them is not specified. Excluding from the register is equal to the enterprise operation suspension. Spot checks and criminal responsibility are introduced for violations.

All these measures can become an insuperable (or unacceptable in terms of risks) bureaucratic barrier for existing and new small breweries and can lead to reduction of their number and the outlet volumes. It is possible that some brewers would choose stop operating, move the production abroad, and import beer or withdraw into the shadows.

Additional problems for craft brewers can be created by preparing law on compulsory National State Standards application in beer production. The regulations developed for big brewers basing on the technologies of the 20-ies century will limit the creativity and use of original materials and technologies.

To get the full article “Russia. Beer market gets more complex” in pdf (44 pages, 17 diagrams) propose you to buy it ($40) or visit the subscription page.

2Checkout.com Inc. (Ohio, USA) is a payment facilitator for goods and services provided by Pivnoe Delo.

The article is prepared using the data by Rosstat, Federal Service of Alcohol Market Regulation, «Catalogue of Russian Beer Producers 2018», presentations and reports by brewing and research companies as well as press-conference of Union of Russian Brewers of 4 March 2018 “Brewing industry of Russia: the results of 2018, outlooks for 2019”. At the article preparation publications in editions Kommersant, Sostav.ru and Vedomosti were used.

The data on output volumes and their interpretation are our assessments based on the regional statistics and current trends in case the source has not been named. We do not claim the given information to be absolutely correct, though it is based on data obtained from reliable sources. The article content should not be fully relied on to the prejudice of your own analysis.