Vietnam is one of the few big beer markets that continue to grow steadily. The beer popularity results from its low price, street consumption culture, and social motives. The outlooks of beer market as well as the Vietnamese economy inspire optimism, though the country is heavily dependent on export of goods. The state regulation can be called liberal, but the key risk for brewers is harbored in intensive rising of excise. Within TOP-4 there are two leaders, Sabeco and Heineken that grow at the fastest rates. The first company effectively employs its capacities, the second one focuses on marketing technologies. Almost 80% of the market belongs to century-old brands, yet the middle class and the youth are shifting their interest toward international premium that is growing taking share from the mainstream.

The tidings on the global beer market over the recent years do not raise any optimism. One of the few growth points is still Vietnam that has been enjoying double digit development rates for two years.

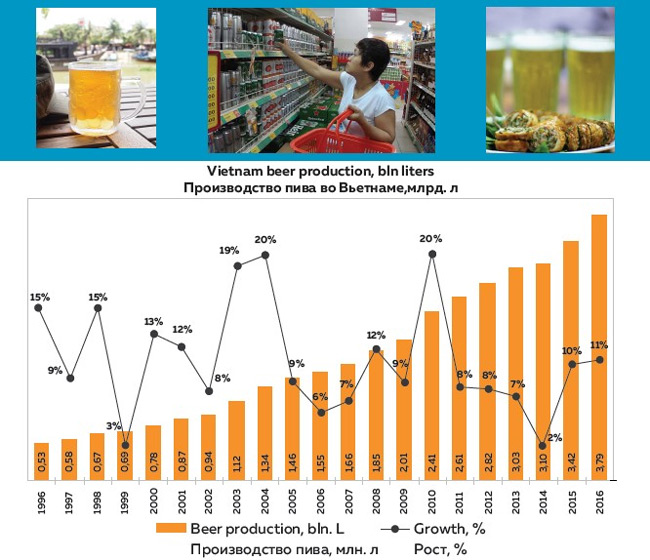

Over the period 1995-2010, the market virtually doubled every five years. That is why we can now say that it is undergoing a transition from riot to moderate growth. Yet, the growth dynamics of beer sales in Vietnam exceeds other major countries considerably.

Even a fleet glance allows us to see why the Vietnamese beer market looks better than other ranking Asian markets. Each of them is affected by negative fundamental factors, which are not found in Vietnam.

- In China there is a demographic pit and economic difficulties of the “new norm”, which touched on a vast class of internal migrant workers.

- In India the growth is hindered by low incomes and extreme over-regulation of the alcohol market.

- Advantaged Japan and South Korea, have long transited to the developed market stage and reached the point of saturation.

- In Thailand there is the mix of the price, demographic, and politic factors (in particular, the new government’s efforts to reduce the alcohol consumption) that have slowed down the rates of the beer market growth.

- Big countries with mostly Muslim population – Malaysia and Indonesia, though increasing beer consumption, but are constantly balancing at the edge of strict state regulation.

- Large but monopolized beer market of Philippines is under the pressure of the excise growth and competition from strong alcohol.

- The markets of Cambodia, Laos, Myanmar are attractive with their growth potentials, yet their infrastructure is still weak, and the population’s income is too low.

Nothing of the mentioned is actual in Vietnam, which makes it attractive for international investors. Besides, the borders of the numerous ASEAN countries are becoming more open and its biggest market, Vietnam is considered to be a space for regional expansion into the countries, where a considerable growth of beer market is expected.

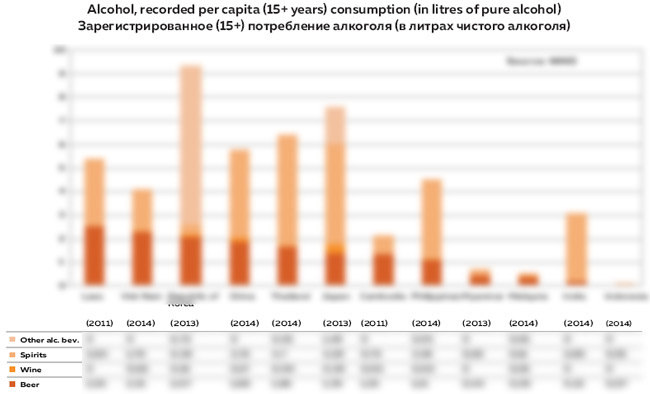

A special group of Asian countries, which includes China, Vietnam, Laos, and Cambodia is characterized for beer popularity and comparatively high volumes of per capita consumption. The popularity is based on low retail price of beer as compared to other alcoholic drinks, the street culture of HoReCa consumption as well as its important role in social links building.

Consumerism connected to gradual transition from the socialistic to market economy system has also become a key driver in this group of countries.

The dynamism of specifically Vietnamese beer market along with the mentioned factors is directly connected to the rapidly growing economy of the country.

Let us cite several basic figures that work well to reflect the beer market development.

In 2016, the beer production grew 9-11% to 3 788 mln liters*.

* The difference in estimations results from the calculation base, current or corrected data.

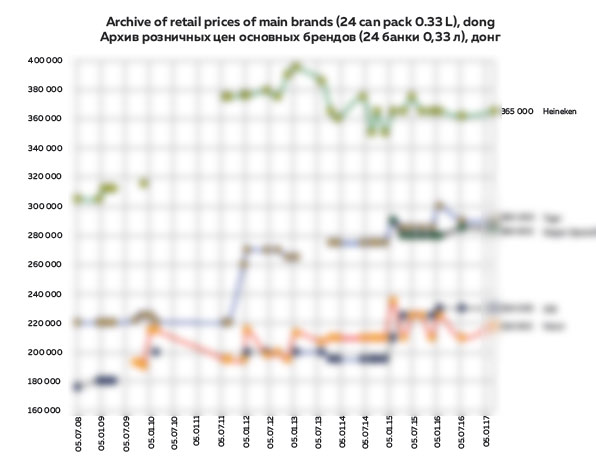

The positive product mix was partially set off by tax increase. The average sale-price for beer by producers has grown only by several percent having amounted to … dong for a liter.

And brewers’ estimated revenues from beer sales have grown nearly …% and reached about … bn VND. Due to devaluation in dollar terms brewers’ sales have risen by …% to $…4 bn.

Owing to the inflation, the tax increase, and the market premiumization the average weighted retail prices for beer increased by …% and amounted to … VND for a liter. In dollars the increase amounted to about …% to $… for a liter.

Considering the rise of volumes and average prices, we can calculate that the beer market in monetary terms has gone …% up, having amounted to … bn VND. In dollars, the growth equaled about …% to $… bn.

And Vietnamese brewers make a big contribution into the development of the retail trade. In 2015, the drink category accrued to 41% of FMCG sales (foods accrued to 15%, tobacco – to 13%, and hygiene products – to 8% etc.). At the same time, beer occupies 31% of the beer market.

The population of Vietnam numbers 92 mln people and this figure is constantly growing. The growth was particularly rapid before millennium, yet currently, it is still 1% per year. This means that every year, there appear about 1 million people aged 18 who are legislatively allowed to drink beer. At the moment, the dynamics of adult consumers increasing has temporary slackened which reflects the economic recession of the 90-ies.

The median age of the population of Vietnam is only 30.1 years. This is only slightly more than in India (27.6 years), where the beer market growth is continuing but considerably less compared to China (37.6), where the beer market has started deceasing.

But was the population increase the leading market driver? Not likely.

Over the last ten years, the general number of Vietnamese population has increase by only 11%, while the beer market has grown 2.5 times since 2006. At the same time, per capita consumption went up from 18.3 to 41.4 liters in 2015. Now only such well-to-do Asian countries as Japan and South Korea have a slightly higher consumption level.

In other words, it was not quantitative but social factor that played the main part in the beer market growth.

Presently, Vietnam is generally following the way that led China to its “economic miracle” competing with it. Ever more often, when buying something we see “Made in Vietnam” label. Main products are textile, mobile phones, and computers. The cheap labor and its growth potential attract big investors.

Economy growth prospects in Vietnam look good, though it strongly depends on the export markets. As far back as in 1990, when the first Export Processing Zones were created and the country embarked upon the course of the market reforms, the export share equaled 36% of GDP, while by 2015, it grew to 90% according to World Bank.

Vietnam’s middle class is growing faster than anywhere else in Southeast Asia. The Boston Consulting Group says Vietnam’s “middle and affluent class” is expected to double amounting to 33 million people by 2020*.

* BCG considers people earning $714 or more per a month to be members of Vietnam’s middle class.

Looking at the expenditure dynamics of Chinese households one can speak of a spike in beer consumption when a person gets to “lower middle class” from low-income group. The same process can be observed in Vietnam.

The key role in the growth of the living standards belongs to urbanization. It is taking place mostly due to the inner labor migration. There is a huge potential in this sphere as only 34% of population live in cities. For comparison in China, that has already gone a long way of urbanization, 56% of people dwell in cities.

The national statistics reflects the urbanization process expressively. Over the last 10 ten years, the number of city dwellers have risen by 37% or 9.3 mln, while in rural areas the population number barely grows. Such discrepancy arises due to the inner labor migration of young people, who are the basic beer consumers.

City dwellers consume … times more beer than villagers. Rough calculations show that presently beer volumes that consumed by city dwellers equal those consumed in rural areas. The same data are given by Nielsen Vietnam concerning the general consumption of FMCG in 2015, that is, city dwellers bought …% of goods and villagers …% accordingly.

The difference in consumption weight is easily explained by the fact that city dwellers’ income is 94.5% higher (their expenses are higher by 68%) and for most of them beer is rather affordable product. Besides, unlike the rural areas, there are a lot of restaurants in the cities and the twilight world is seething, and young people feel freer to consume alcohol.

City dwellers, though being in smaller number, have made a big contribution into increasing absolute volumes of the beer market over the last ten years. They incited the high speed of the market growth. However, brewing companies and distributors are gradually shifting the focus from big regional centers to towns and rural areas.

According to Nielsen Vietnam in 2015, the sales growth dynamics of FMCG slackened in 6 key cities and the rural areas are becoming a new growth point. It is a gradual process fueled by construction of industrial objects in rural areas. It is hindered by weak infrastructure.

Finally we should like to emphasize such an important beer consumers’ category as foreigners. In 2016, 10 mln people visited Vietnam which is 26% more than in 2015. 70% of them are visitors from Asian countries China, Korea, and Japan in the first place, where beer is not less enjoyed and consumed than in Vietnam. Basing on declarations, nearly 2/3 of foreigners are tourists who, obviously prefer premium products. Their contribution into beer consumption can be estimated at … by volume and up to …% by value.

Basing on the existing trends, one can foresee a further growth of the beer market, at least, in mid-term.

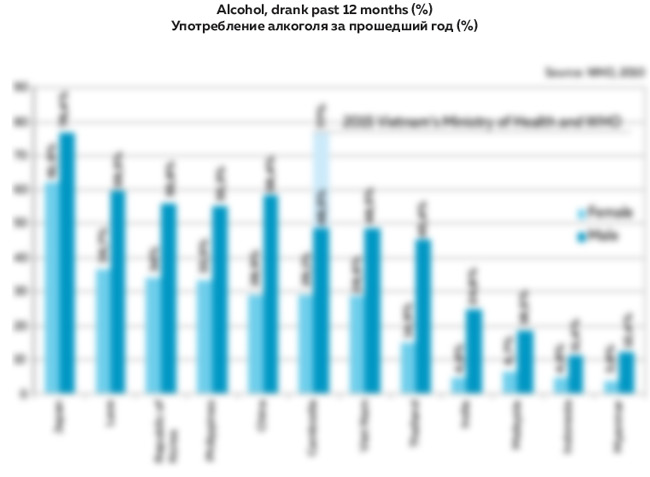

According to WHO, the population of Vietnam are rather moderate in alcohol consumption if we calculate in liters of absolute alcohol. The Vietnamese are behind most of their Asian neighbors except for Muslim and quite disadvantaged countries.

However, the alcohol consumption is rapidly growing. For instance, according to WHO, in 2010, Vietnam occupied a rather modest position among the South-East Asia countries by the share of people drinking alcohol (48.5% of adult males). Yet, new researches that have not been placed on WHO site but have been published in the Vietnamese press, reflect a fast decrease of the abstinent number. The share of males drinking alcohol in 2015 reached …%.

The number of consumers is increasing due to the youth. According to W&S VietNam survey made in 2012, …% of beer is drunk by people aged 19-39. And …% of consumed beer volume accrues the age …-…. This is a very high concentration of consumption in a narrow group, if we compare Vietnam to other countries. For example, the core of consumers in China is much broader and older in general.

On the one hand the share of the youth in Vietnam is bigger that in other Asian countries. On the other hand the Vietnamese enjoy beer much more. They drink it everywhere, often outside at places with most plain equipment, where even boxes serve as furniture. There was a shift of the night life to cheap small restaurants, bars, clubs and karaoke cafés. The young Vietnamese have got used to social activities with beer. It has become a usual drink for meetings; it is often drunk at dinner and sometimes at lunch, mostly light sorts.

In beer consumption and production there is a pronounced seasonality. It is linked to drops of beer consumption in the cold season. It is especially apparent in the North of the country and barely noticeable in the South. Yet there is a spike in demand during celebration of the New Year by lunar calendar (Tet). The celebration start falls on the second half of January or the first half of February. At the threshold of holidays, brewers work hard to load their warehouses. Thus generally in the country the production declines in January and starts growing in May.

The beer consumption character in Vietnam has its peculiarities. According to scientific gradation of the beer consumption motives, the first ones are not social factors but inner psychostimulators when a person is drinking to get pleasure and joy from life, to feel an exciting sense of intoxication. This motive normally stimulates a gradual transition to strong alcohol consumption.

But the Vietnamese are collectivists and very friendly by nature and so extrinsic social motives, that is, “I am drinking in order to chat about things, create a friendly atmosphere or celebrate special events in company” have the top priority for them when consuming alcohol.

Here the analysis led by Vietnamese company Buzzmetrics is demonstrative. For …% of cases of beer consumption the chance to spend time with friends or relatives was the main incentive. The second by frequency reason is consumption of foods that go well with beer, for instance seafood (…%), which is often connected to eating at outdoor restaurants. Besides, beer is consumed to celebrate some events (…%), just wear through an evening (…%) or a weekend (…%), after doing sports, or during sport broadcasting.

Negative factors that caused beer consumption are receding into background. These are sadness and depression (…%), loneliness (…%), and stress (…%).

That is why, as well as due to beer affordability and collective conformism of the Vietnamese strong alcohol drinks are not so popular among them. As the youth is growing older, we cannot see the usual effect of switching to stronger drinks.

Judging by the official data, the wine accounts for …% of the total output volumes of alcohol, and strong alcohol accounts to …%. The remaining …% is beer. Taking into account the sales of international drinks, the official beer share amounts to …% of the total consumption volume.

However, there is no point in analyzing the structure of the official alcohol sales. The WHO data say the official picture is heavily distorted. Here, like in many other Asian countries, the low share of spirits just means that the bulk of the production is in shadow. A vast number of poisoning cases with illegal alcohol and regular news of closures of clandestine brewhouses testify to it.

Self-made and home-made alcohol is an integral part of the traditional Vietnamese cuisine. Historically, during holidays and festivals, in Vietnam strong drinks made by distilling from fermented cereals were popular. In general, each region boasted its own recipe of “home wine” often from exotic ingredients and having original names.

According the Ministry of Public Health, every year, … mln liters of “home wine” is consumed in the country. Its basic consumers are older people and upholders of the traditional consumption.

According to surveys, at least a … of the drinks consumed in rural areas, is produced at home and not accounted officially. By the way this was one of the reasons for the comparatively low beer consumption in the rural regions. However, according to the surveys, there too one can observe the trend of substituting other alcohol by beer both at holidays and in daily life.

In city residential districts there are also a lot of handicraft industries of cheap home-brew (naturally without a license). The low quality alcohol is drunk by the poor Vietnamese, mostly workers employed in physical labor. The local authorities admit it is highly difficult for them to control the production and consumption of “home wine”. Raids are undertaken on a regular basis, there is a public awareness campaign and ever new circular orders. But the situation is more likely to change due to improving the living standards of the Vietnamese and their switching to healthier drinks.

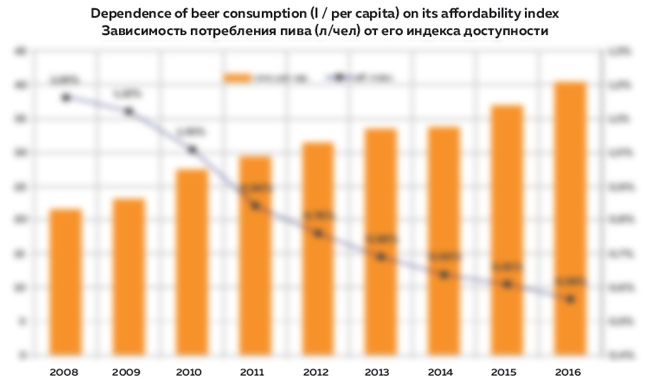

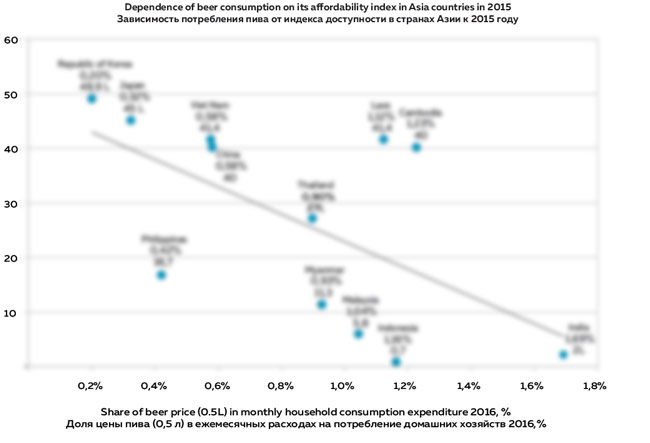

If beer consumption level was determined by solely the price and incomes, the sales would depend on its affordability. The affordability index is usually defined as the share of the average retail price of a product in the incomes (or expenses) of an average consumer (or a household). Here it shows the percentage of a family budget a person should spend to buy 0.5 beer liter on-trade.

The dependence of beer consumption on the affordability index was especially direct in 2009-2013. If we compare the affordability indices in different countries of Asia to other countries, the level in Vietnam can be called moderately low.

For example, in Japan beer is very expensive but incomes are much higher than average in Asia. Here 0.5 l of lager beer (not haposhu) will cost a Japanese household …% of a monthly budget. At the same time, in Myanmar one can buy beer … times cheaper, but a bottle of beer equals …% of a household’s monthly income. In lights of this, in 2015, one Myanmar citizen drank … l of beer per year and one Japanese consumed … l.

A definite and clear link between official incomes and consumption is not always obvious. A discrepancy can be explained by the fact that in every region there is a share of informal sources of well-being and incomes that is not reflected in the official statistics or monetary value. Thus, it is too difficult to estimate the actual affordability of a product without extremely sophisticated calculations.

Additionally the dependence is contorted by the consumption traditions.

For instance Laos and Cambodia are notable for high level of beer consumption though its affordability there is much lower than in other countries with the same consumption level) (and higher level of affordability). The obvious reasons are growing consumerism of the young generation which holds beer important in their social connections as well as a lot of beer outlets.

In Malaysia and Indonesia, countries with mostly Muslim population, beer is little consumed not because it is too expensive but due to social and personal restrictions. And on the contrary, in Philippines and Thailand strong drinks are often preferred to beer.

The beer affordability index in Vietnam corresponds to the Chinese level. However, in the Chinese HoReCa the focus has shifted to the premium, yet there households’ expenses are higher. These two countries have balanced beer prices and households’ consumption possibilities and social factors of consumption and simplicity of beer purchase are generally similar. That is why, probably, the level of beer consumption in China and Vietnam are almost the same.

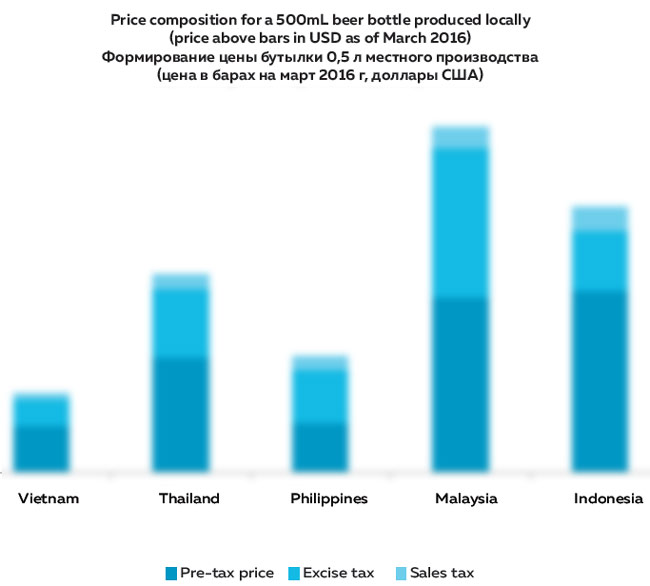

Comparative analysis of beer prices in several countries of South-East Asia was held by CDI Group. If we look at the share proportion in the structure of beer price, Vietnam does not much differ from other countries of the region, as the taxes in March 2016 amounted to nearly …% of the price. But unlike other countries in Vietnamese establishments of HoReCa 0.5 l of beer cost as little as $….

This can be partially explained by the fact that establishments of HoReCa that has become the main sales channel for beer in Vietnam. The share of on-trade consumption in China and Malaysia is commeasurable. Yet the restaurant margin in these countries is higher and in HoReCa the sales structure is shifted to the premium.

That is, Vietnam is notable not for specific share proportion, but for comparatively low prices for all beer price components – producer price, retail margin, and taxes. And the average producer’s price is the base, on which the beer affordability is grounded.

There rises a question – how Vietnamese brewers manage to propose low prices?

To a large extent due to the tastes of Vietnamese consumers who have got used to light beer sorts with addition of large amounts of rice. Normally Vietnamese beer does not demand a long fermentation cycle, which also factor into the cost price decline.

The low beer cost price means that the structure of expenses for its production in Vietnam is specific. FPT Securities research compared the components of the cost price of Sabeco beer production to the world average.

Malt is the most substantial production cost item in the Vietnamese beer amounting to …% of the cost price, while in the whole world the share of malt is half as big.

Naturally, Vietnamese brewers are striving to substitute malt for their most affordable raw material, that is, rice. Rice itself is a rather widely spread additive, for instance, it is a component of Japanese Asahi Super Dry and many other sorts of Asian beer as well as Budweiser in the USA and Klinskoe in Russia.

According to data by FPT Securities, the share of rice constitutes…% of the cost price of Vietnamese beer, while the world’s average expenses for malt-free materials amount to…%. Yet these shares are cited not in volume terms. If we base on Vietnamese average prices for trading rice and malt, we can suppose that the share of rice in grist is normally more than …%.

For instance, the report by Sabeco Quang Ngai (one of the key breweries of Sabeco) for 2016 says that the yearly intake of malt equaled … tons and the intake of rice reached … tons (that is …% of the total volume). And it also states that the enterprise in 2016 produced … mln liters of beer. Basing on these data one can calculate that the malt intake roughly amounted to … kg and … kg of rice per beer decaliter. One can also easily notice low content of hop products in the Vietnamese beer.

As a result mass Vietnamese sorts are represented by low-gravity beers with little alcohol and neutral taste. Due to rice the local beer is more stable and has low foam. Thus the Vietnamese beer is cheap and easily drinkable. Premium high-gravity beer sorts (containing small proportion of rice) have a taste similar to the European one. Their popularity is growing along with the beer sales in general, so there is an increasing demand for malt.

Vietnam yearly imports nearly … thousand tons of malt with the customs value of $… mln. In 2015, … thousand tons was imported from Australia, … thousand tons from China and a … of the volumes was delivered from European countries.

In the nearest future, Vietnamese brewers will have a lot of raw materials of their own. In 2017, Interflour, one of the major milling companies of Asia is planning to launch a malthouse with a capacity of … thousand tons near Ho Chi Minh City taking …% of volumes from malt importers. The bulk of malt barley is planned to be supplied from Australia.

The cost of malt is mainly determined by prices for malt barley. The tropical climate makes it almost impossible to plant it. There were several efforts to plant Chinese sorts of barley in the north-west of Vietnam, yet problems with growth technology arose.

So, the launch of a big malthouse is to be considered in the context of production transition into regions with cheap labor. Vietnamese brewers will depend on the world tone of market.

Taxes determine the bulk of the price for Vietnamese beer.

Special Consumption Tax (SCT) is a specific for Vietnam excise tax which is levied on alcohol, tobacco, automobiles, luxuries, some services etc. Unlike most of countries in Vietnam the excise is not fixed but determined as a percentage. SCT is charged on the price a product is sold to a commercial organization by the producer (or importer). The rate on products made in Vietnam amounts to 15-70 % depending on the product type.

While the commercial organization is affiliated to the producer, the tax is imposed basing on average prices for similar products by random companies. Besides, SCT cannot go below 7% of monthly retail price.

After Vietnam entered WTO which took place in 2009, SCT for beer was lowered from 75% to 45%. Moreover, it was adjusted to the common rate, regardless of the package type. SCT remained 45% for three years, and in 2013, having increased to 50% it again stabilized for three years.

However starting from 2016, it was decided to increase SCT at a much faster rate. That was caused by the riot growth of the beer market, as well as by the Vietnamese government’s efforts to find steady inner sources to pump up the budget. Besides, the tax growth in all developing countries is considered to be the best way to regulate the consumption amid the discussions concerning the alcohol harm.

As a result, from January 1, 2016 SCT grew to 55% and to 60% starting from 2017. One more increase to 65% is planned for 1 January 2018.

It is natural to suppose that SCT raises will be put to consumers’ shoulders. Yet it looks like Vietnamese brewing companies picked up much of the burden and did not allow the prices to grow high aiming at the market premiumization. Some producers were getting ready for excise rise and gradually increased prices for their beer beforehand, in order to smooth the negative effect.

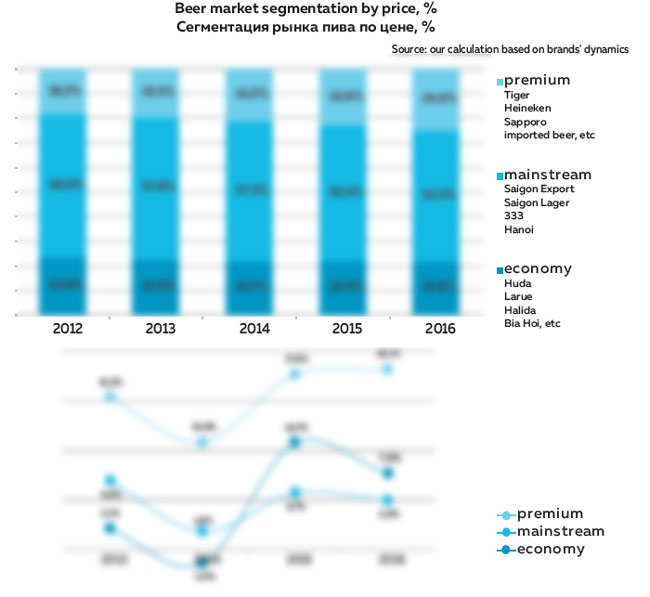

Basing on the data concerning the leading brands (see chapter on companies) we can see the Vietnamese market price segmentation in dynamics. All the three basic segments under our estimation are continuing growing but at different speed. Economy and mainstream segments are growing at approximately the same rates, for them CAGR equals …% and …% accordingly over the period 2012-2016. But the growth dynamics of premium segment is … times higher and here CAGR amounts to …%.

Mainly this is connected to unusually fast sales growth of beer … that is priced to the lower border of the premium segment as well as of other brands in “affordable premium” that suddenly became attractive to all international companies. In 2016, brands …, …, and … made a contribution into it. Besides, sales of … are growing. Import beer is getting ever more popular, though its share at the Vietnamese market is still not so big – …% of the total volume.

As for package the Vietnamese market is undergoing substantial changes too. Unlike Western countries, in Vietnam can is considered to be special and premium package, which grounds a higher price even if it concerns the same beer. It is no surprise that over the recent ten years, there has been a mass mounting of can lines at all market leaders’. Thus today even economy sorts are packed in can if their producers want to give them a shot in the arm.

According to Heineken data, in the period from 2011 to 2015 the market share of canned beer grew by … p.p. to …% of the market. It took place at the expense of sales of beer in glass bottle the share of which decreased proportionally. The share of draft beer (mostly cheap bia hoi) stays relatively stable, despite the market premiumization and the retail development.

The share reduction of glass bottle sales among other factors is connected to reduction of package volume. According to data by Heineken, the market share of beer in small bottles (330/350 ml) in 2012-2013 equaled the share of beer in large package (450/640 ml) and in 2015 it was already substantially ahead of it. Naturally this process coincides with the market premiumization, as more expensive beer is usually packed in smaller tare, while mainstream and economy beer is sold in bigger packages.

Vietnam outstands with its particular big share of beer sales on-trade among other Asian markets. They are promoted by outdoor eating style, a vast number of affordable cafes, and dominating consumption motives of the Vietnamese that we have discussed above. The sellers’ margin in on-trade segment is bigger than in off-trade. However, in the traditional outdoor cafes, which account for the bulk of beer sales the beer price is only …-…% higher than in retail, that is, still affordable.

According to Heineken’s data during the period from 2011 to 2015, the on-trade share of beer sales decreased from …% to …%. It does not mean a drop in beer popularity in HoReCa, off-trade sales are just growing faster. It is connected to a dynamic development of retail, as according to the official data its revenue increased by …% having reached $… bn. The number of traditional food stores with the floor space of 20-200 m2. is growing at a high rate. Besides, under the influence of westernization the Vietnamese willingly shop at supermarkets. The retail has become a key sales channel of expensive beer, so the growth of off-trade and premium segment are connected.

By the way, the decline of on-trade channel and beer sales in glass bottle are also partially interconnected. Beer bottle is a returnable and cheaper tare, so it is preferred in HoReCa.

As of now the state regulation of the beer market in Vietnam can be referred to as liberal. But one of the risks that can be already seen is the fast growth of SCT. The state’s exit from the share capital of the beer market leaders as well as foreign company’s domination can give the impetus for the tax burden growth and for initiatives to limit alcohol consumption. That is what happened in Russia for instance, where the transnational companies invaded the market rapidly but faced a severe tightening of the game rules.

If retail prices growth for beer exceeds the growth of income substantially, the consumption structure can deteriorate. In view of a vast informal market of strong alcohol, the disadvantaged Vietnamese can reduce their beer intake.

It is also expected that in 2018, the Ministry of Public Health will introduce a draft law for alcoholism conquering. The draft law will contain proposals for limitations of alcoholic products consumption in the evening after 22 or 24 o’clock to 6 o’clock in the morning. In theory this can affect brewers very negatively, as exactly at this time people prefer to meet at cafes and drink beer.

According to data by Vietnam Beer Alcohol Beverage Association (VBA) by mid2016, there were … brewing enterprises with the net capacity of … mln liters. Accordingly, the net utilization of brewing capacities in Vietnam amounts to …%.

Only … of the 63 provinces don’t have brewing production. More than … of the output volumes comes from the South-Eastern regions of the country. As few as 6 administrative districts account for … of the beer production.

In particular,

- …% of beer is produced in Ho Chi Minh city

- …% of beer is produced in city Hanoi

- …% of beer is produced in province Thừa Thiên Huế

- …% of beer is produced in province Bình Dương neighboring to Ho Chi Minh aglomiration

- …% in the biggest province Nghệ An in the north of the country

- …% in Quảng Ngãi, a city of provincial significance in the central part of the country.

The remaining regions account for, accordingly, …% of the Vietnamese beer output, though the output volumes in each of them are not big.

As new breweries appear, the production will be more evenly allocated though the country’s territory and the share of the major brewing centers will decrease. At least, this is foreseen in the official plan of beer and beverages production development to 2020.

However breweries’ construction is hindered by a long process of license and permissions acquiring, where Industry and Trade Ministry as well as regional administrations are taking part. So, the main events that can change the power balance in the nearest future is the long awaited sale of Sabeco’s and Habeco’s stakes by the state.

Till that happens, there is still “diffusion” of Sabeco and international companies to the territories where they are poorly represented. Sabeco and Heineken carried out the most successful regional expansion. The first company effectively employs its capacities, the second one focuses on marketing technologies

Among main losers are regional players to whom Habeco can be attributed. Yet there are some exceptions too, for example Masan Brewery located in the Mekong river delta, which is increasing its sales by itself due to the regional expansion.

The competition is transiting to the premium segment, that is growing so far, at the expense of the mainstream. One can expect Carlsberg Group to enforce their positions with Tuborg brand. Besides, AB InBev is currently in full combat alert, having just recently entered the Vietnamese market, but has already had successful distribution of Budweiser.

Sabeco

Sabeco is not only a major brewing country of Vietnam, it is also one of the biggest food industry enterprises in the country. The key activity line of Sabeco is beer production but the company also sells alcohol-free and strong drinks, package materials etc.

Though since 2008, the shares of Sabeco have been available for private shareholders, the company is still state-owned. Currently, 89.59% of its capital belongs to Trade Ministry of Vietnam. Foreign investors own only 9.39% of the capital, 5% of which belonging to Heineken. The state is expected to carry out a two-stage privatization of the company. In 2016 it is planned to sell 53.39% and the remaining 36% in 2017. Though the expected value of the state owned share of Sabeco is nearly $2.4 bn, Heineken, AB Inbev, Asahi, Kirin Holdings, and ThaiBev expressed their interest in purchasing the company.

As we consider the current positions prospects of Sabeco, we cannot omit its history.

Sabeco grew out of a small Saigon brewery, founded by French retired sergeant Victor Larue in 1875. By getting bigger, changing owners and acquiring subsidiaries all over Vietnam it turned into large multidirectional firm Brasseries et Glacières d’Indochine (BGI). Under this name it operated from 1927 to 1977. During the period of colonial rule, BGI portfolio got brand 33 Export (a prototype of today’s 333).

Company’s structure was divided in the course of the war between the North and South and after Vietnam’s union and nationalization in 1977, the industrial group’s activity was purposefully located in the eastern regions of the country. It was logical regarding the socialistic planned management of the production and allocation.

Thus, there historically appeared the territorial activity division between the two major brewing companies, as Sabeco provided beer and beverages to the South Vietnam and Habeco (which will be spoken about below) to the North Vietnam. Yet Sabeco’s development was to a large extent connected to driven by expansion to northern regions as almost half of breweries of the company is located in the central and northern part of the country.

By the end of 2016, Sabeco included 23 branches and 31 co-owned joined ventures. A part of them are dealing only in beer trading or indirectly connected to beer. The production capacity of the 23 breweries reaches about 1800 mln liters per year. In view of growing output volumes the company is investing into construction of new breweries planning to bring their net capacity to the level of 2 000 mln liters by 2020.

In 2016. Sabeco continued its multiannual steady growth its production increased by …% having reached … thousand liters. Yet, as the company developed along with the market, its share remained virtually the same.

In monetary terms the sales of beer by Sabeco in 2016 increased by …% to … bn VND. In dollars, because of the national currency devaluation, the growth amounted to …% to $… bn. The cost price of beer in 2016 was increasing at roughly same rates.

One of the major expense items is sales promotion and advertisement. In 2016, … bn VND (more than $… mln) with a …% growth was spent on it. And obviously the long-term growth trend of expenses is steady both in absolute and volume terms – as a share of revenues.

Such sums are difficult to explain by only advertisement spending, though Sabeco does need to spend much to support its key brand Saigon. The expenses are possibly connected to trade marketing and rearranging of the sales system (see below).

Beer Saigon provides about …% of all Sabeco’s sales. Its sorts range extends from economy to premium segments and in general, the company’s portfolio looks balanced.

In economy (or even discount) segment, the company dominates in the south due to its version of draft beer (Bia Hoi), which is commonly sold from kegs and other package at outdoor restaurants. Due to hot climate, its popularity is more steady and in general higher than in the north of the country. Yet, judging by reports and market researches, the share of Bia Hoi Saigon in the total sales volume is not large.

In more marginal segments one can single out three pairs of related key brands under Saigon umbrella. They form virtually the entire sales volume of Sabeco. The first pair is Saigon subbrands Export and 333 Export, the second one consists of rather similar by design mainstream Saigon lager and premium Saigon Special.

Saigon Export is a major brand of the Vietnamese beer market. It is available anywhere, and the price positioning corresponds to the boarder of the mainstream and economy segments. That is, it costs a little more than regional brands.

Saigon Export is one of the oldest beer brands of Indochina and a symbol of Vietnam as it is a direct relative to “33 Bier Export”. The link was maintained thanks to the brand names and similar design of packages (in red color). This beer is usually bottled in glass of 355 ml. Saigon Export could be considered a separate brand, but it has kept a small logo Saigon on the package, and its production was not calculated separately in the official statistics. The share of the brand on the Vietnamese beer market amounts to nearly …% according to our estimations.

“333 Export” is by essence the same as Saigon Export, which is packed in can of 330 ml. And the popularity of “333 Export” equals that of its bottle analogue. Its market share amounts to about …%, under our estimation.

Saigon Lager is the third largest subbrand, that appeared in 1992 and is positioned in the mainstream market segment. This beer has less gravity than Saigon Export and contains less alcohol. That is why Saigon Lager is easier to drink and its most popular package is bottle of 450 mln. (it is also packed in can of 330 and bottle of 350 ml). The subbrand’s market share equals nearly …%.

Saigon Special is one of the leaders in the premium segment. By design it is little different from Saigon Lager. However, communication of Saigon Special emphasizes that this beer is brewed without rice addition and by traditional long fermentation technologies, which individuates it among Vietnamese brands. The main package type is a bottle of 350 ml and a can of 330 ml.

On the one hand, Saigon Special’s sales are growing driven by the wave of the market premiumization. And on the other hand, it has two strong competitors that are developing at a faster rate, namely, Tiger and Tuborg.

In order to support the subbrand Sabeco invited footballer Nguyen Cong Phuong, famous for his mastery and low height. The slogan of the advertizing campaign can be translated as follows: “You might not be tall, but others have to look up at you”. Besides, in 2016, there was a restyling of the package and several events organized.

Under our rough estimation, Saigon Special’s market share has grown a little and amounted to nearly …%. Good financial performance in the past year is partially connected to Saigon Special sales growth.

In the regional development of brands by Sabeco, one can see two positive trends.

On the company’s home market, that is, in the south of the country, the sales of inexpensive brands are reducing, but the popularity of the marginal beer is growing. Such data are cited by WSB, one of the company’s joint ventures functioning in the Mekong river delta, which is the key sales region for Sabeco.

In particular, in Bassak* region, according to WSB report, the sales of beer 333 Export … over 2016, but in general a …% was still achieved due to a …0% sales increase of Saigon Lager in can. The consumption slides to … beer in … package. And the company is planning considerable marketing expenses in this region.

* The part of the Mekong delta, neighboring Cambodia

Besides, Sabeco is expanding distribution and the market share in Rural areas and those regions where other producers were traditionally stronger. In particular, according to retail audit by Nielsen Vietnam, the market share of Sabeco in the country’s north went up from …% in 2014 to …% in the first half of 2016. It took place due to Habeco’s share reduction, which decreased from … to …% during this period. In general, the expansion of the north market can be explained by both “diffusion” and again premiumization, as Sabeco’s portfolio looks more diverse and expensive. Probably from the point view of state, that is a majority shareholder of Sabeco and Habeco, it is a positive process.

The premiumization also directly influences the company’s revenue. However, the change in consumers’ preferences has not only opened new possibilities but also challenged Sabeco. Premium Tiger and a range of brands of the international premium segment looks status and eye-catching for young consumers. Their aggressive development has become a problem. The probable privatization and affiliation with a foreign company having famous world brands could certainly solve this problem.

Apart from the production base and strong brands, the company’s growth is based on its powerful distribution network. Sabeco own a big share of logistic company Sabetrans, which delivers beer to agents and to the company’s storehouses all over the world. Besides, Sabeco manages 11 affiliated trade companies in different provinces, which form the biggest network of supplies in Vietnam. Their number was once 36, but there is a reduction to this process as Sabeco is putting efforts to exclude competition between distributors and conflict of their interests.

By the way the distributors under the trade subdivisions of Sabeco number …. For comparison – company Heineken cooperates only with … distributors, that is, … times fewer, and Heineken’s market share is only … less than that of Sabeco.

According to Sabeco, they managed to improve the performance of 2016 among other ways by restructuring and optimizing supplies. Production, logistics, and sales in the international markets have become more tuned, deficit and disproportions have been eliminated and transport costs have been reduced.

Heineken Vietnam

Today Heineken is the most dynamic and ambitious market player among Vietnamese brewers with significant market weight. Since 2017, Vietnamese subdivision has been called Heineken Vietnam having changed the old customary name Vietnam Brewery Limited Company (VBL).

VBL was a market pioneer, as company in 1991 got an investment license for brewery construction in Ho Chi Minh city and in 1993 it started bottling beer. VBL was founded as a joint business of Heineken Asia Pacific (HAP)* having 60% of the capital and big state company Saigon Trading Corporation (Satra) with 40% of the capital. Such proportion of the shares remains unchanged till today.

* Previously, Asia Pacific Breweries (APB), a joint venture of Heineken and Fraser and Neave, which has fully belonged to Heineken since 2012.

By rapidly increasing the productive capacities and the market share, in 1996 Heineken decided to found a joint venture, APB Hanoi in the north Vietnam too. However, the Asian economy recession introduced significant corrections into these plans. APB Hanoi was not set to operation until 2003, instead, Heineken managed to get 100% of control over the brewery capital through HAP. Today APB Hanoi provides beer to 29 north provinces.

In 2006, 3 breweries were purchased from Fosters Group. Two of them are located in the center of the country (in city Da Nang and province Quảng Nam) and the third one in the south, in Tiền Giang province.

Finally, starting from August 2016, Heineken has owned 55% of the capital of the sixth brewery, placed in the country’s south, that was purchased from Carlsberg. The second part of the shares belongs to Habeco.

As we can see, Heineken Vietnam is well represented in all the country’s regions. Yet each of them already has a strong leader and regional brands of their own. That is why the company’s development strategy is based on securing the leading positions in the fast growing premium segment of the market. In 2016, it went on paying off. The company’s sales were growing at … rates and, obviously exceeded the level of … mln liters.

Heineken’s share, according to the company’s reports amounts to …% of the premium segment in 2015. Almost a half of the segment (…%) belongs to Tiger brand that is attributed to “affordable premium”. As we can see, competitors have only a … of the volume which includes brands Saigon Special, Sapporo, brands from international premium segment, and import.

Heineken introduced the Vietnamese market to beer Tiger and title Heineken after it had been launched early in the 90-ies. But as we can see, these brands still remain leading by now. Having started in Ho Chi Minh city, Heineken focused on the premium segment and employed western industrial and marketing technologies in order to conquer it. The rapid growth of the brands was hindered by economic recession during the late 90-ies, but it then resumed.

Tiger was the sales growth driver and in Heineken portfolio it returned its youth again. This is no metaphor as Tiger is one of the oldest Asian brands (launched in 1932) and in its motherland, Singapore it is mostly consumed by older low-income people. Essentially, in Vietnam Tiger became a premium beer in 2009-2010, and prior to that, its price was not much higher than the mass brands by Sabeco and Habeco (judging by archive data of on-line stores).

The current growth strategy of Tiger is to attract mainstream consumers by proposing a premium product at a comparatively affordable price. And the brand’s target group is notably younger than that of Heineken. Beside the price, advertisement message creates a distance between brands – for Tiger lovers it is “Authenticity over pretentiousness”.

In 2008, there was launched subbrand Tiger Crystal, a light beer with low alcohol content. This sort managed to attract more young consumers and gave a growth drive to Tiger sales. Since 2015, Tiger Crystal has been packed in can.

In spring 2014, there started a mighty multinational advertisement campaign under the slogan “Uncaged”. Among other goals, it aimed at making Tiger well-known at the world beer market. TV ad consisted of a series of bright shorties about real young people who succeeded and changed their lives, having broken free from limitations and prohibitions.

Dominating key online media (Vietnamese are very active internet users), organizing dramatic events as well as brand’s precise corresponding to demands of the Vietnamese market, provided momentum to the growth. Under our estimation, in 2016, Tiger’s market share crossed the …% line. And the brand has been growing faster than the market, that is, taking sales from mainstream competitors.

Brand Heineken has been on the Vietnamese market almost as long as the company itself. It keeps a considerable price distance from all major brands except for perhaps Sapporo Premium and Budweiser. Besides, import brands can be considered competitors to beer Heineken, but their share is so far too small.

However, the riot growth of the “affordable premium” led to cannibalism effect, despite the efforts to distance brand images. It simply happened because Tiger filled the retail shelves space between mainstream beer and expensive premium, blurring the borders of the both segments. As a result, starting from nearly 2010, Heineken sales on the Vietnamese market were decreasing rapidly.

Only in 2015, Heineken managed to stabilize and achieve a minor growth, which continued during 2016, according to the company’s data. Probably a lot of factors came to force, in particular, growth of Heineken’s distribution and advertisement budgets, global domination in Facebook, which is intensively used by the Vietnamese, the middle class increase, net retail growth, and etc.

The third standpoint of the company at the Vietnamese market is economy brand Larue. It is well represented in the central region and in the south of the country in Camau province. But currently, the ambitions of Heineken Vietnam are exceeding the limits of the regional brand status and it is planned to gradually extend its distribution to neighboring regions.

Larue appeared in 1909 and became a part of BGI legacy we have spoken of in the chapter on Sabeco. It just so happens that not only Tiger but also Larue associates tiger directly to the brand image as it has been long on the label. That is why Heineken, having purchased breweries from Fosters Group has bought the second “tiger” too.

As a result, currently, Larue is one of the major economy brands on the Vietnamese market, that provides more than a third of Heineken Vietnam’s sales. The company supports Larue with an active advertisement with the key message “Friendship Forever”, and openly opposes the brand to the aggressively individualistic character of Tiger. Besides, unlike “urban” Tiger and Heineken, brand Larue is a good candidate for an ambitious expansion into rural areas of the country, where the experience got in the home market is employed.

Along with big brands development, Heineken Vietnam is notable for proposing a lot of interesting alternatives to wealthy consumers. For example, cider Strongbow, put on the market a year ago, beer Desperados for night clubs or beer Affligem for those who prefer rich flavors which is uncommon for Vietnamese beer. That is, the company is actively testing big cities’ markets as centers to form consumption trends of all middle class. Though currently special categories do not yield big dividends, their significance can increase as the well-being of the Vietnamese is growing.

Meanwhile, focusing on the premium segment resulted in Heineken Vietnam being well pronounced in big cities and comparatively hardly noticeable outside them.

On the plus side there are good growth prospects as beer consumers get ever better off and start drinking more premium beer. This will also be promoted by regional development of the off-trade channel, where Heineken Vietnam is especially well represented, in particular, the network retail segment, where Heineken leads. As of now, networks account for about …% of the company’s sales and the supplies there are made directly.

Working with marginal brands in big cities Heineken Vietnam succeeded much more than other brewers in developing distribution networks. From 2009 to 2015, the company managed to increase supply volumes per one distributor by … times, which apparently resulted from precise territorial division and supply line reduction as well as growth of visits number to a retail outlet. Besides, the company managed to increase the numerical distribution in its territories, which is as known a precondition for sales uplift. If Heineken Vietnam manages to scale its experience when expending to little developed regions, the growth of its market share is likely to continue.

Heineken Vietnam’s plans of expansion and brands development can be substantially altered in case of purchasing the controlling stake of the market leader Sabeco, which is quite possible as soon as in 2017. Currently, the both companies having national ambitions are each other’s main competitors. While Heineken is pressing Sabeco in big cities, Sabeco is developing “home” regions of Heineken.

Habeco

The company’s history dates back to 1880 when Frenchman Hommel built a small brewery in Hanoi and gave it his name. The business was gradually increasing the sales of its activity, but as the French army was retreating in 1954 all equipment was taken away. In 1958 the brewery was restored with aid of Czech specialists and got name Hanoi Brewery. At that time, production of beer Truc Bach (the name of a lake in Hanoi), and then beer Hanoi was started.

In 2003, the state company was reorganized in a state corporation, which became the property of the Industry and Trade Ministry. Starting from 2008, the company has been a public company called Hanoi Beer Alcohol And Beverage Joint Stock Corporation or shortly Habeco.

In 2008, 17% of Habeco shares was bought by Carlsberg Group. The strategic partnership of the companies lay among others in joint construction of Hanoi-Vung Tau brewery in the country’s south, where, the both companies needed a production site.

Possibly, in 2017, Carlsberg Group will extend its share in Habeco capital or even become its majority stakeholder. Yet, the current relationships of the two countries cannot be called balanced. In 2015, at a meeting in ministry Habeco’s manager even outspoke disappointment in the cooperation. There were vain hopes for Carlsberg’s help in staff training, technology modernizing, outlet market extending, and improving governance, when Carlsberg became a stakeholder. Besides, dissatisfaction was expressed concerning Carlsberg’s requests for wider rights as compared to other stake holders, though some contract items even contradict the Vietnamese legislation.

Certainly these statements can be considered points in deal-making process, besides the government wishes to maximize Habeco value by attracting other investors to trading. Thus, the negotiations are not likely to be easy for Carlsberg, despite their priority as buyers.

No doubt, Habeco is a major asset that will turn its owner into a leader in the capital and north country’s part. In total the company includes 17 productive and trade subsidiaries, which fully belong to it or where the company is the majority stake holder, as well as nine joint ventures. But Habeco’s value is lowered by comparatively weak financial performance and the fact that the market share of the company is constantly decreasing. The brand portfolio of Habeco has little changed over the recent ten years.

By the end of 2016, according to the official statistical data the sales volumes of Habeco have expanded by …% and amounted to … mln liters. The growth rates have slackened by … times against the previous year. The company market share declined by … p.p. and equaled …% according to our estimation.

Habeco’s revenue by the end of 2016, went …% up to … bn VND (or …% to $… bn). The cost price was growing at the same rates but the company has expanded expenses on realization, as well as other expenses, which affected the revenues.

Company’s sales form mass brand Hanoi that is positioned at the border of the mainstream and economy segments as well as premium brand Truc Bach. The both of them found themselves under a strong pressure of competitors.

In 2016, according to the official data brand Hanoi’s share reached …% of the company’s sales. The output volume of Hanoi beer (all types) increased …% to … mln liters in 2016. Accordingly, against the fast growing market, there was a further reduction of the brand’s market share.

A big proportion of Hanoi beer has a strength of 4.2% or more and is packed in 450 ml glass bottle. Besides, Habeco was the first company to pack beer in can, as far back as 1992, and currently, can beer volumes are comparable to those of bottled beer. Can beer logo looks the same as the label on bottle beer, though its strength is a little higher – 4.6% of alcohol or more.

Draft beer Bia Hoi Hanoi contains as little as just 3.5% of alcohol and remains one of the cheapest sorts on the north Vietnam market.

Interestingly, in 2016, brand Hanoi got an unexpected promotion from the USA president Barak Obama. As he was visiting Vietnam, he decided to drop into a café where he drank Hanoi beer. Pictures of him holding a beer bottle got to the leading media. Habeco, however, did not spin this event widely.

If we consider all sales volumes of the “remaining” Habeco beer to be provided by premium brand Truc Bach, we will also see a …% growth dynamics in 2016, which looks very pale against … rates in 2015.

The main reason for Habeco’s market share decline as we have already mentioned is Sabeco’s expansion to the north of the country where the numeral distribution of its brands is rapidly growing. Even at Hanoi beer market, according to retail sales monitoring, Habeco has to compete with the other player, though just several years ago, the company was the monopolist. As we can see, population of North Vietnam is not very loyal to the traditional brands and willingly switches to new products just out of curiosity or due to advertisement. Though Habeco’s marketing expenses are growing out of necessity, but only a revision of Habeco’s business strategy in all its aspects can substantially improve the sales dynamics and financial performance.

Carlsberg

Carlsberg is an old-timer of the Vietnamese brewing industry, as it has been on the market since 1993, when Vietnam announced the course for foreign capital attraction. At that time, in Hanoi there was South East Asia Brewery founded (outputs brand Halida) together with Viet Ha Corporation. As of now, Carlsberg owns 100% of the brewery capital and the former partner is independently developing brewing in the north of the country.

Let us shortly discuss the main stages of the company’s business development.

In 1994, Carlsberg entered the market of the central Vietnam having acquired 50% stake of Hue Brewery (produces Huda brand).

In the early 90-ies, it was a small brewery with outdated equipment supplying beer to the local urban market. But currently, this brewery is the key asset of Carlsberg company. In 2011, the remaining 50% of shares were purchased.

In 2008, Vung Tau Brewery located 45 miles from Ho Chi Minh City was founded. This event made a start to partnership between Сarlsberg and Habeco. In 2014, Vung Tau Brewery converted into a fully owned business of Сarlsberg.

In 2009, the cooperation with Habeco yielded a formation of a joint venture Halong Brewery, where Сarlsberg owned a 30% stake. However, in 2013, Сarlsberg withdrew from the capital of this brewery.

Besides, in 2009, Сarlsberg became not only a strategic partner but also a co-owner of Habeco, having purchased 17% of the enterprise’s shares.

Just two years after Vung Tau Brewery purchase, in July 2016, Carlsberg sold it to Heineken. The reasons for such step are not quite clear to us, as the brewery’s location in the south, (where Habeco is also rather weakly represented) seemed favorable from the logistic point of view. The proximity to the outlet in Vietnam is important for sales of inexpensive beer. Besides, it is not characteristic for international companies to sell their asset to competitors on the local market.

Possibly, economy sorts by the Hanoi brewery experienced too strong competition and that asset became unprofitable.

Commenting on this sale Carlsberg CEO Cees ‘t Hart explained to investors: “With regards to Vietnam, indeed, we focus on the territory where we are [in the north]. We have a footprint, which we would like to improve at the moment that the privatisation [of Habeco] is being implemented”.

Carlsberg is expecting a permission from the state to increase their stake in Habeco to 30%. By the way, during the communication with investors, Cees ‘t Hart said that privatization of Habeco would progress at the end of the first or beginning of the second quarter of 2017.

Thus, as of now, Carlsberg owns only two breweries in Vietnam. They are South East Asia Brewery Hanoi with a capacity of … mln l per year (100% ownership) and Hue Brewery in city Hue with a capacity of … mln l per year (100% ownership).

Brand Halida by Hanoi brewery failed to gain market weight, despite restyling and advertising campaigns carried out several years ago. The output volumes of South East Asia Brewery as far as we know do not exceed … mln liters.

Thus Carlsberg’s performance in Vietnam can be assessed basing on the performance of Hue Brewery. In 2016, the output volumes of Hue Brewery judging by the regional statistics increased by …% to … mln l. The volumes of beer output in can grew by …% to … mln liters of beer and by …% to … mln l in bottle. This trend has been there for several years already.

The year of 2015 was a period of stagnation, when Carlsberg’s reports said that sales were thwarted by heavy precipitations. And in 2016, the pronounced negative dynamics in the first quarter changed into a hectic growth in the 2-4 quarters. However, will this growth be stable is yet to find out. The point is that the bulk of Carlsberg sales in Vietnam accrues to the regional brands and the economy segment of the beer market. Though Carlsberg is ahead with Huda brand in the central Vietnam, the regional expansion of Heineken and Sabeco is producing ever bigger pressure.

Certainly, Carlsberg is also actively taking part in the market premiumization. According to the company report, after subbrand Huda Gold was launched in 2013, the company’s market share in city Da Nang (the third biggest in Vietnam) grew from … to …% in 2016. Huda Gold was represented by Hoàng Xuân Vinh, the first Olympic gold medal champion in Vietnam history.

The next step, a launch of brand Tuborg in spring 2016, was characteristic not only for Vietnam but for many other developing markets, where Carlsberg intended to give a new impulse to sales growth (for instance India or China). The brand appeared virtually at the same time at connected markets of Laos, Cambodia and Vietnam.

Tuborg corresponds to the core of Vietnamese beer consumers quite precisely. For one thing, it is a youth brand. For another, it has a sounding western name which justifies rather minor premium in the price. The retail price of Tuborg is comparable to beer … and much cheaper than, for example ….

In total the company is planning to spend … bn VND ($… mln) for the brand marketing. One of the promotional methods is girls who go round restaurants presenting the new product. … dollars was spent on the package design, in particular, equipping bottles with pull-off caps.

According to the company’s report, the first results were inspiring – Tuborg was rapidly winning the leading positions in the international premium segment of the Cambodian market and strong positions in the Northern Vietnam. At the administration of

Thua Thien-Hue province there is an opinion that the production growth in 2016 resulted from Tuborg launch.

In 2017, Carlsberg announced brand Beerlao launch in the superpremium market segment. This brand belongs to Lao Brewery Ltd (LBC) located in Laos, that, as far back as in 2002, joined Carlsberg group. It will be no exaggeration to say that virtually all beer market of Laos is represented by brand Beerlao with minor quantity of unofficial import. And the export potential of the brand lies in the exoticism and direct link to the motherland, especially for people who have been to Laos. But will the Vietnamese be impressed by such image and willing to pay premium for it will be shown by time.

As we can see, the results of 2017 for Carlsberg in Vietnam can be multiple-valued. The performance will depend on how successful the “old” economy sorts of beer are in keeping the loyalty of inconstant Vietnamese consumers. And more importantly, how much of the market space is won by premium sorts – brand Tuborg in the first place, and whether the company manages to organize its distribution in the country’s south.

Sapporo Vietnam

In 2007, Sapporo announced a new development strategy, based on expansion to outer markets because of the stagnation of beer consumption in Japan. Let us note that at that moment, the Chinese beer market enjoyed the growth wave. But as Sapporo’s president stated “Competition in China is intensifying, and everyone seems to be having a hard time boosting profits. We can’t take the risk of entering a market that may give us returns 10 or 20 years later”.

Instead, at the end of 2009, the company entered the beer market of Vietnam. An opportunity was given by dispersal of ownership of Scottish & Newcastle that was absorbed by Carlsberg and Heineken. Then Carlsberg got a 50% stake in the joint project for construction of Kronenbourg Vietnam brewery. The second half belonged to state company Vietnam National Tobacco (Vinataba).

Carlsberg needed funds after S&N absorption, besides, the company took part in the capitals of three functioning Vietnamese brewing companies, where it was planning to extend its share. So, the deal on Kronenbourg Vietnam sale was profitable for all parties. Under the terms of the agreement, Sapporo acquired a 50% stake from Carlsberg Breweries A/S and a further 15% stake from Vinataba for $23 mln. The joined venture changed name for Sapporo Vietnam. Later, the remaining stake was purchased from Vinataba.

At the end of 2011, in Long An province brewery Sapporo Vietnam with a capacity of 40 mln liters which could be extended to 150 mln l started operating. The major sale direction of the company became the biggest market of the country – Ho Chi Minh City located near the brewery. In no time, the company got going the production of the key brand Sapporo Premium which was virtually the only one in the portfolio. Its price exceeded the price of mass beer 333 twice and equaled the price of Heineken.

Traditionally for the Japanese companies, Sapporo Vietnam operation was based on full control at all stages – from production to agreements with traders and consumers. One of Sapporo’s major strategies for building the brand in the country is by establishing direct relationships with retailers rather than leaving it up to sales representatives.

In 2014, the number of retail outlets and HoReCa establishments selling beer Sapporo Premium, reached 4 500. Approximately 800 “promogirls” were hired and appointed to the outlets that recently started selling the company’s beer. The sales geography was expanding rapidly. It is no surprise that in 2014, the market share of Sapporo Premium reached nearly …% under our estimation.

This way Sapporo Premium managed to win the popularity and a substantial market share in the segment international premium, competing with brands Heineken and Sabeco. However, the further growth was not two-digit.

On the one hand, Sapporo Vietnam development was limited by the size of the premium segment, and on the other – the sharply intensified activity of competitors, that filled all cultural and media space with their advertisement. That is why, in 2015 and 2016, the dynamics of sales growth became much more moderate and amounted to nearly …%. But as the market is growing rapidly, the Sapporo Vietnam’s market share stays the same, at the level of about …%.

New subbrand Sapporo Blue Cap launched in summer 2016 is expected to give a fresh impetus to sales. The new product was created specially for the Vietnamese market and positioned in the mainstream segment, that is the cost of this beer is nearly a third lower than Sapporo Premium and by price it competes Tiger and Saigon Special. The main message announced at the subbrand launch is “Japanese quality at reasonable prices”. Sapporo Blue Cap, according to the company’s message is sold in all key regions of Vietnam.

AB InBev

The global leader did not enter the Vietnamese beer market until May 2015. A brewery with a capacity of 100 mln liters became the first production site of the company in the South-East Asia. The enterprise is located in the country’s south in province Bình Dương which on the north borders with Ho Chi Minh territories.

During the first stage, as the sales growth is progressing, it is planned to extend the brewery’s capacity to 500 mln liters, but potentially it can be extended to 1000 mln liters. These volumes seem vast for the Vietnamese market, yet AB InBev intends to organize export supplies to other Asian markets – to India, Laos, and Cambodia.

As for development, the company stakes on two brands, namely, Budweiser in the premium segment of the market and Beck’s on the border of the premium and mainstream segments. Naturally, the main sales direction at the beginning became the network retail of Ho Chi Minh City.

To get the full article “Beer market of Vietnam” in pdf (54 pages, 24 diagrams) propose you to buy it ($40) or visit the subscription page.

2Checkout.com Inc. (Ohio, USA) is a payment facilitator for goods and services provided by Pivnoe Delo.

The article materials were prepared using data by General Statistics Office Of Vietnam, Ministry of Industry and Trade Of Vietnam, WHO and FAO UN.

A number of estimations are based on beer producers reports; research companies Nielsen Vietnam, TNS Global, Euromonitor, Canadean, Buzzmetrics; investment and consulting companies Corporate Directions, FPT Securities, Viet Capital Securities; publications in business press; reports on Heineken Financial Markets Conference 2016 (Ho Chi Minh City, Vietnam).

In case the information source is not provided, the data on beer volumes output and their interpretation are our assessment based on the current trends.

We do not guarantee that the given information is absolutely correct, though it is based on data obtained from reliable sources. The article content should not be fully relied on to the prejudice of your own analysis.